|

市場調查報告書

商品編碼

1644320

印度電池:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)India Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

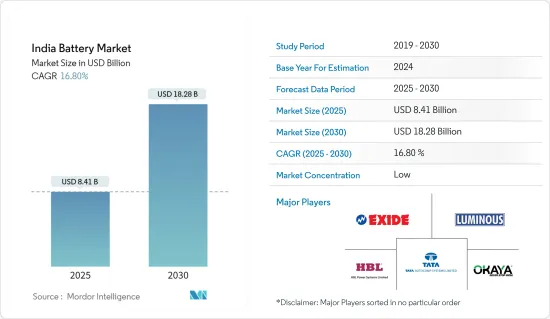

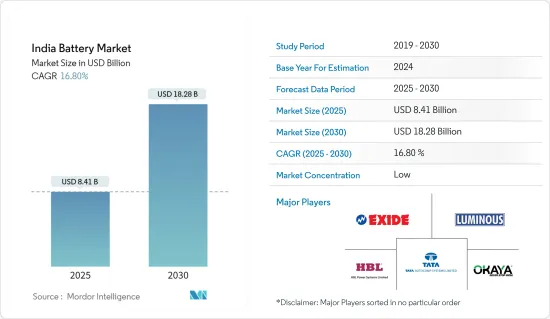

預計2025年印度電池市場規模為84.1億美元,預計到2030年將達到182.8億美元,預測期內(2025-2030年)的複合年成長率為16.8%。

關鍵亮點

- 從中期來看,電動車和用於各種應用的電池能源儲存系統等新興市場的出現,以及電動車中汽車電池的使用日益增多等因素預計將在預測期內推動印度電池市場的發展。

- 另一方面,預測期內印度缺乏鋰離子國內製造設施可能會阻礙印度電池市場的成長。

- 然而,印度國內生產鋰離子電池的計畫可能會在預測期內為印度電池市場提供有利的成長機會。

印度電池市場趨勢

汽車產業將大幅成長

- 隨著政府政策層面的支持推動製造業的發展,預計印度將成為未來幾年電池公司的主要投資熱點。

- 由於中產階級和年輕人口的不斷成長,二輪車市場佔據了主導地位。雖然有組織的公司銷售有保固的品牌電池,但無組織的公司不提供任何保固或售後服務,他們銷售再生電池,且產品價格比品牌電池便宜 30-35%。印度汽車替換電池市場以鉛酸電池為主。

- 2022-23 年,印度最大的汽車製造商瑪魯蒂鈴木印度公司的批發量最高,從 2021-22 年的 1,652,653 輛成長 19% 至 1,966,164 輛。 2022-23會計年度國內出貨量從上年度的1,414,277輛成長21%至1,706,831輛。

- 根據印度汽車製造商組織(OICA)預測,印度汽車產量預計將在2109會計年度至2023會計年度穩步成長,呈現上升趨勢。考慮到所有汽車銷售都與電池銷售成正比,這為市場相關人員帶來了未來強勁的成長。

- 2023 年 2 月,全球領先的 VRLA 和磷酸鋰離子電池製造公司 Okaya Power Pvt. Ltd 宣布向印度市場推出一款新型電動二輪車 E-Scooter Faast F3。新款電動ScooterFast F3 的續航里程為 125 公里,配備防水防塵的 3.53kWh 鋰離子 LFP 雙電池,並採用切換技術以延長電池壽命。新的鋰電池只需4到5個小時就可以充電。

- 由於人口不斷成長和融資便利,預計汽車行業在預測期內將大幅成長。預計電動車(EV)的銷售將支撐這一細分市場。

- 由於上述因素,汽車產業預計將在該國獲得顯著發展勢頭,這反過來將有助於預測期內電池市場的成長。

電動車(EV)需求的不斷成長推動著市場

- 電動車(EV)有望在實現聯合國永續發展目標中發揮核心作用。由於對清潔能源來源的需求不斷增加,預計印度的電動車普及率將大幅成長。印度政府計劃將二輪車、三輪車和商用車的電氣化作為印度在2030年實現30%電動車普及率的目標的主要驅動力。

- 印度每年銷售超過 300 萬輛以石化燃料動力來源的乘用車,包括 Mahindra & Mahindra Ltd、Tata Motors Ltd 和 Ashok Leyland Ltd 在內的多家汽車製造商都在當地生產電動車。現代汽車公司和鈴木汽車公司等外國公司也正在進入這個新領域,因為政府計劃在 2030 年之前使綠色汽車佔持有總數的三分之一左右。

