|

市場調查報告書

商品編碼

1644422

應用控制:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Application Control - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

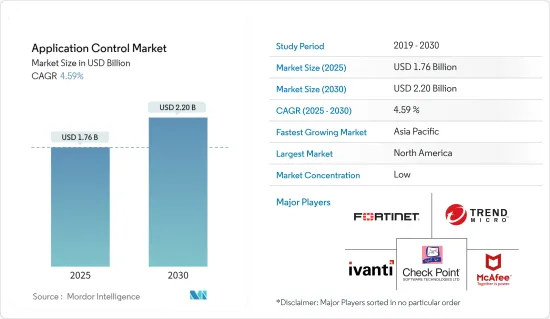

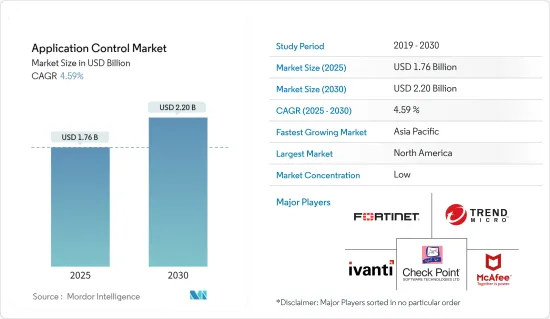

預計 2025 年應用控制市場規模為 17.6 億美元,到 2030 年將達到 22 億美元,預測期內(2025-2030 年)的複合年成長率為 4.59%。

網路攻擊的增加、連接設備和網路基地台的大量增加大大增加了對更好的業務應用程式監控和控制的需求。因此,對全面的端點訪問保護和覆蓋的需求急劇增加,使得其在各行各業中受到歡迎。

主要亮點

- 網路攻擊的增加以及連接設備和網路基地台的增加,大大增加了對企業應用程式進行加強監控和控制的需求。因此,對全面的端點存取安全和覆蓋的需求急劇增加,使得它在各行各業中受到歡迎。因此,應用程式控制市場中的各種市場參與企業現在提供廣泛的商業產品,透過啟用各種控制(包括執行、監控和身份驗證)來實現對企業應用程式的高級保護。

- 此外,基於應用程式控制的解決方案提供廣泛的用途,包括網路安全、伺服器管理、端點保護和身分驗證,同時也為最終使用組織帶來好處。過去幾年來,應用程式控制獲得了很大的發展動力,這主要是由於平衡負載、提高效能和處理與應用傳輸相關的更高級要求的需求日益成長。這些解決方案提供了保持您的應用程式和伺服器正常運作所需的可用性、可擴展性、效能、安全性、自動化和控制。

- 這些功能還可以幫助想要遷移或已經遷移到雲端環境的組織。數位轉型正在推動新的架構和最佳化工作。這對 ADC 的影響是巨大的,因為它們對於應用程式架構和 IT 最佳化至關重要。例如,幾乎所有電子商務網站都使用應用程式交付控制器來提高其應用程式的可用性和可靠性。如今,企業和公司一樣,都在經歷數位轉型。網站的可靠性、靈活性、可擴展性和效能對於您的網站基礎架構和您的業務同樣重要。

- 資料流量的快速爆炸性成長要求網路系統能夠容納增加的應用層流量。市場上現有的解決方案必須應對這些類型的巨大負載。擴展應用程式的需求不斷增加,這些應用程式在許多情況下由來自不同供應商的解決方案組成,並且向網路添加新服務會增加網路複雜性和故障點。因此,向用戶提供這些服務可能會變得更加複雜,並且會出現嚴重的延遲,這可能導致收益來源的損失和用戶體驗的下降。

- COVID-19 疫情對多個關鍵 IT 和技術領域產生了長期影響。例如,幾家 IT 和其他大型科技公司預計製造業、服務業、醫療保健和零售業等各行業的商業合約數量將下降。然而,由於其在公共事業和必要的日常業務中的重要性,BFSI、IT和電信、航太和國防等重要業務在疫情期間在各國受到的影響較小。

