|

市場調查報告書

商品編碼

1644437

先進配電管理系統:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Advanced Distribution Management System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

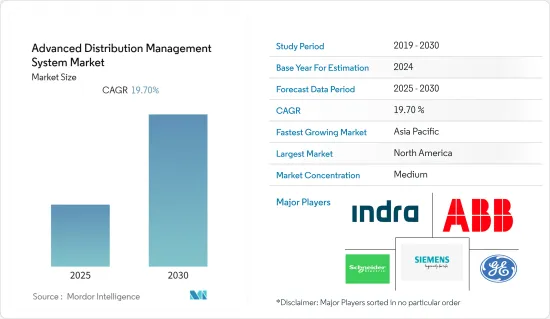

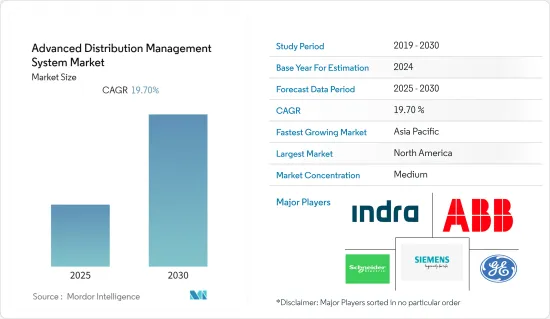

預計預測期內先進配電管理系統市場複合年成長率將達 19.7%。

主要亮點

- 推動市場擴張的主要因素之一是全球對高效率能源資源的需求不斷增加。 ADMS 有助於最佳化電網性能並實現停電恢復的自動化。此外,先進測量基礎設施 (AMI) 的日益普及也推動了市場的成長。 AMI 有助於遠端檢測電力使用情況、電壓監控以及停電識別和隔離。它還使公用事業公司和客戶能夠相互通訊。此外,將連網設備與物聯網 (IoT) 整合、使用先進的組件和控制系統來降低整體成本和功率損耗並提高安全性等技術改進正在推動市場擴張。

- 同時,智慧電網技術的採用不斷增加,從而推動了市場的成長。 ADMS 透過最佳化能源使用和檢測電網問題來幫助有效地傳輸電力和資料。預計推動市場向前發展的其他因素包括加大智慧城市建設力度以及政府實施各種措施以提高碳效率。例如,美國能源局最近的估計預測,到2024年智慧電網投資將達到138億美元以上,占美國電網資訊與控制總投資的64%以上。

- 阿拉伯聯合大公國推出了《2050能源政策》,據說這是該國第一個全面的、基於需求和供應的能源戰略。該策略旨在2050年節省1,900億美元,並將可再生能源在整體能源結構中的佔比從25%提高到50%。我們也計劃將發電產生的二氧化碳排放減少 70%。此外,它還旨在將企業和個人的消費效率提高40%。預計這些政府政策將為市場成長提供巨大的機會。

- 美國能源資訊署稱,全球每年的能源投資自去年以來已增至1.9兆美元,總投資回到了金融危機前的水平。然而,能源結構正從傳統的燃料生產轉向電力和終端使用領域。儘管許多能源公司的財務狀況仍然脆弱,但有跡象表明,開發商正計劃利用寬鬆的貨幣政策和政府支持創造的機會,投資徵兆開發和新計畫。這些對後疫情時代的研究市場產生了正面影響。

- 在建築物或企業中實施全自動 ADMS 系統需要大量的前期成本。每個產業都在尋求降低消費成本。這需要一個能源管理系統來追蹤不同機器和工廠使用了多少能源。雖然從長遠來看,使用節能解決方案和做法可以顯著節省成本和能源,但它們需要大量的初始投資。特定公司、部門或工業設施內可能會存在需要投資更多資源於 EMS 的情況。對於中小型企業來說,這樣的投資是不可行的。大多數情況下,能源管理系統的硬體部分比軟體和服務部分貴得多。

