|

市場調查報告書

商品編碼

1644664

汽車保險絲:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Automotive Fuse - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

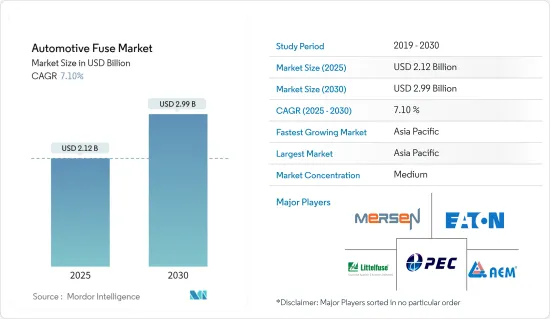

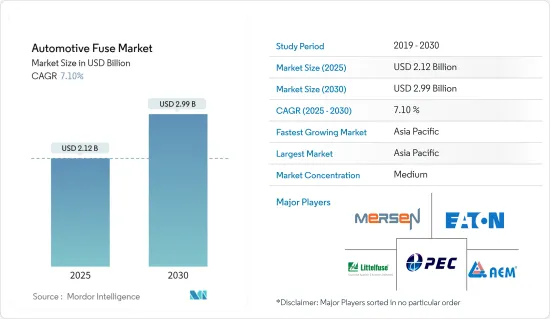

預計 2025 年汽車保險絲市場規模為 21.2 億美元,到 2030 年將達到 29.9 億美元,在市場估計和預測期(2025-2030 年)內複合年成長率為 7.1%。

汽車保險絲可保護車輛內的線路和電氣元件。這些保險絲的額定電壓通常為 32 伏特直流電,但也可以以 42 伏特電壓運作。它們位於一個或多個保險絲盒內,通常位於引擎室的一側或儀表板下方,靠近方向盤。這些保險絲可防止短路和過流,如果檢測到潛在的危險電流水平,則會斷開電路。

主要亮點

- 汽車保險絲可保護電路免受過流和短路的影響。汽車保險絲是從商用卡車到乘用車等所有車型的必備部件,預計未來市場將迅速擴大。這種成長是由多種因素推動的,包括電動車日益普及、對先進安全功能的需求不斷增加以及汽車電氣系統日益複雜。

- 電氣化和自動駕駛技術的引入給汽車行業帶來了巨大的變化。這種發展推動了對汽車保險絲的需求,汽車保險絲是確保現代車輛安全性和可靠性的關鍵部件。

- 汽車產業的技術進步、無人駕駛汽車的興起以及物聯網 (IoT) 技術的整合進一步推動了汽車保險絲的需求。這些進步需要強大的電路保護方法來維持車輛電子設備的可靠性和完整性。保險絲技術的創新,特別是滿足電動和混合動力汽車需求的創新,預計將推動市場成長。

- 儘管現代汽車的複雜性和電氣需求日益增加,但低壓保險絲技術的進步卻落後了。現代車輛配備了許多電子系統,包括高級駕駛輔助系統 (ADAS)、資訊娛樂系統和電動動力傳動系統,這些系統都需要堅固可靠的保險絲。然而,這種技術差距限制了保險絲滿足當今汽車電氣系統不斷變化的需求的能力。

- 由於需求減弱(尤其是已開發國家的需求),預計 2024 年汽車產量成長將放緩。由於家庭收入仍然緊張且資金籌措選擇變得越來越昂貴,持續的高利率對汽車生產和銷售造成壓力。此外,由於現有訂單積壓已被填滿,我們預計 2024 年和 2025 年汽車生產需求將下降。該行業面臨重大的下行風險,包括持續的通貨膨脹和可能擾亂汽車供應鏈的零件短缺。

汽車保險絲市場趨勢

電動/混合動力汽車將大幅成長

- 電池電動車(BEV),通常稱為全電動汽車,使用馬達取代傳統的內燃機。相較之下,混合動力電動車將內燃機與一個或多個馬達結合在一起,並從電池中獲取能量。與純電動車不同,混合動力電動車不能插入電源充電。電池透過再生煞車和內燃機充電。馬達的額外動力允許使用更小的引擎,並且電池還可以支撐輔助負載,從而最大限度地減少車輛靜止時的引擎空轉。

