|

市場調查報告書

商品編碼

1643098

晶片貼裝設備:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Die Attach Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

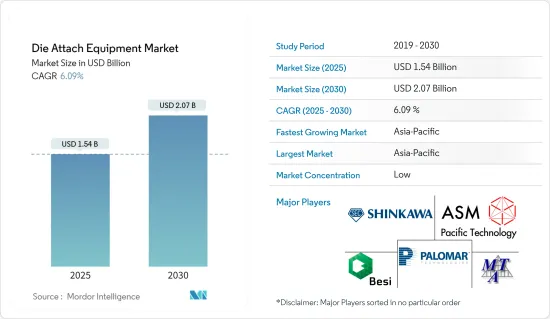

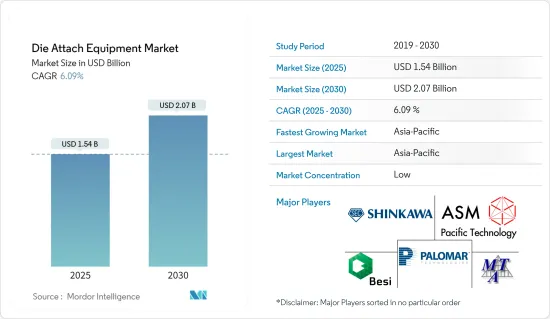

預計 2025 年晶片貼裝設備市場規模為 15.4 億美元,到 2030 年將達到 20.7 億美元,預測期內(2025-2030 年)的複合年成長率為 6.09%。

物聯網 (IoT) 設備中堆疊晶粒技術的日益廣泛使用推動了成長。最近的趨勢表明,由於醫療、軍事、光電和無線電子等新興和成熟的應用,對混合電路的需求仍然強勁。

關鍵亮點

- C2W 混合鍵合是一種很有前景的新技術,可實現直接 Cu-Cu 鍵合,並可取代 TCB 用於 3D 堆疊記憶體和高階邏輯應用。然而,C2W 混合鍵結仍處於起步階段。預計該技術將於2022-2023年在2.5D邏輯裝置市場推出,大幅推動設備市場的成長。

- 對 AuSn 共晶晶片黏接技術的需求將推動市場發展。傳統上,晶片採用各種各樣的晶片粘接產品進行粘接,包括金屬填充的導電環氧樹脂、高鉛焊料和金矽焊料,以確保它們在設備的整個使用壽命內可靠地運行。

- 然而,發熱量不斷增加的趨勢、設備小型化的需求、RoHS和REACH的建立以及向GaAs晶片的過渡限制了傳統材料的使用。對高設備可靠性的需求促使工程師評估各種用於晶粒黏合的新材料。

- 提案的焊料預製件是共晶金錫,可用於大規模生產或在實驗室中使用 Palomar Technologies 晶片焊接機。該設備能夠完成完整的晶片黏接過程,包括高精度拾取和放置基板、共晶金錫預製件和組件、共晶晶片黏接和使用電腦控制脈衝熱台(PHS)進行脈衝熱回流焊接。

- 對分立功率元件的需求正在推動市場的發展。作為傳統電線和帶狀接頭的替代品,銅夾正變得越來越受歡迎。晶片黏接特性是分立功率元件封裝解決方案的特性。寬能能隙半導體晶粒技術(SiC 和 GaN)的採用帶來了新的創新封裝解決方案,包括銀燒結晶片黏接(材料包括環氧模塑膠和互連材料)。

- EV/HEV 應用中從分立 SiC 到 SiC 模組的逐步過渡、嵌入式晶粒封裝系統以及多晶片系統中 GaN 裝置的整合只是這些趨勢的幾個例子。這導致對分立功率元件晶片貼裝設備的需求增加。

