|

市場調查報告書

商品編碼

1644444

應用平台 -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Application Platform - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

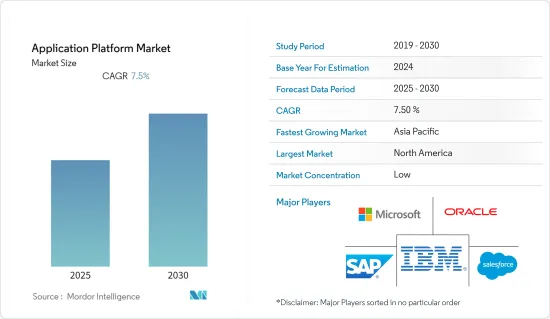

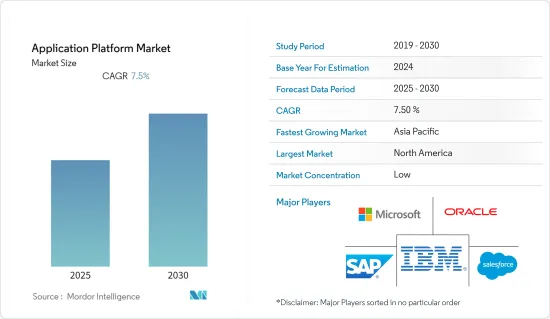

預計預測期內應用平台市場複合年成長率將達到 7.5%。

新冠疫情帶來了積極影響,刺激了該行業的成長率,以滿足應用開發的突然繁榮。

關鍵亮點

- 傳統上,應用平台提供的服務有限。 IBM 大型主機等平台提供 CICS,而桌上型電腦僅提供基本的作業系統。當今的軟體和硬體領域已大大擴展,為開發人員提供了多種選擇。同樣,應用平台現在也很廣泛,支援各種各樣的應用程式。它還允許您使用相同的工具和技能在不同的硬體上建立不同的應用程式,提供一致的體驗。

- 應用平台在現代運算環境中發揮著至關重要的作用。這些平台利用其他應用程式和資料來記錄資訊技術可以提供的所有價值。由於當今大多數組織都依賴應用程式,因此業務價值與應用程式平台之間存在著明顯的關係。我們相信,案例將成為市場成長的主要驅動力之一。

- 此外,雲端基礎的應用平台正在推動軟體產業的發展。 Workday、Salesforce 和 ServiceNow 等純雲端平台供應商都報告了強勁的成長。這些平台能夠快速部署利用和融合人工智慧、自動化和分析等技術進步的應用程式。

- 此外,這些下一代平台的成功也為軟體產業帶來了壓力。例如,Oracle、SAP和Microsoft等應用程式供應商不斷投資這些新一代平台,以提供尖端的應用程式平台並留住現有客戶並吸引新客戶。

- 此外,在新冠肺炎疫情期間,各行各業的公司都在加快數位轉型步伐。曾經預計需要數月或數年的時間的計劃現在只需幾天即可交付,因此快速建置、擴展和交付應用程式的能力至關重要。這對簡化流程和消除耗時任務的工具和平台的需求日益成長。

應用平台市場趨勢

預計雲端基礎服務的普及將推動市場

- 公司正逐漸致力於利用最新技術來減少整體資本支出。中小型企業正在採用雲端基礎的服務(例如 aPaaS 解決方案)來利用減少設定和人事費用以及最小化擴展成本等主要優勢。雲端基礎的解決方案也使公司能夠在需要的時候利用單一、通用的開發框架。

- 此外,資訊科技產業正在經歷前所未有的變革,對直覺的面向客戶的應用程式的需求日益增加。此外,由於需求不斷成長,市場競爭日益激烈,市場速度成為許多公司的關鍵因素。

- 許多軟體解決方案正在從本地轉移到雲端,到應用程式介面 (API) 和微服務的轉變就是明證。隨著技術堆疊的發展,PaaS 的出現也不斷增加。與專注於中間件的傳統 PaaS 解決方案相比,這些服務專注於應用開發和部署。

- PaaS 平台讓開發人員可以存取迭代計劃所需的所有工具。一些平台還提供直覺的功能,如拖放、熱重加載以及第三方路徑整合(如作業系統、資料庫、漏洞管理等),以簡化開發。此外,該平台還提供水平和垂直可擴展性,使企業有機會添加或升級資料庫。

- 根據軟體公司 HashiCorp 的一項調查,到 2021 年,90% 的大型企業受訪者表示他們將採用多重雲端。然而,中小型企業採用多重雲端的速度較慢,主要是因為雲端遷移預算有限。

北美佔很大佔有率

- 由於美國等地區的技術市場已經成熟,預計北美將佔據主要的市場佔有率。許多私人公司正在進入混合 IT 服務的新時代,結合公共、私人和傳統IT基礎設施。這些公司正在採用多重雲端策略來幫助他們改善業務和服務客戶。

