|

市場調查報告書

商品編碼

1643082

銷售支援平台-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Sales Enablement Platform - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

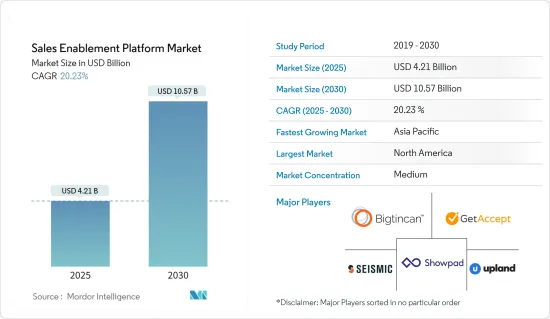

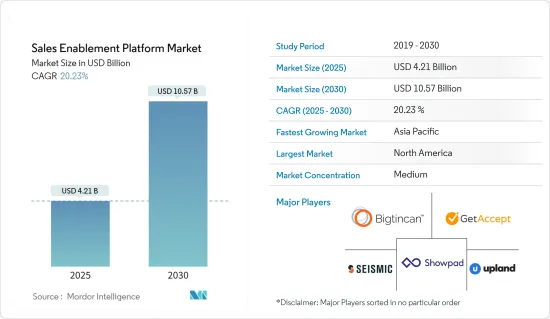

銷售隊伍自動化平台市場規模預計在 2025 年為 42.1 億美元,預計到 2030 年將達到 105.7 億美元,預測期內(2025-2030 年)的複合年成長率為 20.23%。

各行各業的組織都採用銷售支援平台來幫助其銷售和行銷團隊提高各個環節的效率,包括銷售溝通、內容管理、入職和培訓。

關鍵亮點

- 內部和外部的市場競爭推動了中型市場公司對銷售支援的需求。銷售支援將行銷和銷售業務、流程、內容、角色和職責與技術和系統結合。根據賣家的成熟度,這些平台設想提供從產品級資訊到高級分析的功能,以實現卓越的潛在客戶轉換率。

- 銷售支援工具結合了智慧內容管理、培訓、情境指導、客戶參與和可操作的分析,幫助負責人找到合適的內容,將其發送給潛在客戶,並追蹤潛在客戶對內容的參與度。例如,MindTickle 提供了一個銷售準備平台,使負責人能夠無論身在何處都能開發、指導和提高他們的績效,從而將銷售下滑率降低 60%。

- 近年來,數位銷售室(DSR)越來越受歡迎。此外,人們對 DSR 的認知不斷提高,預計會帶來大規模的採用。數位銷售室預計將由銷售支援平台供應商透過持久的微型網站提供,用於內部和外部協作、嵌入式視訊會議、參與、情緒和情感分析。 Showpad 已朝著實現這一願景邁進了一大步,其功能包括共享空間、用於買家和賣家協作的專用微型網站,以及業界首個對 3D 模型和擴增實境的支持,以實現更具沉浸感的產品演示。

- 由於生產暫時停止,新冠肺炎疫情導致世界各地經濟放緩。因此,包括銷售支援市場在內的所有產業都會受到涓滴效應的影響。 COVID-19 危機比以往任何時候都更加暴露了銷售支援的挑戰和機會。為了在這些關鍵時期生存,銷售支援需要與數位轉型策略結合。從長遠來看,將所有內部銷售流程與相關的客戶旅程結合對於建立有效的銷售支援基礎至關重要。

- 為了在疫情期間維持業務運轉,全球許多雇主在 2020 年開始轉向遠距工作。雖然在家工作最初是出於健康和安全方面的考慮,但許多員工都喜歡這種節奏的變化。例如,GoodHire 的「2021 年遠距工作狀況:美國勞動力調查」調查了 3,500 名工人,結果發現 68% 的受訪者更喜歡遠距工作而不是在辦公室工作。

銷售支援平台市場趨勢

消費品和零售業將顯著成長

- 行動裝置的興起和可靠 WiFi 的普及徹底改變了買賣雙方的關係。思科預測,到2030年,全球連網設備數量將達到5,000億。連網型設備的快速成長催生了多樣化和更深層的分銷管道,為銷售自動化平台市場創造了機會。

