|

市場調查報告書

商品編碼

1644346

柴油 -市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Diesel As Fuel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

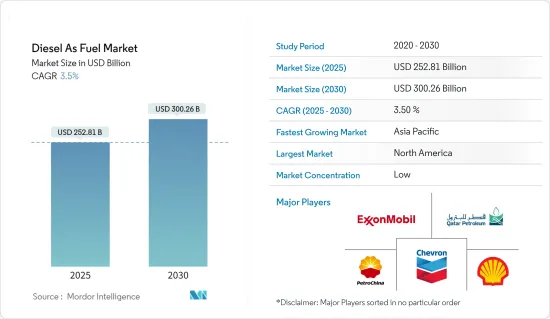

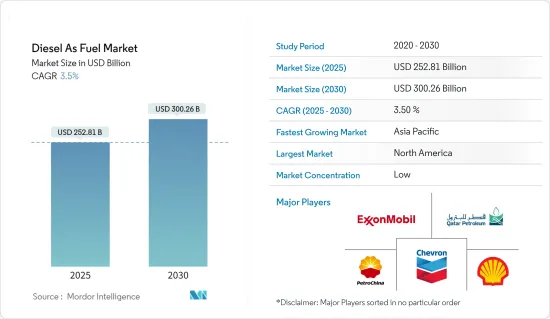

預計 2025 年柴油市場規模將達到 2,528.1 億美元,到 2030 年預計將達到 3,002.6 億美元,預測期內(2025-2030 年)的複合年成長率為 3.5%。

關鍵亮點

- 從中期來看,預計預測期內工業應用中柴油使用量的增加和全球柴油基礎設施的可用性將推動市場發展。

- 然而,預計預測期內人們對空氣污染日益擔憂將阻礙市場成長。

- 生物柴油和可再生柴油技術的不斷進步預計將為柴油市場創造重大機會。

- 由於能源需求和工業基礎設施活動的增加,預計亞太地區的柴油市場將顯著成長。

柴油市場趨勢

市場區隔預計將由運輸業主導

- 柴油廣泛用於卡車、巴士和機車等重型車輛。這些車輛需要能夠提供高扭矩、高效率和高續航里程的能源,以便遠距運輸貨物和人員。柴油引擎以其高功率和低油耗而聞名,非常適合這些應用。因此,交通運輸部門佔柴油消耗的很大一部分。

- 全球運輸網路的不斷擴大和流動性需求的不斷成長推動了對精煉產品的需求不斷成長。據國際汽車工業協會稱,2021年至2022年間全球汽車產量將增加6%以上。預計汽車產量的增加將導致預測期內燃料需求的增加。

- 交通運輸部門已建立柴油配送和加註基礎設施。加油站隨處可見,現有的柴油車輛持有也相當可觀。這種基礎設施,加上柴油車輛的普及,導致運輸業在柴油市場佔據主導地位。

- 柴油因其能量密度和續航里程而非常適合遠距運輸和貨物運輸。遠距運輸的卡車依靠柴油引擎的動力和效率。無需頻繁加油遠距行駛,這使得柴油成為這些應用的一個有吸引力的選擇。這導致了燃料技術的發展。

- 例如,2023 年 5 月,Reliance Industries Ltd 和 bp Plc 的合資企業 Jio-bp 推出了混合添加劑的優質柴油,以提高燃油效率。這種優質柴油比普通柴油或純柴油便宜。該柴油引擎採用 ACTIVE 技術,有助於最大限度地減少因污垢堆積而進行計劃外維護的可能性。

- 因此,如前所述,預計運輸業將在預測期內佔據市場主導地位。

預計亞太地區市場將大幅成長

- 亞太地區經濟快速成長,中國、印度、東南亞等國家正崛起成為經濟強國。這種成長刺激了工業化、基礎設施發展和運輸需求的增加,從而導致對柴油的需求增加。

- 該地區人口稠密,都市化很高。這導致個人和商業用途的交通需求增加。柴油廣泛應用於該地區不斷擴大的交通運輸領域,包括汽車、卡車、巴士和二輪車,進一步推動了市場成長。

