|

市場調查報告書

商品編碼

1643107

混合閥門:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Hybrid Valve - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

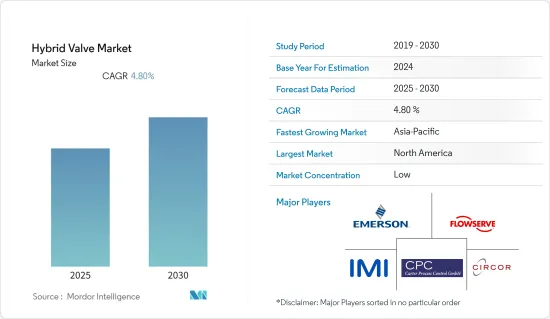

預測期內,混合閥門市場預計複合年成長率為 4.8%。

主要亮點

- 隨著對技術進步的日益關注以及對監控各種工廠設備的無線/遠端基礎設施的需求不斷成長,混合閥門的成長預計將進一步推動。這些因素正在推動智慧閥門和致動器的應用,尤其是在工業領域。

- 石油和天然氣、用水和污水處理以及採礦業等關鍵產業正在轉向具有嵌入式處理器和網路功能的閥門技術,以及透過中央控制站協調的先進監控技術。

- 市場上另一個重要的發展是混合閥門在石油和天然氣工業中的使用日益增加。工業界正在採用這些閥門來解決反覆出現的腐蝕問題。此外,石油和天然氣業務近年來經歷了顯著成長。由於終端工業領域的進步正在擴大市場,這尤其有利於全球混合閥門產業。

- 關鍵設備故障會給製造商帶來維修、生產力損失和停機等巨大的成本。近 98% 的組織表示,一小時的停機時間造成的損失超過 10 萬美元。確保所有設備都以最佳性能運作仍然是製造商的首要任務,許多製造商正在轉向能夠在生產車間進行預測性維護的技術和解決方案。

- COVID-19 疫情對市場成長產生了負面影響。石油和天然氣等主要終端用戶領域受到沉重打擊,原油價格跌至每桶 0 美元的歷史低點。這影響了全球該領域的自動化活動。

混合閥門市場趨勢

石油和天然氣產業可望引領市場

- 預計石油和天然氣行業的區域擴張將推動市場成長。例如,美國內政部(DoI)已根據2019-2024年國家外大陸棚石油和天然氣租賃計劃(國家 OCS 計劃)授權在約 90% 的外大陸棚(OCS)土地上進行海上探勘。這為石油和天然氣市場開闢了新的機會。

- 考慮到各終端用戶產業對石油和天然氣的高需求,主要產油國正在加強對石油探勘活動的投資和力度。例如,國營印度石油天然氣公司(ONGC)宣布將在 2022-2025 會計年度投資約 42.5 億美元加強其石油探勘活動。

- 在去年發布的《數位化再定義》報告中,報告指出數位技術使精製業務利潤率提高 10% 或以上的煉油廠數量從 11% 下降到 3%。所有後續利潤率改善也均下降。這凸顯了石油和氣體純化公司尚未最終利用其數位投資,仍有很大的改善潛力。

- 印度石油集團的加工能力在 2021 年 8 月達到 8,020 萬噸/年,佔國內總加工能力 2.4987 億噸/年的 33%。此外,該計畫要求到2025年將石油年加工產量提高到8,755萬噸。因此,在預測期內,不斷擴張的石油和天然氣產業在混合閥門需求成長中發揮關鍵作用。

預計北美將佔據最大市場佔有率

- 該國的重點產業,包括石油和天然氣、可再生能源以及用水和污水處理,正在向具有嵌入式處理器和網路功能的閥門和致動器技術發展,並與透過中央控制站協調的先進監控技術協同工作。美國發電基礎設施的擴張和天然氣的供應也有望推動新的複合循環燃氣渦輪機(CCGT)電廠的建設。

- 此外,該地區主要國家的石油產量增加預計將促進市場成長。例如,根據美國能源資訊署的數據,預計明年美國原油產量將從每天1,180萬桶增加到每天1,260萬桶。此外,加拿大等國家油砂開採量的增加和新設施的建設預計將在一定程度上促進該行業的工業發展。

- 美國不斷擴大的發電基礎設施和天然氣供應預計將促使該地區建造幾座新的聯合循環燃氣渦輪機(CCGT) 電廠。根據美國能源局(DOE)的數據,美國是世界上最大的液化天然氣(LNG)出口國,預計今年的出口量將在目前的基礎上再增加20%。 2022 年 1 月,美國生產的液化天然氣供應了歐洲一半以上的液化天然氣進口量。

