|

市場調查報告書

商品編碼

1644291

資料發現:市場佔有率分析、產業趨勢、成長預測(2025-2030 年)Data Discovery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

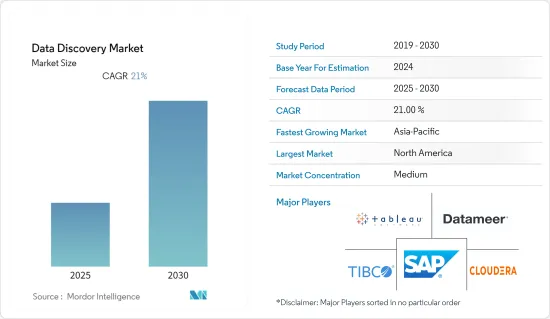

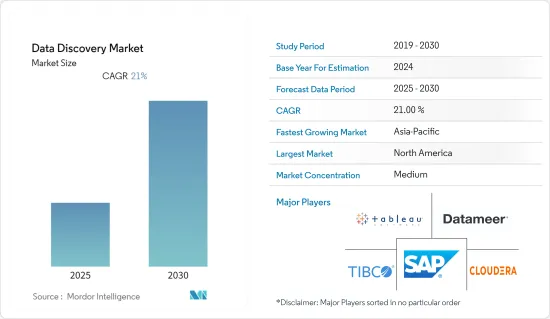

預測期內,資料發現市場預計將以 21% 的複合年成長率成長。

主要亮點

- 根據類型,資料搜尋軟體部分預計很快就會在資料發現市場中出現。 Tableau、QlikView 和 Tibco Spotfire 等資料發現和視覺化軟體專為資料分析和技術驅動的業務用例而設計。

- 網路購物在消費者中的日益普及刺激了全球電子商務產業的擴張。多年來,電子商務企業累積了大量的客戶資料,每天都會增加Petabyte的資料。根據美國人口普查局的數據,零售電商銷售額佔總銷售額的比例將從 2022 年第一季的 14.3% 增加到 2022 年第三季的 14.8%。

- 此外,隨著物聯網設備和資料分析在許多行業中的應用越來越廣泛,該行業可能會產生更多的資料。根據飛利浦的一項調查,2022 年 2 月在新加坡接受調查的醫療保健領導者中,92% 表示他們的公司之前已經實施了預測分析。因此,資料收益解決方案的範圍預計將擴大。

- 巨量資料技術和資料發現工具正在徹底改變通訊。 Apache Hadoop、流分析和機器學習等工具為 CSP 開闢了新的機會,使其能夠從以前難以處理的資料集中獲取洞察力。

- 提供資料發現服務和解決方案的公司在 COVID-19 疫情高峰期間收益略有下降。然而,疫苗資料、在家工作以及對電子健康的重視導致非結構化和結構化資料的激增,需要識別並有效管理這些資料才能獲得洞察力。市場目前正在成長,並且很可能在預測期內繼續成長。

資料發現市場趨勢

銀行、金融服務和保險佔據市場主導地位

- 資料發現工具可以幫助解決銀行員工資料建模能力不足等問題,使他們能夠解讀資料以增強客戶體驗。它有助於識別潛在的客戶群並為他們提供有吸引力的優惠。更重要的是,資料發現將使銀行和金融服務提供者能夠建立商業模型,並透過實質的風險分析做出適當的投資決策。

- 機器學習 (ML) 和人工智慧 (AI) 技術的日益使用正在產生大量資料化和非結構化資料,預計這將在整個預測期內推動敏感資料發現解決方案的採用。此外,隨著企業轉向基於雲端基礎的解決方案,資料量預計也會成長。例如,根據泰雷茲《2022年資料威脅報告》,全球公司儲存在雲端的公司資料比例將從2015年的30%增加到2022年的60%。

- 大量交易產生的資料迫使銀行尋找創新的商業理念和風險管理解決方案。一段時間內收集的每組資料都講述了一個獨特的故事,並指向未來某個明確時期的目標,使企業能夠利用這些資訊在市場上獲得競爭優勢。

- 巨量資料分析可以提高銀行和金融機構所採用的風險模型的評估能力。採用巨量資料分析並將其融入現有的銀行工作流程是數位千禧年快速發展的商業環境中生存和發展的必要條件之一。

