|

市場調查報告書

商品編碼

1644289

身份分析 -市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Identity Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

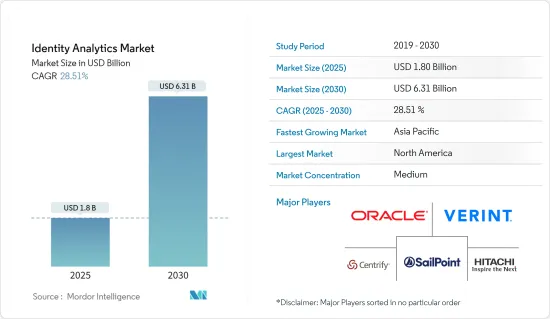

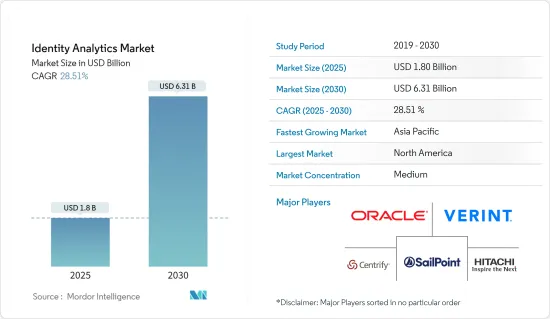

身分分析市場規模預計在 2025 年為 18 億美元,預計到 2030 年將達到 63.1 億美元,預測期內(2025-2030 年)的複合年成長率為 28.51%。

關鍵亮點

- 身分分析解決方案是就使用者存取和權限做出明智決策的關鍵。這些解決方案使用高級分析和機器學習來降低身分存取風險。為了確保持續合規,企業正在採用進階分析和機器學習解決方案等新技術。

- 全球各地的企業都在加大對數位化(包括付款流程)的投入,數位化進程滲透到了各類組織中。 TechRepublic Premium 最近的一項調查發現,47% 的受訪者計劃在 2021 年在數位轉型上投入比 2020 年更多的資金。此外,58% 的受訪者表示將在 2020 年實現紙張數位化,45% 的受訪者表示將採用線上培訓模組。

- 身分分析市場主要受以下因素驅動:由於嚴格的法規、合規性要求以及企業採用 BYOD 趨勢而採用的解決方案。例如,INFORM(線上零售市場誠信、通知和公平性)消費者立法於 2021 年 3 月訂定。該法要求零售商核實市場上暢銷商品的合法性。由於政府的嚴格監管,身份驗證解決方案正在部署到各種終端用戶行業。

- 隨著企業 IT 部門擴大採用雲端系統同時仍維護內部部署解決方案,控制誰可以存取哪些應用程式變得越來越重要。在身分驗證分析方面,這給企業及其團隊帶來了新的挑戰。挑戰包括身分驗證管理、合規性可見性等等。

- 在 COVID-19 大流行期間,身分分析解決方案預計將對市場產生積極影響,並在預測期內為其成長做出重大貢獻。由於疫情,在市場上經營的供應商的收益也激增。 2021 年 2 月,Ekata 宣布已獲得 300 名新客戶,收益激增。疫情加速了電子商務的普及,並增加了對身份驗證等防止網路詐騙的服務的需求。

身份驗證分析市場趨勢

預測期內,BFSI 產業預計將大幅成長

- 各種用途的線上付款趨勢日益成長,迫使銀行建立第三方計費的安全管道,從而增加了對身分分析服務的需求。進一步觀察發現,銀行鼓勵線上查詢,因為這種媒介在提供金融服務方面具有成本效益和效率。

- 根據 CRN 2022 年 2 月的一項調查,金融機構正在使用機器學習和預測分析來預測非法貿易和身分盜竊事件、改善 KYC 自動化並發現個人用戶中不熟悉的模式。在這方面,身分分析可以幫助組織主動減輕犯罪和擔憂。

- 多家公司為各行各業的各個機構提供創新的身份和存取管理解決方案。例如,Wipro 為澳洲四大銀行之一提供識別及存取管理服務,並實現了零重大事故。因此,行業內多個市場參與企業的這些舉措加上銀行業對雲端技術的日益採用,預計將進一步推動身分分析解決方案的採用。

