|

市場調查報告書

商品編碼

1645142

多供應商支援服務:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Multi Vendor Support Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

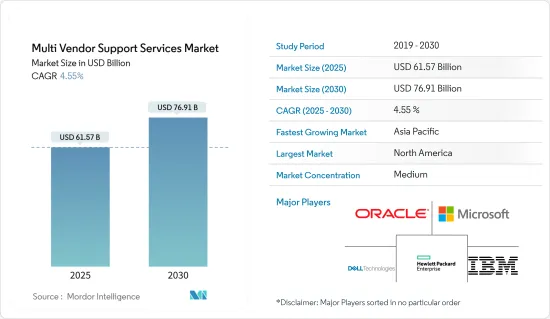

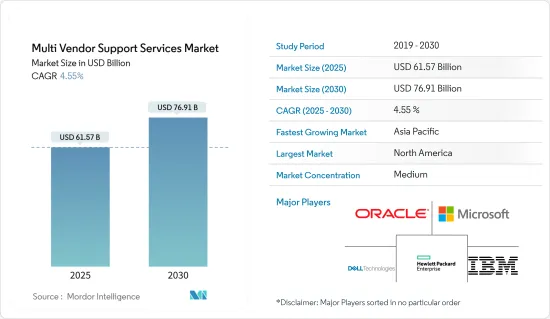

預計 2025 年多供應商支援服務市場規模為 615.7 億美元,到 2030 年將達到 769.1 億美元,預測期內(2025-2030 年)的複合年成長率為 4.55%。

多供應商支援服務為您提供維護來自單一供應商IT基礎設施的專業知識,從而簡化 IT 管理。因此,多供應商支援可透過簡化整個 IT 環境中的問題識別和解決來減少停機時間。企業對先進解決方案的開發和接受度顯著提高。這種多供應商支援服務有助於改善生產的平穩性和日常業務,同時降低管理多種 IT 解決方案和服務所帶來的風險。這導致全球對多供應商支援服務的需求增加。

主要亮點

- 與前幾年的IT基礎設施轉型不同,由於預算緊張和資本支出減少,許多企業轉向第三方、多供應商維護提供者。希望在保持成本效益的同時做更多事情的企業正在轉向第三方維護,以降低解決方案和服務的支出,同時保持傳統的執行時間和效能。

- 預測期內,雲端、物聯網平台、容器、DevOps 和巨量資料等 IT 服務預計將為多供應商支援服務供應商帶來巨大潛力。世界各地的企業和政府機構正在將更多業務關鍵型工作負載和運算實例從傳統環境遷移到雲端。

- 此外,物聯網、雲端運算和巨量資料分析在企業數位轉型策略中被迅速採用,這也增加了資料中心的壓力,從而促進了市場的成長。在當前情況下,資料中心變得比以往更加複雜,擁有數千個元件。在如此惡劣的環境下進行生命週期維護至關重要,但由於 IT相關人員努力平衡效能和成本,因此也極具挑戰性。這就是為什麼生命週期維護成為當今企業管理員如此頭痛的問題。公司與數十家供應商簽訂了維護契約,每家供應商都擁有多種類型的設備。隨著多供應商支援服務的日益普及,資料中心生命週期維護變得更加易於管理且更具成本效益。

- 隨著公司在IT基礎設施中添加新技術、更新服務等級、與各個供應商簽署新的支援合約並續簽保修,支援多供應商支援環境不斷變化的挑戰變得越來越困難。為了解決這些問題,戴爾科技等技術提供者提供了全面支援管理,即一種多供應商支援服務。這項服務不僅可以降低成本、提高整個 IT 組織的生產力,還可以減輕管理許多日常管理任務的資源壓力。

- 當新冠肺炎疫情來襲時,遠距工作在世界各地激增。多供應商支援服務供應商利用機會為企業解決問題,以維持順暢的工作環境。例如,IBM 雲端解決方案可以透過靈活、安全的雲端和數位服務實現虛擬、行動性、協作和支持,幫助企業無縫過渡到小型企業。在遠距工作情況下,IBM 公司的智慧網路支援在思科的深入知識庫的幫助下,提供了一種主動支援模型,使用戶能夠在問題出現並影響業務運作之前識別問題。

多供應商支援服務市場趨勢

預計預測期內 IT 和通訊產業將大幅成長。

- 由於各種技術的採用率很高、BYOD 政策的採用頻率越來越高(使業務營運更加舒適和易於管理)以及由於企業資料快速成長而對高階安全性的需求不斷增加,IT 和通訊業已成為多供應商支援服務的關鍵領域。

