|

市場調查報告書

商品編碼

1644393

服務履約-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Service Fulfillment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

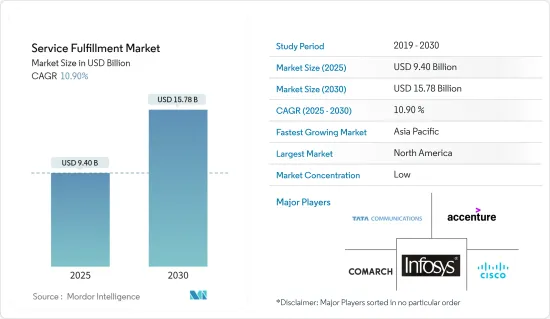

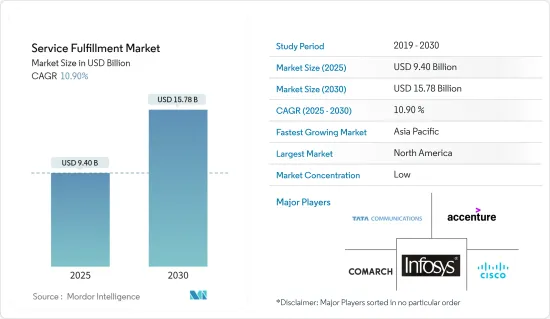

服務履約市場規模在 2025 年估計為 94 億美元,預計到 2030 年將達到 157.8 億美元,在市場估計和預測期(2025-2030 年)內複合年成長率為 10.9%。

服務供應商正在建立提供服務的能力,同時加快下一代產品和服務的上市時間。物聯網、連網型設備、5G 技術、數位化等技術以及對增強連接解決方案日益成長的需求。

關鍵亮點

- 服務履約是一套全面的工具,可簡化 CSP 和組織的各種任務、縮短產品上市時間、最佳化成本並提高自動化。網路最佳化對於滿足新的和不斷成長的履約需求至關重要。

- 動態服務履約流程和軟體支援創建基於組件的服務,從而簡化新產品的發布。自動化訂單到現金流程並最佳化您的供應鏈活動、資本支出和營運費用。供應鏈管理解決方案簡化了網路設備採購,同時簡化了您的供應商生態系統。

- 連網設備和用戶的快速擴張正在推動全球服務履約市場的發展。此外,對電訊操作技術的大規模投入正在推動該產業的需求。此外,輕鬆獲取關鍵管理解決方案正在推動產業向前發展。資訊服務收入的增加正在推動全球服務履約市場的需求。

- 此外,自動化提高了企業生產力,這始終是一件好事。挑戰在於如何以經濟有效的方式實現這一目標。雲端運算有效地簡化了IT基礎設施的自動化和利用,包括伺服器虛擬和配置。然而,網路自動化發展緩慢,特別是在通訊服務供應商(CSP) 網路中,該網路通常跨越許多領域(雲端、行動、WAN、IT)並且需要更高水準的投資,從而增加了複雜性。

- 新冠肺炎疫情已影響到全球的服務履約。疫情期間的一個重大挑戰是勞動力相關問題。疫情過後,隨著虛擬網路功能迅速採用作為可用於創建客戶服務的元件,市場蓬勃發展。

服務履約市場趨勢

預計軟體部分將佔據較大的市場佔有率

- 透過分析網路管理、庫存管理和服務訂單管理等軟體部分,可以發現它們在預測期內佔據了服務履約市場的大部分佔有率。隨著 5G 技術、物聯網、人工智慧和數位化等多項技術進步的推出,通訊服務供應商(CSP) 面臨著持續的壓力,需要超越和提高不斷成長的客戶期望,同時在對平台、系統、工具、分段資料等缺乏了解的情況下最大限度地降低營運成本。

- 愛立信預計,到2028年,全球整體5G用戶數將成長至46.2411億,其中東北亞、東南亞、印度、尼泊爾和不丹預計將佔據地區用戶數最多的位置。用戶數量、5G連接、連接設備、行動裝置、應用程式、先進技術和功能的增加,導致人們越來越依賴增強的網路基礎設施和增強的連接解決方案來連接各種端點。

- 隨後,組織和 CSP 擴大投資於採用先進管理工具的新網路架構,以推動利用 AI 和 ML 等技術的自主網路的採用。因此,CSP 正在聯繫服務履約供應商,採用軟體解決方案來增強其供應鏈活動。

- 另一個市場趨勢是由於網路流量和處理的增加而對持續網路評估和效能的需求,特別是在區域網路中,這需要即時串流網路分析來幫助客戶了解網路健康狀況並持續監控流量。這些發展進一步推動了市場對網路管理軟體的需求。