- 此外,2022 年 1 月,印度 RBL 銀行宣布已與Google合作,以增強其客戶體驗策略並擴展其價值提案,透過其 Abacus 2.0 數位平台為其快速成長的客戶群提供服務。這項合作將使 RBL 能夠更好地管理客戶資料和分析,實現有效的交叉銷售並大幅降低客戶獲取成本。

- 在金融領域,安全至關重要,這就是為什麼我們的銀行夥伴在這方面投入大量資金的原因。例如,在英國,付款和金融服務佔網路攻擊的約75%(根據英國政府的數據)。這些新興市場的發展正在對市場產生正面影響。還有一些努力,例如世界銀行集團的身份識別促進發展(ID4D),旨在幫助開發中國家實施新系統,並在新技術的支持下,增加擁有官方身份證的公民數量。

預計北美將佔很大佔有率

- 北美地區領先的動力在於強大的技術和供應商的存在,以及主要行業中日益增多的身份相關違規行為。該地區的這些公司專注於開發創新解決方案,以在區域和全球競爭中保持領先地位。

- 加拿大市場的各個領域也擴大採用資料主導的決策。雲端業務管理解決方案供應商 Sage 於 2021 年 3 月在美國和加拿大市場推出了針對 Sage 300 和 Sage 100 的雲端優先 Sage 資料和分析服務整合。借助人工智慧和機器學習演算法,該公司的商業智慧套件可以為用戶提供即時銷售儀表板和詳細的損益報告。

- 此外,2021 年 6 月,Stripe 宣布推出 Stripe Identity,這是網路企業安全驗證 30 多個國家用戶身份的簡單方法。 Stripe Identity 讓企業驗證身分就像接受付款一樣簡單。 Stripe Identity 是同類產品中第一個自助服務工具,可讓任何線上企業在幾分鐘內開始驗證其用戶的身份,無需任何代碼。預計這些趨勢將進一步推動北美調查市場的成長。

- 此外,該軟體的使用在加拿大銀行中正成為一種趨勢,加拿大皇家銀行於 2020 年 3 月成為第一家推出數位身分證的銀行。加拿大皇家銀行為加拿大、美國和其他 34 個國家的 1700 萬客戶提供服務。該銀行已引入開戶數位身分驗證,可在銀行分店、透過手機或網站遠端完成。

- 此外,在美國,《格雷姆-里奇-比利雷法案》(GLB)等嚴格的政府法規在身分識別解決方案的採用過程中發揮關鍵作用。該法案要求證券公司和金融機構實施嚴格的法規,透過建立評估資料風險和防範威脅的計畫來保護消費者資料的隱私。

身份行業概覽

身分分析市場競爭適中,由許多全球和地區參與企業組成。這些參與企業已經佔領了相當大的市場佔有率,並致力於在全球擴大基本客群。這些供應商專注於研發投資、策略夥伴關係以及其他有機和無機成長策略,以在整個預測期內獲得競爭優勢。

- 2022 年 8 月-下一代 SIEM、XDR、UEBA、身份驗證和訪問分析提供商 Gurucul 宣布擴大對多雲架構的支援、改進多重雲端部署以及跨包括亞馬遜在內的所有主要雲端堆疊的跨雲支援。除了支援部署之外,這些新的跨雲功能還為跨雲環境的存取和活動提供了關聯、進階連結和行為基準。

- 2022 年 2 月-LogRhythm 宣布新的品牌識別確認。此次品牌重塑體現了該公司致力於幫助其安全營運中心彌補人員差距、加深對新攻擊和新技術的了解,並自信地應對不斷變化的威脅情況。此次品牌重塑是 LogRhythm 在 2022 年進行的眾多變革中的第一次,包括新面貌、未來的雲端原生平台以及反映公司願景和發展的新觀點。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場動態

- 市場促進因素

- 主要行業身分詐騙案例增加

- 市場問題

- 身份驗證分析解決方案實施成本高

第 6 章 COVID-19 對身分分析市場的影響

第7章 市場區隔

- 組件類型

- 解決方案

- 服務

- 擴張

- 本地

- 雲

- 公司規模

- 中小型企業

- 大型企業

- 最終用戶

- 資訊科技/通訊

- BFSI

- 政府

- 零售和消費品

- 醫療

- 其他最終用戶(製造業、能源、電力)

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第8章 競爭格局

- 公司簡介

- Oracle Corporation

- Verint Systems Inc.