- 此外,COVID-19 疫情正加速美國各行各業公司對雲端運算的採用。許多優先採用雲端運算技術的美國公司表示,疫情只會讓這項技術變得更加重要。

- 此外,受需求和快速交付軟體服務的需求推動,技術支出也在增加。例如,美國市場強大的基礎設施和平台,加上龐大的連網設備裝置量和用戶以及這些設備通訊的頻寬,為軟體和服務業的投資鋪平了道路。

- 此外,軟體和技術服務約佔技術市場支出的一半,明顯高於全球許多其他地區。這些案例顯示市場前景樂觀,預計將進一步推動該地區應用平台的採用。

- 此外,該地區的新興企業正在推出新產品和服務以獲得競爭優勢。例如,美國新興企業Fermyon 於 2022 年 10 月宣布已為其雲端應用平台籌集了 2,000 萬美元的早期資金。該新興企業推出了其新的平台即服務 Fermyon Cloud,並宣布了其最新一輪資金籌措。它旨在讓開發人員更輕鬆地使用 WebAssembly 建立雲端應用程式。

- 此外,加拿大政府還採用了「雲端優先」策略,該策略將在啟動資訊技術投資、舉措、策略和計劃時將雲端服務確定並評估為主要交付選項。雲端運算也使加拿大政府能夠利用私人供應商的創新,並使其資訊技術更加靈活。這些努力有望為應用平台提供充足的機會。

應用平台產業概覽

應用平台市場比較集中,有多家知名供應商。該市場的領先供應商正在利用其客戶現有的應用程式投資並轉向新的架構和程式設計範例。此外,供應商正在進行收購並增強其產品以保持市場競爭力。

2022年12月,Salesforce宣佈在其基礎架構上推出低程式碼DevOps Center服務,為開發人員提供建置自訂應用程式的意見平台。 Salesforce DevOps Center 服務是基於 Salesforce 用於建立其應用程式的相同物件模型。

2022 年 5 月,紅帽宣布推出紅帽應用程式基礎。 Red Hat Application Foundations 與 Red Hat OpenShift 一起,是一組連接的應用程式服務,有助於加速混合和多重雲端環境中容器化應用開發和交付。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭對手之間的競爭

- 替代品的威脅

- COVID-19 對市場的影響

第5章 市場動態

- 市場促進因素

- 雲端基礎服務日益普及

- 市場限制

- 新興國家的技能水準較低

第6章 市場細分

- 按類型

- 軟體

- 服務

- 按組織規模

- 中小型企業

- 大型企業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 其他

第7章 競爭格局

- 公司簡介

- International Business Machines Corporation

- Microsoft Corporation

- Oracle Corporation

- Salesforce.com Inc.

- BMC Software Inc.

- Google LLC(Alphabet Inc)

- Micro Focus International Plc

- GigaSpaces Technologies Ltd.

- SAP SE

第8章投資分析

第9章:市場的未來

The Application Platform Market is expected to register a CAGR of 7.5% during the forecast period.

The COVID-19 pandemic positively impacted the industry as it fueled its growth rate to satisfy the sudden boom in application development.

Key Highlights

- Traditionally, application platforms offered restricted services; platforms such as IBM mainframe offered CICS, and desktop PC only offered basic operating systems. Today, software and hardware environments have expanded significantly, and developers often have many options. Similarly, application platforms are now broad and support all kinds of applications. They also provide a consistent experience by enabling the same tools and skills to create different applications on diverse hardware.

- Application platforms play a vital role in modern computing environments. These platforms leverage other applications and data to provide all the value that information technology brings, and also virtually every other application depends on an application platform. Since most organizations today rely on applications, there's a clear connection between business value and application platforms. This instance vows to be one of the primary drivers for the growth of the market.

- Also, cloud-based application platforms are gaining traction in the software industry. Pure cloud platform vendors such as Workday, Salesforce, and ServiceNow have been reporting significant growth. These platforms allow for the faster deployment of applications leveraging and embedding technological advancements such as AI, automation, and analytics.

- Further, owing to the success of these next-generation platforms, the software industry is under pressure. For instance, application vendors such as Oracle, SAP, and Microsoft have been continuously investing in these generation platforms as they aim to provide state-of-the-art application platforms to help retain their existing customers and further attack new customer segments.

- Additionally, amidst the COVID-19 situation, businesses across industries have fast-tracked their digital transformation initiatives. The projects that were scoped to occur over months and years are now aimed to take place in a matter of days, and the ability to build, scale, and ship applications fast has become imperative. Thereby, there is a growing need for tools and platforms that streamline processes and eliminate time-consuming tasks.

