|

市場調查報告書

商品編碼

1644375

切割設備:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Dicing Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

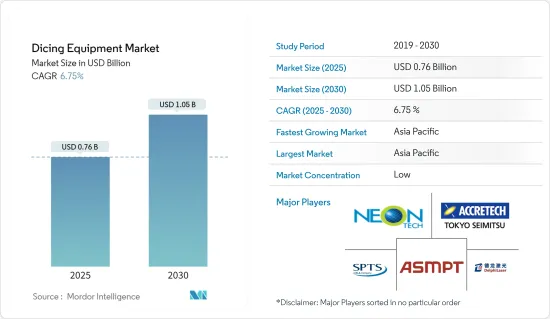

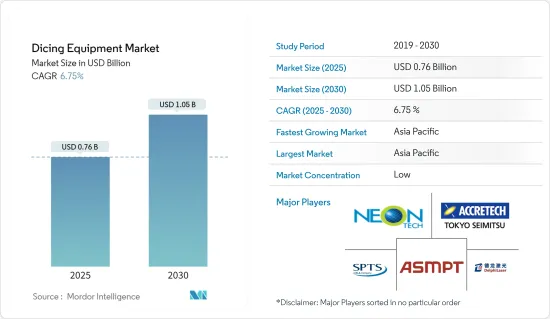

切割設備市場規模預計在 2025 年為 7.6 億美元,預計到 2030 年將達到 10.5 億美元,預測期內(2025-2030 年)的複合年成長率為 6.75%。

切割設備對於確保半導體製造的精度起著至關重要的作用。切割機負責從晶圓上切割出單一的晶圓。通常情況下,切割鋸會將晶圓上未使用的部分(稱為“街道”)切掉,這些部分位於晶圓片之間。這些街道通常有三英里寬,因此它們的狹窄程度比以前更重要,使得切割設備變得更加重要。

關鍵亮點

- 市場促進因素包括智慧卡、無線射頻辨識(RFID)技術和汽車電源 IC 的需求快速成長。這些因素以及蓬勃發展的家用電子電器市場、不斷增加的工廠設置以及小型化和技術遷移的趨勢正在鼓勵市場供應商增加研發投資。在提高性能的同時注重小型化,這刺激了微電子機械系統 (MEMS) 和 3D 封裝等創新。這些領域的持續進步凸顯了市場的動態性和適應技術進步的敏捷性。

- 因此,各行業正在開發可以變得更小但仍保持功率等級的半導體。例如,恩智浦半導體公司取得了驚人的成就,在保持功率性能的同時將電晶體的封裝尺寸縮小了55%。這項里程碑彰顯了業界在不犧牲小封裝性能的情況下突破技術界限的努力。

- 此外,Diodes Incorporated 也推出了兩款汽車級金屬氧化物半導體場場效電晶體(MOSFET),存儲DFN2020 封裝,佔地面積僅 2 mm x 2 mm。這些技術進步進一步加速了半導體和IC封裝市場的小型化,增加了對切割設備的需求。這些創新對於滿足現代電子設備對小型、高效組件日益成長的需求至關重要。

- 這些進步推動了3D積體電路(3D IC)技術的興起。該技術在攜帶式家用電子電器、感測器、微電子機械系統 (MEMS) 和工業產品等空間受限的應用中變得越來越普遍。該技術注重速度、耐用性、低功耗、輕量化設計和增強的記憶體容量,以顯著提高整體產品效能。

- 超薄晶圓處理和切割設備製程在各種半導體應用中發揮關鍵作用,包括 MEMS、複合半導體、LED、扇出型 WLP、CMOS 影像感測器 (CIS) 和利用 TSV 互連的新興 3D IC。這些製程確保了晶圓的完整性和性能,這對於最終產品的功能和效率至關重要。然而,這些製程技術面臨著獨特的挑戰,例如保持晶圓的穩定性、防止處理過程中的損壞以及確保與現有製造系統的兼容性。

- 削片,其特徵是晶片的角落和邊緣出現裂縫或碎片,是一個嚴重的問題。此問題導致製造過程中產量比率降低和成本增加。此外,在切割過程中,切口寬度和切割道寬度(後者相當於切割晶圓的寬度)會增加80-100μm。這會導致切口損失和晶圓浪費。增加切口和切割道寬度不僅會浪費材料,還會影響切割過程的準確性和效率。