- Hitachi ID Systems, Inc.

- Brainwave GRC

- LogRhythm, Inc.

- Securonix, Inc.

- Gurucul Solutions Pvt Ltd.

- Nexis GmbH

- Sailpoint Technologies Holdings Inc

- Centrify Corporation

- Okta Inc.

- MicroStrategy Incorporated

第9章投資分析

第10章:市場的未來

The Identity Analytics Market size is estimated at USD 1.80 billion in 2025, and is expected to reach USD 6.31 billion by 2030, at a CAGR of 28.51% during the forecast period (2025-2030).

Key Highlights

- Identity analytics solutions are key in making informed decisions about user access and permissions. These solutions use advanced analytics and machine learning to mitigate the risk of identity access. Organizations are adopting new technologies, such as advanced analytics and machine learning solutions, to ensure continuous compliance.

- Enterprises worldwide are increasing spending on digitization, including the payment processes, and the push towards digitization can be witnessed in all types of organizations. According to a recent TechRepublic Premium survey, 47% of the respondents planned on spending more on digital transformation in 2021 than in 2020. In addition, in 2020, 58% of the respondents reported digitizing paper, and 45% reported adopting online training modules.

- The market for identity analytics is primarily driven by elements like the adoption of solutions through strict regulations, the requirement for compliance, and the adoption of BYOD trends in businesses. The INFORM (Integrity, Notification, and Fairness in Online Retail Marketplaces) Consumers act, for instance, was introduced in March 2021. Retailers are required by the law to confirm the legitimacy of the top market sellers. Identity verification solutions are deployed in various end-user industries as a result of the government's strict regulations.

- As enterprise IT adopts more cloud systems while maintaining on-premises solutions, controlling who can access which applications become more important. This poses a new challenge for enterprises and their teams regarding identity analytics. Some of the challenges include identity management, compliance visibility, and more.

- During the COVID-19 pandemic, identity analytics solutions will positively impact the market and contribute to its growth significantly during the forecast period. Vendors operating in the market have also witnessed a surge in revenue owing to the pandemic. In February 2021, Ekata announced that its revenue surged with the addition of 300 new customers. The pandemic accelerated the adoption of e-commerce, boosting demand for services, such as identity verification, to safeguard against cyber fraud.

Identity Analytics Market Trends

BFSI Industry is Expected to Grow at a Significant Rate Over the Forecast Period

- The growing trend of online payments for various purposes has driven banks to establish secure channels for third-party charges, thus, driving the demand for identity analytics services. Furthermore, it has been observed that banks encourage online access because the medium is cost-effective and efficient in delivering financial services.

- According to a survey conducted by CRN in February 2022, financial institutions have leveraged machine learning and predictive analytics to predict fraudulent transactions and personal information theft cases, enhance KYC automation, and discover unfamiliar patterns of individual users. In this aspect, identity analytics helps organizations mitigate crime and concerns before they occur.

- Several companies are providing innovative identity and access management solutions to various institutions in the industry. For instance, Wipro provides identity and access management services, which result in zero critical incidents for one of Australia's biggest four banks. Hence, these initiatives by several market players in the industry, coupled with the increasing adoption of cloud technology in the banking industry, are expected to further the adoption of identity analytics solutions.

- Further, in January 2022, RBL Bank, India announced that it has partnered with Google to strengthen its customer experience strategy and expand its value proposition to serve its rapidly growing customer base through the Abacus 2.0 digital platform. Through this collaboration, RBL will ably manage customer data and analytics, enable effective cross-selling, and significantly reduce customer acquisition costs.

- In the financial sector, as security is vital, allied banking firms have been spending a significant share on security. For instance, payment and financial services account for about 75% of cyber-attacks in the United Kingdom According to UK government. Such developments are positively influencing the market. Some initiatives, like the World Bank Group's Identification for Development (ID4D), help developing countries put into effect new systems that increase the number of citizens with official identification with the support of new technologies.

