|

市場調查報告書

商品編碼

1644897

美國網路安全:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)US Cybersecurity - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

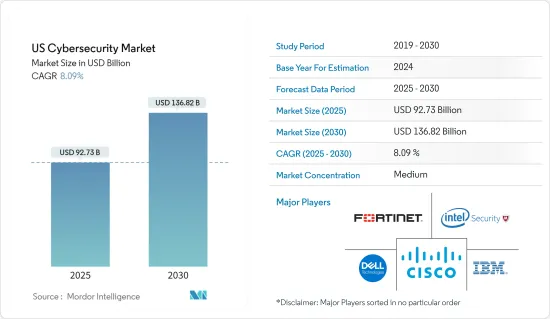

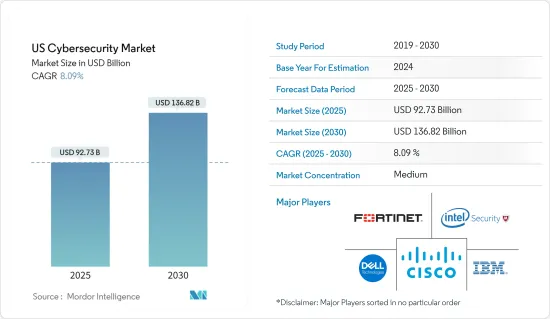

預計 2025 年美國網路安全市場規模為 927.3 億美元,到 2030 年將達到 1,368.2 億美元,預測期內(2025-2030 年)的複合年成長率為 8.09%。

防止持續的資訊安全漏洞的挑戰是目前美國各行各業的公司面臨的問題。為了應對新出現的威脅並保護敏感資料,安全專業人員需要走在危險的前面並運用技術、政策和流程。此外,為了加速數位轉型進程,企業需要能夠在本地、SDN 和雲端環境中快速且安全地更改其核心業務應用程式。這意味著為了管理這些操作,IT 和安全團隊需要充分了解對整個網路架構的精細控制。

主要亮點

- 這個市場的擴大是由於網路攻擊的日益複雜化。在過去十多年中,網路犯罪和詐騙的數量和嚴重性不斷升級,對企業造成了巨大的損失。隨著網路犯罪的急劇升級,企業一直將支出集中在資訊安全解決方案上,以加強其內部安全基礎設施。最近,針對性攻擊的使用有所增加,這種攻擊允許攻擊者保持匿名並滲透到受害者的網路基礎設施。端點、網路、內部設備、雲端基礎的應用程式、資料以及更多IT基礎設施經常成為攻擊者的目標。

- 例如,2021年3月,駭客針對Microsoft Exchange Server電子郵件軟體中的四個安全漏洞進行了攻擊。他們利用 Exchange 伺服器的一個漏洞,獲取了美國至少 30,000 個組織的電子郵件帳戶的存取權限,其中包括小型企業、城市、鄉鎮和地方政府。這次攻擊使駭客能夠遠端控制受影響的系統,從而可能導致資料竊取和進一步入侵。

- 公開呼籲該地區的政府機構與私人公司和學術機構合作,確保醫療設施免受網路威脅。業界正在進行大量合作。例如,2022年3月,美國參議員提出了《醫療保健網路安全法案》。該立法旨在加強網路安全和基礎設施安全局 (CISA) 與衛生與公眾服務部之間的合作,以加強整個醫療保健和公共衛生部門的網路安全工作。

- 2022 年 1 月,美國聯邦銀行監管機構宣布了網路安全規則,要求及時通知資料外洩事件。擬議的規則將對重大電腦安全事件提供預警。該規則要求銀行公司在確定事件發生後儘快(但不得晚於 36 小時)通知他們。這些規定可以控制美國銀行業的網路攻擊。

- 據美國國防安全保障部網路安全部門稱,使用 COVID-19 主題誘餌、包含冠狀病毒或 COVID-19 相關詞語的新網域註冊以及針對最近快速部署的遠端存取和遠程辦公基礎設施的攻擊的網路釣魚和惡意軟體傳播激增。疫情進一步加速了網路安全的需求,因為公司專注於加強網路安全,並準備數月實施業務永續營運計劃(BCP),包括在隔離條件下工作時的資訊安全監控和回應。

美國網路安全市場的趨勢

身分和存取管理需求是市場促進因素之一

- 隨著全國數位化的快速發展,數位身分證已成為實施存取控制的關鍵。因此,身分識別和存取管理 (IAM) 已成為現代企業的首要任務。

- 美國是世界上數字滲透率最高的國家之一,許多用戶和組織都依賴物聯網設備和運算解決方案。美國各地的組織越來越依賴電腦網路、智慧型裝置和電子資料來進行日常業務,導致線上傳輸和儲存的個人和財務資訊量增加。因此,對身分和存取管理解決方案的需求隨著時間的推移而增加。

