|

市場調查報告書

商品編碼

1644489

美國電氣外殼:市場佔有率分析、行業趨勢、統計數據、成長預測(2025-2030 年)US Electrical Enclosures - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

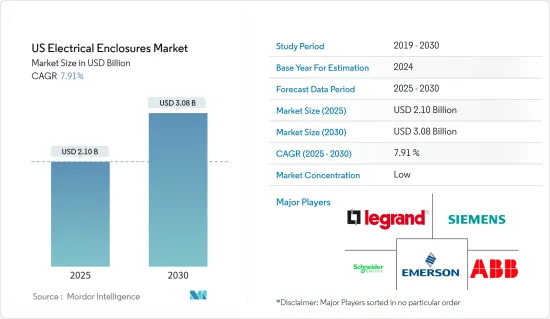

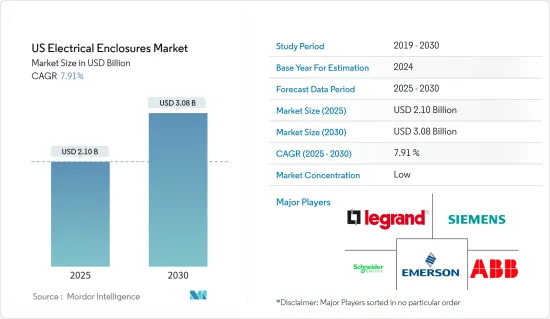

預計 2025 年美國電氣外殼市場規模為 21 億美元,到 2030 年將達到 30.8 億美元,預測期內(2025-2030 年)的複合年成長率為 7.91%。

主要亮點

- 電力和工業基礎設施的增加,加上對安全勞動力的需求,導致了各種工業設施安全標準的發展。這使得電氣外殼成為工業和住宅應用中的關鍵元件。由於各個終端用戶領域的電力消耗不斷成長,尤其是石油和天然氣、汽車和發電領域的電力消耗,日本的需求正在增加。

- 總部位於美國維吉尼亞州的國家電氣工業協會 (NEMA) 針對外殼、耐腐蝕性以及防雨和防水浸沒能力製定了標準。我們還根據電氣外殼的性能對其進行分類。外殼行業須按照特定的最終用戶行業遵守法規。例如,石油和天然氣工業使用本質安全的防火防爆外殼。在預測期內,由於國家OCS租賃計劃導致該國海上和陸上石油和天然氣計劃的增加,預計將增加對電氣外殼的需求,以避免或減輕該國事故的發生。

- 美國石油產量持續快速成長。例如,美國最大的石油生產商之一埃克森美孚已宣布,計劃最早在2024年將其在西德克薩斯州州二疊紀盆地的生產活動擴大到每天100萬桶油當量(BPD)以上。同樣,雪佛龍計劃在 2023 年將其油當量產量提高到 90 萬桶/天。

- 由於新冠疫情迫使美國人待在家中,服務業對商品的需求轉移給供應鏈帶來了壓力。該病毒也影響了工廠工人和原料供應商和製造商等各個相關人員,導致整個電器機殼行業出現原料短缺。 ISM表示,由於零件和勞動力短缺導致的工人缺勤和短期停工,製造業的成長潛力受到阻礙。

美國電氣外殼市場趨勢

商業空間及建築業推動市場需求

- 在商業建築中,通常設有配電盤和專用於電氣設備的空間。商業建築通常有一個主配電室,其他樓層有較小的配電室。美國電氣規範要求面板周圍要有“淨空空間”,也稱為工作空間,以便於接觸過流裝置,並留有足夠的維護空間。工作空間將根據電氣設備的電壓和周圍設備和牆壁而變化。

- 根據美國人口普查局的數據,2008年至2020年美國商業計劃的公共建設支出金額隨著時間的推移而變化。 2019年,公共部門在商業建築計劃上花費了約43億美元。隔年,這一數字下降至約 38.3 億美元。目前,私人辦公室、倉庫和零售/購物主導地位。然而,建築施工正在向智慧建築轉變,商業計劃預計將增加。