- 此外,人工智慧技術必須能夠有效地處理資料,具有足夠的處理能力,並且靈活、適應性強、擴充性,以適應不同數量的資料。因此,小型金融科技公司可能更難以取得實施人工智慧所需的軟體和硬體。

北美主導資料發現市場

- 由於早期採用新技術、對雲端基礎的解決方案進行大量投資以及該地區眾多公司的存在,北美有望引領資料發現市場。隨著資料和相應應用的不斷增加,增加儲存容量的需求為該地區所有主要企業創造了機會。

- 行動寬頻的發展、雲端處理和巨量資料分析的成長正在推動對新資料基礎設施和資料發現軟體的需求。此外,伺服器價格的下降推動了北美各地企業採用雲端處理,有助於建立高效、永續的資料中心,從而推動所研究市場的發展。

- 該地區的幾家公司正在研究產品和解決方案的技術進步,這可能會增加產生的資料量,從而刺激資料發現的需求。例如,Cisco於 2022 年 8 月與微軟在快速資料分析方面展開合作,協助客戶透過分析和基本客群管理來提高銷售效率並建立新的收入來源。

- 此外,2022 年 9 月,SAS 宣布其 Viya 分析工具現已在 Microsoft Azure 市場上架。 SAS Viya 在 Microsoft Azure 上的全部功能為全球客戶提供資訊發現、模型部署分析和機器學習的存取權。此工具支援多種語言,並設有應用程式內指導中心,方便快速上手。 Microsoft Azure 上的 SAS Viya 還提供對整個 Viya 套件的訪問,包括 SAS Visual Statistics、SAS Visual Analytics、Machine Learning、SAS Visual Data Mining 和 SAS Model Manager。

- 微軟、Facebook、谷歌和蘋果等跨國公司正在開發使用可再生能源的綠色資料中心。例如,2022年7月,布里斯班被選為新投資25億美元的「超級節點」資料儲存設施的所在地。這個「南半球最大的資料中心計劃」將由 800MW 的電池和再生能源儲存提供動力。專業投資經理 Quinbrook Infrastructure Partners 已在 Brendale 獲得 30 公頃的土地,並獲得了外國投資審查委員會和摩頓灣地區議會的規劃批准,可將該場地用作最多四個超大規模資料中心的多租戶場地。

資料發現行業概覽

資料發現市場競爭激烈,主要參與者只有少數幾家。就市場佔有率而言,目前少數幾家公司佔據主導地位。然而,隨著分析技術的進步,新的參與者正在進入市場。新參與者正在增加其在市場上的佔有率,從而擴大其在全部區域的業務範圍。此外,巨量資料分析技術能力的巨大擴展(由於開放原始碼工具的可用性)可能導致該地區的公司過度提供改進的產品功能以跟上競爭對手的步伐。這種環境將會推高成本並侵蝕產業盈利。

2022 年 11 月,幫助企業了解企業資料並解決安全、隱私、管治和合規問題的全球領先平台 BigID 宣布與領先的技術安全平台 Wiz 擴大合作夥伴關係,Wiz 可協助客戶快速識別和消除關鍵的雲端風險。 Wiz 和 BigID 結合了資料安全態勢管理 (DSPM) 和雲端原生應用程式保護 (CNAPP),有助於降低雲端風險並加速您的雲端安全工作。

2022 年 3 月,與律師事務所和企業法律部門合作的電子資料展示服務的專業提供者 HaystackID 宣布了用於發現資料的發現管理框架 HaystackID Core。 HaystackID Core 是一個強大的平台、軟體和基礎設施服務組合,它將 HaystackID 發現智慧與最新技術、隱私平台、安全性、流程和通訊協定相結合。 HaystackID Core 提供企業、律師事務所和顧問公司採用新電子取證方法所需的實力和準確性,無需前期投資或硬體或軟體的額外支出。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 產業價值鏈分析

- COVID-19 產業影響評估

第5章 市場動態

- 市場促進因素

- 多種結構化資料來源的興起

- 資料驅動決策的重要性日益增加

- 市場限制

- 資料安全和隱私問題

第6章 市場細分

- 按組件

- 軟體

- 服務

- 按公司規模

- 中小型企業

- 大型企業

- 按行業

- 銀行、金融服務和保險(BFSI)

- 通訊和 IT

- 零售與電子商務

- 製造業

- 能源與公共產業

- 其他行業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- Tableau Software LLC(Salesforce Company)

- Datameer Inc.