- IAM 曾被視為營運後勤部門問題,但由於組織未能有效管理和控制用戶存取而發生了幾起重大資料外洩事件,如今已引起了董事會層面的關注。不斷變化的監管環境以及自帶設備 (BYOD) 和雲端採用等趨勢進一步增強了 IAM 的重要性。此外,獲取資訊和資料的風險也大大增加。

- 據美國聯邦貿易委員會稱,美國銀行和付款行業的身份竊盜有所增加,這可能會推動生物識別解決方案的使用。根據 Pymnts 於 2022 年 3 月發布的《數位身分追蹤報告》,在美國營運的道明銀行 (TD Bank) 等金融機構正專注於數位身分檢驗解決方案,以增強其客戶入職流程,這對 CIP 和 KYC 程序的檢驗做出了重大貢獻。隨著全國各地的金融機構考慮實施各種身分驗證工具,軟體解決方案預計將變得更加普及。

- 身分管理的網路安全漏洞——無論是由有組織犯罪還是國家支持的軍隊所為——除了造成重大的經濟損失、潛在的生命損失以及對 IT 網路和企業聲譽的進一步損害之外,還會影響員工的工作效率和士氣。這些風險需要新等級的識別及存取管理解決方案。

BFSI 部門推動網路安全市場成長

- BFSI 產業是面臨大量資料外洩和網路攻擊的關鍵基礎設施領域之一。由於這是一種利潤豐厚的經營模式,具有驚人的回報,以及相對較低的風險和可檢測性,網路犯罪分子最佳化了一系列邪惡的網路攻擊,以破壞金融部門。這些攻擊的威脅包括木馬、惡意軟體、ATM 惡意軟體、勒索軟體、行動銀行惡意軟體、資料外洩、組織入侵、資料竊取和財務外洩。

- 保護 IT 流程和系統、保護敏感客戶資料、遵守政府法規等策略促使公共和私人銀行機構專注於採用最新技術來防止網路攻擊。此外,客戶期望的不斷提高、技術力的提高和監管要求的不斷提高迫使銀行機構採取積極主動的安全措施。隨著網路銀行和手機銀行等科技和數位管道的興起,網路銀行已成為客戶首選的銀行服務。銀行可能需要利用先進的身份驗證和存取控制流程。

- 2022 年,針對手動工作較少、自動化程度較高的組織的勒索軟體和網路釣魚攻擊也有所增加。 2022 年,全球各地的金融機構都受到了創新型新型勒索軟體技術的影響,這些技術可最大限度地提高威脅行為者的投資報酬率。雖然金融機構只佔勒索軟體攻擊直接針對的受害者的一小部分,但它們可能並且會受到針對第三方的攻擊的影響,而第三方是它們的主要目標。此類威脅將會增加 BFSI 領域對網路安全解決方案的使用。

- 此外,鑑於俄羅斯和烏克蘭之間的衝突以及針對該國的幾乎持續不斷的威脅宣傳活動和漏洞披露,美國政府於 2022 年 4 月成立了一個新機構——網路空間和數位政策辦公室 (CDP),負責制定線上防禦和隱私保護的政策和方向,尋求將網路安全融入美國的外交關係中。

美國網路安全產業概況

美國網路安全市場適度整合,擁有大量中小型供應商,在市場上佔據主導地位。公司不斷投資於策略聯盟和產品開發以擴大市場佔有率。最近的一些市場發展趨勢包括:

- 2022 年 5 月-Google計畫收購美國網路安全公司 Mandiant。收購後,該公司很可能成為Google雲端處理部門的一部分。收購 Mandiant 的舉措源於Google計劃加強其網路安全影響力並建立比市場上的競爭對手更強大的產品組合。

- 2022 年 5 月:思科系統公司宣佈公開發布思科雲端控制框架 (CCF)。思科 CCF 是一個綜合框架,整合了國家和國際安全合規性和認證要求。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 價值鏈分析

- 波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- COVID-19 對市場的影響

第5章 市場動態

- 市場促進因素

- 數位化和對可擴展IT基礎設施日益成長的需求

- 需要因應各種趨勢帶來的風險,包括第三方供應商風險、MSSP 的發展以及雲端優先策略的採用

- 市場限制

- 網路安全專家短缺

- 高度依賴傳統身分驗證方法且缺乏準備

- 趨勢分析

- 泰國越來越多組織使用人工智慧來加強其網路安全戰略

- 向雲端基礎的交付模式的轉變將使雲端安全呈指數級成長。

第6章 市場細分

- 按服務

- 安全類型

- 雲端安全

- 資料安全

- 身分存取管理

- 網路安全

- 消費者安全

- 基礎設施保護

- 其他類型

- 按服務

- 安全類型

- 按部署

- 雲

- 本地

- 按最終用戶

- BFSI

- 衛生保健

- 製造業

- 政府和國防

- 資訊科技/通訊

- 其他最終用戶

第7章 競爭格局

- 公司簡介

- IBM Corporation

- Cisco Systems Inc

- Dell Technologies Inc.