- 根據政府資料,北美石化產業在 2020 年成長了 2.5%,並且到 2022 年將成長 8%,以滿足全球需求。美國化工產業崛起的主要驅動力之一是民用終端用途領域的擴張。對多種最終用途的需求不斷成長,推動了化學工業的投資增加。

- 此外,頁岩氣探勘活動的出現需要控制閥來調節上游、下游和中游活動的溫度和壓力,從而促進北美地區混合閥門市場的成長。

混合閥門產業概況

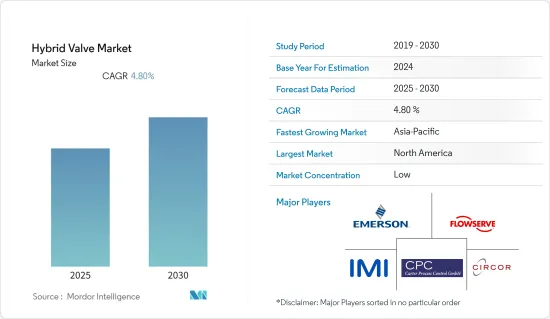

混合閥門市場分散,參與者眾多,包括艾默生電氣公司、福斯公司、Carter Process Control GmbH、IMI PLC 和 CIRCOR International, Inc.市場不斷經歷新產品的推出、併購和合作。

2022 年 5 月,艾默生推出了搭載 HART 7 的 TopWorxTM DX PST。該裝置提供有價值的閥門資料和診斷訊息,實現應用過程的數位轉型。新型 DX PST 與現有的閥門和控制系統無縫整合,使操作員能夠存取用於預測和安排維護的關鍵閥門資料、趨勢和診斷資訊。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 市場促進因素

- 需要控制關鍵製程的過度噪音、壓力、振動和氣蝕

- 預測期內石化、煉油和化工廠數量增加

- 市場限制

- 安裝成本高

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- 產業價值鏈分析

- COVID-19 產業影響評估

第5章 市場區隔

- 按最終用戶產業

- 石油和天然氣

- 污水管理

- 化學

- 飲食

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第6章 競爭格局

- 公司簡介

- Flowserve Corporation

- Emerson Electric Company

- IMI PLC

- Carter Process Control GmbH

- CIRCOR International, Inc.

- L&T Valves Limited

- Koso Kent Introl Pvt. Ltd

- Parcol SpA

- Master Flo Valve Inc.(Stream-Flo Industries Ltd)

- Wuxi Smart Auto-Control Co. Ltd

第7章投資分析

第8章 市場機會與未來趨勢

The Hybrid Valve Market is expected to register a CAGR of 4.8% during the forecast period.

Key Highlights

- The growth of hybrid valves is expected to be further driven by the increasing need for wireless/remote infrastructure to monitor equipment in various plants, along with an augmented focus on technology advancements. Such factors are propelling the application of smart valves and actuators, especially in the industrial sector.

- Major industries, such as oil and gas, water and wastewater, and mining, are moving toward valve technology with embedded processors and networking capability to work alongside sophisticated monitoring technology coordinated through a central control station.

- Another significant development in the market is the rising usage of hybrid valves in the oil and gas industry. These valves are progressively being employed to address the industry's reoccurring corrosion issues. Furthermore, the oil and gas business has seen tremendous growth in recent years. This has particularly benefited the worldwide hybrid valve industry since advancements in the end-use industry sector have increased their market.

- A breakdown in critical equipment is costly to manufacturers in terms of repairs and the loss of productivity and downtime. Approximately 98% of organizations stated that a single hour of downtime costs over USD 100,000. Ensuring the optimal functioning of all equipment remains an essential priority for manufacturers, many of whom are turning to predictive maintenance-enabling technology and solutions on their production floor.

- The COVID-19 pandemic impacted market growth negatively. The primary end-user segments, such as oil & gas, suffered heavily, with crude oil prices hitting USD zero per barrel. This affected the automation activities of the sector across the globe.

Hybrid Valve Market Trends

Oil & Gas Industry is Expected to Drive the Market

- The oil & gas sector's expansion across geographies is expected to drive market growth. For instance, The Department of the Interior (DoI) of the United States allowed offshore exploratory drilling in about 90% of the Outer Continental Shelf (OCS) acreage under the National Outer Continental Shelf Oil and Gas Leasing Program (National OCS Program) for 2019-2024. This has opened up new opportunities to the market in the oil & gas sector.

