|

市場調查報告書

商品編碼

1643101

晶片天線:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)Chip Antenna - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

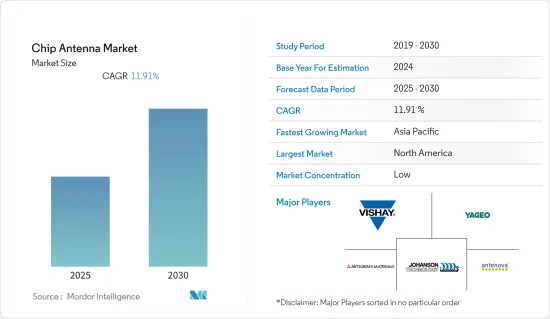

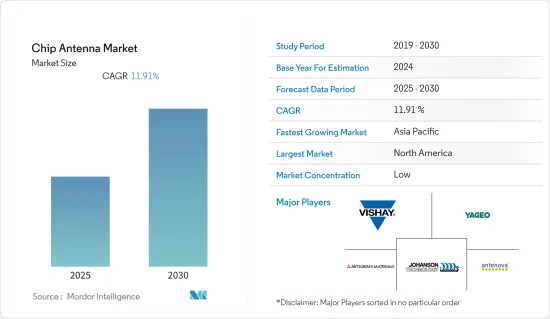

預測期內晶片天線市場預計複合年成長率為 11.91%

關鍵亮點

- 由於資料通訊設備和寬頻應用程式(APP)推動行動資料流量呈指數級成長,市場預計將進一步擴大。愛立信預計,2021年5G用戶總數將達到約6.6418億,到2027年將達到43.9億。

- 此外,霍尼韋爾的研究表明,67% 的製造業高管計劃投資資料分析。 63% 的人認為它將使他們能夠即時做出明智的決策,57% 的人認為它將減少浪費,56% 的人認為它將有助於預測停機風險(56%)。預計這將進一步促進製造業物聯網(IoT)的未來發展。

- 市場正在快速發展,支援5G通訊晶片解決方案。例如,近期,三星電子宣布開發最新的8nm RF解決方案,與14nm RF相比,功率效率提高了35%,邏輯面積減少了35%。

- 由於市場快速成長,許多供應商正在獲得國內外參與企業的資金支持,用於產品開發和創新。例如,2022年5月,Farrowtech宣布獲得1,500萬歐元的A輪資金籌措,以繼續開發其下一代60GHz無線RF收發器和天線技術。

- COVID-19 疫情以多種方式影響了市場。在中國等主要製造地,晶片製造工廠正逐步從疫情的影響中恢復。此外,5G的快速部署有望促進所研究市場的市場成長。此外,5G作為獨立網路的出現以及5G智慧型手機從旗艦機型向中階市場的快速擴張也有望促進市場成長。

晶片天線市場趨勢

晶片天線在物聯網應用中的使用日益增多

- 預計終端用戶群體中物聯網的部署不斷增加將成為市場的主要驅動力。製造業引入物聯網是為了促進工廠生產流程,因為物聯網設備可以自動監控開發週期並管理倉庫和庫存。這就是過去幾十年來物聯網設備投資激增的原因之一。到 2025 年,自動化領域的連網設備數量預計將增加 50 台。

- 對資料分析和分析整合日益成長的需求預計將推動物聯網市場在零售業的應用。此外,購物的便利性和智慧型手機的廣泛使用導致電子商務平台的使用率迅速增加,預計這將推動市場的發展。

- 例如,亞馬遜在美國西雅圖的第一家商店配備了自助結帳機,並整合了可在Android和iOS系統上使用的行動付款方式。該商店配備了攝影機、感測器和RFID讀取器,使用電腦視覺、深度學習演算法和感測器融合來識別消費者和商品。

- 根據《IoT for All》報告,物聯網市場預計將成長 18%,達到 144 億活躍連線數,到 2025 年連網物聯網裝置數將達到約 270 億台。

- 5G的廣泛應用也有望推動物聯網在關鍵應用領域的成長。根據小型基地台論壇 (Small Cell Forum) 預測,2025 年 5G 安裝基地台總數將達到 1,310 萬,佔總使用基地台數量的三分之一以上。此外,根據思科系統公司預測,到 2022 年連網穿戴裝置的數量將超過 10 億。

預計亞太地區將成為預測期內成長最快的市場

- 亞太地區佔據物聯網技術支出的大部分,其中韓國和新加坡預計將成為全球採用物聯網晶片的最大市場之一。根據經濟合作暨發展組織(OECD)的資料,韓國的人均網路連線數位居世界第一,其次是丹麥和瑞士。

