|

市場調查報告書

商品編碼

1644912

油箱保護:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Tank Protection - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

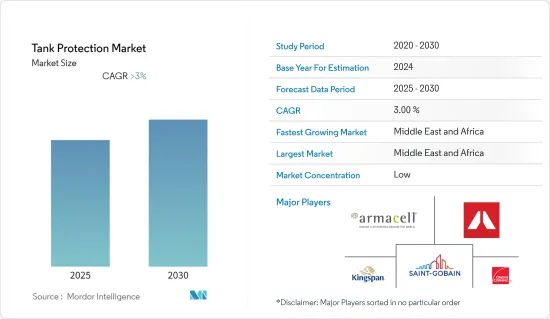

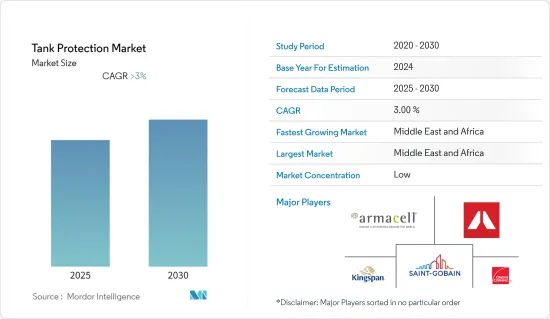

預測期內,油箱保護市場預計將以超過 3% 的複合年成長率成長。

由於石油需求減弱導致石油產量下降並導致儲存槽中的緩衝石油庫存,COVID-19 對市場產生了不利影響。

關鍵亮點

- 從中期來看,由於全球對石油和天然氣的需求不斷增加,以及對需要對低溫儲罐進行特殊保護的液化天然氣的需求不斷成長,預計未來幾年儲罐保護市場將蓬勃發展。

- 另一方面,許多國家對保護和絕緣材料的嚴格規定可能會阻礙市場的成長。

- 絕緣產業發生的併購可能為油箱保護市場創造重大機會。例如,工業主要企業聖戈班收購了挪威絕緣解決方案公司Graba。此類收購為知識共用和新產品的推出鋪平了道路。

- 中東和非洲預計將佔據最高的市場佔有率,因為該地區石油和天然氣產量和出口量較高。

油罐保護市場趨勢

聚氨酯可望強勁成長

- 聚氨酯泡棉是最常見的隔熱材料。這種材料具有優良的絕緣性能。此外,它還具有透濕性低、吸水率高、機械強度相對較高、密度低等特點,在油箱保護行業中備受推薦。

- 由於液化氣體和揮發性有機化合物等貨物的儲存和運輸需要特殊考慮,因此該產品在當前情況下的需求量很大。液化天然氣出口量成長是市場的主要驅動力之一。例如,在美國,月度液化天然氣出口量在 2021 年達到高峰 3.5 兆立方英尺。

- 美國目前領先全球液化天然氣出口市場。隨著對各地液化天然氣出口的增加,預計未來仍將維持這一地位。例如,美國在2022年上半年向歐洲出口了近75%的液化天然氣,而且這數字還在增加。

- 另一個主要的液化天然氣出口國是卡達,其液化天然氣出口量在過去五年一直穩定成長。 2022 年 4 月,卡達液化天然氣出口總額達到約 119 億美元,而 2021 年 4 月為 58 億美元。

- 由於液化天然氣出口在儲存和運輸過程中需要強力的儲槽保護,這些新興市場的發展預計將對儲槽保護市場產生直接影響。

中東和非洲可望主導市場

- 中東和非洲擁有主要的石油和天然氣生產國。繼美國之後,卡達、沙烏地阿拉伯、伊拉克和阿拉伯聯合大公國等國家均有大量原油和天然氣產量,導致對儲運船舶的需求激增。

- 2021年中東地區原油產量達2,815.6萬桶/日,僅次於北美,位居全球第二。隨著該地區石油和天然氣計劃的即將實施,未來幾年對製造儲存和運輸罐的需求預計將成長。

- 2022年8月,沙烏地阿拉伯國家石油和天然氣巨頭沙烏地阿美宣布計畫透過各種計畫和計劃擴大該國海上石油產量。隨著其他 OPEC 成員國的原油產量達到峰值,西方國家向 OPEC 施壓,要求其增加產量,因此 OPEC 也增加了產量。

- 此外,該地區(尤其是卡達和科威特等國家)的液化天然氣出口預計將對油罐保護市場產生正面影響。

- 由於這些事實和新興市場的發展,預計該地區將在不久的將來佔據很大的市場佔有率。

坦克保護產業概況

全球油罐保護市場適度細分。主要企業(不分先後順序)包括聖戈班、Rockwool International SA、金斯潘集團、歐文斯科寧、阿樂斯國際公司。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第2章調查方法

第3章執行摘要

第4章 市場概況

- 介紹

- 2027 年市場規模及需求預測(十億美元)

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 限制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場區隔

- 材料

- PU(聚氨酯)

- 岩絨

- 玻璃纖維

- 泡棉玻璃

- 其他

- 應用

- 運輸

- 倉庫

- 地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 南美洲

- 巴西

- 委內瑞拉

- 南美洲其他地區

- 歐洲

- 挪威

- 英國

- 俄羅斯聯邦

- 歐洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 卡達

- 伊朗

- 奈及利亞

- 阿爾及利亞

- 其他中東和非洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 其他亞太地區

- 北美洲

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- Rockwool International A/S

- Owens Corning

- Saint Gobain

- Kingspan Group

- Armacell International SA

- Archtech Building Systems(Nova Guard)

- Kumtek Thermotech

- Rochling Group

- Yutaka Corporation

第7章 市場機會與未來趨勢

簡介目錄

Product Code: 92898

The Tank Protection Market is expected to register a CAGR of greater than 3% during the forecast period.

