|

市場調查報告書

商品編碼

1643054

石油和天然氣流量電腦 -市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Flow Computer Oil Gas - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

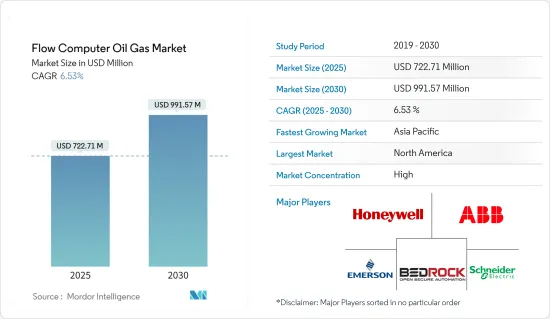

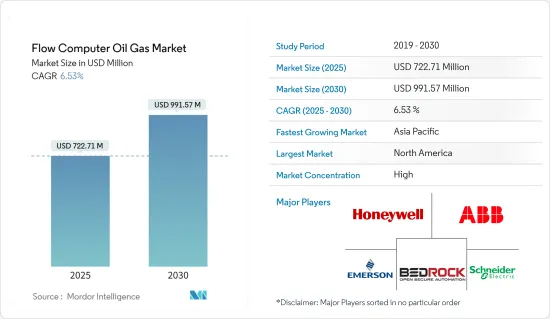

預計 2025 年石油和天然氣流量電腦市場規模將達到 7.2271 億美元,到 2030 年將達到 9.9157 億美元,預測期內(2025-2030 年)的複合年成長率為 6.53%。

流量電腦的整體功能是使用行業標準演算法來計算和記錄天然氣或多種碳氫化合物通過管道分段時的流速。這些儀表包括但不限於孔板儀表、超音波儀表、線性儀表和科氏儀表。典型的孔板測量應用需要一個差壓變送器、一個靜壓感測器和一個溫度探頭。

關鍵亮點

- 傳統的油氣生產田設計是每個墊片有一口或兩口井。相較之下,現代生產井墊片設計整合了許多井,每個井都生產石油、天然氣和水。過去,井口和設備控制位於不同的位置,但現在許多站點都在同一個地方 - 井墊片進行控制。現代石油和天然氣田的經濟性要求將測量和控制集中在一個地方。

- 井口的集中增加了對流量電腦的需求,該流量電腦由複雜的控制演算法支持,並能夠為多個用戶提供即時和歷史資料。隨著越來越多的用戶發現更好的資料分析可以帶來競爭優勢和生產力提升,以及收集、儲存、處理和傳輸資料的要求,對高科技流量電腦的需求日益增加。

- 許多石油和天然氣行業的參與企業都在致力於開發一個具有整合測量和控制、邊緣運算、先進連接和固有網路安全的強大單一平台。這項因素正在擴大流量電腦的處理能力。

- 如果有人未經未授權存取石油和天然氣公司的基礎設施,公司面臨的最大風險是破壞/關閉、設備損壞、生產中斷、公共產業中斷、產品品質、未偵測到的洩漏、違規、非法管道竊聽和安全違規。具體方法包括 DNS 劫持、攻擊網路郵件或企業 VPN 伺服器,甚至抓取公開資訊以獲取資料,試圖勒索駭客洩露通訊或找到一種方法來維持在企業網路上的存在以進行間諜活動。

- 新冠疫情導致美國和其他非歐佩克國家的油氣產業供應成長放緩。國際能源總署(IEA)的一項研究顯示,預計2020年全球石油需求將萎縮。國際能源總署曾預測,由於新冠疫情導致全球大面積停產,對經濟和出行造成影響,2020 年原油日需求量可能從 2019 年的 1.001 億桶降至 9,170 萬桶。

石油和天然氣流量電腦市場趨勢

流量電腦不斷演進的資料運算能力

- 對於石油和天然氣行業,隨著許多參與企業開發出具有整合測量和控制、邊緣運算、先進連接和固有網路安全的單一、強大的平台,流量電腦功能得到了擴展。

- 許多參與企業,例如 Quorum,已經提供了整合解決方案,可滿足價值鏈上游、中游和下游環節的核心處理需求。 Quorum 為超過 75% 的美國石油和天然氣生產商提供軟體平台。

- 新型流量計和舊技術流量計的進一步產品改進也增強了此類系統的資料收集能力。渦流和渦輪供應商現在開始提供使用兩個感測器同時校準的雙流量計。 FCI 擴展了其自我調整感測器技術 (AST),以提供 ST80 系列熱感質量流量計,從而提高了製程工業中空氣和氣體流量測量的可調範圍、準確性、長壽命和可靠性。

- 這些感測器的採用為流量計的內部和外部應用開闢了新的可能性。例如,透過虛擬和擴增實境功能進行預測性維護可以實現遠端維護和技術支持,從而有可能降低日常營運中流量測量的成本。

- 這些感測器的發佈為流量電腦的外部和內部應用開闢了新的可能性。例如,預測性維護和虛擬與擴增實境功能可以實現遠端維護和技術支持,從而降低日常業務中的流量測量成本。

