|

市場調查報告書

商品編碼

1643028

石油和天然氣產業的數位轉型:市場佔有率分析、產業趨勢和統計、成長預測(2025-2030 年)Digital Transformation in The Oil and Gas Industry - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

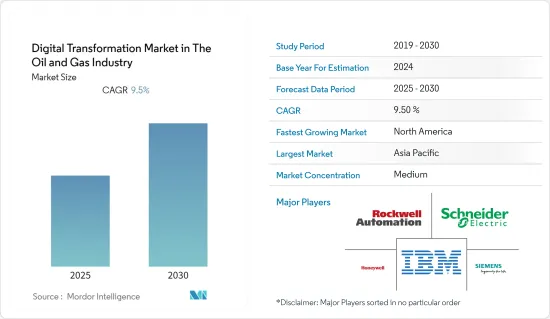

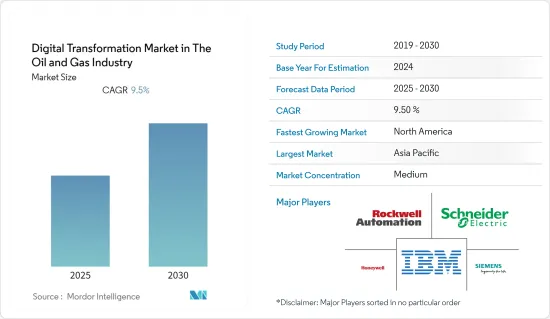

預測期內,石油和天然氣產業數位轉型市場預計複合年成長率為 9.5%

關鍵亮點

- 擴增實境是石油和天然氣產業最新的新興解決方案。

- 在海上石油和天然氣作業中,資料科學中的人工智慧被用於使石油和天然氣探勘和生產中使用的複雜資料更易於獲取。例如,BP最近投資了總部位於休士頓的新興企業Belmont Technology,以增強該公司的人工智慧能力並開發一個名為「Sandy」的雲端基礎的地球科學平台。

- 人工智慧也被用來提高加油站預防性維護的安全性。然而,加油站火災日益增多。例如,拉斯維加斯麥卡倫機場的一個加油站於 2021 年 9 月發生火災。此類事故可能會對加油站及其周邊地區造成致命和破壞。

- 2021年11月,ElectrifAi在阿布達比ADIPEC宣布,將為石油和天然氣能源產業提供電腦視覺(CV)和機器學習(MLaaS)。 ElectrifAi 的 MLaaS 讓企業無需太多經驗即可實現 AI 和 ML 的全部業務和營運優勢。

- 此外,採用物聯網等監控設備將使企業能夠實現流程自動化和最佳化,並透過持續監控設備、消除安全性和監管問題以及遠端存取等相關風險來推動產業進一步數位化。

- 此外,新冠疫情導致2020年全年原油價格大幅下跌,沙烏地阿拉伯與俄羅斯之間的價格戰成為產油企業採用自動化的一大障礙。國際能源總署 (IEA) 稱,總部位於德克薩斯州的西方石油公司 (Oxy) 是全球石油和天然氣生產商中 2020 年資本支出削減幅度最大的公司。受新冠疫情影響,Oxy 公司將2020年資本支出削減48.1%,從年初計畫的52億美元降至27億美元。然而,這場疫情讓人們更加關注石油和天然氣產業的數位化必要性。因此,企業已經開始計劃投資這種轉型。因此,預計預測期內市場將會成長。

石油和天然氣市場的數位轉型趨勢

下游產業可望佔據主要市場佔有率

- 數位轉型被認為是引領石油和天然氣產業下游業務的核心創新之一。公司正致力於透過提高工廠製造效率來提高資產利用率。

- 石油和天然氣公司的下游業務,包括石化和精製,一直採用技術來改善其營運。這些公司已經開發並採用了創新方法來管理複雜流程和解釋資料以提高效能。隨著許多公司採取策略性舉措擴大其在石油和天然氣價值鏈中的下游業務,特別是石化產業,持續的數位化轉變預計將具有更大的潛力。

- 如何預測、預防和降低維護成本是供應商關注的重點。我們的維護和周轉規劃工具自動化解決方案使用應用程式效能管理和基於人工智慧的模擬,可以輕鬆添加到您現有的營運系統中。此外,感測器系統可以升級,以實現更好的預測性和預測性維護,從而提高長期營運效率。

- 許多石油和天然氣公司正在依靠人工智慧、物聯網和巨量資料等技術來改善業務。例如,殼牌負責向最終消費者供應石油和天然氣的下游商業業務正在使用人工智慧技術來預測消費者對石油產品的需求,衡量供不應求並推薦用於精製過程的石油混合物。

