|

市場調查報告書

商品編碼

1644426

智慧氣候控制-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Smart Climate Control - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

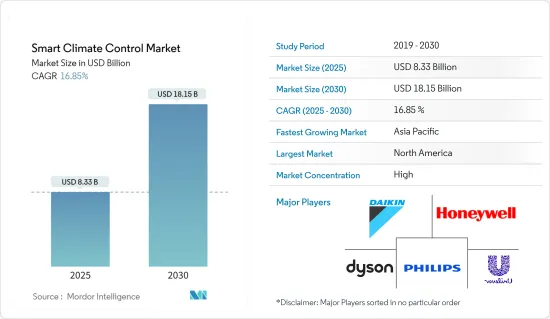

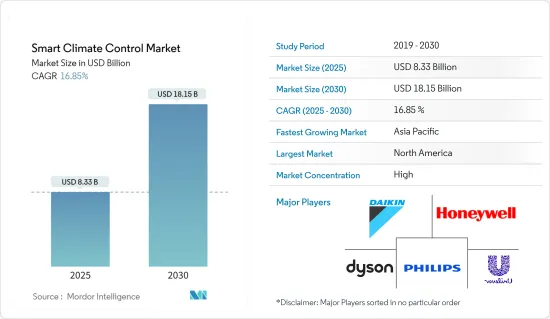

智慧氣候控制市場規模預計在 2025 年為 83.3 億美元,預計到 2030 年將達到 181.5 億美元,預測期內(2025-2030 年)的複合年成長率為 16.85%。

住宅和商業建築對節能環保解決方案的需求不斷成長,從而推動了智慧氣候控制系統的採用。

關鍵亮點

- 物聯網 (IoT) 技術的廣泛應用使得在住宅和建築物中安裝智慧氣候控制系統變得更便宜。借助感測器、智慧恆溫器和連網型設備,這些系統可以收集資料並根據天氣和使用者偏好調整設定。

- 近年來,全球消費者採用節能解決方案、安全設備和建造健康住宅的趨勢顯著成長。因此,住宅越來越傾向於將健康和安全設備作為住宅的一部分,其中空氣清淨機、恆溫器和智慧感測器變得越來越突出。

- 近年來,人們對智慧互聯空氣清淨機的需求日益增加。人們對設備的需求日益成長,這些設備可以在用戶的智慧型手機上顯示空氣過濾水平和其他統計數據,從而給予用戶更多的控制權,並在需要更換過濾器時提醒他們。

- 此外,車輛、住宅、商業空間、辦公室等場所對去除空氣中的顆粒物和細菌的需求日益成長,這也推動了全球對智慧氣候控制的需求。然而,高昂的維護成本和昂貴的安裝成本使得智慧氣候控制產品價格昂貴,從而抑制了市場的成長。

- COVID-19 對市場成長產生了正面影響。疫情期間,人們開始尋求改善室內空氣品質、降低病毒透過空氣傳播的風險的方法,對智慧空氣清淨機的需求也隨之增加。同時,智慧恆溫器和感測器也積極支持了市場成長,因為人們採用這些產品來降低能源成本並監測室內空氣品質。因此,疫情提高了人們對室內空氣品質和舒適度重要性的認知,從而增加了對智慧空氣清淨機、智慧恆溫器和智慧感測器的需求。

智慧氣候控制市場趨勢

家庭支出增加

- 由於快速的都市化和工業化導致開發中國家和世界各地的空氣品質惡化,空氣清淨機等家用電子電器越來越受歡迎。呼吸系統疾病發生率上升、可支配收入激增、家用產品支出增加以及人口成長是推動市場成長的一些因素。

- 已開發國家和開發中國家的消費支出都在成長,其中很大一部分用於消費品和家用電子電器產品。根據全國住宅建築商協會的數據,新建獨棟住宅的典型買家在購房後的頭兩年內往往比不搬家的住宅平均多花費 4,500 美元。同樣,現有單戶住宅的買家可能比不搬家的類似住宅多花費 4,000 多美元,其中第一年花費近 3,700 美元。