- Altair Engineering Inc.

- SAP SE

- Tibco Software Inc.

- Cloudera Inc.

- Platfora Inc.

- ClearStory Data Inc.

- Oracle Corporation

- Birst Inc.

- Qlik Technologies Inc.

- MicroStrategy Incorporated

- Panorama Software

- Alteryx Inc.

- SAS Institute Inc.

第8章投資分析

第9章 市場機會與未來趨勢

The Data Discovery Market is expected to register a CAGR of 21% during the forecast period.

Key Highlights

- Based on types, the data discovery software segment is anticipated to gain prominence in the data discovery market soon. Data discovery and visualization Software like Tableau, QlikView, and Tibco Spotfire is designed for data analysis and technically-oriented business uses.

- The growing popularity of online shopping among buyers has spurred the global expansion of the e-commerce industry, as e-commerce businesses have amassed massive amounts of client data over the years, with petabytes of data being added every day. As per the United States Census Bureau, e-commerce sales of retail as a percentage of total sales grew from 14.3% in the first quarter of 2022 to 14.8% in the third quarter of 2022.

- Furthermore, the increased usage of IoT devices and data analytics in numerous industries is likely to generate even more data in the industry. According to a Philips study, 92% of healthcare leaders polled in Singapore in February 2022 stated that their firms had previously adopted predictive analytics. As a result, the scope of the data monetization solution is expected to expand.

- Big data technologies and data discovery tools are revolutionizing telecommunications. Tools like Apache Hadoop, streaming analytics, and machine learning are opening new opportunities for CSPs to gain insights from data sets that were previously unwieldy.

- Businesses that provide data discovery services and solutions had a small decline in revenue at the peak of the COVID-19 pandemic. However, the emphasis on vaccine research, work-from-home activities, and eHealth resulted in an explosion of unstructured and structured data that needs to be identified and managed effectively in order to gain insights. The market is currently growing and is likely to continue growing over the forecast period.

Data Discovery Market Trends

The Banking, Financial Services, and Insurance Sector Holds a Dominant Position

- Data discovery tools help to take issues such as inadequate data modeling abilities of bank employees and enable bank personnel to interpret the data to magnify the customer experience. It helps to recognize potential customer segments and trap them with compelling offers. More significantly, data discovery allows banks and financial service providers to build business models and make proper investment decisions with substantial risk analysis.

- The rising use of machine learning (ML) and artificial intelligence (AI) technologies has resulted in massive volumes of structured and unstructured data, which is expected to boost the adoption of sensitive data discovery solutions throughout the forecast period. Furthermore, enterprises are migrating to cloud-based solutions, which is likely to increase data volume. According to the Thales Data Threat Report 2022, for example, the percentage of corporate data housed in the cloud in enterprises globally climbed from 30% in 2015 to 60% in 2022.

- With a massive volume of data gushing from many transactions, banks are trying to find innovative business ideas and risk management solutions. Each set of data gathered over a period tells a unique story and shows the goalpost for a definite future period so that a business firm can capitalize on this information to attain a competitive edge in the market.

- Big data analytics can enhance the extrapolative power of risk models employed by banks and financial institutions. Adopting big data analytics and instilling it into the existing banking sector workflows is one of the essential elements of surviving and prevailing in the rapidly evolving business environment of the digital millennium.

- Furthermore, AI-ready technology is capable of effective data handling, has sufficient processing power, is nimble, adaptable, and scalable, and is able to accept varying data quantities. As a result, assembling the necessary software and hardware parts to enable AI would be more difficult for small fintech firms.

North America to Dominate the Data Discovery Market

- North America is expected to lead the data discovery market owing to the early adoption of new and emerging technologies, significant investments in cloud-based solutions, and the presence of a high number of businesses in this region. The need to increase storage capacity has become an opportunity for every major enterprise in the area, as there is a continuous rise in data and respective applications.

- The development of mobile broadband, growth in cloud computing, and big data analytics are propelling the demand for new data infrastructures and data discovery software. Moreover, the declining prices of servers have enhanced cloud computing adoption by businesses across North America, stoking the construction of effective and sustainable data, hence boosting the market being studied.