高階配電管理系統 (ADMS) 市場趨勢

軟體領域成長強勁,推動市場

- 一些軟體具有一些功能,允許用戶透過將能源支出映射到業務指標來獲取其能源支出的簡介。一些公司提供可與現有建築管理系統、ERP 和各種其他系統整合的工具。此外,雲端基礎的能源管理軟體的出現進一步推動了需求。

- 雲端服務有效地降低了開發和維護軟體以及維護內部IT專家和基礎設施以收集、儲存和分析能源資料的營運成本所花費的直接財務成本、時間和資源。此外,美國能源資訊署稱,去年智慧電網管理資訊科技預計投資 47 億美元,智慧電網相關資訊技術投資為 19 億美元。如此巨額的投資可能會為軟體產業創造成長機會。

- 例如,聯想提供基於策略的集中能源管理解決方案XClarity Energy Manager。該軟體可協助您追蹤、管理和規劃伺服器的電源使用情況。該軟體有助於降低能源成本並更好地控制資料中心的電力使用。

- Honeywell也為其雲端基礎的能源管理軟體 Inncom INNcontrol 5 增加了推播通知、警報和增強型使用者介面。 INNcontrol 5 具有即時儀表板,可顯示物業級別資料、HVAC 分析報告以及每個房間中房間自動化 IoT 設備的狀態(恆溫器、居住感測器、門感測器、照明控制等)。

- 數位解決方案能夠在日益複雜的電網中收集、處理和增強測量資料。正是在這樣的背景下,去年三月,薩基姆交付目的地SICONIA 軟體套件,該套件包括一個多能源、可擴展的前端系統 (HES) 和一個基於巨量資料的儀表資料管理系統 (MDMS)。這一重大計劃標誌著瑞士智慧電網之旅的開始以及與 E 集團的長期夥伴關係。

預計北美將出現顯著成長

- 根據美國能源資訊署統計,過去幾年,美國初級能源消費量約98兆英熱單位(Btu),佔全球初級能源消費量約604兆Btu的16%左右。美國佔世界人口的4%,人均初級能源消費量位居世界第十。如此巨大的能源消耗可能會增加能源工廠的生產能力,並影響該地區慣性系統的成長。

- 2023 年 1 月,Landis+Gyr Group AG 的子公司 Landis+Gyr Technology Inc. 與一家美國投資者擁有的電力公司簽署了一份新契約,對該公司的計量軟體基礎設施進行現代化改造。該公用事業公司的現代化計畫仍需獲得監管部門的批准。這份為期20年的合約包括電錶資料管理軟體、軟體即服務(SaaS)和支援該公司50萬台傳統單向通訊電錶的服務,該計劃最終預計將整合超過50萬台新一代智慧電錶設備。

- 美國國防部(DOD)是聯邦政府中最大的能源消耗部門,佔聯邦政府總能源消費量的77%。能源管理對於國防部的運作至關重要。國防部依靠能源來確保任務行動的準備和恢復能力,從維護基地和訓練設施到為噴射機和船隻動力來源。能源效率意味著使用更少的能源提供相同或更優質服務,這可以在長期內節省資金,特別是對於國防部這樣的機構而言,能源開支約佔其年度預算的 2%。

- 根據紐約州能源研究與發展局 (NYSERDA) 的說法,啟用智慧技術和即時能源管理系統可以平均降低 15% 的成本、減少能源浪費並創建提高員工生產力的生態系統,從而提高收益。此外,過去兩年建築業的二氧化碳排放增加。在這裡,也越來越需要按照 SDS 計畫在建築物中實施能源管理系統。