Application Platform Market Trends

Growing Popularity of Cloud-based Services is Expected to Drive the Market

- Companies are gradually focusing on decreasing their overall capital expenditure by using modern technologies. Small and medium enterprises are adopting cloud-based services such as aPaaS solutions to leverage vital benefits, including reduced setup and labor costs and minimized expansion costs. Also, cloud-based solutions enable enterprises to use a single, all-purpose development framework as pay-per-need and pay-per-use.

- Moreover, the Information Technology industry is undergoing unprecedented change with the growing demand for intuitive customer-facing applications. Further, owing to the ever-increasing demand, there is an increase in competition, and speed in the market has become a crucial factor for many businesses.

- Many software solutions have been transformed from on-premises into the cloud, evidenced by the transition towards application programming interfaces (APIs) and microservices. As technology stacks developed, there was growth in the emergence of PaaS. These services offer application development and deployment compared to traditional PaaS solutions focusing on middleware.

- aPaaS platforms provide developers access to all the necessary tools that are required to iterate projects. Some platforms also offer intuitive features such as drag and drag, hot reloading, and other 3rd path integrations like operating systems, databases, and vulnerability management, making development easier. Further, the platform also offers horizontal and vertical scalability thus, providing businesses an opportunity to additionally add and upgrade their databases.

- According to a survey by HashiCorp, a software company, in 2021, 90 percent of respondents from large enterprises indicated that they have already adopted the multi cloud. However, smaller businesses are lagging behind in terms of multi-cloud adoption mainly due to the fact that they have smaller budgets for cloud migrations.

North America to Hold Major Share

- North America is expected to hold a significant market share majorly due to the mature tech market in regions such as the United States. Many regional companies are stepping into a new era of hybrid IT services that combine public, private, and traditional IT infrastructure. These organizations have implemented a multi-cloud strategy as it is aiding them in improving their business and delivering services to customers.

- Additionally, the COVID-19 pandemic has accelerated cloud usage for US companies in every industry. Many US enterprises prioritizing cloud adoption in their organization noted the increased importance of cloud due to the pandemic.

- Also, there has been a trend of increasing technological spending driven by demand and the need for software services' speedy delivery. For instance, robust infrastructure and platforms in the US market coupled with a large installed base of users with connected devices and bandwidth for these devices to communicate have paved the way for software and service industry investments.

- Moreover, software and tech services account for around half of the technology market spending, which is significantly higher than that of most other global regions. These instances showcase the positive outlook of the market and are expected to drive further the application platform's adoption in the region.

- Further, emerging companies in the region are introducing new products or services to gain a competitive advantage. For instance, in October 2022, a United States-based start-up, Fermyon announced that is had raised USD 20 million in early-stage funding for its cloud application platform. The startup announced its latest funding round by introducing Fermyon Cloud, a new platform-as-a-service offering. It is designed to make it easier for developers to build cloud applications using WebAssembly.

- Moreover, the Government of Canada has a "cloud-first" strategy whereby cloud services are identified and evaluated as the principal delivery option when initiating information technology investments, initiatives, strategies, and projects. The cloud will also allow the Government of Canada to harness the innovation of private-sector providers to make its information technology more agile. Such initiatives are expected to provide ample opportunities for the application platform.

Application Platform Industry Overview

The Application Platform Market is moderately consolidated with the presence of prominent vendors, among others. The prominent vendors in the market are leveraging the customer's existing application investments toward the transition to emerging architectures and programming paradigms. Further, the vendors are embracing acquisitions and product enhancements to maintain their competitive position in the market.

In December 2022, Salesforce announced the availability of a low-code DevOps Center service on its infrastructure, providing developers with an opinionated platform for building custom applications. The Salesforce DevOps Center service is based on the same object model that Salesforce uses to construct its applications.

In May 2022, Red Hat announced Red Hat Application Foundations, a connected set of application services that, together with the Red Hat OpenShift, help accelerate containerized application development and delivery across hybrid and multi-cloud environments.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 COVID-19 Impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Popularity of Cloud-based Services

- 5.2 Market Restraints

- 5.2.1 Low Skillset in Emerging Economies

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Software

- 6.1.2 Services

- 6.2 By Organization Size

- 6.2.1 Small and Medium-Sized Enterprises

- 6.2.2 Large Enterprises

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 International Business Machines Corporation

- 7.1.2 Microsoft Corporation

- 7.1.3 Oracle Corporation

- 7.1.4 Salesforce.com Inc.

- 7.1.5 BMC Software Inc.

- 7.1.6 Google LLC (Alphabet Inc)

- 7.1.7 Micro Focus International Plc

- 7.1.8 GigaSpaces Technologies Ltd.

- 7.1.9 SAP SE