|

市場調查報告書

商品編碼

1643185

機器人諮詢服務 -市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Robo-advisory Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

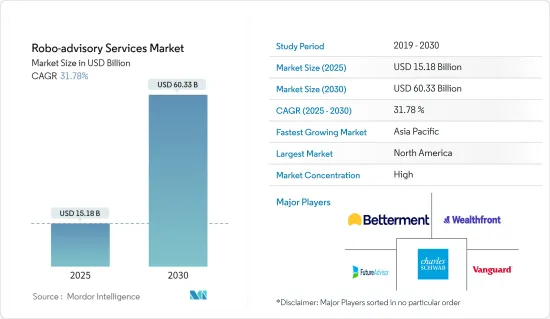

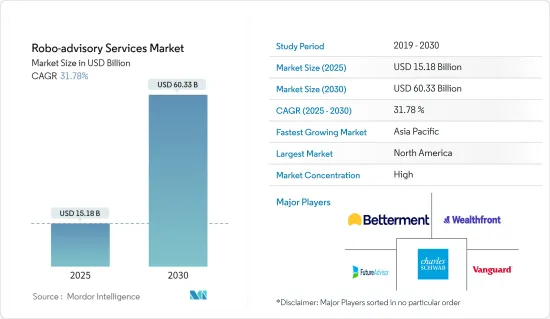

機器人諮詢服務市場規模預計在 2025 年為 151.8 億美元,預計到 2030 年將達到 603.3 億美元,預測期內(2025-2030 年)的複合年成長率為 31.78%。

BFSI 行業的快速數位化正在加速數位投資的成長,其中機器人諮詢發揮著重要作用。機器人諮詢服務對於不喜歡親自監控其投資組合發展的被動投資者來說非常有用。

關鍵亮點

- 終端用戶產業的快速流程和業務自動化是採用機器人諮詢服務的主要驅動力。這些服務消除了對人力的需求,因為線上平台以極低的成本提供相同的服務。此外,只要用戶有網路連接,該服務就可以全天 24 小時、全年 365 天提供。

- 一些新興經濟體正在鼓勵本地參與企業加強對機器人諮詢服務的測試和研究。預計這些措施將進一步促進市場成長。例如,沙烏地阿拉伯資本市場管理局(CMA)已核准Wahed Capital 和 Haseed Investing Company 測試機器人諮詢服務。這是該國鼓勵阿拉伯經濟使用金融科技的策略的一部分。

- 在冠狀病毒、封鎖和市場不確定性期間,我們看到全球 B2B 機器人諮詢、數位投資、財務建議和投資組合管理激增。從傳統投資服務到機器人諮詢投資服務的快速轉變也推動了市場成長。此外,投資平台現在提供機器人投資諮詢作為超越傳統投資服務的新型數位金融諮詢服務,為機器人投資諮詢的發展創造了更大的空間。

- 機器人投顧透過分析資料,利用演算法計算,傳播綜合訊息,正被零售銀行、資產管理等多個產業領域廣泛採用,推動市場的發展。此外,機器人諮詢還列出了一些好處,例如稅收損失收穫、低成本投資組合、更好的決策、安全可靠的投資以及消除信用風險。預計這些因素將在預測期內推動該行業的成長。

- 然而,預計機器人諮詢提供的有限靈活性將在預測期內抑制市場成長。缺乏面對面會議導致投資者和顧問之間的諮詢障礙也預計會阻礙市場成長。然而,對低成本投資諮詢的需求預計將為市場成長帶來機會。此外,高級分析和巨量資料的日益廣泛使用有可能極大地擴展機器人諮詢的範圍。

機器人諮詢服務市場趨勢

投資諮詢可望成為最大推動力

- 機器人諮詢服務包括主要與個人財務相關的投資諮詢服務。機器人諮詢正在迅速填補人類投資諮詢留下的空白,包括能力、容量和成本,這主要是由於投資業日益採用數位化以及機器人技術日益採用人工智慧。