- 保護要求不太嚴格,因此商業級外殼可能合適。 NEMA 1 設計用於室內,可防止意外接觸和污染。例如,美國外殼供應商 Hammond Electronics 擁有全系列的 NEMA 3R 外殼,非常適合許多戶外應用。

- 此外,根據美國能源局) 的數據,僅暖通空調和照明就消耗了普通商業建築能源使用量的約 50%。透過採用智慧建築自動化系統、照明和暖通空調解決方案,能源成本可降低 30% 至 50%。根據美國能源資訊署的數據,商業建築約占美國能源消耗的 20% 和溫室氣體排放的 12%。透過減少浪費和節約能源,智慧建築使全球社會受益。隨著智慧建築的興起,市場預計將滿足巨大的需求。

工業領域佔最大市場佔有率

- 必須保護機械和電線,避免其與人體或其他外部物體直接接觸,否則可能導致事故或對人體或機械造成傷害。這些機櫃必須按照行業標準製造,以確保安裝在其中的關鍵組件具有足夠的強度和安全性。

- 環境法規、高昂的資本成本和現代認證要求意味著主要使用自有設施的面板製造商和機器製造商來發現營運困難。

- 許多製造商都向國際電工委員會 (IEC) 或電氣電子工程師協會 (IEEE) 尋求幫助,前者製定了規格系列,後者是一個技術專業組織,制定標準以促進技術進步並造福人類。選擇工業應用外殼時要考慮的因素包括材質、保護、安裝、氣候控制、尺寸、模組化和多功能性。

- 美國國家電氣工業協會 (NEMA) 採用了標準評級系統來指定可使用電氣外殼的環境類型。它被廣泛用於表示固定外殼承受特定環境條件的能力。

- NEMA 認為標準的使用對使用者和製造商都有利。它提高了製造商與買家關係的安全性、經濟性和溝通能力。 NEMA 標準描述了產品的特性和功能。

美國電氣外殼產業概況

美國電器外殼市場比較分散。工業4.0以及各地區能源消耗的增加為電子外殼市場提供了機會。現有競爭對手之間的敵意很高。未來,大公司的創新策略將推動電子外殼市場的發展。

- 2021 年 2 月-Legrand AV 美國推出新型 On-Q 雙用途入牆式外殼。此解決方案提供 9 吋(ENP0900-NA)和 17 吋(ENP1700-NA)外形規格,可用作電視後方 AV 儲存或結構化佈線的外殼。兩用途入牆式外殼設計用於方便地存放您的有線電視盒、串流媒體播放器等。

- 2020年12月-在2020年北美創新高峰會上,Schneider Electric宣布了在美國擴張的計劃,其中包括一項投資4,000萬美元的計劃,用於升級美國的製造資源。該公司也宣布推出一套針對工業物聯網(IIoT)的新型堅固資料中心外殼。 EcoStruxure 微型資料中心 R 系列專為室內工業環境而設計,可快速輕鬆地在工廠車間等位置部署和管理邊緣運算基礎設施。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭對手之間的競爭

- 替代品的威脅

- 產業價值鏈分析

- 電氣外殼標準

- COVID-19 對產業價值鏈的影響

- COVID-19 產業影響評估

第5章 市場動態

- 市場促進因素

- 增加可再生能源消耗和產能

- 發電和配電網路老化

- 市場限制

- 工業放緩

第6章 市場細分

- 依材料類型

- 金屬

- 非金屬

- 按應用

- 發電和配電

- 金屬和採礦

- 運輸

- 石油和天然氣

- 商業空間與建築

- 製程工業

- 其他用途

- 按最終用戶

- 產業

- 商業的

- 住宅

第7章 競爭格局

- 公司簡介

- Schneider Electric SE

- Legrand SA

- Hubbell Inc.

