|

市場調查報告書

商品編碼

1643110

壓力控制設備:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Pressure Control Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

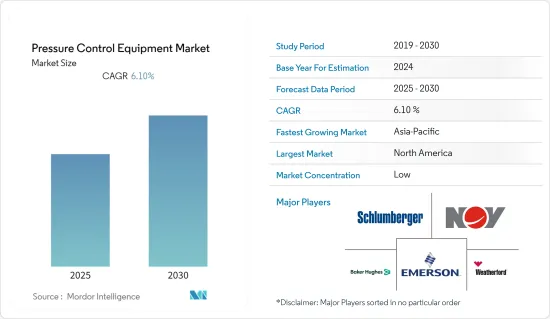

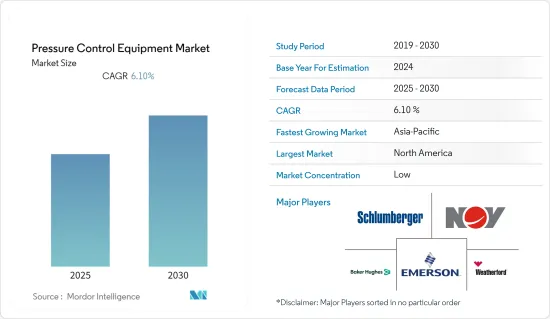

預計預測期內壓力控制設備市場複合年成長率為 6.1%。

主要亮點

- 預計壓力控制設備市場將受到旨在提高陸上和海上探勘和生產活動效率的先進技術、工具和設備日益成長的需求的推動。然而,近期原油價格因供需缺口、地緣政治等多種因素波動,抑制了壓力控制設備需求的成長。

- 作為世界主要能源,碳氫化合物的需求不斷增加,導致全球石油和工業發生重大變化。這種轉變推動了鑽井技術和設備的進步,包括測量、監控和控制流體壓力的壓力控制裝置。

- 預計石油和天然氣設備需求的不斷成長以及鑽井承包商對更高安全標準的不斷成長的需求將推動壓力控制設備市場的成長。此外,對高壓、高溫井的專用設備和材料的需求增加可能會推動對壓力控制設備的需求。

- 此外,工業物聯網 (IIoT)、先進資料分析平台和模擬軟體的發展有望推動市場發展。對於設備可靠性測試,壓力控制設備市場的製造商擴大轉向數位化工具。

- COVID-19 疫情影響了市場成長,尤其是在 2020 年。然而,疫情過後,原油、天然氣、鋼鐵等各類工業的需求將會增加。貝克休斯(通用電氣旗下一家公司)等產業領導者正在與客戶、供應商和廠商密切合作,以盡量減少對其營運的干擾。

- 然而,鑽井活動和鑽機數量的下降可能會阻礙壓力控制設備市場的成長。此外,近期供需缺口、地緣政治等因素造成油價波動,抑制了壓力控制設備市場的需求。

壓力控制設備市場趨勢

閥門行業預計將佔據主要佔有率

- 引導、調節和控制氣體、漿液、液體、蒸氣和其他物質是閥門在製程工業的主要應用。工業閥門通常由碳鋼、鑄鐵、不銹鋼和其他高性能金屬合金製成,用於在水、用水和污水、石油和電力、食品和飲料、化學品等領域提供有效的流量控制。

- 此外,石油和天然氣產業在下游、中游和上游製程應用中使用工業閥門,使其成為世界上最大的工業閥門消費者。

- 在選擇石油和天然氣應用中使用的流體系統組件時,所使用的液壓閥類型會對設備的穩定性能產生重大影響。無論是為了控制壓縮機油壓或控制軸承潤滑而安裝,導向活塞閥都能提供特定的流動和穩定性特性,實現可靠、無顫動的性能。如果使用者意識到導向柱塞閥、泵浦和其他油氣處理設備的相對優勢,它們的使用壽命將會更長。

- 2022 年 7 月,Connex Banninger 在中東推出了其壓力獨立控制閥。透過此次發布,Connex Banninger 透過增加一種新型閥門擴大了其廣泛的產品範圍。新產品旨在提高能源效率並提供更持久、更經濟的解決方案。 PICV 提供「三合一」解決方案,包括體積流量控制、差壓控制和雙埠控制與驅動。