- Considering the high demand for oil & gas across various end-user industries, major oil-producing countries are increasing their investment and efforts in oil exploration activities. For instance, the Oil and Natural Gas Corporation (ONGC), India's state-owned organization, announced investing about USD 4.25 billion in the fiscal years 2022-2025 to intensify its oil exploration efforts.

- The Digital-Re-Definery report released in the past year stated that several refiners that reported digital technologies delivering a margin improvement of more than 10% in refining operations dropped from 11% to 3%. The numbers also dropped for all subsequent margin improvement ranges. This underscores the fact that there is considerable potential for improvement as oil and gas refineries are yet to capitalize on digital investments ultimately.

- The processing output of the Indian Oil Group, which was 80.2 MMTPA in August 2021, accounted for 33% of the 249.87 MMTPA overall national processing capacity. Additionally, the corporation stated that by 2025, it would raise its annual production for oil processing to 87.55 million metric tons. Hence, the expanding oil & gas industry plays a significant role in the growth of hybrid valve demand over the forecast year.

North America is Expected to Hold the Largest Market Share

- Major industries in the country, such as oil & gas, renewable energy, and water and wastewater treatment, are moving toward valve and actuator technology with embedded processors and networking capability to work alongside sophisticated monitoring technology coordinated through a central control station. The expanding power generation infrastructure in the United States and the availability of natural gas are also expected to result in the construction of several new combined cycle gas turbine (CCGT) plants.

- Furthermore, increasing oil production by major regional countries is expected to contribute to market growth. For instance, according to the United States Energy Information Administration, the United States crude oil production is expected to increase from 11.8 million barrels per day to 12.6 million per day in the upcoming year. Additionally, it is anticipated that increased oil sand extraction in nations like Canada, together with the building of new facilities, would help the industry in this area develop to some extent.

- Expanding power generation infrastructure in the United States and the availability of natural gas is expected to result in the construction of several new combined cycle gas turbine (CCGT) plants in the region. As per the United States Department of Energy (DOE), the United States is the top global exporter of liquefied natural gas (LNG) and is set to grow an additional 20% beyond the current levels by the current year. In January 2022, United States LNG supplied more than half the LNG imports in Europe.

- According to government data, the North American petrochemical sector expanded by 2.5% in 2020 and grew by 8% in 2022 to fulfill global demand. One of the main forces behind the rise of the chemical sector in the United States is the expanding private end-use sector. More investments are being made in the chemical sector because of the rising demand for several end-use applications.

- Further, the advent of exploration activities for shale gas, which require control valves to regulate temperature or pressure throughout upstream, downstream, and midstream activities, contribute to the growth of the hybrid valve market in the North American region.

Hybrid Valve Industry Overview

The hybrid valve market is fragmented with numerous players, including Emerson Electric Company, Flowserve Corporation, Carter Process Control GmbH, IMI PLC, and CIRCOR International, Inc., among others. The market has been continually experiencing new product launches, mergers & acquisitions, and partnerships.

In May 2022, Emerson introduced the TopWorxTM DX PST with HART 7. The units provided valuable valve data and diagnostic information, enabling the digital transformation of process applications. The new DX PST integrated seamlessly with existing valves and control systems, giving operators access to critical valve data, trends, and diagnostics used to predict and schedule maintenance.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope Of The Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Need for Controlling Excessive Noise, Pressure, Vibration, and Cavitation in Critical Processes

- 4.2.2 Growing Number of Petrochemical, Refineries and Chemical Plants Acts as a Market Driver in the Forecast Period

- 4.3 Market Restraints

- 4.3.1 High Cost of Installation

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Industry Value Chain Analysis

- 4.6 Assessment Of The Impact Of COVID-19 On The Industry

5 MARKET SEGMENTATION

- 5.1 By End-user Industry

- 5.1.1 Oil & Gas

- 5.1.2 Wastewater Management

- 5.1.3 Chemicals

- 5.1.4 Food & Beverage

- 5.1.5 Other End-user Industries

- 5.2 By Geography

- 5.2.1 North America

- 5.2.2 Europe

- 5.2.3 Asia-Pacific

- 5.2.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Flowserve Corporation

- 6.1.2 Emerson Electric Company

- 6.1.3 IMI PLC

- 6.1.4 Carter Process Control GmbH

- 6.1.5 CIRCOR International, Inc.

- 6.1.6 L&T Valves Limited

- 6.1.7 Koso Kent Introl Pvt. Ltd

- 6.1.8 Parcol SpA

- 6.1.9 Master Flo Valve Inc. (Stream-Flo Industries Ltd)

- 6.1.10 Wuxi Smart Auto-Control Co. Ltd