|

市場調查報告書

商品編碼

1644412

熱敏紙:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Thermal Paper - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

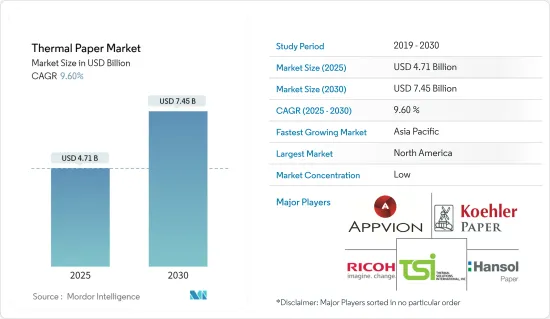

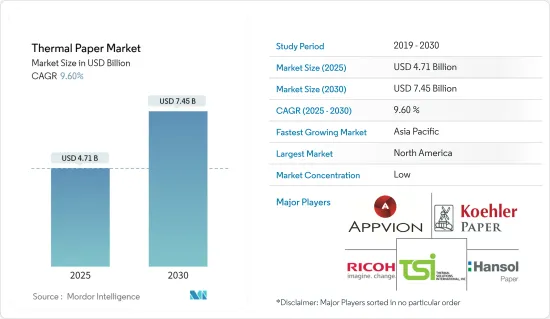

預計 2025 年熱感紙市場規模為 47.1 億美元,到 2030 年預計將達到 74.5 億美元,預測期內(2025-2030 年)的複合年成長率為 9.6%。

主要亮點

- 由於食品和飲料行業對標籤的需求不斷增加,熱敏紙變得越來越重要。這一趨勢是由標準化包裝物品品質和確保符合監管要求的需求所推動的。熱敏紙在標籤列印和其他應用中的採用越來越多,這是推動市場成長的主要因素。熱敏紙具有耐用、耐環境因素、列印品質高等優點,非常適合用於食品包裝標籤。此外,電子商務和宅配服務的興起進一步推動了食品和飲料行業對熱敏紙標籤的需求,為消費者和物流業務提供準確、持久的資訊。

- 銷售點 (POS) 系統提供整合的時鐘和庫存管理功能,並已在餐飲和零售業中廣泛採用。當今快節奏的生活方式導致熱敏紙在各行各業的票證、通行證和其他應用中的使用增加。這種趨勢,加上人們對環境問題的日益關注,推動了對環保型紙張替代品的需求。向永續選擇的轉變預計將刺激造紙行業的創新,促進市場成長,因為企業將其營運與永續性目標相結合,同時滿足消費者對便利性和效率的期望。

- 製藥業對精確標籤的需求日益成長,預計將推動熱敏紙市場的成長。熱敏紙標籤傳達重要訊息,例如藥品、注射劑和製藥設備的有效期限、製造日期、條碼和產品配置。這些標籤具有印刷品質高、耐用性和生產效率高等優點。對病人安全和法規遵從性的日益關注進一步強調了準確、詳細的藥品標籤的重要性,使得熱敏紙成為行業標籤過程中必不可少的元素。

- 對染料製造廠實施的環境法規正在限制染料生產,阻礙熱敏紙市場的整體成長。這些限制導致產量減少,並限制了我們的熱敏紙業務的擴張潛力。因此,熱敏紙市場原料成本的波動是市場擴張的一大限制因素。熱敏紙生產所需關鍵零件價格波動給製造商帶來不確定性,影響其維持穩定利潤率的能力。

- 電子商務應用程式中線上交易的增加是推動這一趨勢的主要原因。隨著越來越多的消費者青睞數位化購物,傳統紙質收據的需求逐漸減少。電子商務平台和零售商擴大提供數位收據作為環保且便利的替代方案。這一趨勢可能會減少某些細分市場對熱敏紙產品的長期需求。

- 公司正在創新適用於各種應用的新型熱敏紙標籤。例如,2023 年 9 月,Appvion 宣布推出其最新創新技術——矽化直接熱感標籤“Resist SR”,旨在提高標籤行業的性能和可靠性。 抗蝕劑 SR 不使用紙質襯墊,使各種規模的公司的標籤貼標流程更簡單、更有效率、更具成本效益。本產品採用無溶劑、乳液型、熱固化矽膠脫模劑製造。 Resiste SR 與多種感壓標籤黏合劑相容,可用於各種行業的無底紙應用,包括食品服務、行動列印、物流、醫療保健和製造業。

