|

市場調查報告書

商品編碼

1644482

歐洲工業自動化軟體市場:佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Europe Industrial Automation Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

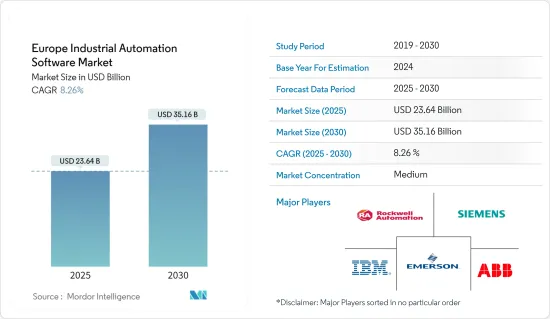

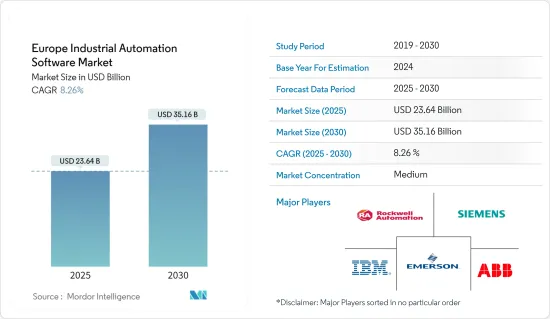

預計 2025 年歐洲工業自動化軟體市場規模為 236.4 億美元,到 2030 年將達到 351.6 億美元,預測期內(2025-2030 年)的複合年成長率為 8.26%。

工業自動化有助於減少每項任務所需的機器工作時間,但這只有透過強大的軟體才有可能實現。

主要亮點

- 人工智慧(AI)和機器人技術的最新趨勢旨在協助甚至完全自動化許多行政和社會任務。在市場發展迅速的歐洲,服務機器人的使用也與工業機器人一起增加。

- 歐盟的許多研究與創新 (R&I) 計畫一直支持解決方案和技術的開發,使歐洲製造業能夠充分利用數位機會。其中許多計劃由未來工廠官民合作關係,涵蓋數位自動化、製造資產流程最佳化、模擬和分析技術以及製造業中小企業的資訊通訊技術創新等領域。

- 歐洲市場在新創企業、合作和收購方面的投資正在增加。預計各地區政府的進一步投資將推動基於客戶端的軟體解決方案的需求,以滿足中小企業和大型組織日益成長的需求。

- COVID-19 疫情推動了工業 4.0 的廣泛應用,該技術採用了多種智慧製造技術。數位化工作流程和自動化不再是一個目標,而正在成為一種要求。物聯網設備為製造商提供了在疫情期間維持收益來源的方法。為應對公共衛生危機,對智慧製造產品和服務的需求不斷成長,預計將推動進一步成長。

歐洲工業自動化軟體市場趨勢

嚴格的節能標準和本地加工推動歐洲市場

- 在歐洲,各國對能源消耗的監管日益加強,包括推出嚴格的節能標準、推廣本地加工等,正在推動該地區工業自動化軟體的成長。日益動態的工業需求要求複雜的操作和流程,以及日益減少特定操作所需的機器運作的需求,也正在推動歐洲對工業自動化軟體的需求。

- 2022 年 5 月,歐盟委員會公佈了 REPowerEU 計畫的細節,該計畫旨在重振歐洲並減少和結束歐洲對俄羅斯石化燃料的依賴。歐盟委員會旨在透過三大支柱加速歐洲的清潔能源轉型,即能源效率、供應源多樣化和石化燃料的快速替代,實現這一目標。這些區域措施正在推動所研究市場對工業自動化的需求。

- 此外,德國電網難以適應日益成長的可再生能源和分散式能源,許多大型電力計劃被擱置。同時,各國政府也正在努力使電網適應新的需求。四大國家電網營運商為提高輸電能力所採取的措施總額將達到 500 億美元。這可能會增加使用 PLC 累積資料並採取進一步的連續措施,從而刺激市場研究。