- 此外,預計該領域的擴張也將於預測期內推動市場成長率。例如,2022 年 5 月,沙烏地阿拉伯石油公司(「阿美」)宣布與泰國國有石油公司 PTT 合作,以擴大其在亞洲的下游業務。雙方旨在加強在原油採購、精製、石化產品和液化天然氣(LNG)行銷方面的夥伴關係。藍氫和綠色氫能以及許多清潔能源計劃也是潛在的參與領域。

- 此外,2020年全球原油需求將下降至9,100萬桶/日。 2020 年的下降是由於冠狀病毒對經濟和營運造成了影響,導致全球大面積停工。根據美國能源資訊署(EIA)的數據,預計2023年原油產量將達到1.012億桶/日。預計原油產量的上升也將進一步推動市場成長。

亞太地區佔很大佔有率

- 該地區在石油和天然氣工業中佔有很大的佔有率。據IBEF稱,印度也有望成為經合組織以外全球石油消費量成長最重要的貢獻者之一。印度22會計年度的石油產品消費量為2.4023億噸。高速柴油是印度消費量最大的石油產品,佔22會計年度石油產品總消費量的38.84%。

- 此外,2022 年 1 月,印度石油公司(IOCL)宣布計劃擴大其城市燃氣發行(CGD)業務,並考慮投資 700 億印度盧比(9.186 億美元)。

- 中國、印度、日本和韓國等國家是亞太地區石油和天然氣下游產業最活躍的國家之一,佔該地區石油精製能力的78%以上。此外,據IBEF稱,印度計劃將50%的戰略石油儲備(SPR)商業化,以籌集資金並建造更多的儲存槽,以抵消不斷上漲的原油價格。

- 此外,新加坡等國家的煉油產能一年內增加了10%以上。因此,現有的煉油廠有擴張的空間,可能的新計畫將推動數位轉型的需求。

- 由於石油和天然氣生產涉及較長的前置作業時間和龐大的資本支出,產業主要企業正在尋求人工智慧等變革性技術來獲得競爭優勢。例如,澳洲最大的天然氣生產商伍德賽德 (Woodside) 使用 IBM Watson 為 AI 演算法提供支持,搜尋超過 2500 萬份文檔,檢索內容,與過去的表現進行對比並提案相關資訊。

- 此外,亞洲領先的中國石油宣布,大慶油田將利用雲端運算、巨量資料和物聯網等技術進行數位轉型,目標是用20年的時間實現5,000萬噸的穩健產量。

- 然而,石油和天然氣產業預計將在 2021 年強勁復甦,將產業提升至新冠疫情之前的水平。國際能源總署(IEA)在 2021 年 10 月的最新報告中預測,到 2030 年印度的石油需求將增加 50%,而全球石油需求成長率為 7%。因此,該行業的成長有望推動市場研究。

石油天然氣數位轉型概述

全球石油和天然氣數位轉型市場競爭激烈,由多家大型參與者組成。佔據市場主導地位的公司正致力於擴大海外基本客群。這些公司正在利用策略合作舉措和收購來增加市場佔有率和盈利。

- 2021 年 10 月 - 艾默生與阿斯彭科技公司達成最終協議,將艾默生的兩個獨立工業軟體業務——開放系統國際公司和地質模擬軟體業務合併,該交易將向阿斯彭科技股東提供 60 億美元現金。

- 2021 年 5 月-艾默生電氣公司升級了自動化技術,以提高殼牌菲律賓探勘公司營運的 Malampaya 天然氣生產和加工設施的可靠性。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 產業價值鏈分析

- COVID-19 市場影響評估

第5章 市場動態

- 市場促進因素

- 越來越需要引入顛覆性技術來最佳化營運並提高安全性

- 監管要求

- 市場問題

- 油價波動

- 已開發國家工業成長停滯

第6章 市場細分

- 實行技術

- 巨量資料/分析和雲端運算

- 物聯網 (IoT)

- 人工智慧

- 工業控制系統(PLC、SCADA、HMI、DCS 等)

- 擴增實境(AR、VR、MR)

- 現場設備(感測器、馬達、變頻器等)

- 石油和天然氣產業按活動分類

- 上游

- 中游

- 下游

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 歐洲其他地區

- 亞太地區

- 中國

- 日本

- 印度

- 其他亞太地區

- 拉丁美洲

- 巴西

- 阿根廷

- 其他拉丁美洲國家

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 其他中東和非洲地區

- 北美洲

第7章 競爭格局

- 公司簡介

- Schneider Electric SE

- Rockwell Automation Inc.

- Honeywell International Inc.

- Siemens AG

- IBM Corporation

- Mitsubishi Electric Corporation

- Omron Corporation

- Yokogawa Electric Corporation

- Fanuc Corporation

- Emerson Electric Co.

- WFS Technologies Ltd

- Magseis Fairfield ASA

- Rohrback Cosasco Systems Inc.