- 預計市場將以電動車為主,主要供客運業者使用。預測期內,電動人力車和私人迷你三輪車的電池需求預計將增加 20% 以上。

- 根據印度公路運輸和公路部 (MORTH) 2023 年 12 月發布的新聞稿,2023 年電動車註冊數量與 2022 年相比增加了 134,434 輛。兩年總銷量為 1,504,012 輛。鑑於印度電池和插電式混合動力汽車市場的蓬勃發展,這參與企業來說是一個好兆頭。

- 2023 年 2 月,雷諾和日產宣布了針對印度的全新長期願景,包括擴大生產和研發活動、採用電動車並轉向碳中和製造。兩家公司將以清奈為基地,共同開發六款新量產車,其中包括兩款全電動汽車。兩家公司計劃投資約6億美元支持新計劃。

- 2023年6月,塔塔集團旗下Agratas Energy Storage Solutions Private Limited與古吉拉突邦政府簽署協議,建立印度首個鋰離子電池超級工廠。該公司最初將向該20吉瓦(GW)發電廠投資15.7億美元。

- 因此,預計預測期內電動車的普及將推動印度電池市場的發展。

印度電池產業概況

印度電池市場呈現分化態勢。市場的主要企業(不分先後順序)包括 Exide Industries Ltd、Luminous Power Technologies Pvt.Ltd、HBL Power Systems Ltd、TATA AutoComp GY Batteries Pvt.Ltd 和 Okaya Power Pvt.Ltd。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第 2 章執行摘要

第3章調查方法

第4章 市場概況

- 介紹

- 2029 年市場規模與需求預測(十億美元)

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 電動車和各種應用的電池儲存系統等新興市場的出現

- 汽車電池在電動車的應用擴大

- 限制因素

- 國內沒有鋰離子生產設施

- 驅動程式

- 供應鏈分析

- PESTLE分析

第5章 市場區隔

- 科技

- 鋰離子電池

- 鉛酸電池

- 其他

- 應用

- SLI 電池

- 工業電池(動力、固定(電訊、UPS、能源儲存系統(ESS)等))

- 可攜式(例如家用電子電器產品)

- 汽車電池(HEV、PHEV、EV)

- 其他

第6章 競爭格局

- 併購、合資、合作、協議

- 主要企業策略

- 公司簡介

- Exide Industries Ltd.

- Luminous Power Technologies Pvt. Ltd

- HBL Power Systems Ltd

- TATA AutoComp GY Batteries Pvt. Ltd

- Okaya Power Pvt. Ltd

- Amara Raja Batteries Ltd

- Su-Kam Power Systems Ltd

- Base Corporation Ltd

- Southern Batteries Pvt. Ltd

- Evolute Solutions Pvt. Ltd

- 市場排名/佔有率(%)分析

第7章 市場機會與未來趨勢

- 印度鋰離子電池本地生產計畫

簡介目錄

Product Code: 71016

The India Battery Market size is estimated at USD 8.41 billion in 2025, and is expected to reach USD 18.28 billion by 2030, at a CAGR of 16.8% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as the emergence of new and exciting markets, i.e., electric vehicles and battery energy storage systems for different applications and the growing usage of automotive batteries in electric vehicles, will likely drive the Indian battery market during the forecast period.

- On the other hand, the absence of lithium-ion domestic manufacturing facilities will likely hinder the growth of the Indian battery market during the forecast period.

- However, plans for local manufacturing of lithium-ion batteries in India will likely create lucrative growth opportunities for the Indian battery market during the forecast period.

India Battery Market Trends

The Automotive Segment to Witness Significant Growth

- India is expected to be a major investment hotspot for battery companies in the coming years because government policy-level support encourages the manufacturing sector.

- The two-wheeler segment dominates the automotive market owing to a growing middle class and a young population. Organized companies sell branded batteries with warranties, while unorganized companies provide no warranty or after-sales, sell recycled batteries, and offer products at a 30-35% discount to branded ones. The Indian automotive replacement battery market is leading the lead-acid battery market.

- During 2022-2023, Maruti Suzuki India, the country's largest automaker, had its greatest wholesales, up 19% from 165,265,3 units in 2021-2022 to 196,616,4 units. Domestic shipments climbed by 21% during 2022-2023 to 170,683,1 units from 141,427,7 units the previous fiscal year.

- According to the International Organization of Motor Vehicle Manufacturers (OICA), automotive production in India increased steadily from FY 2109 to FY 2023, showing an upward graph. Considering that every automotive vehicle sale is directly proportional to battery sales, this promises strong future growth for the market players.

