|

市場調查報告書

商品編碼

1683195

夾層板市場:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Sandwich Panels - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

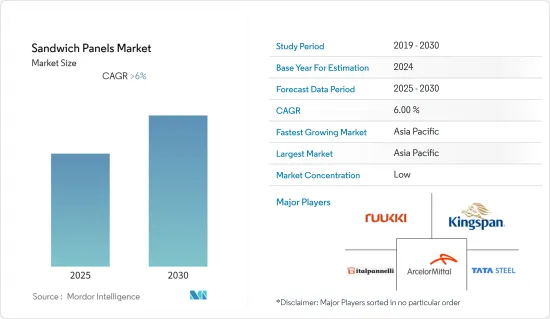

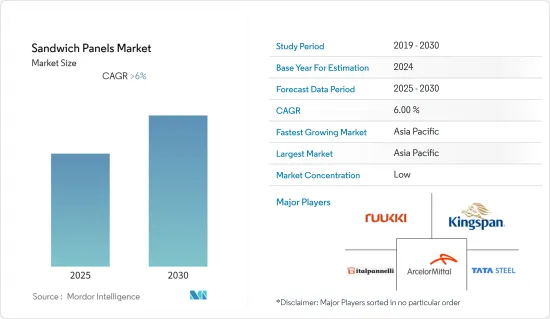

預計預測期內夾層板市場的複合年成長率將超過 6%。

新冠肺炎疫情為市場帶來了負面影響。由於疫情影響,全球多個國家已實施封鎖。由於供應鏈中斷、資金短缺、勞動力短缺和封鎖規定,建築工作暫時停止。夾層板市場已從疫情中恢復並正在經歷強勁成長。

關鍵亮點

- 短期內,預計冷藏倉儲設施對夾層板的需求增加將推動市場發展。此外,預計使用 PVDF 基鋁複合板也將有助於推動市場需求。

- 然而,一些夾層板的防火性能較差,預計這將抑制市場。

- 在預測期內,工業和商務用建築的建設不斷增加為夾層板市場帶來了巨大的成長機會。

- 由於中國、日本和印度等國家的龐大消費量,預計亞太地區將主導市場。

夾層板市場趨勢

工業領域佔市場主導地位

- 在現代建築中,使用高性能材料至關重要。高性能是指材質堅固、輕巧、耐用且用途廣泛。由於這種可靠性,夾層板可以成為工業建築的最佳選擇之一。

- 其應用範圍從工業建築施工到隔熱屋頂和牆板。夾層板在工業應用領域有著很高的需求,尤其是在冷藏倉儲設施和倉庫。

- 冷藏倉庫的數量正在迅速成長,以延長和保護新鮮農產品、魚貝類、冷凍食品、膠卷、化學品和藥品的保存期限。

- 跨國公司食品零售連鎖店的擴張導致對冷藏倉庫的需求增加。由於這些因素,預計全球對夾層板的需求將會成長。

- 預計2021年全球低溫運輸物流市場規模將達2,558.2億美元,未來8年將突破4,100億美元。

- 2021 年亞太低溫運輸物流市場規模價值 689.7 億美元,而 2020 年為 617.5 億美元。未來六年,預計該市場規模將達到近 1,340 億美元。

- 2021 年歐洲低溫運輸物流產業價值超過 850 億美元,預計到 2025 年將成長到 1,128 億美元。使用冷藏包裝解決方案對供應鏈中的貨物進行溫控移動,以保護新鮮農產品、水產品、冷凍食品和藥品等產品的品質。這就是所謂的低溫運輸物流。

- 根據印度製藥協會預測,到2021年,藥品將佔印度低溫運輸倉庫的三分之二以上。低廉的製造成本和政府補貼意味著印度擁有全球第三大製藥業務。

- 預計上述因素將推動工業領域的發展並在預測期內增加對夾層板的需求。

亞太地區主導全球市場

- 由於中國、印度和日本等國家的需求旺盛,預計亞太地區將主導全球市場。

- 中國是亞太地區主要建設活動國家之一,工業和建築業約佔其GDP的50%。

- 根據中國建設業協會的數據,2021年中國竣工建築中住宅佔比很大,住宅建築佔竣工占地面積的67%以上。隨著國家經濟的成長,人們從農村遷移到大城市,增加了這些地區對住宅的需求。此外,用作投資性房地產的公寓也正在刺激需求。