North America is Expected to Hold a Significant Share

- The prior driver for the growth of the North America geographic segment is the significant presence of technology providers and the increasing number of identity-related breaches across major industries. These players present in the region are focusing on the development of innovative solutions to stay in the regional and globally competitive landscape.

- The implementation of data-driven decision-making is also rising in Canadian markets across various sectors. Cloud business management solutions vendor Sage launched its cloud-first Sage Data and Analytics service integration for Sage 300 and Sage 100 in the United States and Canadian markets in March 2021. With its business intelligence toolkit, it can provide users with live sales dashboards and detailed P&L reports with the help of AI and machine learning algorithms.

- Further, in June 2021, Stripe introduced the Stripe Identity, a simple way for internet businesses to securely verify users' identities from over 30 countries. Stripe Identity makes identity verification as effortless for a business as payment acceptance. Stripe Identity is the first self-serve tool of its kind, allowing any online business to begin verifying the identities of their users in just a few minutes, with no code required. Such trends are further expected to boost the growth of the studied market in the North American region.

- Moreover, the software usage among banks in Canada is becoming a trend, with the Royal Bank of Canada being the first to implement digital identity in March 2020. The Royal Bank of Canada serves 17 million customers in Canada, the United States, and 34 other countries. It rolled out a digital identity for account opening, which is available at the bank branches and remotely via mobile and its website.

- Additionally, stringent government regulations, such as the Gramm-Leach-Bliley (GLB) Act, play a crucial role in adopting identity solutions in the United States. The act needs securities firms and financial institutions to implement strict regulations for protecting consumer data privacy by establishing a program that assesses risks to the data and guards against threats.

Identity Analytics Industry Overview

The Identity Analytics market is moderately competitive and consists of many global and regional players. These players account for a considerable market share and focus on expanding their client base globally. These vendors focus more on research and development investment, strategic partnerships, and other organic & inorganic growth strategies to earn a competitive edge throughout the forecast period.

- August 2022 - Gurucul, a provider of next-generation SIEM, XDR, UEBA, identity, and access analytics, announced expanded poly cloud architecture support, improved multi-cloud deployments, and cross-cloud across all major cloud stacks, including Amazon. In addition to deployment support, these new cross-cloud capabilities provide correlation, advanced linking, and behavior baselines on access and activity across cloud environments.

- February 2022 - LogRhythm introduces its new brand identity. This rebranding represents the company's efforts to help security operations centers close staff gaps, increase knowledge of new attacks and technologies, and confidently navigate the ever-changing threat landscape. The rebranding is the first of many changes to LogRhythm in 2022, including a new visual look, a future cloud-native platform, and new perspectives that reflect the company's vision and evolution.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Cases of Identity-Related Frauds Across Major Industries

- 5.2 Market Challenges

- 5.2.1 Significantly High Cost of Deploying Identity Analytics Solutions

6 IMPACT OF COVID-19 ON THE IDENTITY ANALYTICS MARKET

7 MARKET SEGMENTATION

- 7.1 Component Type

- 7.1.1 Solutions

- 7.1.2 Services

- 7.2 Deployment

- 7.2.1 On-Premise

- 7.2.2 Cloud

- 7.3 Enterprise Size

- 7.3.1 Small & Medium Enterprises

- 7.3.2 Large Enterprises

- 7.4 End-users

- 7.4.1 IT and Telecommunication

- 7.4.2 BFSI

- 7.4.3 Government

- 7.4.4 Retail and Consumer

- 7.4.5 Healthcare

- 7.4.6 Other End-users (Manufacturing, Energy and Power)

- 7.5 Geography

- 7.5.1 North America

- 7.5.2 Europe

- 7.5.3 Asia Pacific

- 7.5.4 Latin America

- 7.5.5 Middle East and Africa

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Oracle Corporation

- 8.1.2 Verint Systems Inc.

- 8.1.3 Hitachi ID Systems, Inc.

- 8.1.4 Brainwave GRC

- 8.1.5 LogRhythm, Inc.

- 8.1.6 Securonix, Inc.

- 8.1.7 Gurucul Solutions Pvt Ltd.

- 8.1.8 Nexis GmbH

- 8.1.9 Sailpoint Technologies Holdings Inc

- 8.1.10 Centrify Corporation

- 8.1.11 Okta Inc.

- 8.1.12 MicroStrategy Incorporated