- ABB Ltd

第8章投資分析

第9章:市場的未來

簡介目錄

Product Code: 69175

The Digital Transformation Market in The Oil and Gas Industry is expected to register a CAGR of 9.5% during the forecast period.

Key Highlights

- >

- Extended reality is the latest and emerging solution in the oil and gas industry. Companies such as Shell, ExxonMobil, and BP are among the first players to adopt immersive technologies in the field.

- The offshore oil and gas business uses AI in data science to make the complex data used for oil and gas exploration and production more reachable, which lets companies discover new exploration prospects or make more use of existing infrastructures. For instance, recently, BP invested in Houston-based start-up Belmont Technology to strengthen the company's AI capabilities and develop a cloud-based geoscience platform nicknamed "Sandy."

- Among all the enabling technologies, artificial intelligence is poised to play a significant role over the forecast period. AI is also used to increase the safety of gas stations for preventive maintenance. However, there have been growing incidences of fires at gas stations. For instance, a gas station in Mccarran Airport in Las Vegas had an accidental fire in September 2021. Such events may prove deadly and destroy gas stations and the surrounding area. However, intelligent cameras based on AI can access the risk area and lessen the extent of potential damage.

- In November 2021, ElectrifAi announced the availability of Computer Vision (CV) and Machine Learning as a Service (MLaaS) for the oil, gas, and energy industries at ADIPEC in Abu Dhabi. With ElectrifAi's MLaaS, companies need little to no experience to realize the maximum business and operational benefits of AI and ML. MLaaS deploys quickly within any cloud environment or on the customer premise.

- Additionally, adopting monitor equipment such as IoT will allow companies to further digitize the industry by automating and optimizing the processes and eliminating the risk associated, including safety and regulation issues, and remote access, by constantly monitoring the equipment.

- Furthermore, the oil prices declining drastically over 2020, in the wake of COVID-19, and a price war between Saudi Arabia and Russia, are acting as major restraints for oil-producing companies to deploy automation. In addition, according to the International Energy Agency (IEA), Texas-based Occidental Petroleum Corporation (Oxy) has made the most significant reduction in its capital expenditures for 2020 out of all global oil and gas producers in the world. COVID-19 has caused Oxy to reduce its 2020 capex by 48.1%, down to USD 2.7 billion from the USD 5.2 billion planned at the beginning of the year. However, the pandemic significantly highlighted the need for digitalization in the oil and gas industry. As such, companies started to plan investments in such transformations; hence, the market is expected to grow over the forecast period.

Digital Transformation in Oil & Gas Market Trends

Downstream Sector is Expected to Witness Major Market Share

- Digital transformation is considered one of the core innovations in leading the downstream operations of the oil and gas industry. The companies are focusing on increasing asset utilization by enhancing the manufacturing efficiency of the plants.

- The downstream operations of the oil and gas companies, including both petrochemicals and refining, have always adopted technology to improve their operations. These companies have developed and adopted innovative approaches that manage complex processes and interpret data to improve performance. The ongoing shift to becoming digital is expected to present even greater potential, given the strategic push by many companies to expand their downstream operations of the oil and gas value chain, especially petrochemicals.

- The primary area of concern for the vendors is how to predict and prevent or reduce maintenance costs. The automation solutions for maintenance and turnaround planning tools use application performance management and AI-based simulation and can be easily added to an existing operational system. Moreover, the upgradation of sensor systems to enable better predictive and prescriptive maintenance can lead to long-term operational efficiencies.

- Multiple oil and gas companies are relying on technologies such as AI, IoT, and Big Data, among others, to improve their operations. For instance, Shell's downstream commercial business, responsible for supplying oil and gas to the end consumer, uses AI technology to predict consumer demand for petroleum products, measure supply shortages, and recommend a mix of oil for a refining process.

- Furthermore, the growing expansions in the sector are also set to boost the market growth rate during the forecast period. For instance, in May 2022, as it extended its downstream presence in Asia, the Saudi Arabian Oil Company ("Aramco") announced a collaboration with Thailand's government oil company PTT. The organizations aim to improve their partnership in procuring crude oil, marketing refining, petrochemical products, and liquefied natural gas (LNG). Blue and green hydrogen, and numerous clean energy programs, are other possible areas of engagement.

- In addition, global demand for crude oil in 2020 decreased to 91 million barrels per day. The decrease in 2020 was due to the economic and mobility impacts of the coronavirus pandemic, including widespread shutdowns worldwide. According to the Energy Information Administration (EIA), Crude oil production is forecasted at 101.2 million barrels per day in 2023. The growing crude oil production is also expected to drive market growth further.

