|

市場調查報告書

商品編碼

1644929

亞太地區智慧清管:市場佔有率分析、產業趨勢與成長預測(2025-2030 年)Asia-Pacific Intelligent Pigging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

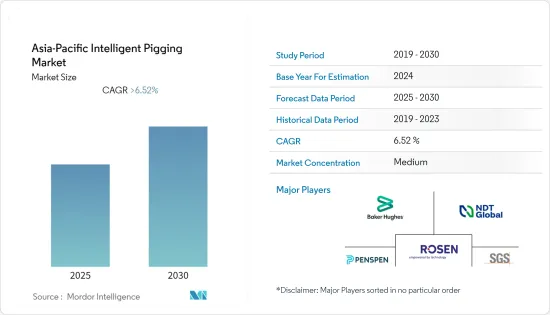

預測期內,亞太地區智慧清管市場預計將以超過 6.52% 的複合年成長率成長。

2020 年,市場受到了 COVID-19 的不利影響。目前市場已經恢復到疫情前的水準。

關鍵亮點

- 短期內,由於亞太地區管道清管服務需求不斷增加及石油天然氣產量高速成長,智慧清管市場預計將大幅成長。

- 另一方面,智慧清管不能應用於未清管的管道,從而阻礙了市場的成長。

- 該地區,特別是新興國家的能源消耗增加,是由都市化進程加快推動的。

- 由於即將實施的石油和天然氣管道計劃,預計中國將佔據該市場的最大佔有率。

亞太地區智慧清管市場趨勢

超音波豬有望實現顯著成長

- 超音波清管器利用超音波檢測管壁厚度的變化。超音波清管器配備有換能器,可垂直於管壁發射訊號並接收來自管道內表面和外表面的訊號。此外,從訊號接收到的迴聲可用於測量管道壁的厚度。超音波清管可以對管道中的缺陷深度進行絕對測量,並且可以測量比磁通漏失技術更厚的管道中的金屬損失。

- 超音波清管可用於各種尺寸的管道,從 4 英吋到 56 英吋。該技術通常用於液體管道,但在耦合劑的幫助下,它也可以用於氣體管道。東亞地區已開發的管道總長度為5.88萬公里。截至 2021 年,由於未來計劃的需求,該長度預計還會進一步增加。

- 例如,西澳大利亞州將於 2022 年開始建造一條 580 公里長的管道。這條價值 4.6 億美元的管道可以將珀斯盆地的天然氣輸送到該州金礦區的資源計劃。北部金礦區互聯管道將成為西澳大利亞州 2,690 公里天然氣管道網路的一部分,預計將大幅增加向內陸的天然氣輸送量。

- 由於該領域的技術發展,預計超音波領域在不久的將來也將實現成長。例如,2022 年 1 月,總部位於泰國的 Dacon Inspection Technologies 公司對其用於管道的超音波線上檢測設備進行了新的改進,提高了檢測資料的準確性,並能夠檢測金屬和高密度聚苯乙烯(HDPE) 管道等塑膠等有色金屬材料。

- 這些新興市場的發展有望快速推動該地區的技術市場。

中國可望主導市場

- 中國是亞太地區最大的原油和天然氣生產國,2021年分別佔該地區原油和天然氣總產量的50%和26%。 2021年原油產量為1.9898億噸,與前一年同期比較成長2.4%,較2020年成長4.0%,較兩年平均值成長2.0%。

- 隨著能源消耗的增加,該國預計其管道網路將持續成長。截至2022年6月,全國運作中石油管線總長度25,271.3公里,為亞洲國家中最長。未來該國也規劃有管道計劃,預計網路將進一步擴大。

- 例如,中國西氣東輸四線計劃將於2022年9月動工。該管道將與已完成的3號線和2號線相連,使該系統的年輸送能力提高到1000億立方米以上。天然氣管線規劃總長3,340公里,起自中國西北部新疆維吾爾自治區吳起縣,止於中國西北部寧夏回族自治區中衛。

- 此外,2022年2月,俄羅斯同意一份為期30年的契約,透過新管道向中國供應天然氣。由於烏克蘭等問題導致莫斯科與西方的關係緊張,莫斯科可能會以歐元付款最近的天然氣銷售,以加強與北京的能源聯盟。壟斷俄羅斯天然氣管道出口的俄羅斯天然氣工業股份公司已同意每年向中國國有能源巨頭中國石油天然氣集團供應 100 億立方公尺的天然氣。

- 預計此類發展將對中國市場產生比該地區任何其他國家都要顯著的推動作用。

亞太地區智慧清管產業概況

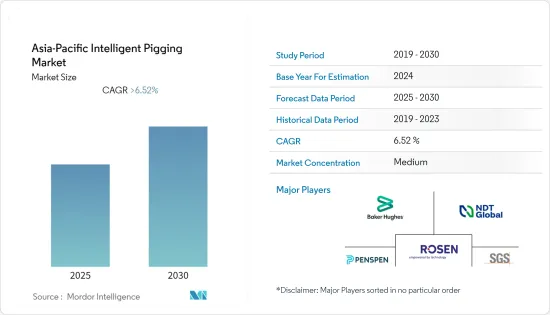

亞太地區智慧清管市場適度細分。市場的主要企業(不分先後順序)包括 Rosen Group、NDT Global Services Ltd、SGA SA、Baker Hughes Company 和 Penspen Limited。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第2章調查方法

第3章執行摘要

第4章 市場概況

- 介紹

- 2027 年市場規模及需求預測(十億美元)

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 限制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場區隔

- 科技

- 漏磁清管

- 毛細管清管

- 超音波清管

- 應用

- 裂痕和洩漏檢測

- 金屬損失和腐蝕檢測

- 形狀測量和彎曲檢測

- 管路流體類型

- 油

- 氣體

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- Rosen Group

- NDT Global Services Ltd.

