|

市場調查報告書

商品編碼

1643109

內視鏡:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Borescope - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

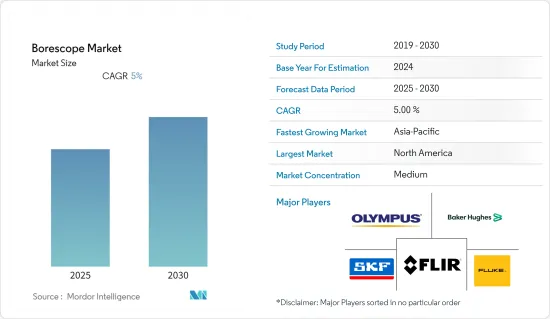

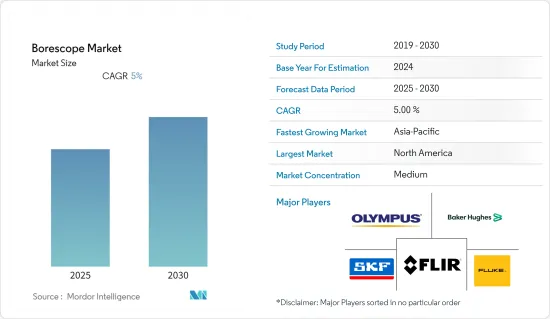

預測期內,內視鏡市場預計複合年成長率為 5%

關鍵亮點

- 由於對高營運生產率和發電廠及維護的需求不斷增加,內視鏡市場正在成長。據印度國家投資促進和設施局稱,印度電力產業正在經歷重大變革時期,正在重塑產業格局。截至 2022 年 5 月,印度火力總合裝置容量為 236.1 吉瓦,其中煤炭佔火力發電量的 58.6%,其餘電力來源為褐煤、柴油和天然氣,這將進一步推動市場成長。

- 此外,檢查損壞貨物內部通道的重大技術創新正在推動市場的發展。例如,2021 年 8 月,Healthmark Industries 將 FIS-007 引入其 ProSys 光學檢測產品線。 FIS-007 是一種具有增強光線、視覺和放大功能的內視鏡,用於目視檢查內部流道中可能被污染或損壞的流體路徑。它還可以捕捉肉眼看不見的內部腔體和裂縫的圖像和影片。

- 內視鏡可以輕鬆檢查機械部件而無需拆卸,從而減少了維修時間和成本。新興國家光學技術的發展將推動內視鏡市場的成長。此外,能夠即時檢查引擎、消音器、汽缸和其他部件的視訊內視鏡的使用也在增加,從而促進了市場的成長。

- 然而,缺乏合理的照明條件阻礙了內視鏡市場的成長。此外,使用內視鏡進行表面觀察也開啟了新的市場機會。

- 由於 COVID-19 疫情爆發,全球終端用戶產業的工廠關閉,導致內視鏡市場的需求和成長受到阻礙。然而,由於內視鏡能夠準確觀察製造和生產線,並提供機械設備零件的整體情況,因此隨著市場復甦,對內視鏡的需求預計會增加。

內視鏡市場趨勢

汽車產業高成長

- 由於政府干涉降低汽車排放氣體,對汽車的需求不斷成長以及對電動車的重視程度不斷提高,對汽車產業產生了重大影響。內視鏡廣泛應用於汽車工業,用於檢查變速箱、襯裡、車架、消音器等,是全球內視鏡市場的主要驅動力。

- 此外,根據國際能源總署的預測,2020年全球將有約1,020萬輛電動車投入運作,2021年將有1,640萬輛電動車運作,這將進一步推動市場成長。根據中國工業協會的數據,2021年中國產量乘用車約2,141萬輛,商用車約467萬輛。

- 隨著車輛變得越來越先進、智慧和複雜,對模組、成品部件和子組件的遠端目視檢查變得越來越重要。內視鏡可以在將非標準或有缺陷的零件整合到更大的系統之前識別它們,從而幫助汽車製造商節省金錢、時間並提高品質。