- 隨著家庭消費能力的提高,消費者更有可能了解並投資於改善生活品質的技術。智慧型 HVAC 系統提供便利、節能和舒適,使其成為可支配收入較多的消費者的理想選擇。

- 家庭支出的增加使得消費者優先考慮舒適性、便利性、能源效率和環境永續性,從而推動了對空氣清淨機、恆溫器和其他安全設備的需求。例如,英國消費者在家用電子電器產品上的支出從 2018 年第一季的 28.31 億英鎊增加到 2023 年第一季的 33.9 億英鎊。

亞太地區將經歷最高成長

- 由於德里和孟買等主要城市的空氣品質指數 (AQI) 水平較高,印度對空氣清淨機的需求很高。宏碁、Zeco Aircon 和飛利浦等公司的空氣清淨機銷量均出現激增。據銷售該產品的公司負責人稱,由於空氣污染日益嚴重,印度各地室內空氣清淨機的銷售量增加了 30% 至 40%。

- 日本也是空調市場的重要投資者和應用國。日本對空氣污染和氣候變遷的日益擔憂促使消費者採用智慧恆溫器等更節能的設備。日本政府也與氣候與清潔空氣聯盟合作應對空氣污染和氣候變遷危機。

- 此外,根據世界銀行的數據,全球空氣污染最嚴重的10個城市中有9個位於南亞,導致該全部區域每年約有200萬人過早死亡,並造成巨大的經濟損失。

- 此外,在該市場營運的供應商正在開發用於智慧氣候控制的先進新產品。例如,2023年1月,中國科技巨頭華為在中國推出了智選720智慧空氣清淨機3s,具有八級淨化和除甲醛功能。這款空氣清淨機配備了備用保護濾網和H13 HEPA 材料。它可以去除室內環境中的潛在污染物。

智慧氣候控制產業概況

智慧氣候控制市場高度集中,大金工業株式會社、霍尼韋爾國際、聯合利華和戴森等主要參與者在全球提供一系列氣候控制解決方案。無論從資本投資或政府監管角度來看,該市場都有很高的進入門檻。新參與企業需要投資建立製造設施、推動技術進步並跟上變化以保持市場競爭力。

2023 年 4 月,中國科技巨頭小米推出了全新智慧空氣清淨機系列。該型號由該公司首席行銷長 Anuj Sharma 發布,配備了預過濾器、真正的 HEPA 過濾器、新型活性碳過濾器和負離子空氣發生器。此外,智慧空氣清淨機4還擁有Filtration+ TUV防過敏認證以及甲醛吸收技術。此型號的設計涵蓋範圍積達 516 平方英尺,潔淨空氣輸送率 (CADR) 為每小時 400 立方公尺。

2023 年 4 月,全球家庭舒適、安防和安全解決方案供應商 Resideo Technologies, Inc. 推出了 Honeywell Home T10+ 智慧恆溫器套件。該公司對其 2019 年發布的獲得能源之星 (ENERGY STAR) 認證的 Honeywell Home T10 Pro 智慧恆溫器進行了改進。新型恆溫器增加了同時控制三種不同室內空氣品質 (IAQ) 設備的功能。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響評估

第5章 市場動態

- 市場促進因素

- 與空氣污染有關的健康問題日益增多

- 家庭支出增加

- 市場限制

- 安裝和維護成本高

第6章 市場細分

- 依產品類型

- 空氣清淨機

- 智慧型恆溫器

- 智慧型感測器(煙霧和空氣品質)

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 歐洲其他地區

- 亞太地區

- 中國

- 日本

- 其他亞太地區

- 其他

- 北美洲

第 7 章 空氣清淨機市場細分

- 按過濾技術

- 高效微粒空氣 (HEPA)

- 其他技術(靜電除塵設備(ESP)、離子產生器、臭氧產生器)

- 按類型

- 獨立的

- 非智慧

第8章 競爭格局

- 公司簡介

- AllerAir Industries Inc.