- Fortinet Inc.

- Intel Security(Intel Corporation)

- F5 Networks, Inc.

- AVG Technologies

- IDECSI Enterprise Security

- FireEye Inc.

- Cyberark Software Ltd

第8章投資分析

第9章:市場的未來

The US Cybersecurity Market size is estimated at USD 92.73 billion in 2025, and is expected to reach USD 136.82 billion by 2030, at a CAGR of 8.09% during the forecast period (2025-2030).

The difficulty of protecting against a persistent information security breach is one that businesses in all industries in the United States are currently confronting. To fight against incoming threats and safeguard sensitive data, security experts are expected to keep ahead of dangers and use technologies, policies, and processes. Additionally, enterprises need to be able to swiftly and securely modify their core business applications across on-premise, SDN, and cloud environments as they speed up their digital transformation activities. This means that to manage these operations, IT and security teams need to have a complete awareness of fine-grained control over their whole network architecture.

Key Highlights

- The market's expansion might be ascribed to the sophistication of cyberattacks, which is rising. Over the past ten years, the number and severity of cybercrimes and scams have escalated, causing enormous losses for enterprises. As cybercrimes have dramatically escalated, businesses have focused their expenditure on information security solutions to bolster their internal security infrastructures. The use of targeted assaults, which penetrate targets' network infrastructure while remaining anonymous, has increased recently. Endpoints, networks, on-premises devices, cloud-based apps, data, and numerous other IT infrastructures are frequently targeted by attackers who have a specific target.

- For instance, in March 2021, Hackers targeted four security flaws in Microsoft Exchange Server email software; they used the bugs on the Exchange servers to access email accounts of at least 30,000 organizations across the United States, which included small businesses, towns, cities, and local governments. The attack allowed the hackers to remotely control the affected systems, allowing them access to potential data theft and further compromise.

- Following a public call asking government agencies in the region to join forces with the private sector and academia to ensure that medical facilities are protected from cyber threats. Various collaborations have been taking place in the industry. For instance, in March 2022, Senators of the United States Parliament introduced Healthcare Cybersecurity Act. The Act aims to promote collaboration between Cybersecurity and Infrastructure Security Agency (CISA) and HHS to enhance cybersecurity efforts across the healthcare and public health sector.

- In January 2022, the federal banking regulators of the United States issued a cybersecurity rule requiring prompt notification of a breach. The proposed rule is poised to provide the agencies with an early warning of considerable computer security incidents. It would need notification as soon as possible and no later than 36 hours after a banking enterprise determines that an incident has occurred. Such regulations could control the cyber attacks in the banking sector of the United States.

- According to the US Department of Homeland Security (DHS) Cybersecurity, there has been a sharp increase in phishing and malware distribution using COVID-19-themed lures, the registration of new domain names containing words related to coronavirus or COVID-19, and attacks against recently and swiftly deployed remote access and teleworking infrastructure. As businesses prepare to implement months-long business continuity plans (BCP), including information security monitoring and response while working under quarantine circumstances, focusing on increasing cybersecurity, the pandemic has further expedited the need for cybersecurity.

US Cybersecurity Market Trends

Need For Identity Access Management is One of the Factor Driving the Market

- With the rapid digitalization across the country, digital identity has become crucial to enforcing access controls. As a result, identity and access management (IAM) has become a significant priority for modern enterprises.

- The United States has one of the highest digital penetration rates globally, with many users and organizations depending upon IoT devices and computing solutions. Organizations all over the US increasingly depend on computer networks, smart devices, and electronic data to conduct their daily operations, which has led to growing pools of personal and financial information transferred and stored online. Hence, the need for identity and access management solutions increased over time.

- IAM, viewed as an operational back-office issue, is now gaining board-level visibility following several high-level breaches that have occurred due to the failure of organizations to manage and control user access effectively. The prominence of IAM has been further elevated by an evolving regulatory landscape and trends, such as Bring your Device (BYOD) and cloud adoption. The risks related to accessing information and data have also increased significantly.

- According to the Federal Trade Commission, the prevalence of identity thefts in the banking and payment industries in the United States would encourage more people to use biometric solutions. Financial institutions like TD Bank that operate in the United States are reportedly focusing on digital identity verification solutions to strengthen the customer onboarding processes, with a significant contribution to verifying the CIP and KYC procedures, according to Pymnts' release of the Digital Identity Tracker Report in March 2022. The software solutions are expected to gain more traction as financial institutions nationwide examine implementing various identity verification tools.