Asia-Pacific to account for a significant share

- The region holds a significant market share in the oil and gas industry. In addition, according to IBEF, India is expected to be one of the most important contributors to non-OECD petroleum consumption growth globally. India's consumption of petrol products stood at 204.23 MMT in FY22. High-Speed Diesel was India's most consumed oil product and accounted for 38.84% of petroleum product consumption in FY22.

- Furthermore, in January 2022, Indian Oil Corp. Ltd (IOCL) announced plans to expand its city gas distribution (CGD) business, looking to invest INR 7,000 crores (USD 918.6 million).

- Countries such as China, India, Japan, and South Korea have one of the most active oil and downstream gas sector in the region, which together is responsible for over 78% of the oil refining capacity, with significant refineries deeply integrated with petrochemical production units, in the Asian-Pacific region. Furthermore, according to IBEF, India aims to commercialize 50% of its SPR (strategic petroleum reserves) to raise funds and build additional storage tanks to offset high oil prices.

- Additionally, countries like Singapore are gaining over 10% refinery throughput in a year. This provides the scope for expansion in current refineries, and possibly new projects are expected to drive the demand for digital transformation.

- Given the long lead times and the massive capital outlay involved in oil and gas production, significant players in the industry are looking to gain a competitive edge through transformational technology such as AI. For instance, Woodside, the most significant Australian natural gas producer, deployed IBM Watson to run AI algorithms operations and search over 25 million documents, retrieve content, benchmark against historical performance, and suggest related information to anyone in the business.

- Furthermore, PetroChina, Asia's leading, announced that its Daqing oilfield, which is aimed to achieve 50 million tons of stable production in 20 years, will leverage digital transformation by enabling technologies such as cloud computing, big data, and IoT, among others.

- However, the oil and gas sector significantly recovered in 2021, boosting the industry to the pre-COVID-19 level. In India, the oil demand is expected to rise 50% by 2030 as against a global expansion of 7%, the International Energy Agency (IEA) has forecast in its latest report in October 2021. Thus, the growth in the sector is expected to drive the market studied.

Digital Transformation in Oil & Gas Industry Overview

The global digital transformation market in the oil and gas industry is highly competitive and consists of several major players. The players with a prominent share in the market are focusing on expanding their customer base across foreign countries. These companies leverage strategic collaborative initiatives and acquisitions to increase their market share and profitability.

- October 2021 - Emerson entered into a definitive agreement with Aspen Technology, Inc. to combine two of Emerson's stand-alone industrial software businesses, Open Systems International, Inc. and the geological simulation software business, along with a contribution of USD 6 billion in cash to AspenTech shareholders, to create "new AspenTech," which is a diversified, high-performance industrial software segment with more excellent capabilities, scale, and technologies.

- May 2021 - Emerson Electric Co. upgraded automation technology to improve the reliability of the Malampaya natural gas production and processing facilities operated by Shell Philippines Exploration, and finishing the work ahead of schedule helped the company restore the supply of gas as planned; therefore, the Philippines would benefit from the continued use of cleaner-burning natural gas to power its economy.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Need to Implement Disruptive Technologies to Optimize Operations & Increase Safety

- 5.1.2 Regulatory Requirements

- 5.2 Market Challenges

- 5.2.1 Volatile Oil Price Situation

- 5.2.2 Stagnant Industrial Growth in Developed Countries

6 MARKET SEGMENTATION

- 6.1 By Enabling Technologies

- 6.1.1 Big Data/Analytics and Cloud Computing

- 6.1.2 Internet of Things (IoT)

- 6.1.3 Artificial Intelligence

- 6.1.4 Industrial Control Systems (PLC, SCADA, HMI, DCS etc.)

- 6.1.5 Extended Reality (AR, VR and MR)

- 6.1.6 Field Devices (Sensors, Motors, VFD etc.)

- 6.2 By Oil and Gas Industry Activity

- 6.2.1 Upstream

- 6.2.2 Mid Stream

- 6.2.3 Downstream

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 United Kingdom

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 Rest of the Asia-Pacific

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Argentina

- 6.3.4.3 Rest of Latin America

- 6.3.5 Middle East and Africa

- 6.3.5.1 United Arab Emirates

- 6.3.5.2 Saudi Arabia

- 6.3.5.3 Rest of Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Schneider Electric SE

- 7.1.2 Rockwell Automation Inc.

- 7.1.3 Honeywell International Inc.

- 7.1.4 Siemens AG

- 7.1.5 IBM Corporation

- 7.1.6 Mitsubishi Electric Corporation

- 7.1.7 Omron Corporation

- 7.1.8 Yokogawa Electric Corporation

- 7.1.9 Fanuc Corporation

- 7.1.10 Emerson Electric Co.

- 7.1.11 WFS Technologies Ltd

- 7.1.12 Magseis Fairfield ASA

- 7.1.13 Rohrback Cosasco Systems Inc.

- 7.1.14 ABB Ltd

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219