- 過去幾年來,電訊業經歷了顯著的成長。在競爭激烈的市場中,電信業者不斷面臨以低成本提供創新服務以留住客戶的壓力。為了應對複雜的競爭環境,多供應商支援服務已受到通訊業者的廣泛追捧。

- 多供應商 SD-WAN 服務的部署也以顯著的速度成長。這包括對 uCPE 平台進行全面的檢驗和整合,並包含廣泛的軟體服務鏈,包括安全性、路由、SDN 交換、vBNG/vCGNAT、NFV 和服務保障。為了滿足多供應商網路的需求,台灣的 Lanner 提供了一系列開放、可互通的 uCPE 平台,提供多核心運算能力、加密加速引擎和 WiFi/LTE/5G 就緒連線。

- 企業必須從集中式 IT 模式轉變為分散式 IT 模式,才能實現其雲端、勞動力和應用程式轉型目標。企業將面臨傳統網路、安全和營運實踐的挑戰,包括過時的遠端存取、VPN 連接、低效的雲端/SaaS 存取、應用程式品質差和安全性降低。

- 在 Aruba Networks 和 Ponemon Institute 去年進行的一項調查中,64% 的北美受訪者表示他們熟悉零信任,47% 的受訪者表示他們熟悉 SASE。整體而言,受訪者對 SD-WAN 了解甚少。安全性通訊協定是使用 SASE 和零信任等安全架構實現的。邊界安全的概念,通常稱為零信任安全模型,是指設備預設不受信任。

北美將佔據顯著的市場成長佔有率。

- 北美地區成長的主要動力是技術提供者的強大影響力。這些參與者專注於建立夥伴關係、進行合併和收購,並提供創新解決方案,以在該地區和全球的競爭中保持領先地位。美國等國家對北美市場的成長做出了重大貢獻。由於IT基礎設施環境的變化,尤其是中小型企業 (SME) 對外包 IT 解決方案和服務的持續關注,美國市場正在成長。

- 這是由一系列因素推動的,包括家庭醫療保健中醫療設備的使用日益增多、手術程序從住院轉向門診病人,以及 MVS 提供者和醫療機構對技術的接受度越來越高。 MVS 市場預計將從傳統的設備維護和維修服務模式轉向完全託管服務模式,由諮詢、分析、IT 解決方案、庫存管理和網路安全等專業服務推動。

- IT基礎設施的快速變化是刺激MVSS市場擴張的主要因素。 IT基礎設施的規模和複雜性日益增加。這是因為不斷成長的運算需求需要更大更好的網路、伺服器和儲存設備。企業擴大使用雲端、容器、物聯網和其他技術來實現業務數位化,以滿足不斷成長的業務任務需求。

- 在美國和加拿大,多重雲端環境的使用正在迅速成長,客戶大量使用一種雲,偶爾使用另一種雲。 MSP 可以透過提供基於消費的服務定價模式來提供巨大的機會。這也有望促進該地區多供應商支援服務市場的成長。

- 此外,物聯網在各個行業和領域的快速融合預計將導致智慧設備的普及率提高。這有望推動託管多供應商服務的採用,從而刺激市場成長。

多供應商支援服務業概況

多供應商支援服務市場競爭適中,由許多全球和地區參與者組成。這些參與者佔有相當大的市場佔有率並致力於擴大基本客群。這些供應商正專注於研發活動、策略聯盟和其他有機和無機成長策略,以在預測期內獲得競爭優勢。

- 2022 年 11 月 - 為了保持競爭力,企業正在對其應用程式進行現代化改造,採用多重雲端和 SaaS,並允許用戶從職場、家中等地點存取這些應用程式。 VMware, Inc. 今天宣布推出其下一代 SD-WAN 解決方案,包括全新 SD-WAN 用戶端,以幫助企業向任何設備提供應用、資料和服務,無論它們位於何處——分店、家中或任何網路上。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場動態

- 市場促進因素

- OEM服務維修成本上升

- 市場挑戰

- 安全和隱私問題

6. COVID-19 對多供應商支援服務市場的影響

第7章 市場區隔

- 按服務類型

- 專業的

- 託管

- 按公司規模

- 中小企業

- 大型企業

- 按最終用戶產業

- 資訊科技/通訊

- BFSI

- 衛生保健

- 能源和電力

- 製造業

- 其他(零售、媒體和娛樂、旅遊和觀光)

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

第8章 競爭格局

- 公司簡介

- IBM Corporation

- Oracle Corporation

- Microsoft Corporation

- Clear Technologies, Inc.