北美預計將創下最大市場規模

- 在北美,由於對視訊串流、視訊通話平台和音訊會議等各種平台的增強連接解決方案的需求不斷增加,對服務履約解決方案和服務的需求也在增加。

- 再加上3G、4G和5G等各種網路的用戶數量的快速成長,鼓勵了參與企業採用服務履約。該地區也已成為 5G 部署的主要樞紐,加拿大服務供應商正在加大對獲取 5G 許可證的投資。

- 市場供應商正在進行合作和收購活動,以加強他們在該地區的服務履約,這有望推動該地區的市場成長。例如,2023 年 5 月,技術主導的物流平台 Flexport 收購了 Shopify Logistics 的資產,其中包括 Deliverr, Inc.透過與 Shopify Logistics 的整合,該公司將加強其基於人工智慧的高級最佳化,以簡化全球供應鏈、降低成本並提高消費者的可靠性。

- 此外,2022 年 12 月,JLL 與 American Eagle Outfitters Inc. 的完全子公司Quiet Platforms 宣布合作,將於 2023 年加速在美國建設更多先進的履約設施,以服務於 Quiet Platforms 供應鏈網路中的零售商和品牌。透過該協議,兩家公司將率先在物流房地產領域開創靈活的收益分成租金模式。

服務履約行業概覽

服務履約市場由 Comarch SA、埃森哲公司、思科系統公司、印孚瑟斯公司和 TATA 通訊有限公司等參與企業組成。該市場的參與企業正在採取合作和收購等策略來加強其產品供應並獲得永續的競爭優勢。

2023 年 12 月,印孚瑟斯公司宣布,它將透過與印孚瑟斯公司共同建構的全通路數位履約和高級分析平台,幫助 Spotlight Retail Group 促進消費者成長,並利用印孚瑟斯公司的 AI 優先產品 Infosys Topaz,使 Spotlight Retail Group 能夠為線上消費者創造超個人化的網路購物體驗。客戶體驗的改善使 12 個月內客戶數量增加了 113%,交易量增加了 93%。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 購買者/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響評估

第5章 市場動態

- 市場促進因素

- 對網路自動化和自動化即時服務的需求不斷增加

- 快速採用虛擬網路功能作為客戶服務創建的可用元件

- 市場限制

- 缺乏意識

第6章 市場細分

- 按類型

- 軟體

- 網管

- 庫存管理

- 服務訂單管理

- 按服務

- 軟體

- 依實施類型

- 本地

- 託管

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 其他

第7章 競爭格局

- 公司簡介

- Comarch SA

- Accenture PLC

- Cisco Systems, Inc.

- Infosys Limited

- TATA Communications Ltd.

- Amdocs Group

- Suntech SA

- Telefonaktiebolaget LM Ericsson

- NEC Technologies India Private Limited

- Hewlett Packard Enterprise Development LP

- TIBCO Software Inc.

第8章投資分析

第9章 市場機會與未來趨勢

The Service Fulfillment Market size is estimated at USD 9.40 billion in 2025, and is expected to reach USD 15.78 billion by 2030, at a CAGR of 10.9% during the forecast period (2025-2030).

Service providers are building capabilities to provide services while reducing time-to-market for next-generation products and services, owing to the introduction of several technologies across industries. Technologies such as IoT, connected devices, 5G technology, digitization, and increase the demand for enhanced connectivity solutions.

Key Highlights

- Service fulfillment is a combined comprehensive set of tools that assist in streamlining various tasks of CSPs and organizations to reduce time to market, optimize cost, and boost automation. Network optimization becomes essential to meet new and growing service fulfillment needs.

- A dynamic service fulfillment process or software enables the creation of component-based services and simplifies the launch of new products. It automates the order-to-cash process to optimize supply chain activities, capital expenditures, and operating expenses. The supply chain management solutions streamline network equipment procurement while rationalizing the supplier ecosystem.

- Rapid connectivity devices and user expansion drive the global service fulfillment market. Moreover, large-scale expenditures in telecom operating technologies are increasing in demand in this industry. Moreover, simple access to crucial management solutions is propelling this industry forward. Rising income from data services drives demand in the global service fulfillment market.

- Further, automation drives business productivity, which is always desirable. The challenge is achieving it cost-effectively. The cloud has efficiently streamlined the automation and use of IT infrastructures, such as server virtualization and configuration. Still, network automation has been slower to evolve due to higher complexity levels, especially among communication service provider (CSP) networks, which often cross an increased number of domains (cloud, mobile, WAN, and IT) and require higher levels of investment.