- Xiaomi Corp.

- Wirlpool Corporation

- LG Electronics Inc.

- Unilever PLC(Blueair AB)

- Sharp Corporation

- Koninklijke Philips NV

- Dyson Ltd.

- Honeywell International Inc.

- Daikin Industries Ltd.

第9章投資分析

第 10 章 MAKRT 的未來

The Smart Climate Control Market size is estimated at USD 8.33 billion in 2025, and is expected to reach USD 18.15 billion by 2030, at a CAGR of 16.85% during the forecast period (2025-2030).

The increasing demand for energy-efficient and eco-friendly solutions in residential and commercial buildings has led to the adoption of smart climate control systems.

Key Highlights

- The proliferation of the Internet of Things (IoT) technology has made installing smart climate control systems in homes and buildings more affordable. With the help of sensors, smart thermostats, and connected devices, these systems can collect data and adjust settings based on weather and user preferences.

- In recent years, the consumer propensity toward adopting energy-efficient solutions, safety equipment, and building healthy homes has increased significantly across the world, due to which homeowners are increasingly leaning toward adopting health and safety equipment as part of their homes and air purifiers, thermostats, and smart sensors are increasingly becoming the focus.

- The demand for smart and connected air purifiers has gained traction in recent years. There is demand for such devices where the amount of air filtered and other stats visible on the smartphones enable users to have more control and offer alerts when the filters are to be changed.

- In addition, the rise in the need to remove fine airborne particles and germs in automobiles, homes, commercial spaces, and offices drives demand for smart climate control across the globe. However, high maintenance costs and premium installation charges have made smart climate control products expensive, restraining the market's growth.

- COVID-19 positively impacted market growth. Smart air purifiers saw an increase in demand due to the pandemic as people looked for ways to improve indoor air quality and reduce the risk of airborne transmission of the virus. At the same time, smart thermostats and sensors also positively supported market growth as people adopted these products to minimize energy costs and monitor indoor air quality. In this way, the pandemic increased awareness of the importance of indoor air quality and comfort, leading to increased demand for smart air purifiers, smart thermostats, and smart sensors.

Smart Climate Control Market Trends

Growing Household Spending

- Home appliances such as Air purifiers are gaining traction due to rapid urbanization and industrialization in developing countries and worldwide, which is now resulting in deteriorated air quality. The increasing prevalence of respiratory issues, soaring disposable income & growth in spending on household products, and growing population are all factors boosting the market's growth.

- With the growing consumer spending ability across developed and developing nations, a prominent share of the spending is directed at consumer goods and home appliances. According to the National Association of Home Builders, during the first two years after closing on the house, a typical buyer of a newly built single-family detached home tends to spend an average of USD 4,500 more than a similar non-moving homeowner. Likewise, a buyer of an existing single-family detached home tends to spend over USD 4,000 more than a similar non-moving homeowner, including close to USD 3,700 during the first year.

- As household spending power increases, consumers are more likely to be aware of and invest in technologies that improve their quality of life. Smart climate control systems offer convenience, energy efficiency, and comfort, making them an attractive option for consumers with higher disposable incomes.

- Increasing household spending enables consumers to prioritize comfort, convenience, energy efficiency, and environmental sustainability, driving the demand for air purifiers, thermostats, and other safety equipment. For instance, consumer spending on household appliances in the United Kingdom increased from GBP 2,831 million in 2018 Q1 to GBP 3,390 million in 2023 Q1.

Asia-Pacific to Witness the Highest Growth

- Due to the high AQI levels across major cities such as Delhi and Mumbai, the demand for air purifiers is rising in India. Companies such as Acer, Zeco Aircon, and Philips have witnessed a sudden increase in the sales of air purifiers. According to spokespersons of different companies selling the product, indoor air purifier sales have increased by 30-40% across India because of deteriorating air pollution.