COVID-19 adversely affected the market due to the dampened oil demand that led to less oil production and buffering of oil stock in storage tanks.

Key Highlights

- Over the medium term, the tank protection market is projected to prosper in the coming years due to the increasing demand for oil and natural gas at the global level and the rising demand for LNG gas that needs special protection for cryogenic tanks.

- On the other hand, the stringent regulations for the material used for protection or insulation in many countries can impede the market growth.

- Nevertheless, the mergers and acquisitions taking place in the insulation industry may create tremendous opportunities for the tank protection market. For example, Saint Gobain, one of the leading industry players, acquired Glava, the Norway-based insulation solutions company. Such acquisitions pave the way for knowledge sharing and new product launches.

- The Middle East and African region is expected to capture the highest market share due to high oil and gas production and exports from the region.

Tank Protection Market Trends

Polyurethane Expected to Witness Significant Growth

- Polyurethane foam is the most commercially available material for insulation. The material possesses excellent thermal insulating properties. Moreover, other features like low moisture-vapor permeability, high resistance to water absorption, relatively high mechanical strength, and low density makes the material highly recommended in the tank protection industry.

- The product is in high demand in the current scenario due to the special care taken for storing and transporting commodities like liquid gases, volatile organic compounds, etc. The increase in LNG exports is one of the factors strongly driving the market. For example, in the United States, the monthly LNG exports peaked at 3.5 tcf in 2021.

- The United States is currently at the top position in the global LNG export market. It is predicted to retain its rank in the future due to the growing volume of LNG exports to different regions. For example, the country exported nearly 75% of its LNG to Europe in the first half of 2022, and the number is still increasing.

- The other major LNG exporter is Qatar, the country which has witnessed a continuous increase in LNG exports in the last five years. The total LNG exports of Qatar reached around USD11.9 billion in April 2022, compared to USD5.8 billion in April 2021.

- Such developments are expected to have a direct impact on the tank protection market as LNG exports strongly require tank protection during storage and transportation.

Middle East and Africa Expected to Dominate the Market

- The Middle East and African region is blessed with the leading oil and gas producers. After the United States, the countries like Qatar, Saudi Arabia, Iraq, and United Arab Emirates (UAE) have remarkable levels of crude oil and natural gas production, creating a huge upsurge in demand for storage and transportation vessels.

- The crude oil production in the Middle Eastern region was recorded as 28156 thousand barrels per day in the year 2021, the second-ranking production level at the global level after the North American region. The demand for the fabrication of storage and transportation tanks is predicted to grow in the coming years due to the upcoming oil and gas projects in the region.

- In August 2022, Saudi Aramco, the state-owned oil and gas giant of Saudi Arabia, announced plans to expand offshore oil production in the country through various schemes and projects. The initiative was taken to boost the output due to the pressure put on the OPEC group by the Western nations to boost the oil output, as other OPEC members have reached their peak levels.

- Furthermore, the LNG exports from the region, particularly from the countries like Qatar and Kuwait, are expected to positively influence the tank protection market, as LNG export tanks need special care under cryogenic conditions.

- Owing to such facts and developments, the region is forecasted to take away the lion's share of the market in the near future.

Tank Protection Industry Overview

The global tank protection market is moderately fragmented. Some of the key players (in no particular order) include Saint Gobain, Rockwool International SA, Kingspan Group, Owens Corning, and Armacell International SA.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Material

- 5.1.1 PU (Polyurethane)

- 5.1.2 Rockwool

- 5.1.3 Fiberglass

- 5.1.4 Cellular Glass

- 5.1.5 Other Materials

- 5.2 Application

- 5.2.1 Transportation

- 5.2.2 Storage

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 South America

- 5.3.2.1 Brazil

- 5.3.2.2 Venezuela

- 5.3.2.3 Rest of South America

- 5.3.3 Europe

- 5.3.3.1 Norway

- 5.3.3.2 United Kingdom

- 5.3.3.3 Russian Federation

- 5.3.3.4 Rest of Europe

- 5.3.4 Middle East and Africa

- 5.3.4.1 Saudi Arabia

- 5.3.4.2 United Arab Emirates

- 5.3.4.3 Qatar

- 5.3.4.4 Iran

- 5.3.4.5 Nigeria

- 5.3.4.6 Algeria

- 5.3.4.7 Rest of Middle East and Africa

- 5.3.5 Asia-Pacific

- 5.3.5.1 China

- 5.3.5.2 India

- 5.3.5.3 Japan

- 5.3.5.4 Australia

- 5.3.5.5 Rest of Asia-Pacific

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Rockwool International A/S

- 6.3.2 Owens Corning

- 6.3.3 Saint Gobain

- 6.3.4 Kingspan Group

- 6.3.5 Armacell International SA

- 6.3.6 Archtech Building Systems (Nova Guard)

- 6.3.7 Kumtek Thermotech

- 6.3.8 Rochling Group

- 6.3.9 Yutaka Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219