- In February 2023, Okaya Power Pvt. Ltd, a world-class VRLA and lithium-ion phosphate battery manufacturing company, announced the launching of a new electric two-wheeler, E-Scooter Faast F3, for the Indian market. The new E-Scooter Faast F3 is capable of providing a range of 125 km and is equipped with waterproof and dust-resistant 3.53 kWh lithium-ion LFP dual batteries with switchable technology to extend battery life. The new lithium battery can be charged in 4 to 5 hours.

- With an increasing population and accessible financing facilities, the automobile sector is expected to grow significantly during the forecast period. Electric vehicle (EV) sales are expected to support the segment.

- The factors above are expected to help the automotive segment gain significant momentum in the country, which, in turn, will help the battery market grow during the forecast period.

Increasing Demand for Electric Vehicles (EVs) to Drive the Market

- Electric vehicles (EVs) are expected to play a central role in achieving the UN Sustainable Development Goals. In India, the adoption of EVs is likely to grow significantly with the increasing demand for clean energy sources. The government has plans to achieve a target of 30% electric vehicle adoption by 2030, powered primarily by the electrification of two-wheeler, three-wheeler, and commercial vehicles in India.

- In India, more than 3 million fossil fuel-powered passenger vehicles are sold annually, and a few automakers, including Mahindra & Mahindra Ltd, Tata Motors Ltd, and Ashok Leyland Ltd, are making EVs domestically. Overseas companies such as Hyundai Motor Co. and Suzuki Motor Corp. are also entering the new segment as the government plans to have green vehicles comprise about a third of its fleet by 2030.

- The market will likely be dominated by electric vehicles mainly used by passenger carriers. The demand for batteries for e-rickshaws and small privately owned three-wheeler taxis is expected to grow by more than 20% during the forecast period.

- According to a December 2023 press release from the Indian Ministry of Road Transport and Highways (MORTH), the registration of EVs in 2023 increased by 1,34,434 units compared to 2022. The total sales in two years stood at 15,04,012 units. Considering India's battery and plug-in hybrid vehicle market boom, this will offer strong future potential to the Indian battery market players.

- In February 2023, Renault and Nissan revealed a new long-term vision for India, including increased production and R&D activities, the introduction of electric vehicles, and a shift to carbon-neutral manufacturing. From their base in Chennai, the firms will collaborate on six new production vehicles, including two fully electric cars. They are expected to invest approximately USD 600 million to support the new projects.

- In June 2023, Tata Group subsidiary Agratas Energy Storage Solutions Private Limited signed an agreement with the Gujarat government to establish India's first gigafactory for lithium-ion batteries. The company will initially invest USD 1.57 billion in the 20 gigawatts (GW) unit.

- Therefore, the increase in the adoption of electric vehicles is expected to drive the battery market in India during the forecast period.

India Battery Industry Overview

The Indian battery market is fragmented. Some of the major players in the market (in no particular order) include Exide Industries Ltd and Luminous Power Technologies Pvt. Ltd, HBL Power Systems Ltd, TATA AutoComp GY Batteries Pvt. Ltd, and Okaya Power Pvt. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 The Emergence of New and Exciting Markets, i.e., Electric Vehicles and Battery Energy Storage Systems for Different Applications

- 4.5.1.2 The Growing Usage of Automotive Batteries in Electric Vehicles

- 4.5.2 Restraints

- 4.5.2.1 The Absence of Lithium-Ion Domestic Manufacturing Facilities

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 Technology

- 5.1.1 Lithium-ion Battery

- 5.1.2 Lead-acid Battery

- 5.1.3 Other Technologies

- 5.2 Application

- 5.2.1 SLI Batteries

- 5.2.2 Industrial Batteries (Motive, Stationary (Telecom, UPS, Energy Storage Systems (ESS)), Etc.)

- 5.2.3 Portable (Consumer Electronics, Etc.)

- 5.2.4 Automotive Batteries (HEV, PHEV, and EV)

- 5.2.5 Other Applications

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Exide Industries Ltd.

- 6.3.2 Luminous Power Technologies Pvt. Ltd

- 6.3.3 HBL Power Systems Ltd

- 6.3.4 TATA AutoComp GY Batteries Pvt. Ltd

- 6.3.5 Okaya Power Pvt. Ltd

- 6.3.6 Amara Raja Batteries Ltd

- 6.3.7 Su-Kam Power Systems Ltd

- 6.3.8 Base Corporation Ltd

- 6.3.9 Southern Batteries Pvt. Ltd

- 6.3.10 Evolute Solutions Pvt. Ltd

- 6.4 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Plans for Local Manufacturing of lithium-Ion Batteries in India

02-2729-4219

+886-2-2729-4219