應用控制市場趨勢

零售預計將佔據很大市場佔有率

- 隨著網路化的提升、多通路業務的發展、智慧零售應用解決方案的演進,零售市場變得充滿活力。此外,電子商務的快速崛起使得商業情報能夠追蹤用戶與電子商務商店的互動方式,並且可以進一步利用這些資訊來改善客戶購物和服務體驗。電子商務也使零售商能夠根據顧客行為做出更明智、更有效的決策。這些資料是即時提供的,有助於企業快速調整價格或更改產品供應。這些發展使得網路購物更具吸引力,零售商正在採用應用程式控制器來減少載入時間。

- 零售業中物聯網連接設備的數量正在呈指數級成長。例如,根據ENTO的報告,在歐盟地區,2019年零售業使用的連網型設備數量為228萬台,預計2025年將成長到309萬台。亞馬遜還在其西雅圖總部附近開設了一家名為 Amazon Go 的實體雜貨店。實體店將使用新設計的攝影機、感測器和智慧型手機組成的廣泛網路來準確確定每個消費者從貨架上挑選哪些商品。識別產品後,該技術會將其添加到數位購物車中。零售業的這些發展推動了 ADC 提高可擴展性和減少伺服器工作負載流量的需求。

- 此外,零售商正在投資多重雲端、多地點和多平台負載平衡策略,零售商行動應用程式網站的訪客可能會根據國家/地區看到不同語言的內容。因此,這些功能吸引了來自世界各地的更多客戶,並採用 ADC 來減輕伺服器的負載。

- 此外,需要遵守歐盟GDPR等法規,對位於不同地點的伺服器進行資料安全和隱私管理,這也對零售業的ADC提出了要求。總體而言,隨著物聯網的不斷融入以及零售業採用數位技術使支付和其他交易更快、更自動化,所研究行業對 ADC 的需求將會增加。

- 可以透過多種方式控制電子商務應用程式以確保正常的功能和安全性。業務流程中常用的控制包括存取控制、資料加密、審核追蹤和防火牆。增加線上消費可能會促進所研究市場的成長。例如,根據銷售團隊 的數據,2022 年第四季度,所有垂直行業的線上消費者平均每次造訪的花費略低於 3 美元。食物和飲料是消費者花費最多的類別,平均每次花費超過 4 美元,其次是奢侈服飾,花費近 3.50 美元。

北美可望主導市場

- 北美是世界各地各大組織的主要基地。因此,這些行業的擴張和成長,加上這些行業對技術的日益採用,正在推動該地區企業對應用程式部署的需求。因此,確保資料安全已成為該地區的首要任務,從而導致應用程式控制解決方案的採用率不斷提高。

- 此外,雲端基礎的應用程式的日益普及也推動了該地區對資料中心的需求。例如,Cloudscene 最近的一份報告發現,微軟在北美資料中心提供了 18 個雲端入口,而亞馬遜、Google、阿里巴巴和 IBM 分別提供了 18、11、10 和 9 個雲端入口。此外,全部區域日益嚴重的網路安全威脅促使企業選擇更靈活、更具成本效益的應用傳遞控制器。

- 該地區擁有許多主要企業的應用程式交付控制器解決方案供應商,包括 F5 Networks、Fortinet、Juniper Networks、A10 Networks 和 Array Networks。該地區的市場參與者正在透過推出新的解決方案來響應數位轉型和業務需求。例如,Fortinet推出了FortiADC 6.1,可提供應用程式加速和進階保全服務。

- 多家公司正在致力於開發創新解決方案,以滿足該地區中小企業對具有成本效益的雲端運算解決方案的需求。例如,應用程式安全性、視覺性和控制領域的先驅 Snapt 最近宣布了 Nova 2 版,這是 Snapt 集中式 ADC 平台的第二代。這個雲端基礎的ADC 包括負載平衡器、WAF、GSLB 和 Web 加速器。 Nova 是一個超大規模、集中式平台,用於大規模部署、控制和監控 ADC。