- 隨著金融業在投資建議中採用技術支援的分析,對機器人諮詢的需求預計會增加。產業成長的另一個驅動力是從傳統投資服務向機器人諮詢投資服務的快速轉變。此外,機器人諮詢現已在投資平台上提供,作為傳統投資服務的替代品,從而推動機器人諮詢的廣泛應用。

- 推動市場發展的是零售銀行業務,根據 evidenceinsights.com 的數據,全球最大的銀行之一摩根大通將在 2023 年採用最高的人工智慧 (AI),財富管理和其他行業也是如此,這得益於評估資料和提供深入資訊的演算法計算,以及在多個垂直行業廣泛使用機器人諮詢。

- 預計這些變數將在預測期內推動產業擴張。推動市場成長的主要因素之一是人工智慧(AI)和機器學習(ML)等新技術的出現。

- 世界各地的金融科技公司都依賴科技和個人諮詢。透過採用人工智慧和機器學習等技術,他們正在快速建立機器人諮詢服務,為散戶投資者提供準確、透明的諮詢服務,進一步防止投資者做出不準確的投資決策。

北美可望主導市場

- 機器人投資諮詢管理被視為以前專屬資產管理服務的突破,因為它使更廣泛的人群能夠以比傳統人工協助更低的成本享受該服務。機器人顧問透過收集有關客戶當前財務狀況的資訊來評估客戶的風險接受度。當機器人顧問決定如何為其客戶分配資產時,它會考慮客戶的風險偏好和目標回報。

- 在北美,參與者包括 Betterment LLC、Charles Schwab & Co. Inc.、Wealthfront Inc. 和 Vanguard Group。該地區在技術進步和機器人行業方面也處於領先地位。該市場中的各類公司都在創新和開發產品,以利用先發優勢並最大限度地吸引市場。

- 一些金融機構仍處於發展階段,致力於創新和開發高度先進的平台,為客戶提供機器人諮詢服務。例如,先鋒集團(Vanguard Group)計劃推出一項機器人諮詢服務,據稱該服務將消除對人工諮詢的需求。

- 此外,北美對區塊鏈技術的投資正在增加。近期,美國已啟動多個區塊鏈開發計劃,加速市場成長。該地區也是許多科技型中小企業的所在地。

- 此外,公共基本服務與 BaaS 解決方案的整合正在取得重大進展,預計將在未來幾年為機器人諮詢創造新的成長前景。 BaaS 是一種雲端基礎的架構,可協助企業開發和營運區塊鏈應用程式。

機器人諮詢服務業概況

機器人諮詢服務市場的競爭格局正在鞏固,Betterment LLC、Wealthfront Inc. 和 Vanguard Group 等主要企業佔據大部分市場佔有率。這些市場參與企業正在創新他們的產品,以最大限度地擴大市場佔有率。此外,一些經濟體的政府也在鼓勵中小型供應商透過創新產品進入市場並建立策略聯盟。

- 2023 年 11 月,Wealthfront 宣布該公司目前為美國超過 70 萬名客戶(主要是年輕專業人士)監督超過 500 億美元的資產。 Wealthfront 的投資團隊不斷監控投資格局的變化並評估機會,以幫助投資最新的行業和趨勢。

- 2023 年 9 月 -美國最大的獨立數位投資顧問公司 Betterment 今天宣布推出新的比特幣/以太坊投資組合,作為其 Betterment 加密投資套件的一部分。對於希望將加密貨幣作為長期投資策略一部分的投資者來說,新的投資組合可讓他們直接投資市場上兩種最大的加密貨幣。

- 2022年11月,摩根大通推出了一項混合機器人諮詢計劃,讓投資者能夠持續訪問數位投資平台和人工財務諮詢,填補了公司財富管理服務的空白。雖然摩根大通個人顧問對所有投資者開放,但該公司主要為那些對財富管理服務感興趣但不願接受摩根分店諮詢服務的銀行和信用卡客戶提供服務。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 購買者/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響分析

第5章 市場動態

- 市場促進因素

- BFSI 產業的數位化

- 經濟高效的個人財務管理

- 市場限制

- 缺乏人類專業知識和同理心

- 技術尚未成熟

第6章 市場細分

- 按服務類型

- 投資諮詢

- 財富管理

- 退休計劃

- 稅收損失收穫

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 其他

第7章 競爭格局

- 公司簡介

- Betterment LLC

- Wealthfront Corporation

- The Vanguard Group Inc.