- 內視鏡和視訊內視鏡在汽車行業中越來越常見,用於檢查汽車部件,例如引擎氣缸、液壓系統、燃油噴嘴、氣門座和焊接管。因此,內視鏡市場需求的不斷成長與汽車行業需求的不斷成長成正比,而汽車行業需求的不斷成長是由於全球人口成長和都市化而激增的。此外,2021 年 12 月,現代汽車宣布計劃在印度投資 400 億印度盧比(5.3025 億美元)用於研發,並計劃在 2028 年推出 6 款電動車。

- 此外,據 IBEF 稱,印度政府於 2021 年 9 月公佈了一項價值 2593.8 億印度盧比(34.9 億美元)的汽車和汽車零件 PLI 計劃。

- 此外,製造設施中需要精確監控以全面了解機器和設備的微小零件和零件,這被認為是推動汽車產業對內視鏡需求的另一個因素。

亞太地區高成長

- 預計亞太地區將佔據全球內視鏡市場的大部分佔有率。基礎設施建設、製造業自動化程度的提高以及印度和中國等新興國家的發電量不斷成長,正在推動亞太地區內視鏡市場的成長。此外,2022年4月,塔塔汽車宣布未來五年向印度乘用車業務投資2,400億印度盧比(30.8億美元)的計劃。

- 石油和天然氣、化學、汽車和冶金等終端行業的顯著成長、先進設備在檢查活動中的使用增加以及維修和保養領域的投資增加是刺激該地區工業內視鏡市場成長的關鍵因素。

- 此外,據 IBEF 稱,到 2030 年,印度有可能成為共用出行領域的領導者,為電動和自動駕駛汽車帶來機會。此外,2021 年印度乘用車市場價值為 327 億美元,預計到 2027 年將成長至 548.4 億美元。

- 該地區各國都有頁岩氣活動和民航機生產計劃核准,有潛力生產大型私人客機。這些計劃可能會促進該地區的市場成長。

- 此外,根據國際航空運輸協會的預測,到2030年,印度預計將超過中國和美國,成為世界第三大航空客運市場。此外,根據IBEF的數據,到2027年飛機數量預計將達到1,100架,這將進一步推動市場成長。

管道鏡產業概況

內視鏡市場競爭激烈,由多家全球參與企業組成。市場參與企業正在採取業務擴張、夥伴關係、協作、併購、新產品發布、合資企業等策略來在市場上佔有一席之地。

2022 年 6 月,Teledyne Technologies Incorporated 的子公司 Teledyne FLIR 推出了 FLIR VS80 系列高效能視訊內視鏡,這是一款適用於廣泛商業和工業應用的專業檢查工具。 FLIR Systems VS80 視訊內視鏡是同類產品中用途最廣泛、性能最高的視訊內視鏡。 VS80 配備 7 吋、1024x600 高清 (HD) 觸控螢幕顯示器。 VS80 有七種不同的套件,可選擇購買可在幾秒鐘內更換的防水超薄探頭。

2021 年 2 月,AMETEK Land 推出了用於反應器的創新新型中波長內視鏡 MWIR-B-640。 MWIR-B-640 可在爐子的整個使用壽命期間以高精度獲取、儲存和趨勢分析完整的輻射溫度測量資料,即使在濃煙和高溫環境下也能提供持續、清晰的可視性。可用於碳氫化合物加工重整爐、熱處理爐、加熱爐、水泥窯、退火爐、生質能、廢棄物、煤鍋爐、焚化爐等。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 市場促進因素

- 對高營運效率的需求不斷增加

- 市場限制

- 缺乏良好的照明條件

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 對內視鏡市場的影響評估

第5章 市場區隔

- 按類型

- 影片

- 靈活的

- 內視鏡檢查

- 半剛性

- 死板的

- 依直徑

- 0~3 mm

- 3~6 mm

- 6~10mm

- 10mm以上

- 角度

- 0~90°

- 90~180°

- 180~360°

- 按最終用戶產業

- 車

- 航空

- 發電

- 石油和天然氣

- 製造業

- 化學

- 飲食

- 藥品

- 採礦和建築

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 其他

第6章 競爭格局

- 公司簡介

- Olympus Corporation

- AB SKF

- Baker Hughes Company

- ACL Stanlay

- FLIR Systems

- Fluke Corporation

- ViZaar Industrial Imaging AG

- Advanced Inspection Technologies Inc.