熱感紙市場趨勢

POS 佔較大市場佔有率

- 由於零售業全球收費需求的增加,預計預測期內銷售點(POS)終端用戶產業將擴張。這種成長是由數位付款方式的日益普及和對高效交易處理系統的需求所推動的。全球超級市場和大賣場的擴張預計將促進POS終端的應用並推動市場成長。這些大型零售店需要先進的 POS 系統來管理大量交易和庫存追蹤。在美國,超級市場主導食品雜貨零售業,對先進 POS 解決方案的需求龐大。

- 這些商店對自助結帳系統系統和非接觸式付款選項的偏好日益增加,進一步推動了市場成長。美國超級市場和其他雜貨店類別的銷售額預計將從 2020 年的 7,288.6 億美元增加到 2023 年的 8,464.8 億美元,這將對 POS 系統中的熱敏紙產生巨大的需求。這項銷售成長凸顯了可靠、高效的銷售點解決方案在零售業的重要性,尤其是對於列印收據和交易記錄。

- 印度等新興經濟體的數位化日益提高,對 POS 系統的需求也日益增加。這一趨勢在零售、餐旅服務業和銀行業尤為明顯,POS 系統在這些行業中變得越來越普遍。數位付款方式的採用和即時交易收據的需求進一步推動了這種需求。此外,產品標記對於打擊仿冒品的重要性日益增加,這也推動了對熱感紙捲的需求。製藥、奢侈品和電子等行業擴大使用熱敏紙作為標籤和包裝,其中包含全像圖和2D碼等安全功能。

- 這些措施不僅有助於整個供應鏈上的產品追蹤,還能讓消費者驗證所購買商品的真實性。此外,與傳統紙張生產相關的環境問題也導致了環保熱敏紙的開發。這些永續的替代品由可回收材料或無化學塗層製成,在注重環保的市場中越來越受歡迎,為熱敏紙市場的新成長鋪平了道路。

- 熱敏紙的卓越列印能力和防褪色效果使其成為各種應用的理想選擇,包括銷售點食品標籤以及製造和運輸中的條碼列印。它們在高流量區域的耐用性、多功能性和高效性正在推動全球各行各業的需求,包括零售、物流、醫療保健和酒店業。熱敏紙對環境因素的抵抗力和成本效益進一步促進了其在各種應用中的日益普及。

- 由於各行業資料量的不斷增加,從傳統交易方式向 POS(銷售點)系統的轉變正在推動熱敏紙市場的成長。 POS 終端透過減少金融交易和庫存管理中的錯誤來提高業務可靠性。零售業的擴張和各類機構對列印收據和發票的需求不斷增加,進一步促進了市場的成長。行動POS終端廣泛應用於各領域的交通票務和庫存管理,預計未來幾年對該產品的需求仍將保持強勁。

亞洲是熱感紙成長最快的市場

- 由於消費者對便利產品的需求不斷增加以及該地區零售連鎖店的興起,亞洲在熱敏紙市場佔據主導地位。中國作為亞洲市場的重要股東,過去幾十年來經歷了顯著的工業成長。該地區工業活動的活性化,對標籤用熱敏紙的需求也隨之增加。新興國家快速消費品 (FMCG) 市場的擴張帶來了增加製造能力的需求。因此,零售貿易量正在推動對熱敏紙的需求。

- 由於市場成長和復甦,印度工業標籤市場顯示出巨大的潛力。政府正在透過教育消費者正確的標籤做法來支持市場。此外,預計預測期內網路購物的興起和倉庫業務的改善將推動市場擴張。根據IBEF預測,到2030年,印度電子商務產業規模將達3,500億美元。

- 受中國和印度經濟不斷擴張對包裝食品需求的推動,食品和飲料行業預計將成為亞洲最大的熱敏紙消費產業。這一趨勢將增加對特殊標籤和標記的需求,對熱敏紙市場產生正面影響。工業 4.0 技術與印刷和貼標施用器的結合將實現食品和飲料行業的即時監控,從而進一步增加需求。熱感紙在食品包裝標籤、最佳食用日期印刷、收據等方面的多功能性,加上對食品安全和可追溯性的日益重視,促使其在該地區的應用日益廣泛。

- 此外,2022 年印度醫藥市場價值為 490 億美元,預計到 2047 年將達到 4,500 億美元。預計未來幾年市場複合年成長率將達到 9%。這種日益成長的趨勢產生了對熱敏紙標籤的需求,以增強產品安全性並防止假冒。印度的製藥業正在擴張,對安全包裝解決方案的需求不斷增加,其中包括熱敏紙標籤。這些標籤對於維護產品完整性、追蹤庫存和確保整個供應鏈的真實性至關重要。隨著市場的成長,對高品質熱敏紙標籤的需求預計會增加,以支持製藥業的法規遵循和消費者安全。