- 電動車 (EV) 和混合動力電動車 (HEV) 中的保險絲可保護電路、設備和電池免受過載和短路等故障的影響。電動車使用直流(DC)電壓來運行電路。

- 隨著充電時間的減少,對支援更高電壓和電流的系統的需求也日益增加。從400V到800V的轉變對電池電路保護提出了重大挑戰。減少充電時間需要提高系統電壓,但較長的行駛距離會增加故障電流。隨著各種電動車的規劃,對更高工作電流的需求也日益成長。這些動態正在重塑電路保護的需求。

- 在中國,每註冊新車就有超過三分之一是電動車,在歐洲,這一數字超過五分之一,而在美國,這一數字為十分之一。相反,即使在日本和印度這樣的已開發汽車市場,電動車銷售也表現低迷。這種銷售集中度正在影響全球電動車庫存,並凸顯了中國趨勢的重要性,中國約佔汽車總銷量和庫存的三分之二。

亞太地區成長強勁

- 中國是汽車和旅遊產業的全球領導者,擁有強大的國內市場和巨大的潛力。根據工業信部預測,到2025年,國內汽車產量可望達到3,500萬輛,鞏固中國作為世界領先汽車製造國之一的地位。這一成長推動了中國汽車產業各個領域的快速發展。

- 根據國際貿易管理局的報告,日本是世界第四大汽車市場,僅次於中國、美國和印度。日本是全球汽車製造強國,主要汽車製造商有豐田、本田、日產、馬自達和鈴木等。汽車業佔日本GDP的2.9%,凸顯其經濟重要性。因此,日本製定了嚴格的車輛安全和污染防治法律。

- 日本支持測量燃油經濟性、二氧化碳和其他排放氣體的測試循環的國際標準。值得注意的是,日本在聯合國世界汽車法規協調論壇制定的世界統一輕型車輛測試循環(WLTC)中發揮了關鍵作用。為了體現這一承諾,日本正在將其乘用車和非重型車輛測試週期從 JC08 過渡到 WLTC。

- 汽車產業對經濟成長和創造就業至關重要,對印度GDP的貢獻率為7.1%。消費需求的增加、收入的提高、都市化和消費行為的改變是汽車產業成長的主要驅動力。

- 光是2024年4月,乘用車、三輪車、二輪車和四輪車的產量就達到了2,358,041輛。此外,2023會計年度印度的汽車出口總量為4,761,487輛。過去幾年,汽車業對GDP的貢獻大幅增加至7.1%。此外,汽車業為約1900萬人提供了直接和間接的就業機會。

汽車保險絲產業概況

由於大量本地製造商的存在,汽車保險絲市場處於半固體。市場的主要企業包括 Pacific Engineering Corporation、Littelfuse Inc.、Eaton Corporation、Mersen Electrical Power、AEM Components (USA) Inc. 等。

由於整合不斷加強、技術進步和地緣政治情勢的變化,市場出現波動。此外,隨著新興中小企業的增加及其收益帶來的投資能力的增強,市場競爭預計還將繼續加劇。

此外,在透過創新獲得永續競爭優勢的市場中,由於預計各個終端用戶行業的新客戶需求將增加,競爭預計會更加激烈。在此背景下,由於最終用戶對保險絲製造商的品質期望,品牌識別起著重要作用。此外,伊頓公司、Little Fuse Inc.、太平洋工程公司、美爾森電力、AEM Components USA Inc. 等現有主要參與者也高度滲透了該市場。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 新冠肺炎疫情和其他宏觀經濟因素對市場的影響

第5章 市場動態

- 市場促進因素

- 汽車新時代的演進-電氣化與自動化

- 汽車上安裝的電氣和電子裝置數量不斷增加

- 市場挑戰/限制

- 低壓保險絲領域發展有限,保險絲市場售後市場混亂

第6章 市場細分

- 按類型

- 刀刃

- 玻璃

- 慢擊

- 高壓保險絲

- 貼片保險絲

- 其他類型

- 按車型

- 乘用車(傳統 - ICE)

- 商用車(傳統內燃機)

- 電動/混合動力汽車

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 法國

- 德國

- 西班牙

- 亞洲

- 中國

- 日本

- 印度

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

- 北美洲

第7章 競爭格局

- 公司簡介

- Pacific Engineering Corporation

- Littelfuse Inc.