- Dell Technologies Inc

- Evernex Group SAS

- Hewlett Packard Enterprise Co

- Quantum Corp

- Blue Sky Group Ltd

- Softcat plc

- NetApp Inc.

第9章投資分析

第10章:市場的未來

The Multi Vendor Support Services Market size is estimated at USD 61.57 billion in 2025, and is expected to reach USD 76.91 billion by 2030, at a CAGR of 4.55% during the forecast period (2025-2030).

Multi-vendor support services can help any business to simplify IT management from multiple vendor contracts to a single vendor with expertise to maintain all the IT infrastructure. Therefore, multi-vendor support reduces downtime by streamlining problem identification and solving across the entire IT environment. There is a significant increase in the development and acceptance of advanced solutions among businesses. These multi-vendor support services help to decrease the risk associated with managing several IT solutions and services while improving smooth production or daily work. This is bolstering the demand for multi-vendor support services across the world.

Key Highlights

- Unlike the last couple of IT infrastructure transition years, many businesses are shifting towards the third-party multi-vendor maintenance provider because of the severe budget constraints and reductions in the CAPEX. Enterprises seeking to do more while keeping it cost-efficient are interested in third-party maintenance to limit their solutions and service expenditures while retaining their conventional uptime and performance.

- The IT services for cloud, IoT platforms, containers, DevOps, and Big Data are expected to hold tremendous potential for the multi-vendor support service providers in the forecast period. Enterprises and government organizations worldwide are moving from conventional environments to placing more work-critical workloads and compute instances into the cloud.

- Further, owing to the rapidly increasing adoption of IoT, cloud, and Big data Analytics across multiple organizations as a significant part of their digital transformation strategy, the burden on the data centers is also increasing, leading to the market's growth. In the current scenario, data centers are more complex than ever, with thousands of components. Lifecycle maintenance in this difficult environment is essential, but it is also very challenging as IT players work to balance performance and cost. This is why lifecycle maintenance is an admin headache for today's enterprises. They have maintenance contracts with dozens of vendors, each with multiple types of equipment. With the increasing adoption of multi-vendor support services, the lifecycle maintenance of data centers becomes more manageable and cost-effective.

- The fast-paced and ever-changing challenges of supporting a multi-vendor support environment get exponentially difficult as an enterprise adds new technology to its IT infrastructure, updates levels of service, new support agreements, or updates warranties with each vendor. To solve these arising problems, total support management provided by technology providers like Dell Technologies is offering multi-vendor support services, which not only cut costs and increase productivity across an IT organization but also lower the burden on resources already managing too many daily admin tasks.

- At the time of the COVID-19 pandemic, remote working has surged worldwide. Multi-vendor support services providers are taking the opportunity to take advantage to solve enterprise problems to maintain a smooth working environment. For example, IBM Cloud solutions can help an enterprise to make a seamless transition to small business with flexible, secure cloud and digital services for virtualization, mobility, collaboration, and support. In the remote working condition, with the help of Cisco's in-depth knowledge base, IBM Corporation's intelligent network support delivers a proactive support model that helps the user to identify problems before they occur and affect enterprise operations.

Multi-Vendor Support Services Market Trends

IT & Telecommunication Vertical is Expected to Grow at a Significant Rate Over the Forecast Period

- The IT and telecommunication vertical is a significant segment for the multi-vendor support services due to the high rate of various technological adoptions, increased frequency of adoption of the BYOD policy (to make business operations much more comfortable and controllable), and growing need for high-end security due to the rapidly increasing data among the organizations.

- The telecom industry has observed extensive growth during the past few years. Telecommunication companies are constantly pressured to deliver innovative services at lower costs to retain their customers in the competitive market. Multi-vendor support services have become a widespread demand for operators to address a complex and competitive environment.

- The deployment of multi-vendor SD-WAN services is also increasing at a significant rate. This involves comprehensive validation and integration of the uCPE platform with a wide range of software service chaining, including security, routing, SDN switching, vBNG/vCGNAT, NFV, and service assurance. To meet the demand for multi-vendor networks, Lanner, a Taiwan-based company, offers a wide range of open, interoperable uCPE platforms that offer multi-core computing power, crypto acceleration engines, and WiFi/LTE/5G-ready connectivity.

