|

市場調查報告書

商品編碼

1643053

基礎設施監控:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Infrastructure Monitoring - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

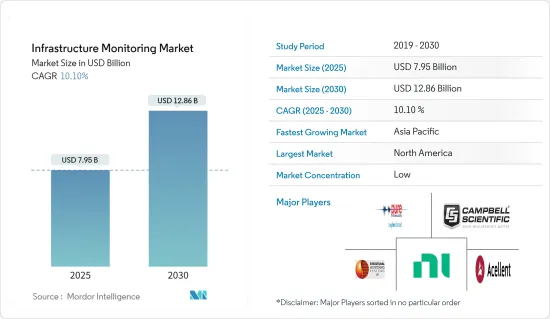

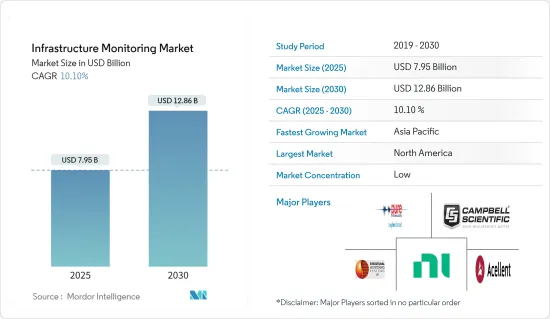

基礎設施監控市場規模預計在 2025 年為 79.5 億美元,預計到 2030 年將達到 128.6 億美元,預測期內(2025-2030 年)的複合年成長率為 10.1%。

主要亮點

- 先進感測器技術的使用不斷增加、感測器成本不斷下降、預防性保養的需求不斷成長以及為確保最終用戶行業更好地維護關鍵基礎設施而增加的資本支出,正在推動基礎設施監控市場的成長。

- 為了降低生命週期維護成本,對預測性維護的需求不斷成長,這是該行業的主要驅動力之一。 MEMS(微機電系統)慣性感測器廣泛用於建築物、生產系統甚至汽車的預測狀態監控。物聯網和高階分析技術的出現進一步增強了這項特性,並不斷提高此類系統的功能。

- 2022 年 2 月,可觀察性公司 New Relic 宣布全面推出一種新的基礎設施監控體驗,專門設計用於使 SRE、DevOps 和 ITOps 團隊能夠主動解決和識別私有、公有和混合雲端基礎設施中的問題。這種現代化的體驗使工程師能夠根據關鍵的黃金訊號條件進行排序和過濾,立即隔離瓶頸,遠端檢測(包括事件、日誌、網路、警報等),在拓撲圖上可視化爆炸半徑,並執行歷史分析以了解各種級聯影響。

- 此外,使用智慧感測器遠端監控關鍵基礎設施的能力正在推動市場成長。這在採礦等終端用戶領域非常有用,使用智慧感測器監控結構可以幫助公司節省金錢和挽救生命。 First Sensor 的慣性感測器能夠實現 10 μg 或 0.0005°(2 角秒)的解析度,廣泛用於建築物、橋樑和風力發電機的遠端監控。

- 透地雷達(GPR)也因其成本優勢而變得越來越重要。它們擴大被用於檢查橋樑和隧道、勘測道路以及確保道路上的瀝青得到充分壓實。例如,肯塔基州交通中心使用 GPR 技術在連接肯塔基州和田納西州的坎伯蘭峽隧道中發現了一個大空洞。此外,GPR 確認隧道一側無需維修,大大降低了維修成本。

- 然而,所涉及的高成本,特別是在實施和部署方面,可能是阻礙整個預測期內整體市場成長的主要問題。

- 在 COVID-19 疫情期間,基礎設施監控市場中的公司因無法進入現場和供應鏈中斷而面臨暫時的營運挑戰,對市場成長產生不利影響。各類協會,包括那些提供多項認證的協會,也受到了嚴重打擊。然而,必維國際檢驗集團等公司報告稱,自疫情爆發以來,對海上資產和設施的遠端檢查需求增加了 900%。

基礎設施監控市場趨勢

能源產業預計將佔據較大的市場佔有率

- 由於對提高能源效率、永續性和成本效益的需求不斷增加,預計能源產業將在基礎設施監控市場中佔據重要地位。此外,及時和預測性維護對能源部門資產的重要性日益增加,為能源部門基礎設施監控的成長帶來了光明的未來。

- 此外,結構安全監控系統提供的遠端維護優勢對於該領域的陸上和海上系統都非常有益。例如,風力發電機擴大使用中央資料模組來傳輸與不同結構條件相關的資料。此外,隨著雲端解決方案的引入,現在可以持續收集這些結構安全監控資料並進行評估以進行預測性維護。大多數風電場營運商使用監控和資料採集 (SCADA)資料進行遠端監控和管理。