- Gradient Lens Corporation

- JME Technologies Inc.

第7章投資分析

第 8 章:市場的未來

The Borescope Market is expected to register a CAGR of 5% during the forecast period.

Key Highlights

- The borescope market is growing due to high operational productivity and the increasing need for power generation plants and maintenance. According to India's National Investment Promotion and Facility Agency, the Indian power sector is undergoing significant change, reshaping the industry outlook. As of May 2022, India had a total thermal installed capacity of 236.1 GW, with coal accounting for 58.6% of thermal power and the remaining sources being lignite, diesel, and gas, which will further drive the market growth.

- Moreover, the market is driven by significant innovation to inspect internal channels of damaged items. For instance, in August 2021, Healthmark Industries introduced the FIS-007 to its ProSys Optical Inspection product line. It is a borescope with enhanced light, vision, and magnification used to visually investigate the internal channels of potentially contaminated or damaged things. It also allows users to capture and video the lumens and crevices that are not visible to the naked eye.

- Borescope reduces repair time and cost due to easy inspection without dismantling machinery parts. The growing development of optical technologies promotes the growth of the borescope market. In addition, the use of video borescopes is increasing due to their real-time inspection of engines and parts of mufflers and cylinders, which contributes to the growth of the market.

- However, the lack of reasonable lighting conditions restrains the growth of the borescope market. Moreover, using borescopes in surface vision creates novel opportunities for developing the market studied.

- With the outbreak of COVID-19, the demand and growth of the borescope market were hindered due to factory shutdowns across end-user industries globally. However, with the resurgence, the need for the borescope is expected to rise as they provide accurate observation at the manufacturing and production line to get the overall view of the parts and components in machines and equipment.

Borescope Market Trends

Automotive Industry to Exhibit High Growth

- The growing demand for the automotive industry and increasing emphasis on electrically driven vehicles, owing to the government intervention toward the low level of vehicle emission, have created a major impact on the industry. These are the primary drivers of the global borescope market, as borescopes are extensively used for the inspection of transmission system, linings, frames, and mufflers in the automobile industry.

- Furthermore, according to the IEA, there were approximately 10.2 million electric vehicles in operation worldwide in 2020, with an estimated 16.4 million electric vehicles in operation by 2021, further driving the market growth. In addition, according to the China Association of Automobile Manufacturers, in 2021, China produced approximately 21.41 million passenger cars and 4.67 million commercial vehicles.

- With automobiles becoming more advanced, smart, and complicated, the importance of remote visual inspection of modules, finished components, and subassemblies have become critical. Borescope helps automobile manufacturers save money and time, and improve quality by identifying out-of-spec or faulty parts before being integrated into a larger system.

- The proliferation of boroscopes and video scopes is gaining transaction in the automotive industry for the inspection of automotive components, including engine cylinders, hydraulic systems, fuel nozzles, valve seats, and welded tubing. Hence the demand for increment in the borescope market is directly proportional to the rising demand for the automotive industry, which has been skyrocketing as a result of the growing population and urbanization, globally. Further, in December 2021, Hyundai announced plans to invest INR 4,000 crores (USD 530.25 million) in R&D in India, intending to launch six EVs by 2028.

- Furthermore, according to the IBEF, in September 2021, the Indian government notified a PLI scheme for automobile and auto components worth INR 25,938 crores (USD 3.49 billion).

- Moreover, the need for precise supervision at manufacturing facilities to get a comprehensive view of minute parts and components in machines and equipment is identified to be another factor that is propelling the demand for borescopes in the automotive industry.

Asia-Pacific to Witness Highest Growth

- The Asia-Pacific region is expected to hold a premium share in the global borescope market. The increasing infrastructural development, growing automation in the manufacturing industry, and power generation in emerging countries, such as India and China, drive the growth of the borescope market in the Asia-Pacific region. Further, in April 2022, Tata Motors announced projects investing INR 24,000 crores (USD 3.08 billion) in its passenger vehicle business over the next five years in India.

