|

市場調查報告書

商品編碼

1643129

軟體定義邊界:全球市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Global Software-Defined Perimeter - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

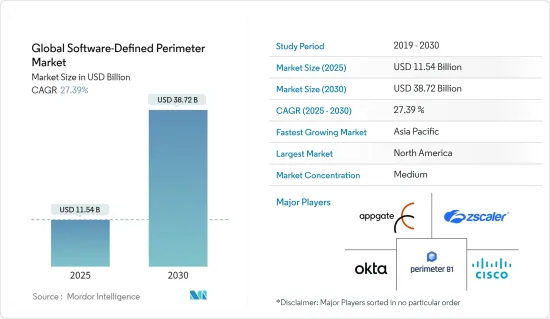

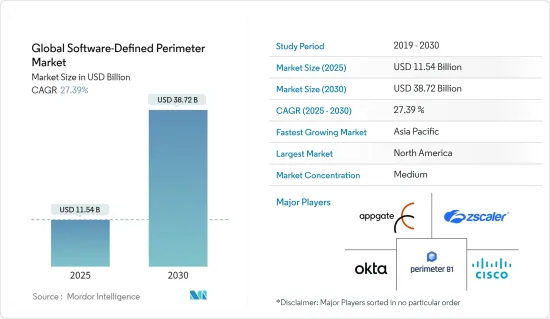

預計 2025 年全球軟體定義邊界市場規模為 115.4 億美元,預計到 2030 年將達到 387.2 億美元,預測期內(2025-2030 年)的複合年成長率為 27.39%。

主要亮點

- 雲端服務是數位轉型的關鍵驅動力,正被各行各業廣泛採用。這為企業帶來了各種安全挑戰,也是預測期內推動全球軟體定義邊界市場成長的關鍵原因。

- 由於大多數企業處於混合 IT 採用的不同階段以支援數位業務轉型,因此企業在未來一段時間內可能會同時依賴虛擬私人網路 (VPN) 和軟體定義的邊界技術。許多企業會根據業務需求、部門或地理位置選擇採用 SDP 來支援其使用者和應用程式。這增加了管理兩個或多個獨立安全存取系統的複雜性,從而抵消了 IT 整合帶來的好處和經濟性。最終,公司應該投資並致力於安全存取。

- 傳統的內部部署 VPN 成本昂貴,且難以操作和維護。因此,許多面臨維持或過渡到遠端勞動力挑戰的組織正在考慮其他網路安全選項。例如,有些人強調軟體定義邊界是 VPN 的可行替代方案。例如,Palo Alto Networks 和 Zscaler 提供的軟體定義邊界服務可以簡化大規模遠端訪問,儘管這需要一些財務和營運投資。

- 雲端服務透過快速的可擴展性和資源利用的靈活性為加速您的業務提供了絕佳的機會。雲端處理還能以合理的成本實現無縫擴展,降低營運成本並避免因重大升級而產生的財務支出。

- 此外,越來越多的公司正在採用企業行動解決方案,以便員工可以在任何地方、使用任何設備工作。這實現了工作與生活的平衡,並提高了員工與消費者之間的互動以及業務效率 34%。預計約有 67% 的員工將採用自帶設備 (BYOD) 政策來業務,這進一步凸顯了行動和遠端設備網路安全的必要性。報告稱,到2023年,30%的IT組織將擴大其BYOD政策,將員工穿戴裝置納入其中,這將進一步推動市場發展。

- 然而,對軟體定義邊界解決方案的顯著優勢缺乏認知以及對免費和開放原始碼安全標準日益成長的需求可能會阻礙市場成長。

- 儘管許多組織已將「採用零信任」列入其「待辦事項」清單,但 COVID-19 疫情加速了零信任的採用。此外,雲端運算的興起導致軟體定義廣域網路 (SD-WAN) 的使用增加,呼籲新的趨勢來適應未來的安全模型,其中包括檢測和阻止漏洞、網路釣魚、勒索軟體和其他現代惡意軟體的方法。

軟體定義邊界市場趨勢

BFSI 產業將大幅成長

- 數位化在各領域的廣泛應用也延伸到了金融領域。大多數銀行正在將資料、流程和基礎設施轉移到混合雲,希望獲得內部和外部部署雲端實施帶來的好處。

- 電子設備的快速普及和網際網路的高普及率推動了數位服務的成長,並提高了客戶對便利付款、全天候執行時間、安全儲存和互通性的期望。雲端處理創造了以顯著降低的成本維持與客戶多通路關係的機會。雲端處理也縮短了新產品的開發週期,幫助企業更快、更有效地回應客戶需求。