- 亞太地區包括多元化的製造業、建設業、採礦業和農業產業。這些領域嚴重依賴柴油來為機械、設備和發電機動力來源。隨著工業活動擴大以滿足日益成長的需求,柴油消費量不斷增加,從而推動市場成長。

- 例如,2023 年 4 月,包裝公司 SIG 宣布將在印度帕爾加爾開設一家新的製造工廠。新工廠將專注於生產盒中袋和帶嘴袋包裝,之前分別以 Scholle IPN 和 Bossar 的名稱出售。

- 此外,亞太地區許多國家也推出了推廣柴油使用、改善燃油品質的政策和措施。這些措施旨在提高能源效率、減少排放氣體並確保遵守環境標準。這些努力為柴油市場的繁榮創造了有利環境。

- 因此,預計亞太地區將在預測期內佔據市場主導地位。

柴油業概況

柴油市場是細分的。市場的主要企業(不分先後順序)包括雪佛龍公司、埃克森美孚公司、中國石油天然氣股份有限公司、卡達石油公司、殼牌公司等。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第 2 章執行摘要

第3章調查方法

第4章 市場概況

- 介紹

- 2028 年市場規模及需求預測(十億美元)

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 工業應用需求增加

- 全球基礎建設成長

- 限制因素

- 人們對碳排放以及向電動車和再生能源來源轉變的擔憂日益加劇

- 驅動程式

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 最終用戶

- 運輸

- 產業

- 其他

- 2028 年市場規模與需求預測(按地區)

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 英國

- 俄羅斯

- 德國

- 挪威

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 印尼

- 馬來西亞

- 越南

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 奈及利亞

- 埃及

- 其他中東和非洲地區

- 南美洲

- 阿根廷

- 巴西

- 委內瑞拉

- 南美洲其他地區

- 北美洲

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- Chevron Corporation

- Exxon Mobil Corporation

- PetroChina Company Limited

- Qatar Petroleum

- Shell Plc

- Reliance Industries Ltd

- Saudi Arabian Oil Co

- SK energy Co., Ltd.

- NK Rosneft'PAO

- BP plc

第7章 市場機會與未來趨勢

- 開發生質燃料和可再生柴油等永續燃料

簡介目錄

Product Code: 71232

The Diesel As Fuel Market size is estimated at USD 252.81 billion in 2025, and is expected to reach USD 300.26 billion by 2030, at a CAGR of 3.5% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, the increasing industrial application of diesel fuel in the industrial application and availability of diesel infrastructure around the globe is expected to drive the market during the forecasted period.

- On the other hand, the increasing environmental concerns for air pollution are expected to hinder the market's growth during the forecasted period.

- Nevertheless, the increasing advancements in biodiesel and renewable diesel technology are expected to create huge opportunities for the Diesel as fuel market.

- Asia-Pacific is expected to witness significant growth in the diesel as fuel market due to the region's increasing energy demand and industrial infrastructure activities.

Diesel Fuel Market Trends

Transportation Segment is to Expected to Dominate in the Market

- Diesel fuel is widely used in heavy-duty vehicles, such as trucks, buses, and locomotives. These vehicles require energy that can provide high torque, efficiency, and range to transport goods and people long distances. Diesel engines are known for their ability to deliver high power output and fuel efficiency, making them well-suited for these applications. As a result, the transportation sector accounts for a significant portion of diesel fuel consumption.

- The expanding global transportation network and the increasing mobility needs contribute to the growing demand for refined products. According to the International Organization of Motor Vehicle Manufacturers, global vehicle production increased by more than 6% between 2021 and 2022. This growth in vehicle production is expected to increase fuel demand during the forecasted period.

- The transportation sector includes a well-established infrastructure for diesel fuel distribution and refueling. Fueling stations are readily available, and the existing fleet of diesel-powered vehicles is substantial. This infrastructure and the widespread use of diesel vehicles contribute to the dominance of the transportation segment in the diesel fuel market.

- Diesel fuel is favored in long-haul and freight transportation due to its energy density and range. Trucks transporting goods over significant distances rely on diesel engines for their power and efficiency. The ability to cover long distances without frequent refueling makes diesel fuel an attractive option for these applications. It led to the development of fuel technologies.