- 此外,印度將 100 個城市轉變為智慧城市的願景預計將在智慧家庭和汽車領域對物聯網設備產生巨大的需求。這也是推動該地區市場成長的重要因素。

- 日本政府發布了《綜合創新戰略2022》,概述了實現國家目標的計畫。日本在第六個科學技術創新基本計畫中提出,從2021會計年度起5年內實現政府和民間120兆日圓的研發投資,以實現5.0社會。

- 根據微軟的物聯網訊號報告,亞太地區是重要的製造業中心,該地區繼續大力採用者物聯網 (IoT)。隨著物聯網與其他技術的結合更加緊密,COVID-19 疫情正在刺激各行各業的更多投資。

晶片天線產業概況

晶片天線市場高度分散。隨著5G和物聯網的發展,市場正在迎來許多新品發表。市場的主要發展如下:

2022年9月,晶片技術公司Arm Ltd推出資料中心晶片技術,以跟上5G和物聯網資料的成長。 Arm 5G 解決方案實驗室正在與 Google Cloud、Marvell、NXP 和 Vodafone 等 5G 生態系統領導者合作,加速 Arm 上的 5G 網路建置。

2022 年 5 月,Pharrowtech 宣布完成 1,500 萬歐元(1,604 萬美元)的 A 輪資金籌措,用於開發下一代 60 GHz 無線RF收發器和天線技術。資金籌措該公司能夠加速部署其最近宣布的 60 GHz CMOS無線電頻率積體電路(RFIC) PTR1060 和相位陣列天線射頻模組 (RFM) PTM1060,用於 5G 免授權固定無線存取、無線基礎設施和消費者應用。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- 產業價值鏈分析

- COVID-19 市場影響評估

第5章 市場動態

- 市場促進因素

- 家用電子電器產品小型化

- 晶片天線在物聯網應用的使用日益增多

- 市場限制

- 晶片天線的性能效率和範圍有限

第6章 市場細分

- 類型

- 介電晶片

- 陶瓷多層晶片

- 最終用戶產業

- 車

- 消費性電子產品

- 醫療

- 資訊科技/通訊

- 其他

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 其他

第7章 競爭格局

- 公司簡介

- Vishay Intertechnology, Inc.

- Yageo Corporation

- Johanson Technology, Inc.

- Fractus SA

- Antenova Ltd.

- Partron Co., Ltd.

- Inpaq Technology Co., Ltd.

- Mitsubishi Materials Corporation

- Taoglas Limited

- Fractus Antennas SL

第8章投資分析

第9章 市場機會與未來趨勢

The Chip Antenna Market is expected to register a CAGR of 11.91% during the forecast period.

Key Highlights

- The market is expected to be further augmented by the exponential growth of mobile data traffic, driven by data-capable devices and high-bandwidth applications (APPs). According to Ericsson, the total number of 5G subscriptions stood at approximately 664.18 million in 2021 and is anticipated to reach 4.39 billion by 2027.

- Moreover, according to a survey by Honeywell, 67% of manufacturing executives are going forward with their plans to invest in data analytics. 63% believe that it enables well-informed decisions in real-time, 57% believe that it limits waste, and 56% say it helps predict the risk of downtime (56%). This is expected to further aid the future growth of Internet of Things (IoT) in the manufacturing sector.

- Rapid developments are being witnessed in the market to support 5G communication chip solutions. For instance, recently, Samsung Electronics introduced its latest 8nm RF solution development which will provide up to a 35% increase in power efficiency and a 35% decrease in a logic area compared to 14nm RF.

- Due to the market's rapid growth, a number of vendors are receiving funding from national and international players for product development and innovation. For instance, in May 2022, Pharrowtech announced a series A funding of EUR 15 million to continue developing next-generation 60 GHz wireless RF transceivers and antenna technology.

- The COVID-19 pandemic outbreak affected the market in multiple ways. The chip production foundries are gradually recovering from the impact of the pandemic in major manufacturing centers like China. Moreover, the rapid deployment of 5G is expected to aid the market growth of the market studied. Further, 5G's emergence as an independent network and the rapid expansion of 5G smartphones from flagship-only models to the mid-range segment is expected to aid market growth.