- The COVID-19 pandemic impacted service fulfillment throughout the globe. The major challenge during the pandemic was workforce-related issues. Post-pandemic, the market was growing rapidly with the rapid adoption of virtualized network functions into usable components for customer service creation.

Service Fulfillment Market Trends

Software Segment is Analyzed to Hold Significant Market Share

- The software segment including network management, inventory management and service order management is analyzed to hold significant market share in th service fulfillment market over the forecast period. The rollout of several technological advancements, such as 5G technology, IoT, AI, Digitization, and many more, Communication Service Providers (CSPs) face constant pressure to enhance and exceed rising customer expectations while minimizing operational costs, with little visibility across platforms, systems, tools, and fragmented data.

- According to Ericsson, 5G subscriptions are forecast to increase globally to 4624.11 million by 2028, North East Asia, South East Asia, India, Nepal, and Bhutan are expected to have the maximum regional subscriptions.With the increasing number of users, 5G connections, connected devices, mobile devices, applications, and the deployment of advanced technologies and capabilities, they are increasing their dependence on enhanced network infrastructure and enhanced connectivity solutions for essential connectivity to a wide range of endpoints.

- Subsequently, organizations and CSPs are increasingly investing in new network architectures that incorporate advanced management tools to drive the adoption of autonomous networks, leveraging technologies like AI and ML. Hence, the CSPs are contacting Service Fulfillment solution providers to enhance their supply chain activities by adopting software solutions.

- Another trend in the market is the demand for continuous evaluation and performance of networks due to increased network traffic and network processing, particularly from the local area networks, which require real-time streaming network analytics and allows customers to keep track of the health of their network and continuously monitor traffic flows. Such developments further fosters the demand for network management software in the market.

North America is Expected to Register the Largest Market

- The North America region is witnessing an increase in the demand for service fulfillment solutions and services due to an increase in the demand for enhanced connectivity solutions across various platforms, such as video streaming, video calling platforms, and teleconferencing, among various others.

- This, coupled with a rapid increase in subscribers on various networks such as 3G, 4G, 5G, etc., propel the players to adopt service fulfillment. Also, the region has become a major hub for the 5G rollout, with Canadian service providers increasingly investing in procuring 5G licenses.

- Market vendors are entering into partnership and acquisition activities to strengthen their service fulfillment offerings in the region, which is analyzed to drive the market growth in the region. For instance, in May 2023, Flexport, the tech-driven logistics platform, acquired the assets of Shopify Logistics, including Deliverr, Inc. Through the integration of Shopify Logistics, the company will strengthen its advanced AI-driven optimization to streamline the global supply chain, reducing costs and improving consumer reliability.

- Furthermore, in December 2022, JLL and Quiet Platforms, an American Eagle Outfitters Inc. completely owned subsidiary, announced a collaboration to speed the building of additional advanced fulfillment facilities across the United States in 2023 to service retailers and brands in the Quiet Platforms supply chain network. The two businesses would pioneer a flexible rent-as-a-percentage-of-revenue model for logistics real estate under the terms of the agreement.

Service Fulfillment Industry Overview

The Service Fulfillment Market is fragmented with the presence of several players like Comarch SA, Accenture PLC, Cisco Systems, Inc., Infosys Limited, and TATA Communications Ltd. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

In December 2023 - Infosys announced that it has helped enhance Spotlight Retail Group's consumer growth via an omnichannel digital fulfillment and advanced analytics platform built with Infosys and by leveraging Infosys' AI-first offering, Infosys Topaz, Spotlight Retail Group enabled a hyper-personalized online shopping experience for its consumers. The improved customer experience has led to a growth of 113% in customer base over 12 12-month period and 93% in transactions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Network Automation and Increasing Demand for Automated, Real-time Services

- 5.1.2 Rapid Adoption of Virtualized Network Functions into Usable Components for Customer Service Creation

- 5.2 Market Restraints

- 5.2.1 Lack in Awareness

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Software

- 6.1.1.1 Network Management

- 6.1.1.2 Inventory Management

- 6.1.1.3 Service Order Management

- 6.1.2 Services

- 6.1.1 Software

- 6.2 By Deployment Mode

- 6.2.1 On-Premise

- 6.2.2 Hosted

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Comarch SA

- 7.1.2 Accenture PLC

- 7.1.3 Cisco Systems, Inc.

- 7.1.4 Infosys Limited

- 7.1.5 TATA Communications Ltd.

- 7.1.6 Amdocs Group

- 7.1.7 Suntech S.A.

- 7.1.8 Telefonaktiebolaget LM Ericsson

- 7.1.9 NEC Technologies India Private Limited

- 7.1.10 Hewlett Packard Enterprise Development LP

- 7.1.11 TIBCO Software Inc.