北美佔有最大市場佔有率

- 北美是世界主要石油和天然氣生產國之一。根據美國能源資訊署(EIA)的數據,2020 年,美國石油產量為 1,840 萬桶/日(MMb/d),消耗量約 1,812 萬桶/日。此外,出口量為851萬桶/日,進口量為786萬桶/日。

- 政府的支持也推動了石油和天然氣行業流量測量設備的成長,在推動流量電腦市場方面發揮了關鍵作用。例如,美國安全與環境執法局 (BSEE) 的直接最終規則於 2021 年 2 月底生效。

- 根據美國運輸部統計,管道總長度超過 260 萬英里,每年輸送 1 億立方英尺的天然氣和數千億噸石油。

- 如此龐大的管網需要設立天然氣計量站,從而推動超音波流量計、孔板流量計和其他流量計等流量測量解決方案的需求。

- 該地區推出的新型流量電腦適合典型的 SCADA 流程。例如,艾默生電氣的FB1000和FB2000油氣流量電腦可以與SCADA和其他現場設備整合,以加速部署並最大限度地減少現場時間。

石油和天然氣流量電腦產業概況

石油和天然氣流量電腦市場的競爭格局中等集中,少數幾家參與企業佔據市場主導地位,例如 ABB 有限公司、霍尼韋爾國際公司和施耐德電氣 SE。近期市場趨勢如下:

- 2020 年 2 月 - Bedrock Automation 將流量電腦功能完全整合到其現有的 OSA 平台中。全新 OSA+Flow 系列將業界領先的 Flow-Cal 測量應用程式與 Bedrock Automation 平台的高效能、安全性和簡易性結合。

- 2021 年 2 月-Quorum 宣布與能源產業綜合規劃、執行和蘊藏量軟體供應商 Aucerna 合併,並收購 TietoEVRY 的整個石油和天然氣軟體業務。

- 2021 年 3 月-該公司宣布,猶他州天然氣公司已部署其天然氣測量軟體 FLOWCAL,實現了計劃里程碑。實施 FLOWCAL 後,測量過程按時、在預算之內完成,公司成功完成了第一個月度結帳週期。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- COVID-19 市場影響評估

第5章 市場動態

- 市場促進因素

- 對可靠流程和高科技運算系統的需求日益增加

- 流量電腦不斷發展的資料運算能力

- 市場限制

- 網路安全威脅阻礙了先進流運算系統的廣泛應用

- 油氣價格動態變化導致基礎建設投資減少

第6章 市場細分

- 按產品

- 硬體

- 軟體

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- Schneider Electric SE

- ABB Ltd.

- Honeywell International Inc.

- Emerson Electric Company

- Bedrock Automation Platforms, Inc.(Maxim Integrated Products, Inc.)

- Yokogawa Electric Corporation

- Quorum Business Solutions, Inc.

- OMNI Flow Computers, Inc.

- Dynamic Flow Computers, Inc.

- Flowmetrics Inc.

第8章投資分析

第9章:市場的未來

The Flow Computer Oil Gas Market size is estimated at USD 722.71 million in 2025, and is expected to reach USD 991.57 million by 2030, at a CAGR of 6.53% during the forecast period (2025-2030).

The overall function of a flow computer is to calculate and record the flow rate using industry-standard algorithms as natural gas and several hydrocarbons pass through a segmented section of the pipeline. These meters could be but are not limited to orifice meters, ultrasonic meters, linear meters, or Coriolis meters. A typical orifice measurement application requires a differential pressure transmitter, static pressure transducer, and temperature probe.

Key Highlights

- Traditional oil and gas production site designs had one or two wells per pad. In contrast, modern production well pad designs integrate numerous wells, each of which may produce oil, natural gas, and water. Whereas wellhead and facility controls were once performed in separate locations, many more sites perform everything at the same location: the well pad. The economics of the modern oil and gas field requires concentrating measurement and control in a single location.

- The concentration at the wellhead has increased the demand for flow computers, which are supported by sophisticated control algorithms and the ability to provide real-time and historical data to multiple users. As more and more users discover the competitive advantage and productivity improvements they can gain from better data analysis and the requirements to collect, store, process, and transmit data, increasing the demand for high-tech flow computers increases.

- The development of a rugged, single platform equipped with consolidated measurement and controls, edge computing, advanced connectivity, and intrinsic cybersecurity is being sought after by many players in the oil and gas industry. This factor has led to expanding flow computer processing capabilities.

- The most critical risks that a company will face if somebody gets unauthorized access to oil and gas companies' infrastructure are planted sabotage/shutdown, equipment damage, production disruption, utility interruption, product quality, undetected spills, compliance violation, illegal pipeline tapping, safety violation, etc. Specific tactics threaten hackers to try and compromise communications or find a way to maintain a presence in corporate networks for espionage purposes, such as DNS hijacking, attacking webmail and corporate VPN servers, or even scraping publicly available information for data.