高階配電管理系統 (ADMS) 產業概覽

由於有多家參與者,先進配電管理市場競爭較激烈。市場參與者正在採用產品創新、併購等策略來擴大產品系列、增加其地理覆蓋範圍,並主要為了保持市場競爭力。

2022 年 5 月,Advanced Utility Systems 推出了 Harris Computer 的 Infinity 客戶資訊系統 (CIS)。它是一個現代化的、雲端基礎的客戶資訊和計費軟體平台,對於公用事業轉變客戶服務和計費、客戶體驗和現場勞動力管理至關重要。隨著公共事業對其客戶體驗進行數位化和現代化,整合 Advanced 的 Infinity CIS 將使他們能夠增強客戶服務和參與舉措。 Infinity CIS 擁有無與倫比的能力,可以幫助公共事業滿足其所有需求,甚至更多。 2022 年 2 月,能源與智慧電網解決方案供應商 Swell Energy Inc. 宣布其專有的分散式能源資源管理系統 GridAmp 全面上市。擴展的 DERMS 平台將把分散式能源資源(DER)(例如太陽能和電池儲存)整合到虛擬發電廠(VPP)中,為公共事業提供額外的電網功能。作為 Swell 家庭電池獎勵計劃的一部分,GridAmp 將使用電錶後太陽能電池管理多個電網服務營運,Swell 是正在瓦胡島、電錶後端和大島開發的 80 兆瓦分佈式 VPP(由夏威夷電力公司承包並獲得夏威夷公共產業委員會的核准)。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 市場促進因素

- 智慧電網技術的快速應用

- 日益成長的能源需求和高效率的配電管理系統

- 新興國家增加基礎建設投資

- 市場限制

- 增加初始投資

- 市場機會

- 產業吸引力-波特五力模型

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響

第5章 市場區隔

- 透過提供

- 軟體

- 服務

- 諮詢

- 系統整合

- 支援和維護

- 依系統類型

- 配送管理系統 (DMS)

- 自動抄表/進階計量基礎設施 (AMR/AMI)

- 分散式能源資源管理系統 (DERMS)

- 能源管理系統 (EMS)

- 客戶資訊系統(CIS)

- 儀表資料管理系統 (MDMS)

- 按最終用戶產業

- 能源與公共產業

- 資訊科技/通訊

- 製造業

- 國防和政府機構

- 基礎設施

- 運輸和物流

- 其他最終用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 其他亞太地區

- 中東和非洲

- 北美洲

第6章 競爭格局

- 公司簡介

- ABB Group

- General Electric Company

- Siemens AG

- Advanced Control Systems

- Schneider Electric SE

- Survalent Technology

- ETAP/Operation Technology,Inc.

- S&C Electric Company

- Capgemini Consulting

- Open Systems International, Inc

- Alstom SA

第7章:未來市場展望

The Advanced Distribution Management System Market is expected to register a CAGR of 19.7% during the forecast period.

Key Highlights

- One of the primary reasons driving market expansion is the increasing demand for efficient energy resources worldwide. ADMS assists in optimizing distribution grid performance and automating outage restoration. Furthermore, the increased adoption of advanced metering infrastructure (AMI) boosts market growth. AMI assists in remotely measuring electricity usage, monitoring voltage, and recognizing and isolating outages. It also allows utilities and customers to communicate with one another. Furthermore, technological improvements such as integrating connected devices with the Internet of Things (IoT) and using modern components and control systems to improve security while reducing total costs and electricity loss propel market expansion.

- In accordance with this, increased implementation of smart grid technologies boosts the market growth. ADMS assists in effectively transporting electricity and data by optimizing energy usage and detecting grid issues. Other reasons, including the increased building of smart cities and the implementation of various government efforts to improve carbon efficiency, are expected to propel the market forward. For instance, according to the recent estimates of the US Department of Energy, smart grid investments are expected to reach over USD 13.8 billion by 2024, accounting for over 64% of the total grid information and control investments in the United States.

- The United Arab Emirates introduced "Energy Policy 2050," which is regarded as the nation's first comprehensive supply-and-demand-based energy strategy. The strategy intends to save USD 190 billion by 2050 and boost the share of renewable energy in the whole energy mix from 25% to 50%. It also aspires to lower the carbon footprint of power generation by 70%. Additionally, it aims to improve corporate and individual consumption efficiency by 40%. Such policies by the government will significantly create opportunities for the market to grow.