- 此外,一些專注於金融的科技新興企業也紛紛湧現,並且正在顛覆我們的購買方式。例如,在印度,從基於應用程式的錢包和 Aadhaar/UPI 連結的即時交易到單視窗電子商務應用程式,金融科技新興企業需要注意威脅並為其應用程式投資強大的資料安全框架。這些案例需要軟體定義的邊界解決方案來控制銀行、金融服務和保險 (BFSI) 行業的網路威脅。

- 許多金融機構正在與政府機構合作,提高網路安全意識並保護敏感資料。例如,2022年2月,菲律賓司法部(DoJ)與產業組織菲律賓銀行家協會(BAP)簽署了一份合作備忘錄(MoU),以提升菲律賓的網路安全意識並打擊網路犯罪。此外,金融機構意識的提高可能會推動軟體定義的邊界解決方案的採用。

北美佔據主要市場佔有率

- 醫療保健產業正在經歷轉型,新的工具和技術正在重塑醫療服務的提供方式,以提高效率並為患者照護。行動健康應用程式和穿戴式技術正在被用作監測患者活動的實用健康工具。例如,智慧型手機可以用作心電圖電極的適配器,來傳輸資料以檢測無症狀心房顫動。

- 根據全球行動通訊系統協會(GSMA)預測,到 2025 年,北美的物聯網(IoT)連線數量預計將從 2018 年的 23 億增加到 59 億。隨著物聯網設備數量的增加,對支援採用 SDP(軟體定義邊界)的高階網路安全解決方案的需求日益成長,尤其是在中大型企業中。

- 2022年4月,美國政府成立網路空間與數位政策局(CDP),以應對網路安全挑戰並加強全國的網路安全。此外,政府還將解決與電腦網路空間、數位科技和數位政策相關的國家安全挑戰、經濟機會以及對美國價值觀的影響。此外,中央民主黨局還有三個政策部門:國際網路空間安全、國際資訊和通訊政策以及數位自由。預計這些政府措施將在預測期內進一步促進市場成長。

- 此外,零售巨頭正在採用混合雲解決方案,一些應用程式在自己的資料中心,其他應用程式在公有公共雲端,以利用內部和外部部署混合雲端實施的好處並提供卓越的購物體驗。例如,AmazonGo 商店結合使用電腦視覺、深度學習和感測器融合技術來自動化付款和結帳流程,讓顧客無需排隊,只需進入、領取商品然後離開即可。同時,付款透過 Amazon Go 應用程式自動完成。因此,零售業正在走向數位化,未來將需要網路安全,為軟體定義邊界市場鋪平了一條充滿希望的道路。

- 最近,由於分散式基礎設施的 API 和其他服務的使用增加,COVID-19 疫情導致安全軟體的需求短期內增加。然而,預計更多企業將採用數位基礎設施,這將推動未來幾年需求大幅成長。

軟體定義邊界產業概覽

軟體定義邊界市場集中度較高,主要由 Perimeter 81、ZScaler、思科系統公司 (Cisco Systems, Inc.)、Okta Inc.、APPGate 和 Check Point 等大型公司主導。這些擁有較大市場佔有率的大公司正致力於發展海外基本客群。此外,這些公司正在利用策略聯盟和夥伴關係關係來擴大市場佔有率並提高盈利。然而,中小企業利用技術進步和創新產品,開拓新市場和贏得新契約,擴大了其市場影響力。

2022 年 6 月,江森自控宣布收購 Temper Networks,為互聯建築帶來零信任網路安全。 Tempered Networks 使用軟體定義的邊界實現安全通訊,實現建築網路的微分段、細粒度的存取控制和身份驗證,以強制執行關鍵資料和服務。 Tempered Networks 開發了「Airwall」技術,這是一種先進的建築物自防禦系統,可實現不同端點設備、邊緣閘道器、雲端平台和服務技術人員之間的安全網路存取。

此外,2022 年 4 月,雲端安全聯盟 (CSA) 宣布了由 SDP 和零信任工作小組創建的軟體定義邊界 (SDP) 2.0 規範。 SDP 2.0 規範可協助安全和技術組織了解實現 SDP 的核心組件和原則。它也強調了雲端原生架構、服務網格實作和零信任更廣泛追求等努力之間的協同效應。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 價值鏈/供應鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 產業影響評估

第5章 市場動態

- 市場概況

- 市場促進因素

- 持續遷移至雲端、採用物聯網和 BYOD

- 嚴格的資料合規性要求和可擴展資料保護策略的需求

- 市場限制

- 對開放原始碼安全標準的需求不斷成長

第6章 市場細分

- 按類型

- 解決方案

- 服務

- 按部署形式

- 雲

- 本地

- 按最終用戶產業

- BFSI

- 通訊和 IT

- 衛生保健

- 零售

- 政府

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第7章 競爭格局

- 公司簡介

- Perimeter 81

- ZScaler

- Cisco Systems, Inc

- Okta, Inc

- APPGate

- Check Point

- Broadcom(Symantec)

- Cato Networks Limited

- Unisys Corporation

- Fortinent Corporation

- Palo Alto Networks Inc.