- 儘管面臨疫情帶來的挑戰,但部分參與企業仍在對晶圓進行策略性投資。例如,Okmetic Oy 已宣布計劃向其芬蘭工廠投資數千萬歐元,以專注於其核心競爭力。矽晶絕緣體(SOI)晶片。疫情後全球切割設備市場的一個顯著趨勢是擴大採用自動化和先進的控制技術。這一轉變預計將提高效率和精度,推動切割設備市場的成長。

切割設備市場趨勢

功率元件應用領域可望佔據主要市場佔有率

- 功率半導體裝置用作電力電子電路中的開關和整流器,預計在預測期內將大幅成長。這一快速成長的主要驅動力是全球對行動電話和健康追蹤器等可攜式電子設備的需求,而有效的電源管理對於延長電池壽命至關重要。此外,對太陽能等替代能源能源的推動以及節能發光二極體(LED) 照明的採用也推動了對這些電源設備的需求。

- 隨著應用的發展,對於更小的外形規格、更快的開關頻率和更高的電壓能力的需求也日益增加。這一演變凸顯了功率元件作為產品製造商和加工設備提供者必不可少的積體電路 (IC) 的價值。半導體裝置的電源需求不僅在家用電子電器中不斷發展,而且在電動車 (EV)、資料中心以及工業和消費者物聯網應用等領域也在不斷發展。

- 汽車產業,尤其是電動車的興起,以及可再生能源和家用電子電器等領域,正在推動對最高效切割設備的需求。監管機構也正在採取重要措施。美國運輸部部製定了企業平均燃油經濟性(CAFE)車輛標準。英國的目標是到2050年實現淨零排放,並計劃在2035年禁止銷售所有污染汽車。德國為自己設定了雄心勃勃的目標,計畫在2020年終將溫室氣體排放減少40%,到2030年減少55%,到2050年減少95%。同時,美國和歐洲政府正在加強排放法規以對抗溫室氣體。這些共同的努力,加上提高汽車燃油效率的動力,正在增加對電動車以及最終動力設備的需求。

- 現代功率裝置受益於雷射切割和先進刀片切割技術等創新,從而實現了更高的精度和效率。例如,ASMPT已經宣布了針對功率半導體市場的解決方案。取得專利的Multi-Beam V-DOE 技術專為切割薄碳化矽 (SiC) 晶片 (<150μm) 而設計。這種改進的光束配置顯著增強了晶粒的後期切割性能。

- 作為一項重大的行業進步,英飛凌於 2024 年 9 月宣布推出全球首個用於電力電子的 300 毫米氮化鎵 (GaN) 晶圓技術。這項突破性技術有望實現更高的效率、更小的尺寸、更輕的重量和更低的整體晶片成本。

- 隨著5G、AI、物聯網、邊緣運算等技術推動半導體市場的擴張,先進切割設備的需求激增。據SWZD稱,北美和歐洲57%的組織已經實施或正在計劃實施資訊技術中的物聯網趨勢。

中國可望佔主要市場佔有率

- 中國是全球成長最快的半導體市場之一。隨著智慧型手機和消費性電子產品的需求激增,許多供應商正在中國建立生產設施。此外,中國政府也舉措吸引國際參與企業設立本地製造工廠。

- 半導體產業協會預測,到2024年,中國半導體產業年收益將達到1,160億美元,佔全球市場佔有率。這項預測取決於中國能否在其他國家成長率保持穩定的情況下保持強勁的成長勢頭。預計的成長凸顯了中國在半導體技術方面的戰略投資和進步,使中國成為全球市場的重要參與企業。

- 此外,國際半導體設備與材料協會(SEMI)的資料顯示,中國晶圓代工產業由跨國公司和國內公司組成,但國內公司將佔據主導地位。預計國內企業將在中國價值 240 億美元的晶圓廠計劃中佔據很大佔有率。

- 晶圓製造涉及切割,這是將單個半導體晶片從矽晶圓上分離出來的關鍵過程。這包括機械鋸切、雷射切割和劃線等精密切割技術。因此,新興國家晶圓製造設施的發展預計將產生對晶圓加工中使用的各種切割設備的需求。

- 例如,2024年11月,北京計畫投資46億美元興建一座12吋晶圓製造廠,由國營企業和基金支持。該計劃凸顯了中國為加強國內半導體生產所做的持續努力。新工廠由北京燕東微電子(YDME)和中國領先的顯示器製造商京東方科技共同投資建設。