- Eaton Corporation

- Mersen Electrical Power

- AEM Components(USA)Inc.

- On Semiconductor Corporation

- OptiFuse

- Bel Fuse Inc.

第8章投資分析

第9章:市場的未來

The Automotive Fuse Market size is estimated at USD 2.12 billion in 2025, and is expected to reach USD 2.99 billion by 2030, at a CAGR of 7.1% during the forecast period (2025-2030).

Automotive fuses safeguard a vehicle's wiring and electrical components. Typically set at 32 volts DC, these fuses can operate at 42 volts. Housed in one or more fuse boxes, they are usually located on one side of the engine compartment or under the dashboard near the steering wheel. These fuses protect against short circuits and over-currents, disconnecting the circuit upon detecting potentially dangerous current levels.

Key Highlights

- Automotive fuses protect electrical circuits from overcurrent and short-circuit situations. Essential for all vehicle types, from commercial trucks to passenger cars, the automotive fuse market is poised for rapid expansion in the coming years. This growth is driven by several factors: the surging popularity of electric vehicles, an increasing demand for advanced safety features, and the escalating complexity of automotive electrical systems.

- The automotive industry underwent a significant transformation with the introduction of electrification and autonomous driving technologies. This evolution is driving the demand for automotive fuses, which are critical components for ensuring the safety and reliability of modern vehicles.

- Technological advancements in the automotive industry, the rise of driverless cars, and the integration of Internet of Things (IoT) technologies further drive the demand for automotive fuses. These advancements require robust circuit protection methods to maintain the dependability and integrity of vehicle electronics. Innovations in fuse technology, particularly those catering to the needs of electric and hybrid vehicles, are expected to propel the growth of the market.

- Despite modern vehicles' growing complexity and electrical demands, advancements in low-voltage fuse technology have lagged. Modern vehicles incorporate numerous electronic systems, such as advanced driver-assistance systems (ADAS), infotainment systems, and electric powertrains, which require robust and reliable fuses. However, this technological gap limits the fuses' ability to cater to the evolving requirements of today's automotive electrical systems.

- The anticipated growth in automotive production is projected to decelerate in 2024 due to a decline in demand, especially within advanced economies. The ongoing high interest rates are exerting pressure on both automotive production and sales as household incomes continue to be strained and financing options have become increasingly expensive. Furthermore, as existing order backlogs are fulfilled, a reduction in demand for automotive production is expected in 2024 and 2025. The sector faces significant downside risks, including persistent inflation and potential component shortages that may disrupt automotive supply chains.

Automotive Fuse Market Trends

Electric/Hybrid Vehicles to Witness Major Growth

- Battery electric vehicles (BEVs), commonly known as all-electric vehicles, utilize an electric motor instead of a traditional internal combustion engine. In contrast, hybrid electric vehicles combine an internal combustion engine with one or more electric motors, drawing energy from stored batteries. Unlike BEVs, hybrid electric vehicles cannot be plugged in for charging; their batteries recharge through regenerative braking and the internal combustion engine. This electric motor's added power can enable a smaller engine, and the battery can also support auxiliary loads, minimizing engine idling when the vehicle is stationary.

- Fuses in Electric Vehicles (EVs) and Hybrid Electric Vehicles (HEVs) safeguard electrical circuits, equipment, and batteries from faults like overloads and short circuits. EVs operate their electrical circuits using direct current (DC) voltage.

- As charging times decrease, a growing demand for systems supporting higher voltage and current is growing. Transitioning from 400V to 800V introduces significant challenges for battery circuit protection. While the push for quicker charging times necessitates elevated system voltages, an extended driving range increases fault currents. The diverse range of planned EVs amplifies the demand for higher operating currents. These dynamics are reshaping circuit protection needs.

- Electric cars are making significant inroads in global markets: in China, over one in three new car registrations were electric; in Europe, the figure surpassed one in five; and in the United States, it reached one in ten. Conversely, electric car sales remain subdued even in advanced automotive markets like Japan and India. This concentration in sales shapes the global electric car stock and underscores the significance of trends in China, which accounts for about two-thirds of total car sales and stocks.