- 然而,加工過程中的尺寸變化、使用壽命以及設備加工過程中運動部件的機械不平衡等因素可能會對設備功能構成挑戰並限制市場的發展。

晶片貼裝設備市場趨勢

LED 越來越受歡迎

- 晶片黏接材料是中功率、高功率和高功率LED 性能和可靠性的關鍵。隨著LED滲透率的不斷提高,對晶片貼裝設備的需求也日益增加。為特定的晶片結構和應用選擇合適的晶片黏合材料取決於許多考慮因素,包括封裝製程(產量和產量比率)、性能(散熱和光輸出)、可靠性(流明維持率)和成本。共晶金錫、載銀環氧樹脂、焊料、矽膠和燒結材料均已用於 LED 晶片黏合。

- 例如,SFE提供一種環氧膠粘合方法,其LED環氧固晶機的索引時間為0.2秒/週期(90%的運行率),晶片尺寸為250*250標準,並描述了透過兩個相機進行導線架識別。此軟體功能包括自動安裝水平和拾取水平教學功能。

- 此外,導電黏合劑(主要是含銀環氧樹脂)是 LED 最廣泛使用的熱晶片黏接材料(以單位數計算)。它們與現有的後處理封裝設備相容,並提供具有吸引力的性價比(通常高達 50W/mK 的熱性能以及二次回流焊接相容性)。由於它附著在裸矽上,因此它是沒有後端金屬化的晶粒的首選材料,例如矽上的 GaN。

- 此外,儘管LED市場上有許多對手和競爭者,但ASM是該市場上最突出的參與企業之一,其LED環氧樹脂高速晶片焊接機AD830在LED市場佔據主導地位。隨著越來越多的國家希望逐步淘汰傳統燈泡,LED 繼續佔據市場主導地位。根據聯合研究中心的數據,LED 營收滲透率正在上升,預計到 2025 年將達到 75.8%。這推動了晶片貼裝設備市場的需求。

- 此外,2022 年 9 月,Palomar Technologies 宣布推出其新型晶片貼片機 3880-II,該產品榮獲 2022 年軍事+航空航太電子創新獎。新機器包括可最大限度提高生產率、減少高達 95% 的編程時間並提高整體黏合機生產率的選項。

亞太地區佔據顯著的市場成長

- 亞太地區在晶片貼裝設備產業中佔有顯著的成長。全球超過 60% 的外包半導體組裝和測試(OSAT)公司總部設在亞太地區。這些 OSAT 公司在其半導體製造過程中使用晶片貼裝設備。此外,該地區的IDM(整合設備製造商)數量正在增加,預計這將很快推動市場成長。

- 在中國和台灣,包括光電子、MEMS和MOEMS在內的多種設備被用於智慧型手機、穿戴式裝置和白色家電家用電子電器等電子產品的大量生產。所有這些設備在組件組裝過程中都需要晶片貼裝設備。

- 此外,預計預測期內韓國、中國以及日本的人口老化將加速對醫療保健服務的需求,為包含 MEMS 壓力感測器的人工呼吸器、透析和血壓監測設備等提供發展空間。亞太經社會預測,到2025年,該地區60歲及以上人口數量將從目前的9.55人增加到10.64人,到2050年將增加到18.44人,佔世界人口的60%。 MEMS壓力感測器晶片貼裝設備的需求正在促進該市場的成長。

- 此外,由於政府的舉措,印度正在發展許多智慧城市,並有望採用電子解決方案來實現監控、維護和監視等目的。根據smartcities.gov.in報道,中央政府已撥款9.77億美元用於建造60個這樣的智慧城市。這導致對更多CMOS影像感測器的需求,從而進一步推動市場成長。

- 高功率雷射在切割、焊接和加工等多種應用領域中得到廣泛需求。該公司正在轉向雷射技術以利用其高性能和可靠性。雷射二極體的進步極大地增加了對處理環氧樹脂和共晶鍵合技術的設備的需求。