切割設備產業概況

市場競爭力是指產業現有參與企業之間的競爭。這種競爭受到品牌識別、競爭策略、透明度和公司集中度等因素的影響。智慧型手機和智慧型手錶等智慧型裝置的興起刺激了對智慧感測器的需求,進而推動了先進半導體市場的發展。

為了追求更大的記憶體和性能而進行的小型化發展也推動了對小型電子封裝的需求。因此,薄晶圓在當今小型化電子設備中成為關注的焦點,導致薄晶圓產量激增,隨之而來的是加工和切割設備的需求增加。

切割設備市場主要被幾家大公司所壟斷,例如迪斯可公司、松下公司等。此外,晶圓製造流程中的挑戰也減緩了新參與企業進入市場的速度。

主要參與企業包括蘇州德爾福雷射、SPTS Technologies Limited(KLA Tencor Corporation)、ASM Laser Separation International (ALSI) BV、Tokyo Seimitsu 和 Neon Tech。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭對手之間的競爭

- 替代品的威脅

- 產業價值鏈分析

- 評估影響市場的宏觀經濟因素

第5章 市場動態

- 市場促進因素

- 技術進步和下一代設備的發展

- 市場問題

- 大規模生產挑戰

第6章 市場細分

- 透過切割技術

- 刀片劃片

- 雷射消熔

- 隱形切割

- 等離子切割

- 按應用

- 邏輯記憶體

- MEMS 設備

- 功率元件

- CMOS影像感測器

- RFID

- 按地區

- 中國

- 台灣

- 韓國

- 北美洲

- 歐洲

- 其他

第7章 切割設備主要客戶列表

第8章 競爭格局

- 公司簡介

- Suzhou Delphi Laser Co. Ltd

- SPTS Technologies Limited(KLA Tencor Corporation)

- ASM Laser Separation International(ALSI)BV

- Tokyo Seimitsu Co. Ltd

- Neon Tech Co. Ltd

- Synova SA

- Panasonic Connect Co., Ltd(Panasonic Holdings Corporation)

- Plasma-Therm LLC

- DISCO Corporation

- 3D-Micromac AG

- Veeco Instruments Inc.

- Advanced Dicing Technologies Limited

- Han's Laser Technology Industry Group Co., Ltd

- EO Technics Co., Ltd.

第9章投資分析

第10章:投資分析市場的未來

The Dicing Equipment Market size is estimated at USD 0.76 billion in 2025, and is expected to reach USD 1.05 billion by 2030, at a CAGR of 6.75% during the forecast period (2025-2030).

Dicing equipment plays a pivotal role in ensuring precision during semiconductor manufacturing. The equipment is responsible for cutting individual dice from a wafer. Typically, a dicing saw slices through an unused section of the wafer, referred to as the 'street,' which is located between the dice. These streets generally measure three miles in width, and their narrowing heightens the significance of the dicing equipment.

Key Highlights

- Key drivers propelling the growth of the studied market encompass surging demands for smart cards, Radio Frequency Identification (RFID) technology, and automotive power ICs. Alongside a flourishing consumer electronics market, an increase in factory establishments, and a trend towards miniaturization and technology migration, these factors have urged market vendors to amplify their research and development investments. This emphasis on downsizing while boosting performance has catalyzed innovations such as micro-electro-mechanical systems (MEMS) and 3D packaging. The ongoing advancements in these domains underscore the market's dynamic nature and its agility in adapting to technological progress.

- As a result, industry players are developing semiconductors that sustain power levels even with size reductions. For instance, NXP Semiconductors achieved a remarkable 55% reduction in package size for its transistors, all while maintaining power performance. This milestone highlights the industry's dedication to pushing technical boundaries, ensuring that compact packages do not sacrifice performance.

- Furthermore, Diodes Incorporated unveiled two automotive-compliant metal-oxide-semiconductor field-effect transistors (MOSFET) housed in a DFN2020 package, occupying a mere 2 mm by 2 mm footprint. Such strides accentuate the upward trajectory of the miniaturized semiconductor and IC packaging markets, subsequently amplifying the demand for dicing equipment. These innovations are paramount, addressing the escalating need for compact and efficient components in contemporary electronic devices.