Chip Antenna Market Trends

Increasing use of Chip Antennas in IoT Applications

- The growing deployment of IoT across end-user segments is expected to act as a significant driver of the market. IoT in manufacturing is being deployed to facilitate the production flow in a plant, as IoT devices automatically monitor development cycles and manage warehouses and inventories. It is one reason investment in IoT devices has skyrocketed over the past few decades. By 2025, the number of connected devices in the automation sector is expected to increase by 50.

- The increasing need for data analysis and analytics integration is expected to propel the utilization of the Internet of Things market in retail. Additionally, owing to the ease of shopping and smartphone penetration, the use of e-commerce platforms is rapidly increasing, which is likely to boost the market.

- For instance, Amazon's first store in Seattle, the United States, is incorporated with a self-checkout service and mobile payment methods available on Android and iOS systems. The store is equipped with cameras, sensors, and RFID readers, to identify shoppers and products and use computer vision, deep learning algorithms, and the sensor fusion.

- According to a report from IoT for All, the market for the IoT is anticapted to grow 18% to 14.4 billion active connections, whereas it is expected to reach approximately 27 billion connected IoT devices by 2025.

- The proliferation of 5G is also expected to aid the growth of IoT across significant application areas. According to Small Cell Forum, the total installed base of 5G in 2025 is predicted to be 13.1 million, over one-third of the total in use. Further, as per Cisco Systems, the number of connected wearable devices is anticipated to reach more than one billion by 2022.

Asia-Pacific is Expected to be the Fastest Growing Market during the Forecast Period

- The Asia-Pacific region accounts for a significant expenditure in IoT technology, with South Korea and Singapore expected to be among the top global markets to adopt IoT chips. As per the data from the Organization for Economic Co-operation and Development, South Korea is the first country in the world to have more things connected to the Internet per habitat, followed by Denmark and Switzerland.

- Further, India's vision to transform 100 cities into smart cities is expected to create a huge demand for IoT devices in smart homes and the automotive sector. This is also an essential factor contributing to the market growth in this region.

- The Japanese government has announced the Integrated Innovative Strategy 2022, which lays out the plan to achieve the country's goals. In the 6th Science, Technology and Innovation Basic Plan, Japan set the goal of reaching 120 trillion yen in R&D investment between the public and private sectors over the five years from fiscal 2021, aiming to realize Society 5.0.

- According to a Microsoft IoT Signals report, the Asia-Pacific region has been a prominent manufacturing base, and the sector continues to be a strong adopter of the Internet of Things (IoT). The COVID-19 pandemic has driven even more significant investment across different industries as IoT becomes more tightly integrated with other technologies.

Chip Antenna Industry Overview

The chip antenna market is highly fragmented. The market is witnessing a number of market launches due to the evolution of 5G and IoT. Some of the key developments in the market are as follows:-

In September 2022, Arm Ltd, a chip technology firm, launched its data center chip technology to meet the growth of data from 5G and IoT. Arm 5G Solutions Lab is working with leaders in the 5G ecosystem, like Google Cloud, Marvell, NXP, and Vodafone, to accelerate 5G networks on Arm.

In May 2022, Pharrowtech announced the closure of its EUR 15 million (USD 16.04 million) series A funding round for the development of next-generation 60GHz wireless RF transceiver and antenna technology. The funding will allow the company to accelerate deployment of its recently launched 60 GHz CMOS Radio-Frequency Integrated Circuit (RFIC) PTR1060, and phased array antenna Radio-Frequency Module (RFM) PTM1060 for 5G unlicensed fixed wireless access, wireless infrastructure, and consumer applications.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Miniaturization in Consumer Electronics

- 5.1.2 Increasing Use of Chip Antennas in IoT Applications

- 5.2 Market Restraints

- 5.2.1 Limited Performance Efficiency and Range of Chip Antenna

6 MARKET SEGMENTATION

- 6.1 Type

- 6.1.1 Dielectric Chip

- 6.1.2 Ceramic Multilayer Chip

- 6.2 End-user Industry

- 6.2.1 Automotive

- 6.2.2 Consumer Electronics

- 6.2.3 Healthcare

- 6.2.4 IT & Telecommunication

- 6.2.5 Other End-User Industries

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Vishay Intertechnology, Inc.

- 7.1.2 Yageo Corporation

- 7.1.3 Johanson Technology, Inc.

- 7.1.4 Fractus S.A.

- 7.1.5 Antenova Ltd.

- 7.1.6 Partron Co., Ltd.

- 7.1.7 Inpaq Technology Co., Ltd.

- 7.1.8 Mitsubishi Materials Corporation

- 7.1.9 Taoglas Limited

- 7.1.10 Fractus Antennas S.L