- Safe-T Group Limited

- Akamai Technologies, Inc(Soha Systems)

- Verizon Communications(Vidder)

第8章投資分析

第9章 市場機會與未來趨勢

The Global Software-Defined Perimeter Market size is estimated at USD 11.54 billion in 2025, and is expected to reach USD 38.72 billion by 2030, at a CAGR of 27.39% during the forecast period (2025-2030).

Key Highlights

- Cloud services are the primary drivers for digital transformation, with ubiquitous adoption in various industries. It has brought different security challenges for the business, which is the crucial reason for promoting the growth of the global software-defined perimeter market during the projected period.

- As most enterprises are at various stages of their hybrid IT implementation to support their digital business transformation, organizations will likely rely on both virtual private networks (VPN) and software-defined perimeter technology for some time. Many organizations have decided to implement SDP according to a business need, division, or region to support that set of users and applications. This introduces complications in managing two or more separate secure access systems, which contradicts IT consolidation's benefits and economies. Ultimately, organizations should progress their investment and initiatives for highly-secure access.

- Traditional on-premises VPNs can be expensive and difficult to operate and maintain. Thus, many organizations tasked with maintaining or moving to a new remote workforce are considering other network security alternatives. For example, some weigh software-defined perimeter as a vital VPN alternative. For instance, software-defined perimeter services from Palo Alto Networks and Zscaler can simplify remote access at a broad scale, pending some degree of financial and operational investment.

- Cloud services provide significant opportunities to accelerate the business through rapid scalability and the flexibility of resource utilization. It also reduces operational costs and controls financial spending on large-scale upgrades as cloud computing facilitates seamless scaling at reasonable costs.

- In addition, more and more businesses are implementing enterprise mobility solutions that enable and encourage employees to work from anywhere and through a wide range of devices. It has created a work-life balance and increased employee-consumer interaction and operational productivity by 34%. About 67% of the workforce is expected to adopt bring your own devices (BYOD) policy for work; this further emphasizes the need for network security for mobile and remote devices. According to the report, by 2023, 30% of IT organizations will extend their BYOD policy to cater to employees' wearables in the workforce, which will further drive the market.

- However, a lack of awareness of the critical benefits of software-defined perimeter solutions and the rise in demand for free and open-source security standards can hamper the market's growth.

- While many organizations put "deploying zero trust" on their "to-do" list, the COVID-19 pandemic sped up zero-trust adoption. Furthermore, with the rise of the cloud, the increasing use of software-defined wide area networks (SD-WANs) has given a new trend demand as it is a future-proof security model that encompasses the ways to detect and block exploits, phishing, ransomware, and other modern malware.

Software-Defined Perimeter Market Trends

BFSI Sector Will Experience Significant Growth

- Wide-scale adoption of digitalization in every sector has also touched the financial sector. Most banks are migrating their data, process, and infrastructure to hybrid cloud to benefit from both on-premises and off-premise cloud implementation.

- The rapid adoption of electronic devices and high internet penetration fuelled the growth of digital services and increased the customers' expectations for ease of payment, 24x7 uptime, secure storage, and interoperability. It has created an opportunity to maintain a multi-channel relationship with customers at a much-reduced cost. Cloud computing has also shortened the development cycles for new products and supports a faster and more efficient response to customers' needs.

- Further, several technology start-ups specializing in the financial segment have emerged, disrupting how we make purchases. For instance, in India, from app-based wallets and Aadhaar/UPI-linked instant transactions to single-window e-commerce apps, fintech start-ups need to be mindful of the threats and invest in robust data security frameworks for the apps. Such instances demand software-defined perimeter solutions to control cyber threats in the banking, financial services, and insurance (BFSI) industry.

- Many financial institutions collaborate with government organizations to advance cyber security awareness and protect sensitive data. For instance, in February 2022, the Department of Justice (DoJ) and the industry group Bankers Association of the Philippines (BAP) signed a memorandum of understanding (MoU) to raise cybersecurity awareness and combat cybercrime in the Philippines. In addition, the increased awareness among financial organizations would prompt deploying software-defined perimeter solutions.