- 物聯網、人工智慧和 ADAS 的發展預計將進一步增加記憶體需求。因此,現在比以前更需要提高儲存晶片製造的生產率和後處理設備的可靠性。為了解決這個問題,2022 年 8 月,史丹佛大學的工程師宣布,他們將創建更有效率、更靈活的 AI 晶片,有可能將 AI 的力量帶入微型邊緣設備,有助於提高記憶體製造的吞吐量和可靠性。

晶片貼裝設備產業概況

由於本地和全球參與企業的存在,晶片貼裝設備市場競爭激烈,因此市場呈現細分化。此外,各公司都致力於透過開發和合作來提高產量和產量比率等設備性能,加劇了市場競爭。主要參與企業包括 Be Semiconductor Industries NV、ASM Pacific Technology Limited 和 Palomar Technologies Inc.

- 2022 年 10 月,Hermetic Solutions Group (HSG) 從 RHP Technologies 收購了 DiaCool 的智慧財產權。這擴大了 HSG 的產品線,並將在未來許多年為客戶提供更多選擇。 HSG 用於散熱器、晶片片和散熱器的 DiaCool 鑽石複合材料為客戶提供了比傳統層壓板和 MMC 材料更顯著的優勢。

- 2022年10月,Kulicke和Soffa贏得了多個熱壓解決方案的新訂單,並成功向主要客戶交付了其第一台助焊劑熱壓鍵合機(TCB),繼續保持其在先進LED組裝領域的地位。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 市場促進因素

- AuSn 共晶晶片黏接技術需求不斷成長

- 分立功率裝置的需求

- LED 領域強勁成長

- 市場限制

- 加工和使用壽命期間的尺寸變化和機械不平衡

- 產業價值鏈分析

- 產業吸引力-五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響評估

第5章 市場區隔

- 類型

- 晶片焊接機

- 覆晶接合機

- 連接技術

- 環氧樹脂

- 共晶

- 軟焊料

- 混合關節

- 其他連接技術

- 應用

- 記憶

- RF &MEMS

- LED

- CMOS影像感測器

- 邏輯

- 光電子學/光電

- 其他

- 地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

第6章 競爭格局

- 公司簡介

- Palomar Technologies, Inc.

- Shinkawa Ltd.

- MicroAssembly Technologies, Ltd.

- ASM Pacific Technology Limited

- Be Semiconductor Industries NV

- Kulicke and Soffa Industries, Inc.

- Dr. Tresky AG

- Fasford Technology Co Ltd.

- Inseto UK Limited

- Anza Technology Inc.

第7章投資分析

第8章 市場機會與未來趨勢

The Die Attach Equipment Market size is estimated at USD 1.54 billion in 2025, and is expected to reach USD 2.07 billion by 2030, at a CAGR of 6.09% during the forecast period (2025-2030).

Growth is fueled by the increased use of stacked die technology in the Internet of Things (IoT) devices. In recent trends, the demand for hybrid circuits has remained strong due to emerging and existing applications in medical, military, photonics, wireless electronics, etc.

Key Highlights

- C2W hybrid bonding is a promising emerging technology that can enable direct Cu- Cu bonding and replace TCB for 3D stacked memory and high-end logic applications. However, C2W hybrid bonding is still in its early stages level. It is expected to hit the market in 2022/23 for logic devices with 2.5D structures, significantly assisting the equipment market's growth.

- The demand for the AuSn Eutectic Die-Attach technique drives the market. Traditionally, various die-attach products, which include metal-filled conductive epoxies, high lead-containing solders, and gold-silicon solders, were sufficient to mount the chip and have it perform reliably for the life of the device.

- However, the trend towards increasing heat generation, demand for compact devices, enactment of RoHS and REACH legislation, and the transition to GaAs chips limited the use of conventional materials. The demand for high device reliability has led engineers to evaluate various new materials for their die attachment.