- 此外,結構健康監測解決方案透過早期檢測節省了大量成本,從而鼓勵對未來預測性維護解決方案的投資。杜克能源利用Schneider ElectricAvantis PRiSM 技術提前檢測渦輪轉子裂紋,節省了超過 750 萬美元。這可確保資產最佳化並避免因維護而導致的成本超支。

- 此外,非侵入式結構監測對核能領域非常重要,核能領域在設計上支援此技術。核子反應爐的感測器在混凝土澆築時安裝,或插入現有結構上鑽的孔中。這需要監控和維護,特別是正常運作和操作,這將極大地促進市場成長。

- 此外,據世界核能協會稱,截至2022年5月,全球整體共有95座核子反應爐計畫興建。中國最多,有33起,其次是俄羅斯27起和印度12起。此外,隨著核能發電廠的老化,維護的重要性預計會增加,為被調查的市場創造市場機會。

亞太地區預計將以顯著的複合年成長率成長

- 最終用戶行業的快速擴張以及結構安全監控系統應用的主要途徑正在推動該地區的市場擴張。例如,據世界核能協會稱,亞太地區的發電能力,尤其是核能正在經歷顯著成長。該地區約有 135 座運作中的核子反應爐,約有 35 座在建。因此,這些發電廠的維護需求也將增加,進而創造結構監測市場。

- 基礎設施監控設備在航太和國防領域的應用正在進一步推動市場的發展。例如,根據斯德哥爾摩國際和平研究所(SIPRI)的數據,中國和印度去年都增加了核武庫。瑞典智庫指出,中國正大力現代化其核武庫。根據斯德哥爾摩國際和平研究所2022年年鑑,截至2022年1月,中國、巴基斯坦和印度的核彈頭數量分別為350枚、165枚和160枚。它們的存在表明有必要對核武進行監視,以確保它們不會落入壞人之手。

- 而且隨著智慧城市的發展,中國推出了700多個創新城市計劃,覆蓋了大大小小的城市。在中國「十四五」規劃(2021-2025年)中,智慧城市發展理念已被納入幾乎所有省區的發展目標。隨著中國都市化進程的加快,智慧城市作為國內城市發展的現實需求,已成為城市資訊化的新浪潮。

- 此外,中國基礎設施老化現像日益嚴重,利用基礎設施監測服務來識別這些結構並確保其完整性勢在必行。因此,由於對進行定期評估以保護老化基礎設施的需求日益增加,以及對最佳化基礎設施成本的需求日益增加,預計預測期內此類解決方案在該國的採用將蓬勃發展。

- 此外,智慧城市計劃的擴張預計將為該國市場提供成長機會。例如,在印度,智慧城市任務預計於 2023 年結束。印度總理莫迪於 2015 年 6 月宣布了這項舉措,中央政府選擇了印度全國 100 個城市參與。這些城市將採用智慧解決方案進行開發,為其公民提供核心基礎設施、健康、永續的環境和體面的生活水準。該任務的實施時間表已延長至 2023 年 6 月,這使得 2023 年成為印度智慧城市的關鍵一年。

基礎設施監控產業概況

基礎設施監控市場的競爭格局仍然分散,只有幾位家中小型參與者。最終用戶群體不斷變化的需求正在推動市場供應商提供創新產品。此外,市場的成長機會正在吸引新的參與者和投資進入市場。

- 2022 年 9 月-Equinor 和挪威科技公司 Vissim 已完成為挪威和英國大陸棚的能源營運商開發新的增強式海上空間監視系統。新的增強型海上空間監視系統融合了海底基礎設施監控、具有天氣預報和即時監控的海上規劃以及 3D情境察覺功能。

- 2022 年 1 月-Netreo 宣布其全端IT基礎設施監控解決方案「Netreo」及其全生命週期 APM 解決方案「Retrace by Netreo」已通過 Veracode 驗證標準認證,證明其程式碼開發流程符合 AppSec 最佳實踐,進一步加強了「Netreo」和「Retrace by Netreo」的安全態勢。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- 產業價值鏈分析

- COVID-19 產業影響評估

第5章 市場動態

- 市場促進因素

- 能源和民用基礎設施等終端用戶產業將推動成長

- 先進感測器技術簡介

- 市場限制

- 高成本

第6章 市場細分

- 依技術分類

- 有線

- 無線的

- 按服務

- 硬體

- 軟體和服務

- 按最終用戶產業

- 礦業

- 航太和國防

- 民用基礎設施

- 能源

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- National Instruments Corporation

- Campbell Scientific Inc. Company

- Pure Technologies Ltd Company(Xylem Inc.)