- Charles Schwab & Co. Inc.

- BlackRock Inc.(FutureAdvisor)

- FMR LLC(Fidelity Go)

- Roboadviso

- M1 Holdings Inc.

第8章投資分析

第9章 市場機會與未來趨勢

The Robo-advisory Services Market size is estimated at USD 15.18 billion in 2025, and is expected to reach USD 60.33 billion by 2030, at a CAGR of 31.78% during the forecast period (2025-2030).

The rapid digitization of the BFSI industry has accelerated the growth of digital investments in which Robo-advisors play a major role. The Robo-advisory services are beneficial majorly for passive investors who do not prefer personal monitoring of their portfolio development.

Key Highlights

- Rapid automation of processes and businesses across end-user industries is acting as a major catalyst for the adoption of Robo-advisory services. These services eliminate human labor, as the online platforms offer the same services at a fraction of the cost. Also, the services are available 24/7 as long as the user has an Internet connection.

- Several emerging economies are stimulating the regional players to enhance their testing and research of Robo-advisory services. These initiatives are further expected to act as a catalyst for market growth. For instance, Saudi Arabia's Capital Market Authority (CMA) approved Wahed Capital and Haseed Investing Company to test its Robo-advisory services. This was done as part of the country's strategy to encourage the use of financial technology in the Arab economy.

- Amidst the coronavirus outbreak, lockdown, and market uncertainty, a surge in B2B Robo-advisors, Digital investing, financial advice, and portfolio management is witnessed globally. A rapid shift from traditional investment services to robo-advisory investment services is another factor in market growth. In addition, investment platforms are now offering robo-advisors as new digital financial advisors over traditional investment services, enabling the scope of expansion for robo-advisors.

- The widespread use of robo-advisory throughout industrial verticals such as retail banking, asset management, and others for conducting algorithmic calculations to analyze data and transmit comprehensive information driving the market forward. Moreover, robo advisors offer specific benefits such as tax-loss harvesting, low-cost portfolio, better decision-making, safe and secure investments, and help eliminate credit risks. Such factors are anticipated to drive industry growth over the forecast period.

- However, the limited flexibility offered by robo advisors is anticipated to restrain the market's growth during the forecast period. In addition, the lack of face-to-face meetings leading to consultation barriers between investors and advisors is also expected to hinder market growth. However, the demand for low-cost investment advisory is anticipated to open up opportunities for market growth. Furthermore, the growing usage of advanced analytics and big data can potentially broaden the scope of robo-advisors significantly.

Robo Advisory Services Market Trends

Investment Advisory Expected to Gain Maximum Traction

- Robo-advisory services majorly include investment advisory services related to the personal finance of individuals. Robo-advisors are rapidly filling the gaps created by human investment advisors, such as capability, capacity, and cost, majorly due to the increase in the adoption of digitization across the investment industry, coupled with the adoption of AI in robotics.

- The demand for robo-advisers is anticipated to increase due to the financial sector's increased adoption of technology-enabled analytics for investment consultations. Another driver of industry growth is the quick transition from traditional investment services to robo-advising investment services. Furthermore, robo-advisors are now available on investment platforms instead of traditional investment services, allowing for the spread of robo-advisors.

- The market is being driven ahead by the extensive usage of robo-advisory across several industrial verticals, including retail banking, According to evidentinsights.com Among the largest banks in the world, JPMorgan Chase had the highest artificial intelligence (AI) adoption in 2023, asset management, and others, for algorithmic calculations to evaluate data and provide thorough information.

- Over the forecast period, these variables are anticipated to fuel industry expansion. One of the key factors propelling the market's growth is the emergence of new technologies like artificial intelligence (AI) and machine learning (ML).