- Emerson Electric Co.

- ABB Ltd

- Eaton Corporation

- Hammond Manufacturing Ltd

- AZZ Inc.

- Austin Electrical Enclosures

- Siemens AG

- Nvent Electric PLC

- Rittal GmbH & Co. Kg

- Adalet(Scott Fetzer Company)

第8章投資分析

第9章:市場的未來

The US Electrical Enclosures Market size is estimated at USD 2.10 billion in 2025, and is expected to reach USD 3.08 billion by 2030, at a CAGR of 7.91% during the forecast period (2025-2030).

Key Highlights

- The increasing power and industrial infrastructure, combined with the need for a safe workforce, has led to various safety standards for the equipment in the industries. This has made electrical enclosures a crucial element in industrial and residential applications. The country has increased demand, owing to the growing electric consumption from various end-user segments, especially from the oil and gas, automotive, and power generation segments.

- The National Electrical Manufacturers Association (NEMA), based out of Virginia, United States, established the standards, such as cover, corrosion resistance, ability to protect from rain and submersion, etc. It also classified electrical enclosures based on their performance. The enclosure industry has to follow the regulations as per a specific end-user industry. For instance, the oil and gas industry uses intrinsically safe, fire and explosion-proof enclosures. Over the forecast period, the increasing offshore and onshore oil and gas projects in the country, owing to the National OCS leasing program, are expected to increase the demand for electrical enclosures to avoid or control any incidents from further taking place in the country.

- Oil production in the United States continues to expand rapidly. For instance, ExxonMobil, one of the prominent oil producers in the country, announced its plans to increase the production activity in the Permian Basin of West Texas by producing more than 1 million barrels per day (BPD) oil-equivalent by as early as the year 2024. Similarly, Chevron plans to increase its net oil-equivalent production to reach 900,000 BPD by 2023.

- As the COVID-19 pandemic kept Americans at home, a change in demand for commodities from services stressed supply chains. The virus also affects labor at factories and various stakeholders such as raw material suppliers and manufacturers, resulting in raw material shortages across the electrical enclosure industry. According to the ISM, manufacturing's growth potential has been hampered by worker absenteeism and short-term shutdowns due to component and labor shortages.

US Electrical Enclosures Market Trends

Commercial spaces and buildings industry to drive the market demand

- It is typical for space to be dedicated to electrical panels and equipment in a commercial building. Often, commercial buildings will have a leading electrical service room and smaller electrical rooms on the other floors. The National Electrical Code requires "clear space," referred to as working space around panelboard, to ensure easy access to overcurrent devices and provide adequate space for maintenance and inspection. The working space will vary as a function of the voltage of the electrical equipment and the surrounding equipment and walls.

- According to US Census Bureau, the value of public construction spending on commercial projects in the United States between 2008 and 2020 varied over time. In 2019, the public sector spent approximately USD 4.3 billion on commercial construction projects. This number had dropped to around USD 3.83 billion by the following year. Currently, private offices, warehouses, and retail/shopping take the primary lead. However, the building construction is moving toward the smart building, which is expected to increase the commercial projects.

- As protection requirements are less severe, a commercial-grade enclosure might be suitable. NEMA 1 is designed for indoor use and protects against incidental contact and dirt. For instance, Hammond Electronics Limited, which supply its enclosure in the United States, has a full NEMA 3R line and is ideal for many outdoor applications.

- Additionally, according to the US Department of Energy (DOE), HVAC, lighting alone consume about 50% of energy use in the average commercial building. Incorporating smart building automation systems, lighting, and HVAC solutions can decrease energy costs between 30% and 50%. According to the United States Energy Information Administration, commercial buildings account for nearly 20% of United States energy consumption and 12% of greenhouse gas emissions. By reducing waste and conserving energy, smart buildings create benefits for the global community. With increasing smart buildings, the market is expected to cater to significant demand.