- SAP 表示,截至 2022 年 7 月的第二季度,各種規模的企業都選擇 SAP 來支援其雲端遷移。這表明 RISE with SAP 解決方案在北美公司中繼續被廣泛採用。公共雲端的採用在客戶中持續成長,今年稍早已有數百家公司選擇了 RISE 和 SAP。

應用控制行業概況

應用控制市場的競爭格局較為分散,全球有多家解決方案供應商。這些解決方案提供者不斷創新,為市場提供更強大的解決方案。此外,市場參與者正在進行策略合作,以加強其全球立足點和市場影響力。

- 2023 年 7 月 - Fortinet 發布了在企業資料中心部署 FortiGate 新世代防火牆 (NGFW) 和 FortiGuard 人工智慧安全服務的成本節約和業務優勢的分析,顯示三年內投資收益(ROI) 超過 300%,回收期為六個月。 FortiGate 3200F 和 900G 威脅防護透過啟用防火牆、IPS、應用程式控制和反惡意軟體以及日誌記錄來衡量。

- 2023 年 4 月-諾基亞推出四款第三方 MX Industrial Edge (MXIE) 應用程式,幫助組織在強化、安全的內部部署邊緣連接、收集和分析來自操作技術(OT) 資產的資料。資產密集型產業將從諾基亞的 OT Edge 生態系統中立方法中受益最多,該方法利用了許多關鍵數位化推動因素的創新。新應用程式還利用了諾基亞 MXIE 中最近發布的 GPU 功能。這種強大的內部部署 OT 邊緣解決方案可協助您即時、最接近源頭地處理資料,同時保持資料主權。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 市場促進因素

- 由於擴大採用來自不同來源的應用程式, IT基礎設施變得越來越複雜

- 更多採用資料安全措施

- 組織擴大採用 BYOD 趨勢

- 市場限制

- 對最終使用者體驗的影響

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 購買者/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響評估

第5章 市場區隔

- 按組織規模

- 中小型企業

- 大型企業

- 按組件

- 解決方案

- 服務

- 按應用程式類型

- 基於網路

- 雲端基礎

- 行動應用程式

- 其他應用

- 按最終用戶產業

- BFSI

- 衛生保健

- 資訊科技/通訊

- 政府和國防

- 零售

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第6章 競爭格局

- 公司簡介

- Trend Micro Inc.

- McAfee, LLC

- Fortinet, Inc.

- Ivanti Inc.

- Checkpoint Software Technologies Ltd.

- Veracode, Inc.

- WatchGuard Technologies, Inc.

- Comodo Group, Inc.

- VMware, Inc.

- Thycotic Software, LLC

第7章投資分析

第8章 市場機會與未來趨勢

The Application Control Market size is estimated at USD 1.76 billion in 2025, and is expected to reach USD 2.20 billion by 2030, at a CAGR of 4.59% during the forecast period (2025-2030).

The rising number of cyberattacks and considerable growth in connected devices and access points has significantly raised the demand for superior business application monitoring and control. As a result, the demand for comprehensive end-point access protection and coverage has increased dramatically, gaining popularity across a wide range of industry verticals.

Key Highlights

- The growing number of cyberattacks, combined with an increase in connected devices and access points, has significantly raised the demand for enhanced monitoring and control of enterprise applications. As a result, the demand for comprehensive end-point access security and coverage has increased dramatically, gaining popularity across a wide range of industry verticals. As a result, various market participants in the application control market presently offer extensive business products that permit advanced protection of enterprise applications by enabling varying degrees of control, such as execution, monitoring, and authentication, among other controls.

- Further, the application control-based solutions offer a broad range of uses, including network security, server management, end-point protection, and authentication, among other benefits to the end-user organization. Application control has gained significant traction in the past few years, primarily owing to the rising need for load balancing, improving performance, and handling much more advanced requirements associated with application delivery. These solutions provide availability, scalability, performance, security, automation, and control essential to keep the applications and servers running in their power band.