熱敏紙產業概況

熱感紙市場比較分散,理光公司 (Ricoh Company Ltd.)、Appvion LLC、Koehler Paper SE 和 Hansol Paper Co. 等多家全球和地區性參與者在這個備受爭議的市場領域爭奪關注。該市場的特點是產品差異化程度低、產品滲透率高、競爭激烈。

- 2024 年 5 月 - Appvion 推出 EarthChem,這是一系列永續的直接熱感產品,旨在改變造紙產業。 EarthChem 產品線包括各種紙張和薄膜熱感產品,體現了對永續性和環境責任的承諾。

- 2023 年 9 月 - Hansol 透過推出不含雙酚 S (BPS) 和不含苯酚的顯影劑產品,擴展了其直接熱感產品線。我們也開發了新產品,例如用於布料的熱轉印紙、用於離型紙的灰銅卡紙(CCK) 和超級壓延牛皮紙(SCK)。

- 2023 年 6 月 - Appvion 推出 CleanSlate,擴展其下一代技術產品線,CleanSlate 是一種直接熱感膜,透過增強環境耐久性來改善傳統的直接熱感性能。 Appvion 的 CleanSlate 薄膜與用於感壓標籤的標準直接熱敏印表機相容。 CleanSlate 的獨特顏色使其很容易被識別為不含酚類顯影劑的直接熱感膠片。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 相關人員分析

第5章 市場動態

- 市場促進因素

- 提高 POS收費業務的效用

- 熱敏紙具有極強的耐用性和列印精度

- 市場限制

- 原物料價格波動影響生產

- 市場挑戰

- 由於電子商務線上交易增加,數位收據增加

第6章 市場細分

- 按最終用戶產業

- 銷售點 (POS)

- 標籤

- 娛樂

- 醫療和製藥

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞洲

第7章 競爭格局

- 公司簡介

- Ricoh Company Ltd

- Oji Holdings Corporation

- Appvion LLC

- Koehler Paper SE

- Mitsubishi HiTec Paper Europe GmbH

- Hansol Paper Co. Ltd

- Henan JiangHE Paper Co. Ltd

- Kanzaki Specialty Papers Inc.

- Thermal Solutions International Inc.

- Paper Rolls Plus

- Jujo Thermal Ltd

- NAKAGAWA Manufacturing(USA)Inc.

- Panda Paper Roll

- Bizerba SE & Co. KG

- Rotolificio Bergamasco SRL

- Twin Rivers Paper Company Inc.

- Iconex LLC

- Telemark Diversified Graphics

第8章投資分析

第9章:市場的未來

The Thermal Paper Market size is estimated at USD 4.71 billion in 2025, and is expected to reach USD 7.45 billion by 2030, at a CAGR of 9.6% during the forecast period (2025-2030).

Key Highlights

- Thermal paper has gained significant importance due to the increasing demand for labeling in the food and beverage industry. This trend is driven by the need to standardize the quality of packaged items and ensure compliance with regulatory requirements. The increased adoption of thermal paper in applications like label printing is a significant factor driving market growth. Thermal paper provides benefits such as durability, resistance to environmental factors, and high-quality printing, making it well-suited for food packaging labels. Additionally, the rise of e-commerce and home delivery services has further boosted the demand for thermal paper labels in the food and beverage industry, providing precise and long-lasting information for consumers and logistics operations.

- Point-of-sale (POS) systems are gaining widespread adoption in the foodservice and retail industries, offering integrated time clock and inventory management functionalities. The fast-paced modern lifestyle has increased the use of thermal paper for applications such as tickets and passes across various industries. This trend, coupled with growing environmental concerns, is driving demand for eco-friendly paper alternatives. The shift toward sustainable options is expected to stimulate innovation in the paper industry and contribute to market growth as businesses align their operations with sustainability goals while meeting consumer expectations for convenience and efficiency.

- The pharmaceutical industry's increasing need for precise labeling is expected to drive growth in the thermal paper market. Thermal paper labels convey essential information such as expiration dates, production dates, bar codes, and product composition for medications, injections, and pharmaceutical equipment. These labels offer advantages, including high-quality printing, durability, and efficiency in production. The growing focus on patient safety and regulatory compliance has further emphasized the importance of accurate and detailed pharmaceutical labeling, making thermal paper an essential component in the industry's labeling processes.