- According to EIA, from the past year, annual global energy investment was set to rise to USD 1.9 trillion, bringing the total investment volume back towards pre-crisis levels. However, the composition has shifted towards power and end-use sectors - and away from traditional fuel production. While many energy companies remain in a fragile financial state, there are signs developers are using the window provided by accommodative monetary policy and government backing to plan infrastructure developments and investments in new projects. These positively affected the studied market during the post covid.

- Significant upfront costs are associated with installing an entirely automated ADMS system in buildings or enterprises. Every industry seeks to reduce the cost of its consumption. Therefore, they need energy management systems to track how much energy various devices and factories use. Even while using energy-efficient solutions and practices results in significant long-term cost and energy savings, it necessitates a hefty initial investment. There may be circumstances when certain businesses, sectors, or industrial facilities need more resources to invest in EMS. For small- or medium-sized companies, such an expenditure is not practical. In most cases, the hardware parts of energy management systems are substantially more expensive than the software and service parts.

Advanced Distribution Management System (ADMS) Market Trends

Software Segment would Experience Significant Growth and Drive the Market

- Some software comprises features, such as the user getting a snapshot of energy spending mapped to business metrics. Some of the companies provide tools that integrate with the existing building management systems, ERP, and various other systems. Moreover, the advent of cloud-based energy management software further fuels the demand.

- Cloud services effectively minimize operational costs of software development and maintenance and direct monetary costs, time, and spent resources on maintaining in-house IT professionals and infrastructure for gathering, storing, and analyzing energy data. Further, According to EIA, the Admin Information technology of smart grids is expected to invest USD 4.7 billion in the last year, and smart grid-related information technology investment is USD 1.9 billion. Such huge investments would create an opportunity for the software segment to grow.

- For instance, Lenovo offers XClarity Energy Manager, a centralized policy-based energy management solution. The software helps track, manage, and plan server power utilization. It helps decrease energy costs and further control data center power usage.

- Also, Honeywell added enhancements to its cloud-based energy management software, Inncom INNcontrol 5, with push notifications, alarms, and enhanced UI, which allows multi-property scalability for full portfolio management. INNcontrol 5 features a live dashboard with property-level data and HVAC analytics reports, as well as the status of each guestroom's room automation IoT devices, such as the thermostat, occupancy sensor, door sensor, and lighting controls.

- Digital solutions make it possible to collect, process, and enhance the metering data in increasingly complex grids, and in this context, in March last year, Sagemcomwas selected by Groupe E for the delivery of its SICONIA Software suite, which is composed of Multi-energy and scalable Head-End System (HES) and Big data-based Meter Data Management system (MDMS). This large-scale project is the beginning of the Smart Grid journey in Switzerland and a long-term partnership with Groupe E.

North America is Expected to Experience Significant Growth

- According to US Energy Information Administration, past few years, total primary energy consumption in the United States was around 98 quadrillion British thermal units (Btu), accounting for approximately 16% of total global primary energy consumption of approximately 604 quadrillion Btu. The United States had a 4% share of the global population, and the country had the world's tenth highest per capita primary energy consumption. Such huge consumption of energy would increase the production capacity of energy plants that would impact the growth of inertia systems in the region.

- In January 2023, Landis+Gyr Technology Inc., a subsidiary of Landis+Gyr Group AG, and a U.S. investor-owned utility have signed a new agreement to modernize the company's metering software infrastructure. The utility's plans to modernize are still subject to regulatory clearance. The 20-year contract comprises meter data management software, Software as a Service, and services to support the utility's 500,000 legacy one-way communicating electric meters, and the project will eventually incorporate over 500,000 next generation smart metering devices.