Asia Pacific to Register Major Growth

- China is a global leader in the automotive and mobility industry, driven by its strong domestic market and immense potential. The Chinese Ministry of Industry and Information Technology predicts domestic vehicle production is expected to reach 35 million by 2025, reinforcing China's position as the world's leading car manufacturer. This growth propels rapid advancements across various sectors of China's automobile industry.

- As reported by the International Trade Administration, Japan ranks as the world's fourth-largest automotive market, trailing only China, the United States, and India. Japan is a global powerhouse in automotive manufacturing, hosting major automakers like Toyota, Honda, Nissan, Mazda, and Suzuki. The automotive sector constitutes 2.9% of Japan's GDP, underscoring its economic significance. Consequently, Japan enforces stringent laws focused on vehicle safety and pollution control.

- Japan is championing international standards for testing cycles that gauge fuel consumption, CO2, and other emissions. Notably, Japan played a pivotal role in developing the World Harmonized Light Vehicle Test Cycle (WLTC) under the UN's World Forum for Harmonization of Vehicle Regulations. Reflecting this commitment, Japan is transitioning from its JC08 test cycle to the WLTC for passenger and non-heavy-duty vehicles.

- The automotive industry is crucial to economic growth and job creation, contributing 7.1% to India's GDP. The growing consumer demand, rising income, urbanization, and changing consumer behavior are the major driving forces for the automotive industry's growth.

- In April 2024 alone, production figures for passenger vehicles, three-wheelers, two-wheelers, and quadricycles reached 2,358,041 units. Additionally, in FY23, total automobile exports from India amounted to 4,761,487 vehicles. Over the years, the sector's contribution to the national GDP has significantly increased to 7.1%. Moreover, the automotive sector provides direct and indirect employment to approximately 19 million individuals.

Automotive Fuse Industry Overview

The automotive fuse market is semiconsolidated due to the large number of local manufacturers available in the automotive fuse market landscape. The significant players in the market include Pacific Engineering Corporation, Littelfuse Inc., Eaton Corporation, Mersen Electrical Power, and AEM Components (USA) Inc.

The market studied is fluctuating due to growing consolidation, technological advancement, and geopolitical scenarios. In addition, with the increasing number of new SMEs, the intense competition in the market studied is expected to continue to rise, considering their ability to invest, which results from their revenues.

Further, in a market where the sustainable competitive advantage through innovation is considerably high, competition is anticipated to grow, considering the projected increase in demand from new customers across various end-user industries. In such a situation, the brand identity plays a major role, considering the importance of quality that the end-users expect from a fuse manufacturing player. The market penetration levels are also high with large market incumbents, such as Eaton Corporation, Little Fuse Inc., Pacific Engineering Corporation, Mersen Electric Power, and AEM Components USA Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Evolution of New Automotive Era -Electrification and Autonomy

- 5.1.2 Increasing Incorporation of Electrical and Electronic Units in Automobiles

- 5.2 Market Challenges/Restraints

- 5.2.1 Limited Development in the Field of Low-Voltage Fuses and Unorganized Aftermarket in the Fuse Market

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Blade

- 6.1.2 Glass

- 6.1.3 Slow Blow

- 6.1.4 High-Voltage Fuses

- 6.1.5 Chip Fuse

- 6.1.6 Other Types

- 6.2 By Type of Vehicle

- 6.2.1 Passenger Cars (Traditional -ICE)

- 6.2.2 Commercial Vehicles (Traditional -ICE)

- 6.2.3 Electric/Hybrid Vehicles

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 France

- 6.3.2.2 Germany

- 6.3.2.3 Spain

- 6.3.3 Asia

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Pacific Engineering Corporation

- 7.1.2 Littelfuse Inc.

- 7.1.3 Eaton Corporation

- 7.1.4 Mersen Electrical Power

- 7.1.5 AEM Components (USA) Inc.

- 7.1.6 On Semiconductor Corporation

- 7.1.7 OptiFuse

- 7.1.8 Bel Fuse Inc.