North America to Hold a Significant Market Share

- The healthcare industry is experiencing a transformation with new tools and technologies to reconstruct the delivery of health services to improve efficiency with better patient care. Mobile health applications and wearable technologies are leveraged as practical health tools to monitor patients' activities. For instance, smartphones are used as an adapter with electrocardiogram electrodes to transmit data to detect silent atrial fibrillation.

- According to Groupe Speciale Mobile Association (GSMA), by 2025, the number of Internet of Things (IoT) connections in North America is expected to grow to 5.9 billion from 2.3 billion in 2018. With the rising trend of IoT devices, the demand for high network security solutions is increasing, which caters to adopting the software-defined perimeter (SDP), mostly in medium and large enterprises.

- In April 2022, the US government launched the Bureau of Cyberspace and Digital Policy (CDP) to enhance cybersecurity across the nation, aiming to address cybersecurity challenges. In addition, the government would address the national security challenges, economic opportunities, and implications for US values associated with cyberspace, digital technologies, and digital policy. Further, the CDP bureau includes three policy units: International Cyberspace Security, International Information and Communications Policy, and Digital Freedom. Such initiatives taken by the government would further boost the market growth over the forecast period.

- Moreover, major players in the retail sector are embracing hybrid cloud solutions with various applications in their data centers and others in the public cloud to benefit from both on-premise and off-premise cloud implementation and create a great shopping experience. For instance, AmazonGo stores utilize a combination of computer vision, deep learning, and sensor fusion technology to automate the payment and checkout process so that customers can directly enter the store, pick up items and leave without queuing. In contrast, the payment is made automatically through the Amazon Go app. Therefore, the retail sector is shifting to digitalization and requires network security in the future, which paves a promising road for a software-defined perimeter market.

- The recent outbreak of COVID-19 worldwide resulted in a short-term increase in demand for security software owing to the increased usage of API and other services from distributed infrastructure. However, this is expected to influence a significant growth in demand over the next few years as the number of enterprises adopting digital infrastructure is expected to increase.

Software-Defined Perimeter Industry Overview

The software-defined perimeter market is moderately concentrated and dominated by significant players like Perimeter 81, ZScaler, Cisco Systems, Inc, Okta Inc., APPGate, and Check Point. With a significant market share, these major players focus on developing their customer base across foreign countries. In addition, these companies are leveraging strategic collaborations and partnerships to raise their market share and boost their profitability. However, with product innovations using technological advancements, mid-size to smaller firms are growing their market presence by tapping new markets and securing new contracts.

In June 2022, Johnson Controls announced the acquisition of Tempered Networks to bring zero-trust cybersecurity to connected buildings. Tempered Networks use software-defined perimeters to create secure communications enabling micro-segmentation of building networks and granular access control and authentication that fortifies critical data and services. Tempered Networks has created 'Airwall' technology, an advanced self-defense system for buildings that enables secure network access across diverse groups of endpoint devices, edge gateways, cloud platforms, and service technicians.

Moreover, in April 2022, The Cloud Security Alliance (CSA) published the software-defined perimeter (SDP) 2.0 specification created by their SDP and zero-trust working groups. SDP 2.0 specification helps security and technology organizations understand the core components and tenets of implementing an SDP. It also highlights the synergies among efforts such as cloud-native architectures, service-mesh implementations, and the broader pursuit of zero trust.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Value Chain / Supply Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Overview

- 5.2 Market Drivers

- 5.2.1 Ongoing Migration to The Cloud, Adoption of IoT & BYOD

- 5.2.2 Stringent Data Compliance Requirements and Need for Scalable Data Safeguarding Strategies

- 5.3 Market Restraints

- 5.3.1 Growing Demand for Open-Source Security Standards

6 MARKET SEGMENTATION

- 6.1 Type

- 6.1.1 Solutions

- 6.1.2 Services

- 6.2 Deployment Mode

- 6.2.1 Cloud

- 6.2.2 On-Premise

- 6.3 End-User Verticals

- 6.3.1 BFSI

- 6.3.2 Telecom and IT

- 6.3.3 Healthcare

- 6.3.4 Retail

- 6.3.5 Government

- 6.3.6 Other End-user Verticals

- 6.4 Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Perimeter 81

- 7.1.2 ZScaler

- 7.1.3 Cisco Systems, Inc

- 7.1.4 Okta, Inc

- 7.1.5 APPGate

- 7.1.6 Check Point

- 7.1.7 Broadcom (Symantec)

- 7.1.8 Cato Networks Limited

- 7.1.9 Unisys Corporation

- 7.1.10 Fortinent Corporation

- 7.1.11 Palo Alto Networks Inc.

- 7.1.12 Safe-T Group Limited

- 7.1.13 Akamai Technologies, Inc (Soha Systems)

- 7.1.14 Verizon Communications (Vidder)