- These capabilities also aid organizations that want to or have already migrated to the cloud environments. Digital transformation has been inspiring new architectures and optimization initiatives. It significantly impacts ADCs as they are crucial to application architectures and IT optimization. For example, almost any E-commerce website uses an application delivery controller to improve the availability and reliability of its applications. Currently, businesses have been undergoing digital transformation as their enterprise counterparts. Website reliability, flexibility, scalability, and performance are as essential to website infrastructure as they are to an enterprise.

- The exponential explosion in data traffic has been demanding that network systems be capable of handling the increasing rates of application layer traffic. The solutions offered in the market must handle these types of huge loads. The increasing need to scale out applications, which in various cases consists of solutions from different vendors, along with adding new services to the network, can result in increased complexities and increased points of failure in the network. As a result, delivering these services to the consumers becomes more complex and can result in major delays, leading to loss of revenue streams and lowered subscriber quality of experience.

- The global COVID-19 pandemic caused long-term impacts in various major IT and technology sectors. For example, several IT and other big technology organizations anticipated fewer commercial contracts across various industrial verticals such as manufacturing, service sector, healthcare, and retail. However, due to their importance in utilities and necessary everyday operations, critical businesses such as BFSI, IT & telecom, aerospace & defense, and others experienced minor impacts during the pandemic across different nations.

Application Control Market Trends

Retail is Expected to Hold the Significant Share of the Market

- With the improvement of the Web, the development of multi-channel operations, and the evolution of intelligent retail application solutions, the retail market has become dynamic. Moreover, with the rapid rise of e-commerce, business intelligence is being enabled to track how users interact with e-Commerce stores, and this information can be used further to enhance the customer shopping and service experience. E-Commerce also allows retailers to make smart, efficient decisions based on customer behavior. This data can be viewed in real-time, allowing businesses to adjust prices quickly or alter merchandise offerings. Such developments increase the attraction towards online shopping, and retailers are adopting Application Controller to reduce load times.

- The number of IoT-connected devices in the retail sector is exponentially increasing. For instance, in the EU region, the number of connected devices used in the retail industry was 2.28 million units in 2019, and it is expected to grow to 3.09 million units by 2025, as per the ENTO reports. Also, Amazon opened Amazon Go, a physical grocery store near its Seattle headquarters. The brick-and-mortar store uses a broad network of newly designed cameras, sensors, and smartphones to determine the exact product each consumer takes off a shelf. After identifying the product, the technology adds it to a digital cart. Such developments in the retail sector increase the need for ADCs to improve scalability and reduce server workload traffic.

- Furthermore, retailers are investing in multi-cloud, multi-location, and multi-platform load balancing strategies where visitors to the retail mobile application sites might view the content in different languages depending on the customers based on the country they are located in. Therefore, such capabilities attract more customers worldwide, and to reduce the server workload, ADCs are being adopted.

- The need for regulatory compliance for servers located in different locations, such as GDPR in the European Union, for governing data security and privacy also demands the ADCs in retail sectors. Overall, the demand for ADC increases across the studied sector with the increased incorporation of IoT and the introduction of digital technologies in retail to automate payments and other transactions faster.

- E-commerce applications can be controlled through various means to ensure proper functionality and security. Some commonly used controls in business processes include access controls, data encryption, audit trails, and firewalls. The rise in online spending would allow the studied market to grow. For instance, according to Salesforce, In the fourth quarter of 2022, online shoppers across all verticals spent an average of slightly under three dollars per visit. Food and beverage is the category in which consumers spend the most money each visit on average, at more than four dollars, followed by luxury clothes at almost USD 3.5.

North America is Expected to Dominate the Market

- North America is a primary hub for all the major organizations worldwide; hence, the expansion and growth in these industries, coupled with increased adoption of technology across these industries, is driving the demand for the deployment of applications amongst enterprises in the region. Thus, securing the data has become a priority in the region, increasing the adoption of application control solutions.

- The increasing adoption of cloud-based applications has also increased the demand for regional data centers. For instance, according to a report published by Cloudscene recently, Microsoft offers 18 cloud on-ramps in data centers in North America, followed by Amazon, Google, Alibaba, and IBM with 18, 11, 10, and 9 cloud on-ramps in data centers, respectively. Moreover, the rising cybersecurity threats across the region have further encouraged businesses to opt for more agile and cost-effective application delivery controllers, which are scalable and secure, and increase visibility over data traffic and movement across the users.