- 自動化軟體還幫助歐洲終端用戶產業控制整個製造業務並精確地交付高品質的產品。有效實施自動化軟體可以幫助最大限度地減少流程故障,降低產品故障成本和浪費。

汽車產業工業自動化應用的增加將對市場產生正面影響

- 智慧工廠為汽車產業提供了更快回應市場需求、減少製造停工時間、簡化供應鏈和提高生產力的機會。汽車產業是全球自動化生產設施佔比最大的產業之一。

- 為了保持效率,各汽車製造商的生產設施正在自動化。電動車取代傳統汽車的趨勢日益成長,預計將進一步增加汽車產業的需求。

- 在汽車製造廠實施工業控制系統軟體,使公司能夠透過工廠連接產生的資料即時追蹤生產力和質量,為生產線監督和工廠高管提供緩解措施。

- 此外,汽車組裝配對採用自動化的需求龐大,將使生產的汽車數量呈現成長模式,同時降低成本。此外,該領域對智慧工廠的採用顯著增加,對工業自動化軟體產生了巨大的需求。

歐洲工業自動化軟體產業概況

歐洲工業自動化軟體市場被認為是一個中等整合的市場,擁有大量參與者。然而,大部分市佔率被少數幾家公司瓜分,例如:西門子股份公司、ABB 有限公司、IBM 公司、艾默生電氣公司和羅克韋爾自動化公司。

2022年4月,ABB與Savannah Resources PLC簽署了一份合作備忘錄,開始為Savannah位於葡萄牙北部的Barroso鋰計劃開發探索工業自動化和智慧電氣化解決方案。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 全球工業自動化軟體市場分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場動態

- 市場促進因素

- 推出嚴格節能標準,推動各地就地加工

- 大規模生產的需求不斷增加,同時營運成本也不斷降低

- 在工業環境中採用物聯網和人工智慧等新技術

- 市場挑戰

- 貿易緊張局勢與貨幣政策收緊

- 實施工廠自動化解決方案的成本高

第6章 COVID-19 對市場的影響

第7章 市場區隔

- 依軟體類型

- 製造執行系統(MES)

- 資產績效管理 (APM)

- 先進製程控制 (APC)

- 產品生命週期管理 (PLM)

- 操作員訓練模擬器(OTS)

- 工業控制系統軟體(營運和網路安全)

- 按最終用戶產業

- 石油和天然氣

- 化工和石化

- 力量

- 用水和污水

- 飲食

- 汽車與運輸

- 其他最終用戶產業

- 按國家

- 德國

- 法國

- 英國

- 義大利

- 東歐(包括俄羅斯和土耳其)

- 其他歐洲國家

第8章 競爭格局

- 公司簡介

- Siemens AG

- ABB Ltd

- IBM Corporation

- Emerson Electric Co.

- Rockwell Automation Inc.

- OMRON Corporation

- Yokogawa Electric Corporation

- Koyo Electronic Industries Co. Ltd

- Daifuku Co. Ltd

- Honeywell International Inc.

第9章投資分析

第10章:市場的未來

The Europe Industrial Automation Software Market size is estimated at USD 23.64 billion in 2025, and is expected to reach USD 35.16 billion by 2030, at a CAGR of 8.26% during the forecast period (2025-2030).

Industrial automation helps in reducing the machine hours required for the respective operations, which can be made possible only through robust software.

Key Highlights

- Recent developments in artificial intelligence (AI) and robotics aim to assist, or even completely automate, many clerical and social interaction tasks. Along with industrial robots, the use of service robots is increasing in the fast-developing market of the European region.

- Many of the EU's research & innovation (R&I) programs have constantly supported the development of solutions and technologies that enable the European manufacturing sector to utilize digital opportunities fully. Many of the projects are financed by the Factories of the Future Public-Private Partnership as they cover areas such as digital automation, process optimization of manufacturing assets, simulation and analytics technologies, and ICT innovation for manufacturing SMEs.

- The market in Europe experiences high investments in terms of new developments, partnerships, and acquisitions. Further investment by various regional governments is expected to increase the need for client-based software solutions to meet the rising demands of SMEs and larger organizations.

- The COVID-19 pandemic brought significant adoption of Industry 4.0, which utilizes several smart manufacturing technologies. Digital workflows and automation are no longer goals; they are becoming necessary requirements. IoT devices offered manufacturers a path toward preserving revenue streams during the pandemic. Rising demand for smart manufacturing products and services in response to the public health crisis is expected to drive further growth.

Europe Industrial Automation Software Market Trends

Launch of Stringent Energy Conservation Standards and the Drive for Local Processing is Driving the Market in Europe

- The growing regulations on energy consumption across the country, with the launch of strict energy conservation standards and the drive for local processing in Europe, are driving the growth of industrial automation software in the region. The increasingly dynamic needs of the industry, demanding complex operations and processes, and the need to reduce machine hours required for a specific operation are also driving the demand for industrial automation software in Europe.