亞太地區推動市場成長

- 市場主要受開發中國家石油需求的推動,預計發展中國家的石油需求將很快超過已開發國家的石油需求。這主要歸因於中國、印度和亞洲其他開發中國家的強勁需求,這些國家的經濟成長持續強勁。預計隨著煤層氣和頁岩氣探勘活動的增加以及油氣價格的上漲,鑽井量將會增加,市場將會擴大。

- 印度對石化和精製業的投資正在不斷增加,預計將開拓高壓控制設備市場。過去一年來,印度煉油煉製產業呈指數級成長。印度精製能力為每年2.489億噸,是繼美國、中國和俄羅斯之後的世界第四大精製。

- 隨著100萬噸/年的乙烯貿易和中化泉州精製煉油廠開發計劃的實施,中國的精製能力也不斷提升。此外,根據英國石油公司的數據,到 2021 年,中國的精製能力將從每天約 1,670 萬桶成長至每天近 1,700 萬桶。 1970年至2021年間,該國的石油精製能力每天增加約1,640萬桶,並在2021年達到高峰。這些因素可能有助於為壓力控制設備的成長開闢新的可能性。

- 國際能源研究所能源與氣候中心稱,中國的天然氣需求也將繼續上升,預計每年成長 7% 至 9%,到 2025 年達到 5,000 億立方公尺。由於頁岩氣生產的蓬勃發展,國內天然氣產量也持續大幅增加。根據中國的五年計劃,政府打算加強國內探勘和生產活動,以增加天然氣在國家能源消費結構中的佔有率。這些政府措施是推動壓力控制設備市場擴張的因素之一。

- 在預測期內,中國還將擴大其天然氣管道網路,以尋求增加無污染燃料在其能源結構中的佔有率。根據國發改委預測,未來幾年我國石油天然氣管網總長度將達24萬公里,其中天然氣管道總合將達12.3萬公里。因此,推動壓力控制設備市場成長的一些主要因素是亞太地區不斷成長的需求和新的管道基礎設施。

壓力控制設備產業概況

全球壓力控制設備市場高度分散。主要企業包括斯倫貝謝有限公司 (原卡梅倫國際公司)、艾默生電氣公司、福斯公司、IMI PLC 和克蘭公司。

- 2022 年 10 月—艾默生宣布,中國一位客戶最近購買了 300 萬台 Fisher FIELDVUE 數位閥門控制器,用於膜廠水處理的壓力控制閥。數位閥門控制器調節和監控控制閥的開啟和關閉,同時提供大量有關閥門狀態和健康狀況的資訊。

- 2022 年 6 月 - Pressure Tech Ltd. 及其馬來西亞授權經銷商 ENE Petro Services Sdn Bhd 慶祝了其在東南亞的重要里程碑。 Pressure Tech 已訂單PETRONAS/MMHE 的契約,將在 Kasawari天然氣田安裝壓力調節器。包括用於井口控制系統的額定壓力為 1,034 bar (15,000 PSI) 的 Inconel 625 背壓穩壓器。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 市場促進因素

- 油田裝備技術進步

- 全球探勘與生產(E&P)投資增加

- 市場限制

- 鑽井承包商的客製化請求

- 減少鑽井活動和鑽機數量

- COVID-19 產業影響評估

第5章 市場區隔

- 按組件

- 閥門

- 控制頭

- 井口法蘭

- 聖誕樹(漂浮)

- 適配法蘭

- 快速聯盟

- 其他

- 按應用

- 海上

- 陸上

- 按類型

- 高壓(超過 10,000 PSI)

- 低壓(低於 10,000 PSI)

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 中東和非洲

- 拉丁美洲

第6章 競爭格局

- 公司簡介

- Allied Valves, Inc.

- Baker Hughes(A GE Company)

- Brace Tool Inc.

- Emerson Electric Co.