- 由於這種全球轉變,買家現在可以控制他們的購買旅程,並且在聯繫負責人之前會花費大量時間在線研究產品或服務的每一個細微差別。因此,買家可能比賣家自己了解更多資訊,負責人必須提供一些買家無法透過 Google搜尋輕易找到的東西。消費品和零售業面臨的上述挑戰使得市場迫切需要銷售支援平台。

- 由於負面的客戶經驗,線上零售商面臨失去用戶的風險。這就是為什麼世界各地的零售商都在開發銷售支援策略,以便他們能夠透過個人化內容瞄準客戶。銷售支援平台幫助零售商透過數位管道吸引和吸引客戶,並為他們提供全通路體驗。

- 在新興市場中,越來越多提供產品及強化銷售支援的新興企業進入市場,市場開發不斷進步。例如,2021年12月,跨領域的AR整合視訊購物平台ShopConnect宣布已資金籌措,為零售商提供線上線下一體化購物服務。

- 然而,不同存取管道之間不一致的使用者體驗可能會對預測期內銷售自動化平台市場的成長產生負面影響。

北美占主要佔有率

- 北美等市場正在接近成熟,在如此競爭激烈的環境中銷售需要一個能夠幫助公司實施、擴展和執行其銷售支援策略的銷售支援平台。銷售流程自動化以提高交易成交率估計是美國銷售支援平台市場的關鍵驅動力。同時,採用雲端基礎的銷售支援平台從資訊中獲取可操作的見解預計將推動加拿大市場的成長。

- 此外,各組織也提高人們對這項技術的認知。例如,2022年3月,為住宅承包商提供銷售支援軟體的公司Leap宣布收購為住宅承包商提供工作流程和CRM產品的JobProgress。此次收購將為北美超過 2,400 家住宅承包商提供服務,滿足大型和小型承包商的需求。

- 此外,該地區還擁有積極投資新產品開發的知名市場參與企業。例如,2022年1月,銷售支援平台Highspot在F輪融資中籌集了2.48億美元。包括 B Capital Group 和 D1 Capital Partners 在內的新投資者主導了此輪融資,現有投資者也參與其中。參與者包括 ICONIQ Growth、Madrona Venture Group、Salesforce Ventures、Sapphire 和 Tiger Global Management。該公司聲稱,這項投資將促進國際擴張、產品開發和就業。

- 美國銷售支援平台市場主要受銷售流程自動化推動,以提高轉換率。在加拿大,市場成長是由採用雲端基礎的銷售支援平台來從資訊中獲取可操作的見解所推動的。

銷售支援平台產業概覽

近年來,銷售支援平台市場競爭日益激烈。擁有壓倒性市場佔有率的大公司正致力於擴大海外基本客群。這些公司正在利用戰略合作計劃來增加市場佔有率和盈利。

- 2022 年 6 月 - 獨立投資資料管理和分發公司 APX Stream, Inc. 宣布與關鍵支援供應商 Seismic 建立合作夥伴關係,為資產管理者提供無縫的資料提交管道和自動生成行銷資料。 Seismic Enablement Cloud 協助各種規模的企業吸引客戶、增強團隊能力並推動收益成長。

- 2021 年 1 月 - 數位轉型雲端基礎工具供應商 Upland Software, Inc. 宣布收購 Second Street Media, Inc.,後者提供受眾參與雲端軟體平台,用於建立促銷和電子郵件宣傳活動,從而增加收益、客戶資料庫和消費者參與度。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭對手之間的競爭

- 替代品的威脅

- COVID-19 工業影響評估

第5章 市場動態

- 市場促進因素

- 改善內部業務流程的需求日益增加

- 利用尖端技術擴大銷售力度

- 市場限制

- 不同訪問管道的使用者體驗不一致

第6章 市場細分

- 成分

- 平台

- 服務

- 組織規模

- 大型企業

- 中小型企業

- 實施形式

- 雲端基礎

- 本地

- 最終用戶產業

- BFSI

- 消費品和零售

- 資訊科技/通訊

- 媒體娛樂

- 醫學生命科學

- 製造業

- 其他

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- GetAccept Inc.

