|

市場調查報告書

商品編碼

1644876

IGBT(絕緣柵雙極電晶體):市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Insulated Gate Bipolar Transistors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

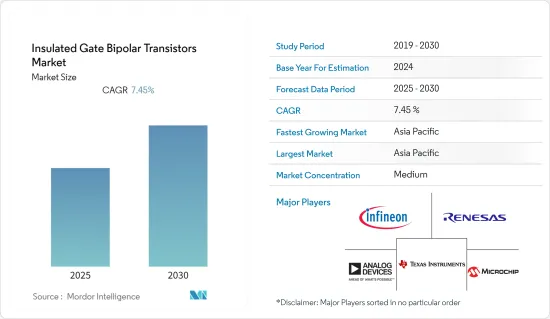

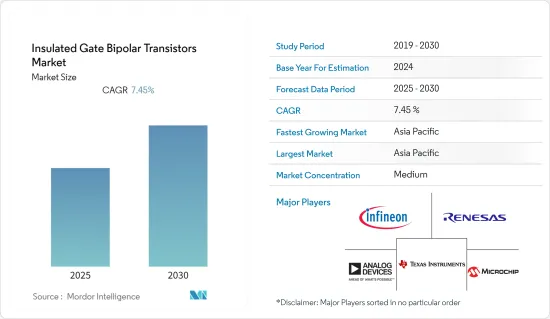

預計預測期內絕緣柵雙極電晶體市場複合年成長率為 7.45%。

主要亮點

- IGBT 等功率電晶體有助於快速散熱,防止過熱並最大限度地減少碳排放和電費。這些優勢使得IGBT成為多種電子產品中不可或缺的一部分。全球人口的成長和石化燃料使用的增加推動了對節能電子設備的需求。

- 此外,電動車市場的快速成長也有望推動IGBT(絕緣柵雙極電晶體)市場的成長。 IGBT是電動車電源的關鍵部件,該領域的發展將有助於降低電動車的成本並延長其續航里程。 IGBT 在電動和混合動力汽車中的應用包括動力傳動系統和充電器中的電能利用以及馬達的電源和控制。

- 太陽能和風能應用通常使用高功率半導體元件來最佳化發電和網路連接。在處理大型可再生計劃中的高功率等級時,IGBT 是極具吸引力的選擇。在太陽能逆變器應用中,逆變器將太陽能板的直流電壓轉換為交流電壓。後者可用於使用單相交流正弦電壓波形為交流負載(如照明、電器、電動工具等)供電,其頻率和電壓取決於逆變器的預期設計。許多 IGBT 選項可以幫助實現這些要求。

- IGBT 等半導體由多種原料製成,包括矽、鍺和砷化鎵。這些材料經過加工和精製形成結晶結構,作為建構不同類型電晶體等半導體元件的基礎。製造半導體裝置所使用的其他原料包括用於摻雜的硼和磷等雜質、用於互連的金屬、用於絕緣的絕緣體以及用於清洗和蝕刻的各種化學品。

- COVID-19 疫情在全球爆發,嚴重擾亂了疫情初期所調查市場的供應鏈和生產。市場上的許多終端用戶產業也受到了疫情的影響,從而對市場產生了負面影響。然而,隨著第二年許多與 COVID-19 相關的限制放寬,許多採用 IGBT 的產品的需求恢復,對市場產生了積極影響。

IGBT(絕緣柵雙極電晶體)市場趨勢

汽車和電動車/混合動力汽車實現顯著成長

- 近年來,汽車產業對電力電子系統施加了嚴格的可靠性限制,推動了對具有成本效益的解決方案的關注。除了典型的車載電氣和電子系統外,混合動力汽車(HEV)和電動車(EV)也需要高電壓和高電流,這對電力轉換帶來了技術挑戰。因此,由於 IGBT 容易受到高內部電場和顯著的結溫波動的影響,因此在確保 HEV動力傳動系統的可靠性方面發揮關鍵作用。

- IGBT 模組用於將電能從一種形式轉換為另一種形式,使人們日常使用的許多物品(包括電動車)都能方便、安全地使用能源。 IGBT功率模組被認為是電動車電動傳動系統的「心臟」。