- The suggested solder preforms are eutectic gold-tin and can be implemented for high volume or lab quantity adoption using a Palomar Technologies' die bonder. This equipment can handle the complete die-attach process, including high-accuracy pick-and-place of substrates, eutectic gold-tin preforms, and components; eutectic die-attach; and pulsed-heat reflow using a computer-controlled Pulse Heat Stage (PHS).

- The demand for discrete power devices drives the market. Copper clips are becoming increasingly popular as an alternative to traditional wire and ribbon bonding. Die-attach functionality is a feature of packaging solutions for discrete power components. The adoption of wide-bandgap semiconductor die technologies (SiC and GaN) brings new innovative packaging solutions, including silver sintering die-attach (materials include epoxy molding compounds and interconnection materials).

- The progressive transition from discrete SiC towards SiC modules in EV/HEV applications, the embedded-die packaged systems, and the integration of GaN devices in multichip systems are just a few examples of such a trend. This factor enhances the demand for the die attaches equipment for the discrete power devices.

- However, primarily dimensional changes during processing and service life and mechanical unbalance of moving parts during processing through equipment challenges the equipment's functionality which could restrain the market.

Die Attach Equipment Market Trends

LED to Witness Significant Growth

- Die attach material is key in the performance and reliability of mid, high, and super-high power LEDs. The demand for die-attach equipment is increasing with an increasing LED penetration rate. The selection of suitable die-attach material for a particular chip structure and application depends on various considerations, which include the packaging process (throughput and yield), performance (thermal dissipation output and light output), reliability (lumen maintenance), and cost. Eutectic gold-tin, silver-filled epoxies, solder, silicones, and sintered materials have all been used for LED die attach.

- For instance, SFE provides an Epoxy Adhesive bonding method where its LED Epoxy Die Bonder machine features an index time of 0.2 Sec /Cycle (90 Percent Rate of Operation) with a chip size of 250 * 250 standards, providing lead frame recognition through 2 Cameras. Its software function provides auto mount level & pick-up level teaching functions.

- Further, conductive adhesives (mostly silver-filled epoxies) constitute LEDs' most extensive thermal die-attach materials (by unit number). They are compatible with existing back-end packaging equipment and provide an attractive cost/performance balance (typically up to 50 W/mK thermals with secondary reflow compatibility). As they stick to bare silicon, they are the most preferred material for dies without back-end metallization like GaN on silicon.

- Further, in the LED market, there are a lot of rivals or competitors, and ASM is one of the prominent players in this market, and its LED Epoxy High speed die bonder AD830 dominates in the LED market. As more and more countries are getting close to phasing out conventional bulbs, LEDs are continuing their march to the top of the market. According to Joint Research Center, The penetration rate of LEDs based on sales is raising and is expected to reach a penetration rate of 75.8 % by 2025. This factor enhances the demand for the die attaches equipment market.

- Furthermore, in September 2022, Palomar Technologies launched a new 3880-II die-bonder, which won the 2022 military+Aerospace electronics Innovation Award. This new machine includes options to maximize productivity, reduce programming time by up to 95% and improve overall bonder productivity.

Asia-Pacific Accounts for Significant Market Growth

- Asia-Pacific accounted for the significant growth of the die-attach equipment industry. More than 60% of OSAT (Outsourced Semiconductor Assembly And Test) players present across the world have their headquarters in the APAC region. These OSAT companies use die-attach equipment in the semiconductor fabrication process. Additionally, an increasing number of IDMs (Integrated Device Manufacturers) in the region is expected to boost the market growth shortly.

- In China and Taiwan, the mass production of electronic products, including smartphones, wearables, and white goods, uses several devices, such as optoelectronics, MEMS, and MOEMS. All these devices require die-attach equipment in the assembly process of these components.