- Environmental regulations imposed on dye manufacturing plants have restricted dye production, hindering the overall growth of the thermal paper market. These constraints have led to reduced output and limited the expansion potential of thermal paper businesses. Consequently, fluctuations in raw material costs within the thermal paper market are considered a primary constraint to market expansion. The volatility in prices of essential components used in thermal paper production creates uncertainty for manufacturers and affects their ability to maintain consistent profit margins.

- Rising online transactions in e-commerce applications primarily drive this trend. The growing consumer preference for digital shopping experiences is leading to a gradual decline in demand for traditional paper receipts. E-commerce platforms and retailers are increasingly offering electronic receipts as an environmentally friendly and convenient alternative. This trend may reduce the long-term demand for thermal paper products in specific market segments.

- Companies are innovating new thermal paper labels for various applications. For instance, in September 2023, Appvion announced the launch of its latest innovation, Resiste SR, a pre-siliconized direct thermal facestock that aims to improve performance and reliability in the label industry. By eliminating paper liners, Resiste SR simplifies the labeling process, making it more efficient and cost-effective for businesses of all sizes. The product is manufactured using a solvent-free, emulsion-based thermal cure silicone release. Resiste SR is compatible with various pressure-sensitive label adhesives for linerless applications across multiple industries, including foodservice, mobile printing, logistics, healthcare, and manufacturing.

Thermal Paper Market Trends

POS to Hold Significant Market Share

- The point-of-sale (POS) end-user industry is projected to proliferate during the forecast period, driven by the increasing global billing requirements in the retail industry. This growth is attributed to the rising adoption of digital payment methods and the need for efficient transaction processing systems. The worldwide expansion of supermarkets and hypermarkets is expected to boost POS terminal applications and fuel market growth. These large-format retail stores require sophisticated POS systems to manage high transaction volumes and inventory tracking. In the United States, chain supermarkets dominate grocery retail, contributing significantly to the demand for advanced POS solutions.

- The increasing preference for self-checkout systems and contactless payment options in these stores further drives the market growth. Sales in the supermarket and other grocery store categories in the United States rose from USD 728.86 billion in 2020 to USD 846.48 billion in 2023, generating substantial demand for thermal paper in POS systems. This growth in sales underscores the importance of reliable and efficient POS solutions in the retail industry, particularly for printing receipts and transaction records.

- The increasing digitization in emerging economies like India has led to a higher demand for point-of-sale (POS) systems, consequently boosting the market for thermal paper rolls. This trend is particularly evident in retail, hospitality, and banking, where POS systems are becoming increasingly prevalent. The adoption of digital payment methods and the need for instant transaction receipts have further accelerated this demand. Additionally, the rising importance of product marking as a measure against counterfeiting has increased the demand for thermal paper rolls. Industries such as pharmaceuticals, luxury goods, and electronics are increasingly using thermal paper for labels and packaging to incorporate security features like holograms and QR codes.

- These measures not only help in tracking products throughout the supply chain but also enable consumers to verify the authenticity of their purchases. Furthermore, the environmental concerns associated with traditional paper production have led to the development of eco-friendly thermal paper options. These sustainable alternatives, often made from recycled materials or featuring chemical-free coatings, are gaining traction in environmentally-conscious markets, opening new avenues for growth in the thermal paper market.

- Thermal paper's superior printing capabilities and fade-resistant finish are ideal for various applications, including POS food labeling and barcode printing in manufacturing and shipping. Its durability, versatility, and efficiency in high-traffic areas have increased global demand across multiple industries, including retail, logistics, healthcare, and hospitality. Thermal paper's resistance to environmental factors and cost-effectiveness further contribute to its growing popularity in diverse applications.

- The shift from traditional transactional methods to point-of-sale (POS) systems, driven by increasing data volumes across industries, is propelling the growth of the thermal paper market. POS terminals enhance business reliability by reducing errors in financial transactions and inventory management. The retail industry's expansion and increased demand for receipt and bill printing in various establishments further contribute to market growth. Mobile POS terminals, widely used in transportation ticketing and inventory management across different sectors, are expected to sustain product demand in the coming years.

Asia is the Fastest Growing Market for Thermal Paper

- Asia dominates the thermal paper market due to increased consumer demand for conveniently available products and the rise of retail chains in the region. China, a significant Asian market shareholder, has experienced remarkable growth in its industries over the past few decades. The region's growing industrial activity has increased the demand for thermal paper in labeling applications. The expanding market for FMCG (fast-moving consumer goods) in developing nations has necessitated increased manufacturing capacity. Consequently, the volume of transactions at retail outlets has driven up the demand for thermal paper.