- In May 2022, the European Commission presented details of its plan, the REPowerEU Plan to repower Europe and reduce and end Europe's reliance on Russian fossil fuels. The European Commission aims to make it possible with three pillars of energy conservation, diversifying supplies, and quickly substituting fossil fuels by accelerating Europe's clean energy transition. Such regional initiatives drive the demand for industrial automation in the market studied.

- Moreover, the electricity grid in Germany is struggling to cope with the extent of renewable and distributed energy in the country, and many major power projects are on hold. At the same time, the government has attempted to adapt the grid to the new demands placed upon it. The measures by the four national grid operators to boost power transmission capacity sufficiently add up to a cost of USD 50 billion. This is likely to escalate the usage of PLC to accumulate data and further take successive measures, thereby fueling the market studied.

- Automation software also helps end-user industries in Europe control the overall manufacturing operations and deliver high-quality products with high precision. The effective deployment of automation software minimizes process failures and reduces product failure costs and waste.

Increasing Use of Industrial Automation in the Automotive Sector Positively Impacts the Market

- Smart factory offers the automotive industry opportunities to react faster to market requirements, reduce manufacturing downtimes, enhance the efficiency of supply chains, and expand productivity. The automotive industry is among the prominent sectors that hold a significant share of the world's automated manufacturing facilities.

- The production facilities of various automakers are automated to maintain efficiency. The growing trend of replacing conventional vehicles with EVs is expected to augment the automotive industry's demand further.

- The implantation of industrial control systems software in auto manufacturing plants allows companies to keep real-time track of productivity and quality through the data generated through plant connectivity and provides mitigating actions to the line supervisors and plant executives.

- Moreover, auto assembly witnessed substantial demand employing automation, showing a growth pattern in the number of cars manufactured while simultaneously cutting costs. Furthermore, the smart factory implementation in this sector has increased considerably, creating significant demand for industrial automation software.

Europe Industrial Automation Software Industry Overview

The Europe industrial automation software market is considered a moderately consolidated market with many players. However, a majority share of the market is divided among a few players such as Siemens AG, ABB Ltd., IBM Corporation, Emerson Electric Co., and Rockwell Automation. Innovations in the market require the developers to understand the industrial process better to deliver a suitable solution and drive close collaboration among the stakeholders during development and customization to suit the end users' needs.

In April 2022, ABB signed a memorandum of understanding (MOU) with Savannah Resources PLC to explore industrial automation and smart electrification solutions for developing Savannah's Barroso Lithium Project in northern Portugal.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Global Industrial Automation Software Market Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Launch of Stringent Energy Conservation Standards and Drive for Local Processing Across Various Geographies

- 5.1.2 Growing Need for Mass Production with Reduced Operating Costs

- 5.1.3 Adoption of Emerging Technologies such as IoT and AI in Industrial Environments

- 5.2 Market Challenges

- 5.2.1 Trade Tensions and Monetary Policy Tightening

- 5.2.2 High Cost of Implementing Factory Automation Solutions

6 IMPACT OF COVID-19 ON THE MARKET

7 MARKET SEGMENTATION

- 7.1 Type of Software

- 7.1.1 Manufacturing Execution Systems (MES)

- 7.1.2 Asset Performance Management (APM)

- 7.1.3 Advanced Process Control (APC)

- 7.1.4 Product Lifecycle Management (PLM)

- 7.1.5 Operator Training Simulator (OTS)

- 7.1.6 Industrial Control Systems Software (Operational and Cybersecurity)

- 7.2 End-user Industry

- 7.2.1 Oil and Gas

- 7.2.2 Chemical and Petrochemical

- 7.2.3 Power

- 7.2.4 Water and Wastewater

- 7.2.5 Food and Beverage

- 7.2.6 Automotive and Transportation

- 7.2.7 Other End-user Industries

- 7.3 Country

- 7.3.1 Germany

- 7.3.2 France

- 7.3.3 United Kingdom

- 7.3.4 Italy

- 7.3.5 Eastern Europe (Including Russia and Turkey)

- 7.3.6 Rest of Western Europe

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Siemens AG

- 8.1.2 ABB Ltd

- 8.1.3 IBM Corporation

- 8.1.4 Emerson Electric Co.

- 8.1.5 Rockwell Automation Inc.

- 8.1.6 OMRON Corporation

- 8.1.7 Yokogawa Electric Corporation

- 8.1.8 Koyo Electronic Industries Co. Ltd

- 8.1.9 Daifuku Co. Ltd

- 8.1.10 Honeywell International Inc.