- For instance, in May 2023, Jio-bp, the joint venture between Reliance Industries Ltd and bp Plc, introduced a high-quality diesel fuel blended with additives that enhances fuel efficiency. This superior-grade diesel is priced lower than regular or additive-free diesel available. The diesel, infused with ACTIVE technology, helps minimize the likelihood of unplanned maintenance caused by dirt accumulation.

- Therefore, as mentioned above, the transportation segment is expected to dominate the market during the forecasted period.

Asia-Pacific is Expected to Witness Significant Growth in the Market

- The Asia-Pacific region is experiencing rapid economic growth, with countries like China, India, and Southeast Asian nations emerging as major economic powerhouses. This growth drives increased industrialization, infrastructure development, and transportation needs, contributing to higher demand for diesel fuel.

- The region contains a large and growing population, along with increasing urbanization. It leads to greater demand for transportation for personal and commercial purposes. Diesel fuel is widely used in the region's expanding transportation sector, including cars, trucks, buses, and motorcycles, further fueling the market growth.

- Asia-Pacific includes diverse manufacturing, construction, mining, and agriculture industries. These sectors heavily rely on diesel fuel to power machinery, equipment, and generators. As industrial activities expand to meet the growing demand, diesel fuel consumption increases, driving market growth.

- For instance, in April 2023, SIG, a packaging company, unveiled the inauguration of a new manufacturing facility in Palghar, India. The newly established plant will focus on producing bag-in-box and spouted pouch packaging, previously marketed under Scholle IPN and Bossar, respectively.

- Additionally, many countries in the Asia-Pacific region implemented policies and regulations to promote the use of diesel fuel and improve fuel quality. These measures aim to enhance energy efficiency, reduce emissions, and ensure compliance with environmental standards. Such initiatives provide a supportive environment for the diesel fuel market to thrive.

- Therefore as per the points mentioned above, the Asia-Pacific region is expected to dominate the market during the forecasted period.

Diesel Fuel Industry Overview

The diesel as fuel market is fragmented. Some of the major players in the market (in no particular order) include Chevron Corporation, Exxon Mobil Corporation, PetroChina Company Limited, Qatar Petroleum, and Shell Plc., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Demand from Industrial Applications

- 4.5.1.2 Growing Infrastructure Across the World

- 4.5.2 Restraints

- 4.5.2.1 A Rise In Concerns Related To Carbon Emissions And A Shift Towards Electric Vehicles And Renewable Sources Of Energy

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Force Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 End-User

- 5.1.1 Transporation

- 5.1.2 Industrial

- 5.1.3 Others

- 5.2 Geography Regional Market Analysis {Market Size and Demand Forecast till 2028 (for regions only)}

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 United Kingdom

- 5.2.2.2 Russia

- 5.2.2.3 Germany

- 5.2.2.4 Norway

- 5.2.2.5 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 India

- 5.2.3.3 Indonesia

- 5.2.3.4 Malaysia

- 5.2.3.5 Vietnam

- 5.2.4 Middle-East and Africa

- 5.2.4.1 Saudi Arabia

- 5.2.4.2 United Arab Emirates

- 5.2.4.3 South Africa

- 5.2.4.4 Nigeria

- 5.2.4.5 Egypt

- 5.2.4.6 Rest of Middle-East and Africa

- 5.2.5 South America

- 5.2.5.1 Argentina

- 5.2.5.2 Brazil

- 5.2.5.3 Venezuela

- 5.2.5.4 Rest of South America

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Chevron Corporation

- 6.3.2 Exxon Mobil Corporation

- 6.3.3 PetroChina Company Limited

- 6.3.4 Qatar Petroleum

- 6.3.5 Shell Plc

- 6.3.6 Reliance Industries Ltd

- 6.3.7 Saudi Arabian Oil Co

- 6.3.8 SK energy Co., Ltd.

- 6.3.9 NK Rosneft' PAO

- 6.3.10 BP plc

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development of Sustainable Fuels Such as Biofuels and Renewable Diesel

02-2729-4219

+886-2-2729-4219