- Bigtincan Holdings

- Upland Software

- Showpad

- Seismic Software Inc.

- Outreach

- Accent Technologies

- ClearSlide

- Brainshark

- Quark

- Highspot, Inc

- DocSend Inc.

- Qorus Software Ltd

- Pitcher

- Mediafly

- Rallyware Inc.

- MindTickle

- Qstream Inc.

第8章投資分析

第9章:市場的未來

The Sales Enablement Platform Market size is estimated at USD 4.21 billion in 2025, and is expected to reach USD 10.57 billion by 2030, at a CAGR of 20.23% during the forecast period (2025-2030).

Organizations across industries are adopting the sales enablement platform, enabling their sales and marketing teams to enhance their efficiencies in various areas, including sales communication, content management, onboarding, and training.

Key Highlights

- Internal and external market/competitive forces are driving the need for Sales Enablement within Mid-sized Enterprises as it aligns marketing and sales operations, processes, content, roles, and responsibilities with technology and systems. Depending on the seller's maturity, these platforms envisage enablement right from product-level information to advanced analytics, enabling superior lead conversion ratios.

- Sales enablement tools ensure that any sales representative can find the appropriate content, submit it to prospects, and track prospect engagement within that piece of content by combining intelligent content management, training, contextual guidance, customer engagement, and actionable analytics. For instance, MindTickle provides a sales readiness platform to gain the ability to develop, coach, and improve the performance of sales representatives independent of their location and reduces sales ramp by 60%.

- In recent years, digital sales rooms (DSRs) are gaining traction. Further, it is expected that an increase in awareness regarding the DSRs would result in their significant adoption. They are expected to be offered by sales enablement platform vendors through persistent microsites for internal or external collaboration, embedded video conferencing, and engagement, sentiment, and emotional analysis. Showpad has already made headway in delivering on this vision with its Shared Spaces, dedicated microsites for buyer-seller collaboration, and as the first in the industry to support 3D models and augmented reality for more immersive product demonstrations.

- Due to the outbreak of COVID-19, there is a slowdown across various world economies due to a temporary halt in production. Thus, every industry has a trickle-down effect, including the sales enablement market. Triggered by the COVID19 crisis, sales enablement challenges and opportunities have become more apparent than ever. To survive in such critical times, sales enablement has to be integrated with the digital transformation strategy. In the long run, aligning all internal selling processes to relevant customer journeys is essential to implement a foundation for effective sales enablement.

- Many employers globally began transitioning to remote work in 2020 to keep operations running amid the pandemic. While working from home was initially a result of health and safety concerns, many employees enjoyed the change of pace. For instance, according to the State Of Remote Work In 2021: A Survey Of The American Workforce, by GoodHire, based on 3500 workers, 68% of respondents prefer to work remotely over in-office work.

Sales Enablement Platform Market Trends

Consumer Goods and Retail Industry to Exhibit Significant Growth

- The rise of mobile devices and access to reliable WiFi has turned the buyer/seller relationship inside out. Cisco estimates that the number of connected devices worldwide will reach 500 billion by 2030. This exponential rise in connected devices has created varied and deeper sales channels, thus creating opportunities for the sales enablement platform market.

- As a result of this massive global shift, buyers are now in control of the buyer's journey and spend a considerable amount of time researching every nuance of a product or service online before reaching out to a salesperson. Therefore, buyers may be more informed than the seller themselves, meaning salespeople must deliver something that buyers can't easily find through a quick Google search. Challenges in consumer goods and retail, such as those above, create a dire need for sales enablement platforms in the market.

- Online retailers risk losing out on their users because of negative customer experience. Hence, retailers worldwide are formulating sales enablement strategies that will help them target customers with personalized content. The sales enablement platform helps retailers attract and engage customers on different digital channels to deliver an Omni-channel experience to their customers.

- The studied market is witnessing developments as more and more start-ups are entering the market with enhanced offerings for sales enablement. For instance, In December 2021, ShopConnect, a sector-agnostic AR-integrated video shopping platform, announced that it had raised funds to offer Integrated Online And Offline Shopping Services For Retailers.