- SGA SA

- Baker Hughes Company

- Penspen Limited

- Dtaic Inspection Equipment(Suzhou)Co Ltd.

- Dacon Inspection Technologies

- Panorama Oil & Gas Sdn Bhd

- Romstar Sdn Bhd.

- NDTS India(P)Limited

第7章 市場機會與未來趨勢

簡介目錄

Product Code: 93194

The Asia-Pacific Intelligent Pigging Market is expected to register a CAGR of greater than 6.52% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. Currently, the market has reached pre-pandemic levels.

Key Highlights

- Over the short term, the Asia-Pacific intelligent pigging market is expected to register significant growth due to the increasing demand for pipeline pigging services in the region and the high growth of oil and gas production.

- On the other hand, intelligent pigging is not applicable to unpigged pipelines, which impedes the market growth.

- Nevertheless, the growing energy consumption in the region, distinctly in developing countries, is propelled by the advancing steps of urbanization.

- Due to the upcoming oil and gas pipeline projects, China is predicted to have the highest share in the market studied.

APAC Intelligent Pigging Market Trends

Ultrasonic Pigs Expected to Witness Significant Growth

- An ultrasonic pig uses ultrasounds to detect the thickness changes in the pipe wall. Ultrasonic pigs are equipped with a transducer, which perpendicularly transmits signals to the pipe wall surface and receives signals from both the pipeline's internal and external surfaces. Furthermore, the echo received from the signals can be used to determine the pipeline wall's thickness. Ultrasonic pigs provide an absolute measurement of defect depth in the pipe and can measure metal losses in much thicker pipes than is possible with magnetic flux leakage technology.

- Ultrasonic pigs can be used in a wide range of pipeline sizes, ranging from 4 inches up to 56 inches. The technology is generally used for liquid pipelines but can also be used for gas pipelines with the help of a couplant. The pipelines developed in the East-Asian region are 58,800km in length. As of 2021, the length is expected to extend even more due to the demand in upcoming projects.

- For example, in 2022, the construction of the 580 kilometers pipeline in Western Australia started. The USD 460 million worth of pipelines may transport natural gas from the Perth basin to resources projects in the state's Goldfield. The Northern Goldfield Interconnect is expected to be a part of the 2,690-km gas pipeline network in Western Australia and significantly increase the volume of gas transported inland.

- The ultrasonic segment is also expected to grow in the near future due to the technological developments made in the sector. As an example, in January 2022, Dacon Inspection Technologies, the Thailand-based company, made new advancements in the ultrasonic in-line inspection fleet used for pipelines, which increases the inspection data accuracy as well as the inspection of non-ferrous materials such as metals and plastics like High-Density Poly Ethylene (HDPE) pipelines.

- Such developments are expected to drive the technology market in the region in a fast-paced manner.

China Expected to Dominate the Market

- China is the largest crude oil and natural gas producer in the Asia-Pacific region and accounted for around 50% and 26% of the total crude oil and natural gas production in the region in 2021. In 2021, 198.98 million tons of crude oil were produced, an increase of 2.4% over the previous year, a rise of 4.0% over 2020, and an average increase of 2.0% over the two years.

- The country envisaged consistent growth in the pipeline network established due to the increasing energy consumption. The total length of the operational oil pipelines in the country was recorded as 25,271.3 km as of June 2022, the highest among all the Asian countries. The network is bound to grow more due to the upcoming pipeline projects in the country.

- For instance, the construction of the No.4 pipeline of China's West-to-East transmission project started in September 2022. The pipeline was designed to lift the annual carrying capacity of the system to more than 100 billion cubic meters (bcm) after linking with the completed No.3 and No.2 pipelines. The No.4 gas pipeline is expected to be 3,340km long, from Wuqiacounty in Northwest China's Xinjiang Uygur Autonomous Region to Zhongwei in Northwest China's Ningxia Hui Autonomous Region.

- In addition, in February 2022, Russia agreed to a 30-year contract to supply gas to China via a new pipeline. It may settle the recent gas sales in Euros, bolstering an energy alliance with Beijing amid Moscow's strained ties with the West over Ukraine and other issues. Gazprom, which has a monopoly on Russian gas exports by pipeline, agreed to supply Chinese state energy major CNPC with 10 billion cubic meters of gas annually.

- Such developments are expected to visibly steer the market in China more than any other country in the region.

APAC Intelligent Pigging Industry Overview

The Asia-Pacific intelligent pigging market is moderately fragmented. Some of the key players in the market (in no particular order) include Rosen Group, NDT Global Services Ltd, SGA SA, Baker Hughes Company, and Penspen Limited.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Technology

- 5.1.1 Magnetic Flux Leakage Pigs

- 5.1.2 Capiller Pigs

- 5.1.3 Ultrasonic Pigs

- 5.2 Application

- 5.2.1 Crack & Leakage Detection

- 5.2.2 Metal Loss/ Corrosion Detection

- 5.2.3 Geometry Measurement & Bend Detection

- 5.3 Pipeline Fluid Type

- 5.3.1 Oil

- 5.3.2 Gas

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Rosen Group

- 6.3.2 NDT Global Services Ltd.

- 6.3.3 SGA SA

- 6.3.4 Baker Hughes Company

- 6.3.5 Penspen Limited

- 6.3.6 Dtaic Inspection Equipment (Suzhou) Co Ltd.

- 6.3.7 Dacon Inspection Technologies

- 6.3.8 Panorama Oil & Gas Sdn Bhd

- 6.3.9 Romstar Sdn Bhd.

- 6.3.10 NDTS India (P) Limited

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219