- Structural Monitoring Systems plc

- Acellent Technologies Inc.

- Geocomp Corporation

- Geokon Inc.

- SISGEO SRL

- AVT Reliability Company(AES Engineering Ltd)

第8章投資分析

第9章:未來展望

The Infrastructure Monitoring Market size is estimated at USD 7.95 billion in 2025, and is expected to reach USD 12.86 billion by 2030, at a CAGR of 10.1% during the forecast period (2025-2030).

Key Highlights

- The growing use of advanced sensor technologies, declining cost of sensors, growing demand for preventive maintenance, and increasing capital investments to ensure better maintenance of critical infrastructure across the end-user industries are driving the growth of the infrastructure monitoring market.

- The growing demand for predictive maintenance to reduce life cycle maintenance costs is one of the primary drivers of this industry. The MEMS (Micro electro mechanical systems) inertial sensors are extensively used in predictive condition monitoring of buildings, production systems, and even vehicles. This has been further augmented by the emergence of IoT and advanced analytics that continually improve such systems' functionality.

- In February 2022, New Relic, the observability company, declared the general availability of a new infrastructure monitoring experience especially to empower SRE, DevOps, and ITOps teams to proactively resolve and identify issues in their private, public, and hybrid cloud infrastructure. The modernized experience mainly enables engineers to instantly isolate bottlenecks by sorting and filtering based on key golden signal conditions, analyze all related telemetry (including events, logs, network, alerts, etc.) in context, visualize blast radius with topology maps and perform historical analysis to understand the various cascading impacts.

- Moreover, the ability to remotely monitor critical infrastructure using smart sensors has led to the proliferation of the market. This is extremely helpful in the end-user segments, like mining, where structural monitoring using smart sensors enables companies to save money and lives. Inertial sensors from First Sensor that can achieve resolutions of 10 µg or 0.0005° (2 arc seconds) are extensively used for remote monitoring of buildings, bridges, and wind turbines.

- Ground-penetrating radar (GPR) is also growing in importance because of its cost advantages. It is increasingly being used for bridge and tunnel inspections, roadway investigations, and to ensure adequately compacted asphalt on roads. For instance, by utilizing the GPR technology, Kentucky Transportation Center found the location of large voids in the Cumberland Gap Tunnel, which links Kentucky and Tennessee. It also significantly reduced the repair costs by using GPR to confirm that no voids needed to be fixed on one end of the tunnel.

- However, the high-cost involvement, especially in implementation and deployment, might be a significant matter of concern that can hamper the overall market's growth throughout the forecast period.

- During the COVID-19 pandemic, the companies operating in the Infrastructure Monitoring market faced temporary operative issues due to the absence of site access and disruption in the supply chain, which negatively affected the market's growth. Various associations, including those that provide multiple certifications, have also taken a hit. However, companies such as Bureau Veritas reported a 900% rise in demand for the remote inspection of offshore assets and equipment since the pandemic outbreak.

Infrastructure Monitoring Market Trends

Energy Sector is Expected to Account for a Significant Share of the Market

- The energy segment is anticipated to get significant traction in the infrastructure monitoring market owing to the increasing demand for improving energy efficiency, sustainability, and cost-effective practices. Additionally, the growing importance of timely and predictive maintenance for energy sector assets provides a promising future for the growth of infrastructure monitoring in the energy sector.

- Further, the remote maintenance benefits that the Structural Health Monitoring Systems offer is extremely beneficial for both onshore and offshore systems in this sector. In a wind turbine, for instance, central data modules are being increasingly used to transmit data related to various structural conditions. Moreover, the introduction of cloud solutions has enabled this structural health monitoring data to be continually collected and evaluated for predictive maintenance. Most wind farm operators leverage Supervisory control and data acquisition (SCADA) data for remote monitoring and management.

- Moreover, Structural Health Monitoring solutions led to substantial cost savings through early detection, thereby facilitating higher investment in future predictive maintenance solutions. Duke Energy deployed Schneider Electric's Avantis PRiSM technology to save over USD 7.5 million through early crack detection in a turbine rotor. This has ensured the prevention of cost overruns through asset optimization and maintenance.

- In addition, non-invasive structural monitoring remains highly critical to the nuclear energy sector, which, by design, supports such technologies. The sensors in nuclear reactors are installed during concrete casting or by inserting them into holes that are drilled into the existing structures. Hence it requires monitoring and maintenance, especially for proper functioning and operations, thereby facilitating the market's growth significantly.