- However, the inconsistent user experience across different access channels may negatively influence the sales enablement platform market's growth during the forecast period.

North America to Hold Major Share

- Markets, such as North America, have been closer to maturing, and sales in such highly competitive environments need sales enablement platforms to help companies implement, scale, and execute their sales enablement strategies. Automating the sales process to improve the deal closure rate is estimated to be the primary driver for the US sales enablement platform market. In contrast, the deployment of a cloud-based sales enablement platform to get actionable insights from information is expected to fuel Canada's market growth.

- Also, various organizations have gained awareness regarding technology. For instance, in March 2022, Leap, a home contractor sales enablement software provider, announced the acquisition of JobProgress, a workflow and CRM product for home contractors. The acquisition will serve over 2,400 home contractors in North America, meeting the need of both large and small contractors.

- Further, the region consists of prominent market players who actively invest in developing their products with new launches. For instance, in January 2022, Highspot, a sales enablement platform provider, raised USD 248 million in Series F funding. New investors, like B Capital Group and D1 Capital Partners, led the round with participation from existing investors: ICONIQ Growth, Madrona Venture Group, Salesforce Ventures, Sapphire, and Tiger Global Management. The investment would fuel international expansion, product development, and hiring, as claimed by the company.

- Automating the sales process to improve the deal closure rate is the main driver for the United States sales enablement platform market. The deployment of a cloud-based sales enablement platform to get actionable insights from information is to fuel market growth in Canada.

Sales Enablement Platform Industry Overview

The sales enablement platform market has gained a competitive edge in recent years. With a prominent share in the market, major players are focusing on expanding their customer base across foreign countries. These companies leverage strategic collaborative initiatives to increase their market share and profitability.

- June 2022 - APX Stream, Inc., an independent investment data management and distribution company, has announced a partnership with Seismic, a significant enablement provider, to offer asset managers a seamless pipeline for data submission and automated marketing collateral generation. The Seismic Enablement Cloud helps companies of all sizes engage customers, allow teams, and ignite revenue growth.

- January 2021 - Upland Software, Inc., a provider of cloud-based tools for digital transformation, announced the acquisition of Second Street Media, Inc., an audience engagement cloud software platform to build promotions and email campaigns that grow revenue, customer databases, and consumer engagement.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Assessment of Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Need to Improve the Internal Business Process

- 5.1.2 Scaling Sales Efforts With the Help of Advanced Technology

- 5.2 Market Restraints

- 5.2.1 Inconsistent User Experience Across Various Access Channels

6 MARKET SEGMENTATION

- 6.1 Component

- 6.1.1 Platform

- 6.1.2 Services

- 6.2 Organization Size

- 6.2.1 Large Enterprises

- 6.2.2 Small and Medium-Sized Enterprises

- 6.3 Deployment Mode

- 6.3.1 Cloud-based

- 6.3.2 On-premises

- 6.4 End-user Industry

- 6.4.1 BFSI

- 6.4.2 Consumer Goods and Retail

- 6.4.3 IT and Telecom

- 6.4.4 Media and Entertainment

- 6.4.5 Healthcare and Life Sciences

- 6.4.6 Manufacturing

- 6.4.7 Other End-user Industries

- 6.5 Geography

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Asia-Pacific

- 6.5.4 Latin America

- 6.5.5 Middle-East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 GetAccept Inc.

- 7.1.2 Bigtincan Holdings

- 7.1.3 Upland Software

- 7.1.4 Showpad

- 7.1.5 Seismic Software Inc.

- 7.1.6 Outreach

- 7.1.7 Accent Technologies

- 7.1.8 ClearSlide

- 7.1.9 Brainshark

- 7.1.10 Quark

- 7.1.11 Highspot, Inc

- 7.1.12 DocSend Inc.

- 7.1.13 Qorus Software Ltd

- 7.1.14 Pitcher

- 7.1.15 Mediafly

- 7.1.16 Rallyware Inc.

- 7.1.17 MindTickle

- 7.1.18 Qstream Inc.