- The region has many leading Application Delivery Controller solution provider companies, such as F5 Networks, Fortinet, Juniper Networks, A10 Networks, and Array Network. Market players in the region are keeping up with digital innovations and business demands by launching new solutions. For instance, Fortinet launched FortiADC 6.1 to accelerate applications and deliver advanced security services.

- Several companies are working on innovative solutions to tap into the growing SME sector in the region, looking for cost-effective cloud-enabled solutions for their businesses. For instance, Snapt, the pioneering application security, visibility, and control company, recently launched Nova Version 2, the second generation of Snapt's centralized ADC platform. This cloud-based ADC includes a load balancer, WAF, GSLB, and web accelerator. Nova is a hyper-scale-ready, centralized platform for deploying, controlling, and monitoring ADCs at scale.

- In July 2022, in the second quarter of 2022, firms of all sizes chose SAP to support their cloud transitions, according to a statement from SAP. This indicated that the RISE with SAP solution continued to enjoy a high rate of acceptance across businesses in North America. Hundreds of companies chose RISE with SAP in the first part of the year, with public cloud deployments becoming increasingly popular among customers.

Application Control Industry Overview

The competitive landscape of the Application Control Market is fragmented owing to the presence of several solution providers across the globe. These solution providers are increasingly innovating to provide enhanced solutions in the market. The market players are also strategically collaborating to strengthen their global foothold and market presence.

- July 2023 - Fortinet announced an analysis of the cost savings and business benefits of deploying FortiGate Next-Generation firewalls (NGFWs) and FortiGuard AI-Powered Security Services within the enterprise data center, including more than a 300% return on investment (ROI) over three years and payback in six months. FortiGate 3200F and 900G Threat Protection is measured with Firewall, IPS, Application Control and Malware Protection, and Logging enabled.

- April 2023 - Nokia released four third-party MX Industrial Edge (MXIE) applications to assist organizations in connecting, collecting, and analyzing data from operational technology (OT) assets on a strong and secure on-premises edge. Asset-heavy sectors will benefit the most from Nokia's OT edge ecosystem-neutral approach, which taps into innovation from many leading digitalization enablers. The new apps also use the recently released GPU functionality on the Nokia MXIE. This robust on-premises OT edge solution helps process data closest to the source in real time while maintaining data sovereignty.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Deployment of Applications From Various Sources Leading to Complexity in the IT Infrastructure

- 4.2.2 Increasing Adoption of Data Security Measures

- 4.2.3 Increasing Adoption of BYOD Trends in Organizations

- 4.3 Market Restraints

- 4.3.1 Impacting the End-User Experience

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Assessment of Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Size of the Organization

- 5.1.1 Small and Medium Enterprises

- 5.1.2 Large Enterprises

- 5.2 By Component

- 5.2.1 Solutions

- 5.2.2 Services

- 5.3 By Type of Applications

- 5.3.1 Web-based

- 5.3.2 Cloud-based

- 5.3.3 Mobile Applications

- 5.3.4 Other Applications

- 5.4 By End-user Industry

- 5.4.1 BFSI

- 5.4.2 Healthcare

- 5.4.3 IT and Telecom

- 5.4.4 Government & Defense

- 5.4.5 Retail

- 5.4.6 Other End-user Industries

- 5.5 Geography

- 5.5.1 North America

- 5.5.2 Europe

- 5.5.3 Asia-Pacific

- 5.5.4 Latin America

- 5.5.5 Middle East & Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Trend Micro Inc.

- 6.1.2 McAfee, LLC

- 6.1.3 Fortinet, Inc.

- 6.1.4 Ivanti Inc.

- 6.1.5 Checkpoint Software Technologies Ltd.

- 6.1.6 Veracode, Inc.

- 6.1.7 WatchGuard Technologies, Inc.

- 6.1.8 Comodo Group, Inc.

- 6.1.9 VMware, Inc.

- 6.1.10 Thycotic Software, LLC