Industrial segment to hold the highest market share

- Machine and wiring are protected from direct contact with humans and other external bodies, which could otherwise result in an accident or harm human life or the machine. These cabinets must be built according to industry standards to offer enough strength and safety for vital components installed inside.

- Due to environmental regulations, high capital costs, and the latest certification requirements, panel builders and machine manufacturers who predominantly used their facilities found it difficult to run.

- Many manufacturers use the International Electrotechnical Commission (IEC), which establishes a family of electrical enclosure standards, and the Institute of Electrical and Electronics Engineers (IEEE), a technical professional organization that establishes standards to advance technology and benefit humanity. When choosing an enclosure for industrial applications, factors such as material, protection, mounting, climate control, size, modularity, and versatility are considered.

- The National Electrical Manufacturers Association (NEMA) employs a standard rating system to specify the types of settings in which an electrical enclosure can be utilized. It is widely used to indicate a fixed enclosure's ability to tolerate specific environmental conditions.

- NEMA believes that using standards benefits both the user and the manufacturer. It increases the manufacturer-purchaser relationship's safety, economics, and communication. A NEMA standard describes a product in terms of its characteristics and capabilities.

US Electrical Enclosures Industry Overview

The United States Electrical Enclosures Market is fragmented. Industry 4.0, along with the increasing energy consumption in different regions, provides opportunities in the electronic enclosures market. The competitive rivalry among existing competitors is high. Moving forward, the innovation strategies of large companies are driving the electronic enclosures market.

- February 2021 - Legrand AV United States announced its new On-Q Dual-Purpose In-Wall Enclosures. The solutions are offered in 9-inch (ENP0900-NA) and 17-inch (ENP1700-NA) form factors and can be used for AV storage behind a TV or as enclosures for structured wiring. The Dual-Purpose In-Wall Enclosures are designed to house cable boxes, streaming players, and more conveniently.

- December 2020 - At the Innovation Summit North America 2020, Schneider Electric shared its plans for expansion in the United States with USD 40 million projects to upgrade its US manufacturing resources. The company also unveiled a new set of ruggedized data-center enclosures targeting the Industrial Internet of Things (IIoT). Designed for indoor industrial environments, the EcoStruxure Micro Data Center R-Series offers a fast and straightforward way to deploy and manage edge computing infrastructure in a place like a factory floor.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Industry Value Chain Analysis

- 4.4 Electrical Enclosure Standards

- 4.5 COVID-19 Impact on Industry Value Chain

- 4.6 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Consumption and Capacity of Renewable Energy

- 5.1.2 Aging Power Generation and Distribution Network

- 5.2 Market Restraints

- 5.2.1 Economic Slowdown in Industries

6 MARKET SEGMENTATION

- 6.1 By Material Type

- 6.1.1 Metallic

- 6.1.2 Non-metallic

- 6.2 By Application

- 6.2.1 Power Generation and Distribution

- 6.2.2 Metal and Mining

- 6.2.3 Transportation

- 6.2.4 Oil and Gas

- 6.2.5 Commercial Spaces and Buildings

- 6.2.6 Process Industries

- 6.2.7 Other Applications

- 6.3 By End-User

- 6.3.1 Industrial

- 6.3.2 Commercial

- 6.3.3 Residential

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Schneider Electric SE

- 7.1.2 Legrand SA

- 7.1.3 Hubbell Inc.

- 7.1.4 Emerson Electric Co.

- 7.1.5 ABB Ltd

- 7.1.6 Eaton Corporation

- 7.1.7 Hammond Manufacturing Ltd

- 7.1.8 AZZ Inc.

- 7.1.9 Austin Electrical Enclosures

- 7.1.10 Siemens AG

- 7.1.11 Nvent Electric PLC

- 7.1.12 Rittal GmbH & Co. Kg

- 7.1.13 Adalet (Scott Fetzer Company)