- Due to the COVID-19 pandemic, the oil and gas industry witnessed a slowdown in supply growth in the United States and other non-OPEC countries. The global oil demand is expected to contract in 2020, according to a study by the International Energy Agency (IEA). IEA had predicted that the daily need for crude oil was likely to decrease in 2020, from 100.1 million barrels in 2019 to 91.7 million barrels in 2020, due to the economic and mobility impacts of the COVID-19 pandemic which included widespread shutdowns across the world.

Flow Computer Oil Gas Market Trends

Evolving Data Computational Capacity of Flow Computers

- The development of single, rugged platform equipped with consolidated measurement and controls, edge computing, advanced connectivity and intrinsic cyber security by many players for the oil and gas industry has led to the expansion of flow computer processing capabilities.

- Many players like Quorum are already offering integrated solutions for core processing demands across the upstream, midstream and downstream segments of the value chain. Quorum offers its software platform to more than 75% of the top oil and gas producers in the United States.

- Further product improvements in new and traditional technology flowmeters are also contributing to the data capturing ability of such systems. Vortex and turbine suppliers have now started offering flowmeters with two sensors and simultaneously calibrated dual flowmeter. FCI expanded its Adaptive Sensor Technology (AST) to offer ST80 Series Thermal Mass Flow Meter that has enhanced the rangeability, accuracy, extended service life, and reliability for process industry air/gas flow measurement.

- The introduction of these sensors have led to the possibility to create new internal and external applications for flow computeres. For instance, predictive maintenance along with virtual- and augmented-reality capabilities has the potential to enable remote maintenance and technical support thereby reducing flow measurement costs in day to day operations.

- The launch of these sensors has led to the possibility of creating new external and internal applications for flow computers. For instance, predictive maintenance and virtual- and augmented-reality capabilities can enable remote maintenance and technical support, thereby, reducing flow measurement costs in day-to-day operations.

North America to Hold the Largest Market Share

- North America is one of the significant producers of oil and gas across the globe. According to U.S. Energy Information Administration (EIA), in 2020, the United States produced 18.40 million barrels per day (MMb/d) of petroleum and consumed about 18.12 MMb/d. In addition, the country exported 8.51 MMb/d and imported about 7.86 MMb/d of petroleum.

- The government's support is also triggering the growth in the flow measurement devices in the oil and gas industry, which plays a significant role in driving the market for flow computers. For instance, the Bureau of Safety and Environment Enforcement (BSEE) direct final rule came into effect at the end of February 2021.

- Also, according to the United States Department of Transportation, there are more than 2.6 million miles of pipeline that delivers million cubic feet of natural gas and hundreds of billions of tons of petroleum every year.

- Such a vast network of pipelines requires gas metering stations raising the demand for flow metering solutions such as ultrasonic, orifice, and other flow meters.

- The new flow computers launched in the region are conducive to the typical SCADA processes. For instance, the FB1000 and FB2000 flow computers for oil and gas offered by Emerson Electric can be integrated with SCADA and other field devices to accelerate deployment and minimize the time in the field.

Flow Computer Oil Gas Industry Overview

The competitive landscape for the Flow Computer in the Oil and Gas Market is moderately consolidated, with few players like ABB Ltd, Honeywell International Inc., Schneider Electric SE dominating the market. Some of the recent developments of the market are as follows:-

- Feb 2020 - Bedrock Automation has introduced full integration of its flow computer functionality into the existing OSA platform. The new OSA + Flow family integrates industry-leading Flow-Cal measurement applications with the high performance, security, and simplicity of the Bedrock Automation platform.

- Feb 2021 - Quorum announced the merger with Aucerna, a provider of integrated planning, execution, and reserves software for the energy industry, and acquisition of TietoEVRY's entire oil and gas software business As per Quorum, this deal will position Quorum as a global leader for energy software across the upstream, midstream, and downstream sectors of the energy value chain.

- March 2021 - The company announced that Utah Gas Corp. achieved its project milestone with the implementation of FLOWCAL gas measurement software. After the implementation, measurement processes were on time and within budget, and the successfully completed its first monthly close cycle.company

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Need for Reliable Flow and High-tech Computing Systems

- 5.1.2 Continually Evolving Data Computational Capacity of Flow Computers

- 5.2 Market Restraints

- 5.2.1 Cyber-Security Threats Deterring Deployment of Advanced Flow Computer Systems

- 5.2.2 Dynamic Changes in Oil & Gas Prices leading to Reduced Investment in Infrastructure

6 MARKET SEGMENTATION

- 6.1 By Offering

- 6.1.1 Hardware

- 6.1.2 Software

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia Pacific

- 6.2.4 Latin America

- 6.2.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Schneider Electric SE

- 7.1.2 ABB Ltd.

- 7.1.3 Honeywell International Inc.

- 7.1.4 Emerson Electric Company

- 7.1.5 Bedrock Automation Platforms, Inc. (Maxim Integrated Products, Inc.)

- 7.1.6 Yokogawa Electric Corporation

- 7.1.7 Quorum Business Solutions, Inc.

- 7.1.8 OMNI Flow Computers, Inc.

- 7.1.9 Dynamic Flow Computers, Inc.

- 7.1.10 Flowmetrics Inc.