- Moreover, as per World Nuclear Association, as of May 2022, globally, there were 95 nuclear reactors planned worldwide. China recorded the largest figure with 33 units., followed by Russia and India with 27 and 12. Further, as nuclear power plants age, maintenance's importance increases, which is expected to create market opportunities for the market studied.

Asia-Pacific is Anticipated to Grow at a Significant CAGR

- The rapid expansion of the end-user industries that have major avenues for the application of structural health monitoring systems is leading to the expansion of the market in the region. For instance, according to World Nuclear Association, the Asia-Pacific region is witnessing significant growth in terms of electricity generating capacity and specifically nuclear power. The region is home to about 135 operable nuclear power reactors, and about 35 are under construction, with the fastest growth in nuclear generation expected in China. Thus, the need for maintenance of those power plants will also increase, which in return will create a market for structural monitoring.

- The application of infrastructure monitoring equipment within Aerospace and Defense is further driving the market. For instance, according to the Stockholm International Peace Research Institute (SIPRI), China and India have enhanced their nuclear arsenal over the last year. The Swedish think-tank pointed out that China is significantly modernizing its nuclear arsenal. According to the SIPRI Yearbook 2022, as of January 2022, China, Pakistan, and India have 350 165 and 160 nuclear warheads, respectively. Such existence mandates the need to monitor them so that they don't fall into the wrong hands.

- Further, with the development of smart cities, China has established more than 700 innovative city projects in more than 500 cities, covering big and small cities. The concept of smart city development has been incorporated in the 14th Five Year Plan (2021 to 2025) development goals of nearly all Chinese provinces and regions. With the acceleration of urbanization in China, smart city, as the internal realistic demand of urban development, has become the new wave of urban informatization.

- Moreover, there has been an increased count of aging infrastructure in China, making it essential for the usage of infrastructure monitoring services to identify and secure the integrity of these structures. As a result, the deployment of these solutions in the country is expected to grow rapidly over the forecast period due to the increasing need to conduct periodical assessment operations to preserve aging infrastructure and the need to optimize infrastructure expenses.

- Additionally, growing smart city projects are expected to provide opportunities for the growth of the market in the country. For instance, In India, The Smart City Mission is scheduled to be finished in 2023. Prime Minister Narendra Modi declared the initiative back in June 2015, and the Centre chose 100 cities from across India to participate. These cities will be developed to provide citizens with access to core infrastructure, a healthy and sustainable environment, and a decent standard of living using smart solutions. The mission's implementation timeline was extended till June 2023, making 2023 one of the most important years for India's Smart Cities.

Infrastructure Monitoring Industry Overview

The competitive landscape of the infrastructure monitoring market remains fragmented, with several small and medium-sized players operating in the market. The evolving needs of the end-user segments are driving the market vendors to offer innovative products. In addition, growing opportunities in the market are attracting new players and investments in the market.

- September 2022 - Equinor and Norwegian technology Vissim have completed the development of a new and expanded ocean space surveillance system for energy operators on the Norwegian and UK continental shelves. The new and expanded ocean space surveillance system incorporates subsea infrastructure monitoring, marine planning through weather forecasts and real-time monitoring, and 3D situational awareness.

- January 2022 - Netreo announced that both the Netreo full-stack IT infrastructure monitoring and Retrace by Netreo full lifecycle APM solutions earned Veracode Verified Standard recognition proving that code development processes meet AppSec best practices and further boosting the security posture of the Netreo and Retrace by Netreo solutions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of Covid-19 on the industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 The End-user Segments like Energy and Civil Infrastructure will Drive Growth

- 5.1.2 Introduction of Advanced Sensor Technologies

- 5.2 Market Restraints

- 5.2.1 High Cost of Implementation and Deployment

6 MARKET SEGMENTATION

- 6.1 By Technology

- 6.1.1 Wired

- 6.1.2 Wireless

- 6.2 By Offering

- 6.2.1 Hardware

- 6.2.2 Software and Services

- 6.3 By End-user Industry

- 6.3.1 Mining

- 6.3.2 Aerospace and Defense

- 6.3.3 Civil Infrastructure

- 6.3.4 Energy

- 6.3.5 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 National Instruments Corporation

- 7.1.2 Campbell Scientific Inc. Company

- 7.1.3 Pure Technologies Ltd Company (Xylem Inc.)

- 7.1.4 Structural Monitoring Systems plc

- 7.1.5 Acellent Technologies Inc.

- 7.1.6 Geocomp Corporation

- 7.1.7 Geokon Inc.

- 7.1.8 SISGEO SRL

- 7.1.9 AVT Reliability Company (AES Engineering Ltd)