- Japan is also one of the significant investors and adopters of the climate control market. The country's growing concern for air pollution and climate change encourages consumers to adopt energy-efficient equipment like a smart thermostat. The Japanese government has also collaborated with the Climate and Clean Air Coalition to tackle air pollution and the climate change crisis.

- Furthermore, according to World Bank, South Asia has become home to 9 of the world's 10 cities with the worst air pollution, which causes an estimated 2 million premature deaths across the region each year and incurs significant economic costs and the countries required to coordinate policies and investments.

- Moreover, the vendors operating in the market are developing new advanced products for smart climate control. For instance, in January 2023, Chinese tech giant Huawei revealed its Zhixuan 720 smart air purifier 3s in China, which has eight purification and formaldehyde removal capability stages. The air purifier has a preliminary protective filter and H13 HEPA material. It is capable of removing potential pollutants from your room environment.

Smart Climate Control Industry Overview

The market for smart climate control is concentrated with major giants, such as Daikin Industries Ltd, Honeywell Internation Inc., Unilever PLC, and Dyson Ltd, providing a range of climate control solutions globally. The market poses a high entry barrier in terms of both capital expenditure and government regulations. New entrants are required to invest in setting up manufacturing facilities, along with technological advancements, to keep track of the changes to remain relevant in the market.

In April 2023, the Chinese tech giant Xiaomi launched a pair of new smart air purifiers, with the first model being the Smart Air Purifier 4. The company's CMO, Anuj Sharma, unveiled this model, and it comes with a pre-filter, a True HEPA Filter, a new Activated Carbon Filter, and a Negative Air Ionizer. Furthermore, the Smart Air Purifier 4 also arrives with Filtration + TUV allergy care certifications & formaldehyde absorption technology. The model is designed to cover up to 516 square feet of area and offers a CADR (clean air delivery rate) of 400 meters cubic per hour.

In April 2023, Resideo Technologies, Inc., a global provider of solutions for home comfort, security, and safety introduced Honeywell Home T10+ Smart Thermostat Kits. The company enhanced its ENERGY STAR certified Honeywell Home T10 Pro Smart Thermostat that launched in 2019. The new thermostat offer additional control over three types of indoor air quality (IAQ) equipment simultaneously.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Health Problems Associated with Air Pollution

- 5.1.2 Growing Household Spending

- 5.2 Market Restraints

- 5.2.1 High Adoption and Maintenance Costs

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Air Purifier

- 6.1.2 Smart Thermostat

- 6.1.3 Smart Sensors (Smoke and Air Quality)

- 6.2 By Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 Germany

- 6.2.2.2 United Kingdom

- 6.2.2.3 France

- 6.2.2.4 Spain

- 6.2.2.5 Rest of Europe

- 6.2.3 Asia-Pacific

- 6.2.3.1 China

- 6.2.3.2 Japan

- 6.2.3.3 Rest of Asia-Pacific

- 6.2.4 Rest of the World

- 6.2.1 North America

7 AIR PURIFIERS MARKET SEGMENTATION

- 7.1 By Filtration Technology

- 7.1.1 High-efficiency Particulate Air (HEPA

- 7.1.2 Other Technologies (Electrostatic Precipitators (ESPs), Ionizers, and Ozone Generators)

- 7.2 By Type

- 7.2.1 Standalone

- 7.2.2 Non-smart

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 AllerAir Industries Inc.

- 8.1.2 Xiaomi Corp.

- 8.1.3 Wirlpool Corporation

- 8.1.4 LG Electronics Inc.

- 8.1.5 Unilever PLC (Blueair AB)

- 8.1.6 Sharp Corporation

- 8.1.7 Koninklijke Philips NV

- 8.1.8 Dyson Ltd.

- 8.1.9 Honeywell International Inc.

- 8.1.10 Daikin Industries Ltd.