- FinTechs across the world rely upon both technology and personal advisory. They are rapidly creating robo-advisory services by adopting technologies such as AI and ML, offering accurate and transparent advisory services to retail investors, further preventing them from making inaccurate investment decisions.

North America Expected to Dominate the Market

- Investment management robo-advice is regarded as a breakthrough in the formerly exclusive wealth management services since it makes the services accessible to a wider audience at a cheaper cost in comparison to conventional human assistance. Robo-advisors estimate the client's risk tolerance by gathering information about the client's current financial status. The client's risk choices and intended target return are taken into account when the robo-advisor decides how to distribute the client's assets.

- The North American region is expected to dominate the market owing to the presence of several market players in the region, such as Betterment LLC, Charles Schwab & Co. Inc., Wealthfront Inc., and Vanguard Group, amongst others. Also, the region has led other regions in terms of technological advancement and the robotics industry. Various companies in the market have been making product innovations and developments to leverage the first-mover advantage and gain maximum market traction.

- Several financial institutions are still in the development phase to innovate and develop highly advanced platforms offering robo-advisory services to their customers. For instance, the Vanguard Group plans to launch a Robo-advisory service, which the company claims is expected to eliminate human advisory.

- Moreover, increasing investment in blockchain technology in North America. Several blockchain development projects have been initiated in the United States in recent years, accelerating the market's growth. In addition, this region is home to a significant number of small and medium-sized technology-based firms.

- In addition, great progress has been made in the integration of public vital services with BaaS solutions, which is anticipated to create new growth prospects for the robo advisory over the next few years. BaaS is a cloud-based architecture that assists enterprises in developing and operating blockchain applications.

Robo Advisory Services Industry Overview

The competitive landscape of the Robo-advisory Services Market is consolidated owing to the presence of major players like Betterment LLC, Wealthfront Inc., and The Vanguard Group, amongst others holding the majority of the market share. These market players are making product innovations to capture maximum market share globally. Also, several economies' governments are stimulating smaller vendors to enter the market with innovative products or by forming strategic collaborations.

- In November 2023 - Wealthfronthas announced that the company now oversees more than USD50 billion in assets for over 700,000 clients, largely young professionals across the United States. Wealthfront's Investment Team constantly monitors the changing investment landscape and evaluates opportunities to help clients invest in the latest industries and trends.

- In Spetember 2023 - Betterment, the largest independent digital investment advisor in the U.S., announced today the launch of a new Bitcoin/Ethereum Portfolio as part of the crypto investing by betterment suite. The new portfolio provides direct access to the two largest cryptocurrencies in the market for investors who are interested in gaining exposure to crypto as part of their long-term investment strategy.

- In November 2022, JPMorgan Chase was filling in a gap in its suite of wealth management services with the launch of a hybrid robo-advisor program that would offer investors a digital investment platform and ongoing access to a human, financial advisor. J.P. Morgan Personal Advisors is open to all investors, but the company envisions it primarily serving banking or credit card customers who are interested in wealth management services but wouldn't be inclined to engage with J.P. Morgan's in-branch advisors.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MAKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Analysis of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Digitization of the BFSI Industry

- 5.1.2 Cost-efficiency in Managing Personal Finance

- 5.2 Market Restraints

- 5.2.1 Lack of Human Expertise and Empathy

- 5.2.2 Nascency of the Technology

6 MARKET SEGMENTATION

- 6.1 By Type of Services

- 6.1.1 Investment Advisors

- 6.1.2 Wealth Management

- 6.1.3 Retirement Planning

- 6.1.4 Tax-loss Harvesting

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia-Pacific

- 6.2.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Betterment LLC

- 7.1.2 Wealthfront Corporation

- 7.1.3 The Vanguard Group Inc.

- 7.1.4 Charles Schwab & Co. Inc.

- 7.1.5 BlackRock Inc. (FutureAdvisor)

- 7.1.6 FMR LLC (Fidelity Go)

- 7.1.7 Roboadviso

- 7.1.8 M1 Holdings Inc.