- These advancements have catalyzed the ascent of three-dimensional integrated circuits (3D ICs) technology. This technology is becoming increasingly popular in space-constrained applications, spanning portable consumer electronics, sensors, Micro-Electro-Mechanical Systems (MEMS), and industrial products. It significantly boosts overall product performance, emphasizing speed, durability, low power consumption, lightweight design, and enhanced memory capacity.

- Ultra-thin wafer handling and dicing equipment processes play a crucial role in various semiconductor applications, including MEMS, compound semiconductors, LEDs, fan-out WLP, CMOS image sensors (CIS), and the emerging 3D ICs utilizing TSV interconnects. These processes ensure the integrity and performance of the wafers, which are essential for the functionality and efficiency of the end products. Nevertheless, these processing technologies face specific challenges, such as maintaining wafer stability, preventing damage during handling, and ensuring compatibility with existing manufacturing systems.

- Chipping, characterized by the cracking or chipping of the corners and edges of chips, poses a significant challenge. This issue can lead to reduced yield and increased costs in the manufacturing process. Furthermore, during dicing, the kerf width and the street width (the latter corresponding to the width of the diced wafer) increase by 80 to 100 μm. Consequently, this results in a kerf loss, leading to wastage of the wafers. The increased kerf width and street width not only waste material but also impact the precision and efficiency of the dicing process.

- Despite the challenges posed by the pandemic, certain players are making strategic investments in wafers. For example, Okmetic Oy announced plans to invest tens of millions of euros in its Finland facility, focusing on its core competency: Silicon-On-Insulator (SOI) wafers. Post-pandemic, a prominent trend in the global dicing equipment market is the rising adoption of automation and advanced control technologies. This shift is anticipated to enhance efficiency and precision, subsequently driving the dicing equipment market growth.

Dicing Equipment Market Trends

Power Devices Application Segment is Expected to Hold Significant Market Share

- Power semiconductor devices, utilized as switches or rectifiers in power electronic circuits, are poised for substantial growth during the forecast period. This surge is primarily driven by the global appetite for cell phones and portable electronics, such as health trackers, where effective power management is crucial for extending battery life. Additionally, the demand for these power devices is bolstered by the push for alternative energy sources like solar power and the adoption of energy-efficient Light Emitting Diode (LED) lighting.

- As applications evolve, there's a growing demand for smaller form factors, faster-switching frequencies, and higher voltage capabilities. This evolution underscores the value of power devices as essential integrated circuits (ICs) for product manufacturers and processing equipment providers. Beyond consumer electronics, sectors like electric vehicles (EVs), data centers, and both industrial and consumer IoT applications are witnessing evolving power requirements for semiconductor devices.

- The automotive industry, particularly with the rise of electric vehicles, alongside sectors like renewable energy and consumer electronics, is driving a heightened demand for top-tier, efficient dicing equipment. Regulatory bodies are taking significant steps: The US Department of Transportation has established Corporate Average Fuel Economy (CAFE) vehicle standards. The UK aims for net-zero emissions by 2050 and plans to ban the sale of all polluting vehicles by 2035. Germany has set ambitious targets, seeking a 40% reduction in greenhouse gas emissions by the end of 2020, 55% by 2030, and up to 95% by 2050. Concurrently, US and European governments are tightening emission limits to combat the greenhouse effect. These concerted efforts, alongside a push for enhanced vehicle fuel economy, are amplifying the demand for electric vehicles and, in turn, power devices.

- Modern power devices are benefiting from innovations like laser dicing and advanced blade dicing techniques, which offer enhanced precision and efficiency. For example, ASMPT has introduced a solution for the power semiconductor market. Their patented multi-beam V-DOE technology is designed for dicing through thin Silicon Carbide (SiC) wafers (less than 150 µm). This modified beam configuration notably strengthens the die post-cutting.

- In a significant industry advancement, Infineon unveiled the world's first 300mm Gallium Nitride (GaN) wafer technology for power electronics in September 2024. This breakthrough promises enhanced efficiency, reduced size and weight, and a lower overall cost for chips.

- As technologies like 5G, AI, IoT, and edge computing propel the semiconductor market's expansion, the demand for sophisticated dicing equipment has surged. According to SWZD, 57 percent of organizations in North America and Europe have either implemented or plan to implement IoT trend in information technology.