- The impact of an identity management cybersecurity breach by organized crime, state-sponsored militaries, and others is packed with implications that can impact staff productivity and morale, apart from substantial financial and potential life losses and further damage to the IT network and company reputation. These risks demand a new level of identity and access management solutions.

BFSI Segment Is Boosting The Cybersecurity Market Growth

- The BFSI industry is one of the critical infrastructure segments that face multiple data breaches and cyber-attacks, owing to the massive customer base that the sector serves and the financial information that is at stake. Being a highly lucrative operation model with phenomenal returns and the added upside of relatively low risk and detectability, cybercriminals are optimizing a plethora of diabolical cyberattacks to immobilize the financial sector. These attacks' threat landscape ranges from Trojans, malware, ATM malware, ransomware, mobile banking malware, data breaches, institutional invasion, data thefts, fiscal breaches, etc.

- With a strategy to secure their IT processes and systems, secure customer critical data, and comply with government regulations, public and private banking institutes focus on implementing the latest technology to prevent cyber attacks. Besides, with greater customer expectations, rising technological capabilities, and regulatory requirements, banking institutions are pushed to adopt a proactive security approach. With the growing technological penetration and digital channels, such as Internet banking, mobile banking, etc., online banking has become customers' preferred choice for banking services. There is a significant need for banks to leverage advanced authentication and access control processes.

- The country also marked the increase of ransomware and phishing attacks targeted at organizations that involved less manual effort and were highly automated in 2022. In 2022, financial firms worldwide were impacted by innovative new ransomware tactics that maximized ROI for the threat actors. While financial firms represent a small percentage of victims directly targeted by ransomware attacks, they can and have been impacted by attacks on third parties, who are prime targets. Such threats are poised to increase the usage of cybersecurity solutions in the BFSI sector.

- Moreover, in light of Russia - Ukraine conflict and a virtually endless cycle of threat campaigns and vulnerability disclosures towards the country, the US State Department, on April 2022, launched a new agency, the Bureau of Cyberspace and Digital Policy (CDP), responsible for developing online defense and privacy-protection policies and direction as the Biden administration seeks to integrate cybersecurity into America's foreign relations.

US Cybersecurity Industry Overview

The united states cybersecurity market is moderately consolidated, with the presence of a large number of SME vendors and dominant major companies in the market. The companies are continuously investing in making strategic partnerships and product developments to gain more market share. Some of the recent developments in the market are:

- May 2022 - Google plans to acquire Mandiant, a United States-based cybersecurity firm. Post-acquisition the company will most likely join Google's cloud computing division. The move to acquire Mandiant stems from Google's plan to strengthen its cybersecurity footprint and create a robust portfolio compared to its competitors in the market.

- May 2022: Cisco Systems Inc. announced that, it has released the Cisco Cloud Controls Framework (CCF) to the public. Cisco CCF is a comprehensive set of national and international security compliance and certification requirements, aggregated in one framework.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Value Chain Analysis

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of Covid-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Digitalization and Scalable IT Infrastructure

- 5.1.2 Need to tackle risks from various trends such as third-party vendor risks, the evolution of MSSPs, and adoption of cloud-first strategy

- 5.2 Market Restraints

- 5.2.1 Lack of Cybersecurity Professionals

- 5.2.2 High Reliance on Traditional Authentication Methods and Low Preparedness

- 5.3 Trends Analysis

- 5.3.1 Organizations in Thailand increasingly leveraging AI to enhance their cyber security strategy

- 5.3.2 Exponential growth to be witnessed in cloud security owing to shift toward cloud-based delivery model.

6 MARKET SEGMENTATION

- 6.1 By Offering

- 6.1.1 Security Type

- 6.1.1.1 Cloud Security

- 6.1.1.2 Data Security

- 6.1.1.3 Identity Access Management

- 6.1.1.4 Network Security

- 6.1.1.5 Consumer Security

- 6.1.1.6 Infrastructure Protection

- 6.1.1.7 Other Types

- 6.1.2 Services

- 6.1.1 Security Type

- 6.2 By Deployment

- 6.2.1 Cloud

- 6.2.2 On-premise

- 6.3 By End User

- 6.3.1 BFSI

- 6.3.2 Healthcare

- 6.3.3 Manufacturing

- 6.3.4 Government & Defense

- 6.3.5 IT and Telecommunication

- 6.3.6 Other End Users

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Cisco Systems Inc

- 7.1.3 Dell Technologies Inc.

- 7.1.4 Fortinet Inc.

- 7.1.5 Intel Security (Intel Corporation)

- 7.1.6 F5 Networks, Inc.

- 7.1.7 AVG Technologies

- 7.1.8 IDECSI Enterprise Security

- 7.1.9 FireEye Inc.

- 7.1.10 Cyberark Software Ltd