- 印度計劃在未來四到五年內投資 2,100 億印度盧比(25.3 億美元)建立和升級冷藏設施,以解決生鮮產品儲存難題。現有冷藏倉庫迫切需要升級機械和技術。

- 在公共和私人基礎設施投資、可再生能源和商業計劃的推動下,日本建築業預計將在未來五年內溫和擴張。

- 根據國土交通省統計,日本2021會計年度建築建設投資超過42.6兆日圓(3,199.3億美元)。本年度的大部分投資都集中在住宅。 2022會計年度建設投資將增加至43.4兆日圓(3,259.3億美元)。

- 因此,所有上述因素都可能在預測期內增加夾層板市場的需求。

夾芯板產業概況

夾層板市場較為分散,眾多參與企業爭奪市場佔有率。市場的主要企業包括安賽樂米塔爾、ITALPANNELLI SRL、Rautaruukki Corporation、塔塔鋼鐵、金斯潘集團等。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 擴大結構隔熱板在冷藏倉庫的應用

- PVDF 基鋁複合板需求不斷成長

- 限制因素

- 一些夾層板的防火性能

- 定向塑合板(OSB)的揮發性有機化合物(VOC)排放

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場區隔(以金額為準的市場規模)

- 核心材料

- 聚氨酯(PUR)

- 聚異氰酸酯(PIR)

- 礦棉

- 發泡聚苯乙烯 (EPS)

- 其他核心材料

- 表皮材質

- 常用的纖維增強熱塑性塑膠(CFRT)

- 玻璃纖維增強板 (FRP)

- 鋁

- 鋼

- 其他覆蓋材料

- 應用

- 牆板

- 屋頂板

- 保溫板

- 其他

- 最終用途部分

- 住宅

- 商務用

- 工業的

- 設施基礎設施

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 卡達

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- ArcelorMittal

- Areco

- Assan Panel AS

- Building Components Solutions LLC

- Cornerstone Building Brands

- DANA Group of Companies

- ITALPANNELLI SRL

- Kingspan Group

- Multicolor Steels (India) Pvt Ltd

- Rautaruukki Corporation

- Safal group

- Sintex

- Tata Steel

第7章 市場機會與未來趨勢

- 工業和商業建築建設增加

- 其他機會

The Sandwich Panels Market is expected to register a CAGR of greater than 6% during the forecast period.

The market was negatively impacted due to the COVID-19 pandemic. Owing to the pandemic scenario, several countries around the world went into lockdown. Construction works were halted temporarily due to supply chain disruptions, lack of funds, labor shortages, and lockdown restrictions. The sandwich panels market recovered from the pandemic and is growing significantly.

Key Highlights

- Over the short term, the rising demand for these panels from cold storage facilities is expected to drive the market. Moreover, the usage of PVDF-based aluminum composite panels is also expected to contribute to the market demand.

- However, the low fire performance of some sandwich panels is expected to restrain the market.

- Nevertheless, increasing the construction of industrial and commercial buildings is a significant growth opportunity for the sandwich panels market over the forecast period.

- Asia-Pacific region is expected to dominate the market with enormous consumption from countries such as China, Japan, and India.

Sandwich Panel Market Trends

Industrial Segment to Dominate the Market

- In modern-day construction, the use of high-performance materials is essential. High performance entails that the material is strong, lightweight, and durable and can be used in various applications. For this reliability, sandwich panels can be one of the best options for industrial buildings.

- The vast spectrum of applications includes everything from industrial building construction to insulated roof and wall panels. Sandwich panels are in high demand in industrial applications, particularly in cold storage facilities and warehouses.

- The number of cold storage operations meant to extend and ensure the shelf life of fresh agricultural produce, seafood, frozen food, photographic film, chemicals, and pharmaceutical drugs is rapidly increasing.

- Multinational companies' expansion of retail food chains led to increased demand for cold storage. These factors, in turn, are expected to augment the demand for sandwich panels across the globe.

- The global cold chain logistics market was worth USD 255.82 billion in 2021 and is expected to exceed USD 410 billion over the next eight years.

- The Asia-Pacific cold chain logistics market was valued at USD 68.97 billion in 2021, compared to USD 61.75 billion in 2020. Over the next six years, this market is expected to reach just under USD 134 billion.