China is Expected to Hold Significant Market Share

- China stands out as one of the fastest-growing semiconductor markets globally. The surging demand for smartphones and consumer electronics is prompting numerous vendors to establish production facilities in the nation. Further, the Chinese government's initiatives are attracting international players to set up local production units.

- The Semiconductor Industry Association forecasts that by 2024, China's semiconductor industry will generate an annual revenue of USD 116 billion, capturing over 17.4% of the global market share. This forecast depends on China maintaining its strong growth momentum, assuming other countries' growth rates remain stable. The anticipated growth underscores China's strategic investments and advancements in semiconductor technology, positioning it as a significant player in the global market.

- Further, Semiconductor Equipment and Materials International's (SEMI) data indicates that while China's foundry industry comprises both multinational and domestic vendors, domestic companies are poised to dominate. Out of the USD 24 billion fab projects in China, domestic firms are expected to command a significant share.

- Wafer fabrication includes dicing, a critical process where individual semiconductor chips are separated from a silicon wafer. This involves precise cutting techniques such as mechanical sawing, laser cutting, and scribing. Thus, the development of new wafer fabrication facilities in the country is expected to generate demand for various dicing equipment used in wafer processing.

- For instance, in November 2024, Beijing, supported by state-owned enterprises and funds, plans to invest USD 4.6 billion in a 12-inch wafer fabrication facility. This initiative highlights China's ongoing efforts to strengthen its domestic semiconductor production. The new facility involves Beijing Yandong Microelectronics (YDME) and BOE Technology, China's leading display manufacturer.

Dicing Equipment Industry Overview

Competitive rivalry in the market refers to the competition among established players in the industry. This competition is influenced by factors such as brand identity, competitive strategies, transparency levels, and the concentration ratio of firms. The rise of smart devices, including smartphones and smartwatches, has spurred the demand for smart sensors, consequently boosting the market for advanced semiconductors.

Factors like the trend towards miniaturization, aiming for enhanced memory and performance in smaller sizes, have spurred demand for compact electronic packages. As a result, thin wafers have gained prominence in today's miniaturized electronics landscape, leading to a surge in thin wafer production and a corresponding demand for processing and dicing equipment.

The dicing equipment market is dominated by a handful of major players, including Disco Corporation and Panasonic Corporation, among others. Additionally, challenges in thin wafer manufacturing processes have slowed the entry of new players into the market.

Some of the major players in the market are Suzhou Delphi Laser Co. Ltd, SPTS Technologies Limited (KLA Tencor Corporation), ASM Laser Separation International (ALSI) BV, Tokyo Seimitsu Co. Ltd, and Neon Tech Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Technological Advancements, and Evolution of Next Generation Devices

- 5.2 Market Challenges

- 5.2.1 Mass Manufacturing Challenges

6 MARKET SEGMENTATION

- 6.1 By Dicing Technology

- 6.1.1 Blade Dicing

- 6.1.2 Laser Ablation

- 6.1.3 Stealth Dicing

- 6.1.4 Plasma Dicing

- 6.2 By Application

- 6.2.1 Logic & Memory

- 6.2.2 MEMS Devices

- 6.2.3 Power Devices

- 6.2.4 CMOS Image Sensor

- 6.2.5 RFID

- 6.3 By Geography

- 6.3.1 China

- 6.3.2 Taiwan

- 6.3.3 South Korea

- 6.3.4 North America

- 6.3.5 Europe

- 6.3.6 Rest of the World

7 POTENTIAL LIST OF KEY CUSTOMERS FOR DICING EQUIPMENT

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Suzhou Delphi Laser Co. Ltd

- 8.1.2 SPTS Technologies Limited (KLA Tencor Corporation)

- 8.1.3 ASM Laser Separation International (ALSI) BV

- 8.1.4 Tokyo Seimitsu Co. Ltd

- 8.1.5 Neon Tech Co. Ltd

- 8.1.6 Synova SA

- 8.1.7 Panasonic Connect Co., Ltd (Panasonic Holdings Corporation)

- 8.1.8 Plasma-Therm LLC

- 8.1.9 DISCO Corporation

- 8.1.10 3D-Micromac AG

- 8.1.11 Veeco Instruments Inc.

- 8.1.12 Advanced Dicing Technologies Limited

- 8.1.13 Han's Laser Technology Industry Group Co., Ltd

- 8.1.14 EO Technics Co., Ltd.