- The US Department of Defense (DOD) consumes the most energy of any federal entity, accounting for 77% of total federal government energy consumption. The control of energy is critical to DOD operations. DOD relies on energy to ensure readiness and resiliency for mission activities, from maintaining bases and training facilities to powering jets and ships. Energy efficiency-providing the same or better quality of service with less energy-can lower agency expenses over time, especially for a department like the DOD, where energy accounts for around 2% of the annual budget.

- According to the New York State Energy Research and Development Authority (NYSERDA), enabling smart technologies and real-time energy management systems can decrease costs by an average of 15% and improve the bottom line by creating an ecosystem that reduces energy waste and boosts employee productivity. Moreover, the building sector's CO2 emission has increased over the past two years. Again, this has intensified the need to install energy management systems in buildings, keeping track with the SDS program

Advanced Distribution Management System (ADMS) Industry Overview

The Advanced Distribution Management Market is moderately competitive owing to the presence of multiple players. The players in the market are adopting strategies like product innovation, mergers, and acquisitions to expand their product portfolio, expand their geographic reach, and primarily stay competitive in the market.

In May 2022, Advanced Utility Systems debuted its Infinity Customer Information System (CIS), a Harris Computer firm. It is a modern, cloud-based customer information and billing software platform that is critical in transforming customer service and billing, customer experience, and field workforce management for utilities. As utilities digitally modernize their customer experience, integrating Advanced's Infinity CIS would boost customer service and engagement initiatives. It boasts unrivaled functionality to assist utilities in accomplishing all of their needs and more. In February 2022, Swell Energy Inc. (Swell), an energy and smart grid solutions provider, announced the general availability of GridAmp, its proprietary Distributed Energy Resource Management System. The expanded DERMS platform combines Distributed Energy Resources (DERs), such as solar and battery storage devices, into virtual power plants (VPPs) to provide utilities with additional grid capabilities. GridAmp will manage multiple grid service operations using behind-the-meter solar-powered batteries as part of Swell's Home Battery Rewards program, an 80-megawatt distributed VPP being developed on the islands of O'ahu, Maui, and Hawai'i - as contracted with Hawaiian Electric and approved by the Hawai'i Public Utilities Commission.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid Adoption Of Smart Grid Technology

- 4.2.2 Rising Energy Demand And Efficient Distribution Management System

- 4.2.3 Increasing Investment in Infrastructure Construction in Emerging Economies

- 4.3 Market Restraints

- 4.3.1 Higher Initial Investment

- 4.4 Market Opportunities

- 4.5 Industry Attractiveness - Porter Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 Offering

- 5.1.1 Software

- 5.1.2 Service

- 5.1.3 Consulting

- 5.1.4 System Integration

- 5.1.5 Support and Maintenance

- 5.2 System Type

- 5.2.1 Distribution Management System (DMS)

- 5.2.2 Automated Meter Reading/Advanced Metering Infrastructure (AMR/AMI)

- 5.2.3 Distributed Energy Resources Management Systems (DERMS)

- 5.2.4 Energy Management Systems (EMS)

- 5.2.5 Customer Information Systems (CIS)

- 5.2.6 Meter Data Management Systems (MDMS)

- 5.3 End-user Verticals

- 5.3.1 Energy & Utilities

- 5.3.2 IT and Telecommunications

- 5.3.3 Manufacturing

- 5.3.4 Defense and Government

- 5.3.5 Infrastructure

- 5.3.6 Transportation & Logistics

- 5.3.7 Others End-user Verticals

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Rest of Europe

- 5.4.3 Asia Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 Rest of Asia Pacific

- 5.4.4 Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 ABB Group

- 6.1.2 General Electric Company

- 6.1.3 Siemens AG

- 6.1.4 Advanced Control Systems

- 6.1.5 Schneider Electric SE

- 6.1.6 Survalent Technology

- 6.1.7 ETAP/Operation Technology,Inc.

- 6.1.8 S&C Electric Company

- 6.1.9 Capgemini Consulting

- 6.1.10 Open Systems International, Inc

- 6.1.11 Alstom S.A.