- FHE USA LLC

- GKD Industries Ltd

- Hunting PLC

- IKM Pressure Control AS

- Schlumberger Ltd

- Weatherford International PLC

- National Oilwell Varco Inc.

- Kirloskar Brothers Ltd

- Lee Specialties Inc.

- TIS Manufacturing Ltd

第7章投資分析

第8章 市場機會與未來趨勢

簡介目錄

Product Code: 69760

The Pressure Control Equipment Market is expected to register a CAGR of 6.1% during the forecast period.

Key Highlights

- The market for pressure control equipment is expected to be driven by increased demand for advanced technology, tools, and equipment to improve the efficiency of exploration and production activities in onshore and offshore areas. However, the recent volatility in oil prices due to the supply-demand gap, geopolitics, and a variety of other factors has stifled growth in the demand for pressure control equipment.

- Increasing demand for hydrocarbons, a key source of global energy supply, has resulted in significant changes in oil and industry in various parts of the world. This transformation has resulted in advancements in well-drilling technologies and various equipment, including pressure control equipment that measures, monitors, and controls fluid pressure.

- The rising demand for oil and gas equipment, as well as the increasing need for higher safety standards by well-drilling contractors, are expected to drive the growth of the pressure control equipment market. Furthermore, rising demand for special instruments and materials in high-pressure and high-temperature wells may drive up demand for pressure control equipment.

- Also, the market expansion is anticipated to be aided by developments in the Industrial Internet of Things (IIoT), sophisticated data analytics platforms, and simulation software. For equipment reliability testing, manufacturers in the pressure control equipment market are increasingly turning to digital tools.

- The COVID-19 pandemic affected the market's growth, particularly in 2020, due to lockdowns across various countries. However, post-COVID-19, the demand for various industrial goods, including crude oil, natural gas, steel manufacturing, etc., will rise. Major companies in the industry, such as Baker Hughes (GE Company), are working closely with customers, suppliers, and vendors to minimize operational disruption.

- However, declining drilling activities and rig counts may hamper the growth of the pressure control equipment market. Also, the volatile oil prices over recent periods, owing to the supply-demand gap, geopolitics, and several other factors, have been restraining the demand for the pressure control equipment market.

Pressure Control Equipment Market Trends

Valves Segment Expected to Hold Significant Share

- The direction, regulation, and control of gases, slurries, liquids, vapors, and other substances are the main uses of valves in the process industries. Industrial valves are often built of carbon steel, cast iron, stainless steel, and other high-functioning metal alloys to achieve effective flow control in water and wastewater, oil and power, food and beverage, chemicals, and others.

- Additionally, the oil and gas sector uses industrial valves in downstream, midstream, and upstream process applications, making it the largest consumer of industrial valves worldwide.

- When choosing components for fluid systems used in oil and gas applications, the type of hydraulic valve can significantly impact how consistently the equipment performs. Whether installed to control compressors' oil pressure or lubrication for bearings, guided piston valves offer specific flow and stability characteristics for dependable performance without chatter. If users are aware of the relative benefits of guided piston valves, pumps, and other oil and gas processing equipment, it will have a long service life.

- In July 2022, Conex Banninger launched pressure-independent control valves in the Middle East. Conex Banninger, with its launch, expanded its wide range of products with the addition of a new kind of valve. The newest addition aims to increase energy efficiency to provide a more lasting and economical solution. PICVs offer a "three-in-one" solution, with volume flow control, differential pressure control, and two-port control and actuation.

Asia-Pacific to Drive Market Growth

- The market is primarily driven by the demand for oil in developing nations, which is anticipated to surpass that in industrialized nations soon, primarily due to strong demand from China, India, and other developing nations throughout Asia, which are continuing to experience strong economic growth. The market is anticipated to expand as more wells are dug due to increased efforts to find coal seam gas and shale gas and favorable oil and gas prices.

- India's investment in the petrochemicals and refining sectors is anticipated to open up the country's market for high-pressure control equipment. The refining industry in India has grown dramatically over the past year. With a 248.9 MMTPA refining capacity, India is the world's fourth-largest refiner after the United States, China, and Russia.