- 電動汽車中的IGBT用作馬達逆變器中的開關。由於它是一種高電壓、大電流設備,因此通常直接連接到電動車的牽引馬達。各地區電動車市場的大幅成長預計將推動該地區 IGBT 市場的成長。例如,預計 2022 年電動車數量將成長,交付1,050 萬輛新 BEV 和 PHEV,比 2021 年增加 55%。

- IGBT(絕緣柵雙極電晶體)在電動車發展中發揮關鍵作用。由於電動車銷量的成長,預計未來幾年對 IGBT 的需求將大幅成長。例如,國際能源總署最近的一份報告預測,有利的政策和價格下降將意味著到 2030 年全球道路上將有 1.25 億輛電動車。由於這些發展,IGBT 可能會變得越來越受歡迎,以滿足電動車的需求。

- 此外,隨著電動車市場的成長,許多供應商正在增加研發支出,專注於透過開發、整合和製造牽引驅動和控制應用的尖端解決方案來支援混合動力/電動車市場。本公司不斷開發具有更高開關頻率和短路額定值的產品,以支援更耐用、更有效的汽車設計。

亞太地區將迎來顯著成長

- 中國是亞太地區乃至全球整體最大的半導體消費國。中國是世界上最大的家用電子電器生產國和出口國。因此,MOSFET 和 IGBT 被廣泛應用於各種電子設備,使其成為市場最重要的領域之一。

- 過去幾年,電子製造業也一直在穩步擴張。中國資訊通訊研究院報告顯示,2022年1-2月兩個月,主要電子設備製造業增加增加價值額年增12.7%,而全國整體工業增加值的成長率僅7.5%。

- 中國擁有世界上最大的製造業。中國工業和資訊化部表示,儘管新冠疫情管制導致生產和物流中斷,但 2022 年中國工業產值與前一年同期比較增 3.6%。根據工信部預測,2022年製造業產出將成長3.1%,佔中國國內生產總值(GDP)的28%。隨著 MOSFET 和 IGBT 廣泛應用於馬達控制應用,預計該領域將繼續在市場上產生巨大的需求。

- 中國也正在全球引領5G部署。根據GSMA預測, 年終年底,中國5G基地台數量將超過230萬個,其中今年已建成約88.7萬個。根據GSMA預測,到2025年,中國將成為第一個實現10億5G連接的市場。

- 在日本,汽車產業佔該國整體半導體需求的很大佔有率,根據德國工業協會 (VDA) 的數據,到 2022 年,日本將成為第五大汽車市場。汽車產業正在從石化燃料汽車向混合動力汽車汽車和電動車轉型,推動了對動力設備的需求。

- 例如,2022年4月,行動供應商電裝株式會社(Denso Corporation)與全球半導體代工廠聯華電子(United Microelectronics Corporation)的子公司日本聯合半導體公司(United Semiconductor Japan,以下簡稱「USJC」)宣布達成協議,將在USJC的中心合作以滿足300毫米晶圓廠合作生產市場的生產。

IGBT(絕緣柵雙極電晶體)產業概況

IGBT(絕緣柵雙極電晶體)市場競爭激烈,國內外有許多大大小小的公司。市場參與者正在採用產品創新、併購和策略夥伴關係等關鍵策略來擴大產品系列併拓寬其地理覆蓋範圍。市場參與企業包括瑞薩電子、英飛凌科技股份公司和富士電機。

2022 年 8 月,瑞薩電子宣布推出新一代小型高壓 IGBT,以改善電動車核心的電力電子設備。這些設備的額定電流高達 300A,可承受高達 1,200V 的電壓。透過利用該公司的 AE5 系列 IGBT 節省電力,汽車製造商可以節省電池電量並延長其電動車的行駛里程。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 產業價值鏈分析

- COVID-19 市場影響評估

第5章 市場動態

- 市場促進因素

- 功率元件技術的發展增強了IGBT市場

- 物聯網設備和家用電子電器市場擴張

- 市場挑戰

- 由於電壓範圍較低,IGBT 不是首選

第6章 市場細分

- 按類型

- 分立式 IGBT

- 模組IGBT

- 按功率等級

- 高功率

- 中等功率

- 低功耗

- 按應用

- 汽車和 EV/HEV

- 消費者

- 可再生能源

- UPS

- 鐵路

- 工業/馬達驅動

- 其他用途

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- Infineon Technologies AG

- Renesas Electronics Corporation

- Texas Instruments Incorporated

- Analog Devices Inc.