- An enterprise must transition from a centralized to a distributed IT paradigm to undertake these cloud, workforce, and application transformation objectives. Businesses will experience difficulties using conventional networking, security, and operational methods, such as old-fashioned remote access, VPN connectivity, ineffective cloud/SaaS access, subpar application quality, and compromised safety.

- In the last year, 64% of North American respondents to a survey by Aruba Networks and Ponemon Institute said they were familiar with zero trust, while 47% said they were aware of SASE. In general, respondents had little exposure to SD-WAN. Security protocols are implemented using security architectures like SASE and zero trust. The notion of perimeter security commonly referred to as the zero-trust security model holds that devices are not trusted by default.

North America to account for significant market growth.

- The primary driver for the North American geographic segment's growth is the significant presence of technology providers. These players focus on entering into partnerships, merger acquisitions, and innovative solutions offerings to stay in the regional and globally competitive landscape. Countries like the US are significant contributors to the growth of the North American market segment. The US market is growing due to the changing IT infrastructure landscape, especially in small and medium enterprises (SMEs) continually focusing on outsourcing IT solutions and services.

- The growing use of medical equipment in home healthcare, the transition of surgical procedures from inpatient to outpatient settings, and the increased technology acceptance by MVS providers and healthcare facilities. The MVS market is anticipated to transform from a conventional equipment maintenance and repair service-based model to a fully managed service model due to professional services like consulting, analytics, IT solutions, inventory management, and cybersecurity.

- The quick changes in IT infrastructure are the primary elements fueling the MVSS market expansion. The size and complexity of IT infrastructure are proliferating. This is because larger and better networks, servers, and storage devices are required to meet the growing computing demands. Organizations are progressively digitalizing their operations using the cloud, container, IoT, and other technologies to satisfy the increased needs of business tasks.

- The use of multi-cloud environments sees massive growth in the United States and Canada, wherein clients rely on one cloud massively while using the other sporadically. MSPs can offer a great opportunity by giving consumption-based service pricing models. This will also boost the growth of the multi-vendor support services market in the region.

- Furthermore, the penetration of smart devices is expected to increase, owing to the rapid integration of IoT across various industries and sectors. This is projected to propel the adoption and incorporation of managed multi-vendor services, thereby fueling the market's growth.

Multi-Vendor Support Services Industry Overview

The multi-vendor support services market is moderately competitive and consists of many global and regional players. These players account for a considerable market share and focus on expanding their client base globally. These vendors focus on research and development activities, strategic alliances, and other organic & inorganic growth strategies to earn a competitive edge over the forecast period.

- In November 2022 - Enterprises are modernizing their applications, implementing multi-cloud and SaaS, and enabling users to access these applications from the workplace, home, or elsewhere to remain competitive. To assist businesses in delivering apps, data, and services-no matter where they are located-to the site, branch, and home, across any network, to any device, VMware, Inc. revealed its next-generation SD-WAN solution, which includes a new SD-WAN Client.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Maintenance Cost of OEM Services

- 5.2 Market Challenges

- 5.2.1 Concern Over Security and Privacy Issues

6 IMPACT OF COVID-19 ON THE MULTI VENDOR SUPPORT SERVICES MARKET

7 MARKET SEGMENTATION

- 7.1 By Service Type

- 7.1.1 Professional

- 7.1.2 Managed

- 7.2 By Enterprise Size

- 7.2.1 Small & Medium Enterprises

- 7.2.2 Large Enterprises

- 7.3 By End-user Verticals

- 7.3.1 IT & Telecommunication

- 7.3.2 BFSI

- 7.3.3 Healthcare

- 7.3.4 Energy & Power

- 7.3.5 Industrial Manufacturing

- 7.3.6 Others (Retail, Media & Entertainment, Travel & Tourism)

- 7.4 By Geography

- 7.4.1 North America

- 7.4.2 Europe

- 7.4.3 Asia

- 7.4.4 Australia and New Zealand

- 7.4.5 Latin America

- 7.4.6 Middle East and Africa

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 IBM Corporation

- 8.1.2 Oracle Corporation

- 8.1.3 Microsoft Corporation

- 8.1.4 Clear Technologies, Inc.

- 8.1.5 Dell Technologies Inc

- 8.1.6 Evernex Group SAS

- 8.1.7 Hewlett Packard Enterprise Co

- 8.1.8 Quantum Corp

- 8.1.9 Blue Sky Group Ltd

- 8.1.10 Softcat plc

- 8.1.11 NetApp Inc.