- India's industrial labels market shows significant potential due to increasing market growth and recovery. The government is supporting the market by educating consumers about proper labeling practices. Additionally, the rising trend of online shopping and improved warehouse operations are expected to boost the market during the forecast period. According to IBEF, India's e-commerce industry is projected to reach USD 350 billion by 2030.

- The food and beverage industry is projected to be the largest consumer of thermal paper in Asia, driven by the growing demand for packaged food products in the expanding economies of China and India. This trend boosts the need for specialty labels and tags, positively impacting the thermal paper market. Integrating Industry 4.0 technologies with print and label applicators enables real-time monitoring in the food and beverage industry, further enhancing demand. Thermal paper's versatility in food packaging labels, expiration date printing, and receipts, coupled with the focus on food safety and traceability, contributes to its increasing adoption in the region.

- Furthermore, India's pharmaceutical market was valued at USD 49 billion in 2022, with projections indicating it could reach USD 450 billion by 2047. The market is expected to register a CAGR of 9% in the coming years. This growth trend creates demand for thermal paper labels to enhance product safety and prevent counterfeiting. The expanding pharmaceutical industry in India is driving the need for secure packaging solutions, including thermal paper labels. These labels are crucial for maintaining product integrity, tracking inventory, and ensuring authenticity throughout the supply chain. As the market grows, the demand for high-quality thermal paper labels is expected to increase, supporting regulatory compliance and consumer safety in the pharmaceutical industry.

Thermal Paper Industry Overview

The thermal paper market is fragmented, with several global and regional players, such as Ricoh Company Ltd, Appvion LLC, Koehler Paper SE, and Hansol Paper Co., vying for attention in a contested market space. This market is characterized by low product differentiation, growing levels of product penetration, and high levels of competition.

- May 2024 - Appvion launched EarthChem, a portfolio of sustainable direct thermal products designed to transform the paper industry. The EarthChem range includes various paper and film direct thermal products, reflecting the company's dedication to sustainability and environmental responsibility.

- September 2023 - Hansol broadened its direct thermal facestock range by introducing products with bisphenol S (BPS)-free and phenol-free developers. The company also developed new offerings, including thermal transfer paper for facestock, clay-coated kraft (CCK) paper, and supercalendered kraft (SCK) paper for a release liner.

- June 2023 - Appvion expanded its next-generation technology product line by introducing CleanSlate, a direct thermal film that improves traditional direct thermal performance by enhancing environmental durability. Appvion's CleanSlate film is compatible with standard direct thermal printers for pressure-sensitive labels. The distinctive color of CleanSlate makes it easily identifiable as a direct thermal film that does not contain phenolic developers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Stakeholder Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing POS Utility in Services for Billing Operations

- 5.1.2 Robust Durability and Print Precision Offered by the Thermal Paper

- 5.2 Market Restraints

- 5.2.1 Fluctuating Raw Material Prices Affecting the Production

- 5.3 Market Challenges

- 5.3.1 Increase in Digital Receipt Due to Rising Online Transactions for E-commerce Applications

6 MARKET SEGMENTATION

- 6.1 By End-user Industry

- 6.1.1 Point-of-Sale (POS)

- 6.1.2 Labels

- 6.1.3 Entertainment

- 6.1.4 Medical and Pharmaceutical

- 6.1.5 Other End-user Industries

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Ricoh Company Ltd

- 7.1.2 Oji Holdings Corporation

- 7.1.3 Appvion LLC

- 7.1.4 Koehler Paper SE

- 7.1.5 Mitsubishi HiTec Paper Europe GmbH

- 7.1.6 Hansol Paper Co. Ltd

- 7.1.7 Henan JiangHE Paper Co. Ltd

- 7.1.8 Kanzaki Specialty Papers Inc.

- 7.1.9 Thermal Solutions International Inc.

- 7.1.10 Paper Rolls Plus

- 7.1.11 Jujo Thermal Ltd

- 7.1.12 NAKAGAWA Manufacturing (USA) Inc.

- 7.1.13 Panda Paper Roll

- 7.1.14 Bizerba SE & Co. KG

- 7.1.15 Rotolificio Bergamasco SRL

- 7.1.16 Twin Rivers Paper Company Inc.

- 7.1.17 Iconex LLC

- 7.1.18 Telemark Diversified Graphics