- Microchip Technology Inc.

- NXP Semiconductors

- Broadcom Inc.

- Mitsubishi Electric Corporation

- Toshiba Corporation

- Vishay Intertechnology Inc.

第8章投資分析

第9章:市場的未來

The Insulated Gate Bipolar Transistors Market is expected to register a CAGR of 7.45% during the forecast period.

Key Highlights

- Power transistors, such as IGBTs, help in the rapid dissipation of heat, prevent overheating, and minimize carbon dioxide emissions and the cost of electricity. These advantages make them a crucial component of several electronic products. Due to the increasing worldwide population and usage of fossil fuels, there has been a rising demand for power-efficient electronic devices.

- Further, the enormous growth in the EV market is also anticipated to drive growth in the insulated-gate bipolar transistor (IGBT) market. It forms an integral part of electric vehicle power supplies, and developments in the field will decrease the cost and increase the range of electric vehicles. IGBT applications in electric and hybrid electric vehicles include power usage in powertrains and chargers for delivery and control of power regarding motors.

- Solar and wind applications often use high-power semiconductor devices to optimize generation and network connections. IGBTs are a highly suitable option when working with the high power levels found in large-scale renewable projects. In solar inverter applications, inverters convert DC voltage from a solar array panel to AC voltage. The latter can be used to power AC loads (e.g., lighting, home appliances, power tools, etc.) using a single-phase AC sinusoidal voltage waveform at a frequency and voltage that depend on the design for which the inverter is intended. Many IGBT options can help achieve those requirements.

- Semiconductors, such as IGBTs, are made from a range of raw materials, including silicon, germanium, gallium arsenide, etc. These materials are processed and purified to create a crystalline structure, which forms the foundation for building semiconductor devices such as different types of transistors. Other raw materials used in the manufacture of semiconductor devices include impurities such as boron and phosphorus for doping, as well as metals for interconnects, insulators for isolation, and various chemicals for cleaning and etching.

- The outbreak of COVID-19 across the globe significantly disrupted the supply chain and production of the market studied in the initial phase of the pandemic. Many end-user industries of the market were also affected due to the pandemic, which negatively impacted the market. However, with many COVID-19-related restrictions easing in the following year, the demand for many products incorporating IGBTs picked up, thereby positively influencing the market.

Insulated Gate Bipolar Transistors Market Trends

Automotive and EV/HEV to Register Significant Growth

- In recent years, the automotive industry has imposed stringent reliability constraints on power electronic systems, focusing on cost-effective solutions. Beyond those typically associated with vehicle electrical and electronic systems, the high voltage and high current required in hybrid electric vehicles (HEVs) and electric vehicles (EVs) present technical challenges for power conversion. In accordance with this, IGBTs have assumed a crucial role in ensuring the dependability of the HEV powertrain due to their high internal electric fields and susceptibility to significant junction temperature swings.

- IGBT modules are required to convert electricity from one form to another, allowing for the convenient and secure use of the energy by many items used by people daily, including electric cars. The IGBT power module is regarded as the "heart" of the electrified drive train in electric vehicles.

- The IGBT in an electric vehicle is used in the motor inverter as a switch. It is typically connected directly to the traction motor in an electric vehicle because it is a high-voltage, high-current device. The massive growth of the EV market in various regions is expected to drive growth in the regional IGBT market. For instance, EV volumes estimated that 10.5 million new BEVs and PHEVs were to be delivered in 2022, an increase of +55% from 2021.

- The Insulated Gate Bipolar Transistor (IGBT) has emerged as a key player in the development of electric vehicles. In the upcoming years, it is anticipated that the demand for IGBTs will rise significantly due to the rise in EV sales. For instance, a recent report from the International Energy Agency projects that by 2030, 125 million electric cars will be on the road worldwide because of favorable policies and falling prices. As a result of these developments, IGBTs will be in demand to meet the needs of EVs.