- Several firms in the region are interested in the technical advancement of their goods and solutions, which is likely to increase the quantity of data generated, fueling the demand for data discovery. For example, Cisco Systems Inc. teamed with Microsoft in August 2022 for Big and Fast Data Analytics, enabling its clients to increase operating effectiveness and establish new income streams in analytics and customer base administration.

- Furthermore, SAS announced in September 2022 that its Viya analytics tool was made accessible on the Microsoft Azure Marketplace. All SAS Viya functionalities on Microsoft Azure would provide clients worldwide with access to information exploration, model deployment analytics, and machine learning. The tool is accessible in a variety of languages and features an in-app instructional centre to facilitate quick onboarding. Users can also access to the whole Viya suite, including SAS Visual Statistics, SAS Visual Analytics, Machine Learning, SAS Visual Data Mining, and SAS Model Manager, with SAS Viya on Microsoft Azure.

- Multinational corporations such as Microsoft, Facebook, Google, and Apple are developing in green data centers that use renewable energy. For example, in July 2022, Brisbane was chosen as the location for a new USD 2.5 billion 'Supernode' data storage facility. The "biggest in the Southern Hemisphere" data center project will be fuelled by battery and renewables storage with a capacity of 800 megawatts. Quinbrook Infrastructure Partners, a specialized investment manager, managed to secure a 30 hectare site at Brendale and has previously acquired both Foreign Investment Review Board and local planning authorizations from Moreton Bay Regional Council for a multi-tenant premises of up to four hyperscale datacenters.

Data Discovery Industry Overview

The data discovery market is moderately competitive and consists of a few major players. In terms of market share, some of the players currently dominate the market. However, with the advancement in analytics. New players are increasing their market presence, thereby expanding their business footprint across the region. The vast expansion of capabilities in big data analytics technology (owing to the availability of open-source tools) may also push the companies in the area to keep up with rivals and give away too much of the improved product performance. The environment escalates costs and erodes industry profitability.

In November 2022, BigID, the world's leading platform that allows companies to comprehend their enterprise information and take action for security, privacy, governance, and compliance, announced an expanded partnership with Wiz, the leading technology security platform that allows customers to quickly identify and eliminate critical cloud risks. Data Security Posture Management (DSPM) and Cloud-Native Application Protection (CNAPP) are combined by Wiz and BigID to decrease cloud risk and speed up cloud security initiatives.

In March 2022, HaystackID, a specialist eDiscovery services provider which works with law firms and company law departments, launched HaystackID Core, a discovery management framework for discovery data. HaystackID Core is a strong portfolio of platform, software, and infrastructure services that integrates HaystackID Discovery Intelligence with the latest technology, privacy platforms, security, processes, and protocols. HaystackID Core gives enterprises, law firms, and consultancies the strength and accuracy they need to adopt a new approach to eDiscovery without making any upfront or extra expenditures in hardware or software.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Number of Multi-Structured Data Sources

- 5.1.2 Growing Importance for Data-Driven Decision-Making

- 5.2 Market Restraints

- 5.2.1 Data Security and Privacy Concerns

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Software

- 6.1.2 Services

- 6.2 By Enterprise Size

- 6.2.1 Small- and Mid-Sized Enterprises

- 6.2.2 Large Enterprises

- 6.3 By Industry Vertical

- 6.3.1 Banking, Financial Services, and Insurance (BFSI)

- 6.3.2 Telecommunications and IT

- 6.3.3 Retail and E-Commerce

- 6.3.4 Manufacturing

- 6.3.5 Energy and Utilities

- 6.3.6 Other Industry Verticals

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle-East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Tableau Software LLC (Salesforce Company)

- 7.1.2 Datameer Inc.

- 7.1.3 Altair Engineering Inc.

- 7.1.4 SAP SE

- 7.1.5 Tibco Software Inc.

- 7.1.6 Cloudera Inc.

- 7.1.7 Platfora Inc.

- 7.1.8 ClearStory Data Inc.

- 7.1.9 Oracle Corporation

- 7.1.10 Birst Inc.

- 7.1.11 Qlik Technologies Inc.

- 7.1.12 MicroStrategy Incorporated

- 7.1.13 Panorama Software

- 7.1.14 Alteryx Inc.

- 7.1.15 SAS Institute Inc.