- The European cold chain logistics industry was valued at more than USD 85 billion in 2021 and is predicted to grow to USD 112.8 billion by 2025. The temperature-controlled items movement along a supply chain utilizing chilled packaging solutions to protect the quality of products such as fresh agricultural commodities, seafood, frozen food, or pharmaceutical products. It is known as cold chain logistics.

- According to the Indian Pharmaceutical Association, pharmaceutical items accounted for over two-thirds of India's cold chain storage by 2021. Due to cheap manufacturing costs and government subsidies, India includes the world's third-biggest pharmaceutical business.

- All the above factors are expected to drive the industrial segment, enhancing the demand for sandwich panels during the forecast period.

Asia-Pacific Region to Dominate the Global Market

- Asia-Pacific region is expected to dominate the global market due to the high demand from countries such as China, India, and Japan.

- China is one of the major countries in Asia-Pacific with ample construction activities, with the industrial and construction sectors accounting for approximately 50% of the GDP.

- According to China Construction Industry Association, in 2021, residential buildings accounted for a significant share of finished construction in China. Buildings intended for housing accounted for over 67% of finished floor space. As the country's economy grows, people migrate from rural regions to major cities, increasing demand for residential accommodation in these locations. Furthermore, flats utilized as investment properties also drive up demand.

- In India, in the next 4-5 years, INR 21,000 crore (USD 2.53 billion) is planned to be invested in setting up or upgrading cold storage to address the stockpiling perishable commodities problem. There is an urgent need to upgrade the existing cold storage plant machinery and technology.

- Japan's construction sector is expected to expand moderately over the next five years, owing to increasing public and private infrastructure investments, renewable energy, and commercial projects.

- According to The Ministry of Land, Infrastructure, Transport, and Tourism (Japan), building construction investments in Japan were over JPY 42.6 trillion (USD 319.93 billion) in the fiscal year 2021. Most of the investments were made that year to construct residential houses. Building construction investment raised to JPY 43.4 trillion (USD 325.93 billion) in the fiscal year 2022.

- Thus, all the above factors will likely increase demand for the sandwich panels market during the forecast period.

Sandwich Panel Industry Overview

The sandwich panels market is fragmented, with numerous players sharing the market demand. Key players in the market include ArcelorMittal, ITALPANNELLI SRL, Rautaruukki Corporation, Tata Steel, and Kingspan Group, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Cold Storage Applications of Structural Insulated Panels

- 4.1.2 Increasing Demand for PVDF-based Aluminum Composite Panels

- 4.2 Restraints

- 4.2.1 Fire Performance of Some Sandwich Panels

- 4.2.2 Oriented Stranded Board (OSB) Emissions of Volatile Organic Compounds (VOCs)

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size by Value)

- 5.1 Core Material

- 5.1.1 Polyurethane (PUR)

- 5.1.2 Polyisocyanurate (PIR)

- 5.1.3 Mineral Wool

- 5.1.4 Expanded Polystyrene (EPS)

- 5.1.5 Other Core Materials

- 5.2 Skin Material

- 5.2.1 Continuous Fiber Reinforced Thermoplastics (CFRT)

- 5.2.2 Fiberglass Reinforced Panel (FRP)

- 5.2.3 Aluminum

- 5.2.4 Steel

- 5.2.5 Other Skin Materials

- 5.3 Application

- 5.3.1 Wall Panels

- 5.3.2 Roof Panels

- 5.3.3 Insulated Panels

- 5.3.4 Other Applications

- 5.4 End-use Sector

- 5.4.1 Residential

- 5.4.2 Commercial

- 5.4.3 Industrial

- 5.4.4 Institutional and Infrastructure

- 5.5 Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 Italy

- 5.5.3.4 France

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle-East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Qatar

- 5.5.5.4 South Africa

- 5.5.5.5 Rest of Middle-East and Africa

- 5.5.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) **/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ArcelorMittal

- 6.4.2 Areco

- 6.4.3 Assan Panel A.S.

- 6.4.4 Building Components Solutions LLC

- 6.4.5 Cornerstone Building Brands

- 6.4.6 DANA Group of Companies

- 6.4.7 ITALPANNELLI SRL

- 6.4.8 Kingspan Group

- 6.4.9 Multicolor Steels (India) Pvt Ltd

- 6.4.10 Rautaruukki Corporation

- 6.4.11 Safal group

- 6.4.12 Sintex

- 6.4.13 Tata Steel

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Construction of Industrial and Commercial Buildings

- 7.2 Other Opportunities