- China's refining capacity is also increasing with a deal for 1 MTA ethylene and a refinery development project by Sinochem Quanzhou Petrochemical. Additionally, according to BP Plc., China's oil refinery capacity increased from roughly 16.7 million barrels per day in 2021 to almost 17 million barrels per day in 2021. The capacity of the country's oil refineries expanded by around 16.4 million barrels per day between 1970 and 2021, reaching a peak in the latter year. These factors will help to open up new potential for pressure control equipment growth.

- According to the IFRI Centre for Energy & Climate, China's natural gas demand is also expected to continue to climb, rising by 7% to 9% yearly to reach up to 500 bcm by 2025. Due to a boom in shale gas production, domestic gas production has also continued to increase significantly. According to China's five-year plans, the government intends to boost domestic exploration and production efforts in order to raise the share of natural gas in the country's energy consumption mix. One of the factors fueling the expansion of the market for pressure control equipment is such government efforts.

- During the forecast period, China is also anticipated to expand its network of gas pipelines to increase the proportion of clean fuels in the nation's energy mix. The oil and gas pipeline network in China is anticipated to reach 240,000 km in the next few years, with natural gas pipes totaling 123,000 km, according to the National Development and Reform Commission of China. Therefore, some of the key factors propelling the growth of the pressure control equipment market are the rising demand and new pipeline infrastructure in the Asia-Pacific region.

Pressure Control Equipment Industry Overview

The global pressure control equipment market is highly fragmented. The major companies include Schlumberger Limited (previously Cameron International), Emerson Electric Co., Flowserve Corporation, IMI PLC, and Crane Co., among others.

- October 2022 - Emerson announced that a customer in China recently purchased the 3 millionths Fisher FIELDVUE digital valve controller for use in their membrane plant's water treatment pressure control valve. A digital valve controller regulates and monitors the opening and closing of a control valve, and it also provides a wealth of information about the status and health of the valve.

- June 2022 - Pressure Tech Ltd. and Malaysian authorized reseller, ENE Petro Services Sdn Bhd, celebrated a significant milestone reached in Southeast Asia. Pressure Tech was given a contract by Petronas/MMHE to install pressure regulators in the Kasawari Gas Field. A 1,034 bar (15,000 PSI) rated Inconel 625 back pressure regulator for a wellhead control system is included in the box.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Market Drivers

- 4.4.1 Technological Advancement in Oilfield Equipment

- 4.4.2 Increase in Global Investments in Exploration & Production (E&P)

- 4.5 Market Restraints

- 4.5.1 Customized Demands by Drillers

- 4.5.2 Decline in Drilling Activities and Rig Counts

- 4.6 Assessment of Impact of COVID-19 on the Industry

5 MARKET SEGMENTATION

- 5.1 Component

- 5.1.1 Valves

- 5.1.2 Control Head

- 5.1.3 Wellhead Flange

- 5.1.4 Christmas Tree (Flow Tee)

- 5.1.5 Adapter Flange

- 5.1.6 Quick Unions

- 5.1.7 Others

- 5.2 Application

- 5.2.1 Offshore

- 5.2.2 Onshore

- 5.3 Type

- 5.3.1 High Pressure (Above 10,000 PSI)

- 5.3.2 Low Pressure (Below 10,000 PSI)

- 5.4 Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia Pacific

- 5.4.4 Middle East & Africa

- 5.4.5 Latin America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Allied Valves, Inc.

- 6.1.2 Baker Hughes (A GE Company)

- 6.1.3 Brace Tool Inc.

- 6.1.4 Emerson Electric Co.

- 6.1.5 FHE USA LLC

- 6.1.6 GKD Industries Ltd

- 6.1.7 Hunting PLC

- 6.1.8 IKM Pressure Control AS

- 6.1.9 Schlumberger Ltd

- 6.1.10 Weatherford International PLC

- 6.1.11 National Oilwell Varco Inc.

- 6.1.12 Kirloskar Brothers Ltd

- 6.1.13 Lee Specialties Inc.

- 6.1.14 TIS Manufacturing Ltd

7 INVESTMENT ANALYSIS

8 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219