- Further, South Korea, China, and mostly Japan's old age population are anticipated to accelerate the need for healthcare services during the forecast period, thus providing scope for devices, such as ventilators, dialysis, and blood pressure monitoring devices constituting MEMS pressure sensors. ESCAP estimates that the geriatric population in the region, aged 60 years and older, could penetrate at the rate of 10.64 by 2025 with 9.55 in the current year and raise to 18.44 by 2050, which represent 60 percent of the worlds population. The instance caters to the growth of the market due to the demand for die-attach equipment for MEMS pressure sensor.

- Furthermore, India is also witnessing growth in a number of smart cities, due to government initiatives and are expected to incorporate electronic solutions for purposes, such as surveillance, maintenance, monitoring, etc. According to smartcities.gov.in, the central government has allotted USD 977 million into the development of 60 such smart cities. This leads to the demand for a higher number of CMOS image sensors, which further supports the market growth.

- High Power lasers are finding extensive demand in industrial sectors for a wide range of applications, including cutting, welding, and fabrication. Companies are moving towards Laser technologies to take advantage of high performance and reliability. The advancement in laser diode significantly increases the demand for equipment, which processes the technique of Epoxy and Eutectic bonding.

- Further memory demand is expected to increase with the development of IoT, AI, and ADAS. As a result, productivity improvement in memory chip manufacturing and improvement of post-processing device reliability will be required more than in the past. To address this, in August 2022, Stanford engineers created a more efficient and flexible AI chip, which could bring the power of AI into tiny edge devices that contributes to improved throughput and reliability in memory production.

Die Attach Equipment Industry Overview

The die-attach equipment market is fragmented as the presence of local and global players penetrates the intense rivalry in the market. Further, players are focusing on improving their equipment performance in terms of throughput and yield through development and partnership, making the market more competitive. Key players are Be Semiconductor Industries N.V., ASM Pacific Technology Limited, Palomar Technologies Inc, etc. Recent developments in the market are -

- In October 2022, Hermetic Solutions Group (HSG) acquired the Intellectual property of DiaCool, from RHP Technologies. This expands HSG's product lineup and offers customers significantly more options for many years. HSG's DiaCool diamond composite material for heat sinks, die tabs, and heat spreaders provide customers with significant advantages over conventional laminate or MMC materials.

- In October 2022, Kulicke and Soffa received multiple new purchase orders for its thermo-compression solution and successfully shipped its first Fluxless Thermo-Compression Bonder (TCB) to a key customer and continues its position in the advanced LED Assembly.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Demand of AuSn Eutectic Die-Attach Technology

- 4.2.2 Demand of Discrete Power Devices

- 4.2.3 LED Segment to Witness Significant Growth

- 4.3 Market Restraints

- 4.3.1 Dimensional Changes During Processing and Service Life and Mechanical Unbalance

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assessment of Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Die Bonder

- 5.1.2 Flip Chip Bonder

- 5.2 Bonding Technique

- 5.2.1 Epoxy

- 5.2.2 Eutectic

- 5.2.3 Soft Solder

- 5.2.4 Hybrid Bonding

- 5.2.5 Other Bonding Techniques

- 5.3 Application

- 5.3.1 Memory

- 5.3.2 RF & MEMS

- 5.3.3 LED

- 5.3.4 CMOS Image Sensor

- 5.3.5 Logic

- 5.3.6 Optoelectronics / Photonics

- 5.3.7 Other Applications

- 5.4 Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia

- 5.4.4 Australia and New Zealand

- 5.4.5 Latin America

- 5.4.6 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Palomar Technologies, Inc.

- 6.1.2 Shinkawa Ltd.

- 6.1.3 MicroAssembly Technologies, Ltd.

- 6.1.4 ASM Pacific Technology Limited

- 6.1.5 Be Semiconductor Industries N.V.

- 6.1.6 Kulicke and Soffa Industries, Inc.

- 6.1.7 Dr. Tresky AG

- 6.1.8 Fasford Technology Co Ltd.

- 6.1.9 Inseto UK Limited

- 6.1.10 Anza Technology Inc.