- Moreover, with the EV market's growth, many vendors are increasing their R&D expenditures and concentrating on supporting the H/EV market by developing, integrating, and manufacturing cutting-edge solutions for traction drive and control applications. Businesses are constantly developing high switching frequency and short-circuit rating products to support durable and effective automotive designs.

Asia Pacific is Expected to Witness Significant Growth

- In Asia-Pacific as well as globally, China is the largest consumer of semiconductors, primarily owing to the size of its domestic electronics industry. The country is the largest producer and exporter of consumer electronics in the world. Thus, it is one of the most prominent regions for the market, as MOSFETs and IGBTs are used in a wide range of electronic devices.

- The electronics manufacturing industry has also continued to maintain steady expansion in recent times. As per a report by the China Academy of Information and Communications Technology, during the two months from January to February 2022, the added value of major electronics manufacturers rose 12.7% year-on-year, compared with the 7.5% growth seen in the overall industrial sector in the country.

- The country has the largest manufacturing industry in the world. China's industrial output grew by 3.6% in 2022 from the previous year, as per the Ministry of Industry and Information Technology (MIIT), despite production and logistics disruptions from COVID-19 curbs. The output of the manufacturing sector was estimated to have risen by 3.1% in 2022, accounting for 28% of China's gross domestic product (GDP), according to the MIIT. As MOSFETs and IGBTs find widespread use for motor control applications, the sector is expected to continue creating significant demand for the market.

- China also leads in 5G adoption globally. As per the GSMA, the number of 5G base stations in China exceeded 2.3 million at the end of 2022, including around 887,000 built during the year. The country will be the first market with 1 billion 5G connections, reaching the milestone by 2025, as per the organization.

- In Japan, the automotive industry accounts for a significant share of the total demand for semiconductors in the country, having emerged as the 5th largest automobile market in 2022, as per the German Association of the Automotive Industry, or VDA. The automotive industry's migration from fossil fuel vehicles to hybrid and electric vehicles drives the demand for power devices.

- For instance, in April 2022, DENSO Corporation, a mobility supplier, and United Semiconductor Japan Co., Ltd. ("USJC"), a subsidiary of global semiconductor foundry United Microelectronics Corporation, announced that the companies had agreed to collaborate on the production of power semiconductors at USJC's 300 mm fab in order to serve the growing demand in the automotive market.

Insulated Gate Bipolar Transistors Industry Overview

The insulated gate bipolar transistor market is moderately competitive, owing to several small and large players operating in domestic and international markets. The players in the market are adopting major strategies, like product innovations, mergers and acquisitions, and strategic partnerships, to widen their product portfolio and expand their geographical reach. Some of the players in the market are Renesas Electronics Corporation, Infineon Technologies AG, and Fuji Electric Co. Ltd., among others.

In August 2022, Renesas Electronics unveiled a new generation of small, high-voltage IGBTs in an effort to improve the power electronics at the core of EVs. These devices have current ratings of up to 300 A and can withstand voltages of up to 1,200 V. Automakers will be able to conserve battery power and increase the range of EVs by saving power in the company's AE5 series of IGBTs.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Deployment of Power Device Technologies is Strengthening the IGBT Market

- 5.1.2 Increasing Demand for IOT Devices and Consumer Electronics is Expanding the Market

- 5.2 Market Challenges

- 5.2.1 IGBT not a Preferred Option Due to Lower Voltage Range

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Discrete IGBT

- 6.1.2 Modular IGBT

- 6.2 By Power Rating

- 6.2.1 High Power

- 6.2.2 Medium Power

- 6.2.3 Low Power

- 6.3 By Application

- 6.3.1 Automotive and EV/HEV

- 6.3.2 Consumer

- 6.3.3 Renewables

- 6.3.4 UPS

- 6.3.5 Rail

- 6.3.6 Industrial/Motor Drives

- 6.3.7 Other Applications

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Infineon Technologies AG

- 7.1.2 Renesas Electronics Corporation

- 7.1.3 Texas Instruments Incorporated

- 7.1.4 Analog Devices Inc.

- 7.1.5 Microchip Technology Inc.

- 7.1.6 NXP Semiconductors

- 7.1.7 Broadcom Inc.

- 7.1.8 Mitsubishi Electric Corporation

- 7.1.9 Toshiba Corporation

- 7.1.10 Vishay Intertechnology Inc.