- The increasing usage of advanced equipment in inspection activities and increasing investment in the repair and maintenance sector are major factors that stimulate the growth of the industrial borescope market in the region, as there is significant growth in end-use industries such as oil and gas, chemicals, automotive, and metallurgical, among others.

- Furthermore, according to IBEF, India could be a leader in shared mobility by 2030, opening up opportunities for electric and autonomous vehicles. Further, the Indian passenger car market was valued at USD 32.70 billion in 2021; is expected to grow to USD 54.84 billion by 2027.

- Countries in the region have shale gas activities and approved projects for commercial aircraft production, which is expected to manufacture sizeable in-house passenger planes. These projects are likely to propel market growth in the region.

- Moreover, according to the International Air Transport Association, India is anticipated to overtake China and the United States as the world's third-largest air passenger market by 2030. Furthermore, according to IBEF, the number of planes is expected to reach 1,100 by 2027, further driving the market growth.

Borescope Industry Overview

The borescope market is competitive and consists of several global players. Players in the market are adopting strategies like expansions, partnerships, collaborations, mergers & acquisitions, new product launches, joint ventures, and others to gain a stronghold in the market.

In June 2022, Teledyne FLIR, a subsidiary of Teledyne Technologies Incorporated, introduced the FLIR VS80 high-performance videoscope series, a professional inspection tool suitable for a broad range of commercial and industrial applications. The FLIR VS80 videoscope is intended to be the most versatile and powerful in its class. The VS80 features a 1024 600 high resolution (HD) seven-inch touchscreen display. It is available in seven different kits, with the option of purchasing waterproof, ultra-slim probes that can be swapped in and out in seconds.

In February 2021, AMETEK Land introduced the MWIR-B-640, an innovative new mid-wavelength borescope for furnace applications. The MWIR-B-640 captures, stores, and trends highly accurate and fully radiometric temperature measurement data over the furnace's lifetime, providing a continuous and clear view even through heavy smoke and hot atmospheres. It can be used in hydrocarbon processing reformers, heat treatment furnaces, reheat, cement kilns, annealing furnaces, biomass, waste and coal boilers, and incinerators.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Requirement for High Operational Productivity

- 4.3 Market Restraints

- 4.3.1 Lack of Good Lighting Conditions

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assessment of the Impact of COVID-19 on the Borescope Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Video

- 5.1.2 Flexible

- 5.1.3 Endoscopes

- 5.1.4 Semi-rigid

- 5.1.5 Rigid

- 5.2 By Diameter

- 5.2.1 0 mm to 3 mm

- 5.2.2 3 mm to 6 mm

- 5.2.3 6 mm to 10 mm

- 5.2.4 Above 10 mm

- 5.3 By Angle

- 5.3.1 0° to 90°

- 5.3.2 90° to 180°

- 5.3.3 180° to 360°

- 5.4 By End-user Industry

- 5.4.1 Automotive

- 5.4.2 Aviation

- 5.4.3 Power Generation

- 5.4.4 Oil and Gas

- 5.4.5 Manufacturing

- 5.4.6 Chemicals

- 5.4.7 Food and Beverages

- 5.4.8 Pharmaceuticals

- 5.4.9 Mining and Construction

- 5.4.10 Other End-user Industries

- 5.5 By Geography

- 5.5.1 North America

- 5.5.2 Europe

- 5.5.3 Asia-Pacific

- 5.5.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Olympus Corporation

- 6.1.2 AB SKF

- 6.1.3 Baker Hughes Company

- 6.1.4 ACL Stanlay

- 6.1.5 FLIR Systems

- 6.1.6 Fluke Corporation

- 6.1.7 ViZaar Industrial Imaging AG

- 6.1.8 Advanced Inspection Technologies Inc.

- 6.1.9 Gradient Lens Corporation

- 6.1.10 JME Technologies Inc.