|

市場調查報告書

商品編碼

1642999

裝飾瓷磚:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)Decorative Tiles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

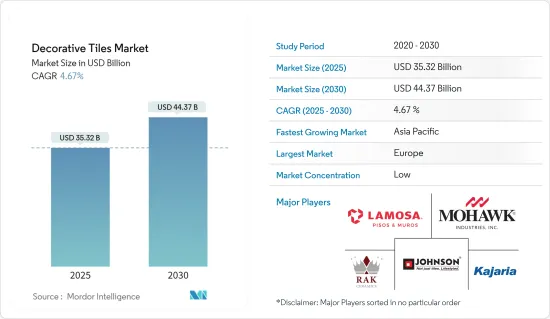

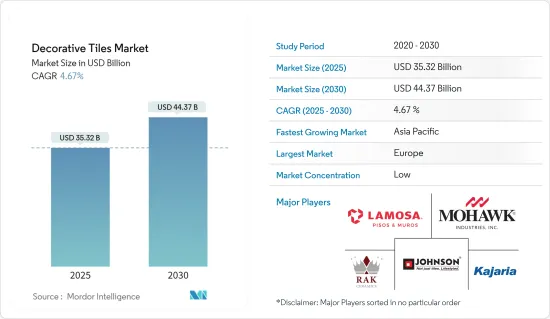

預計 2025 年裝飾磁磚市場規模為 353.2 億美元,到 2030 年預計將達到 443.7 億美元,預測期內(2025-2030 年)的複合年成長率為 4.67%。

由於全球建築支出不斷增加以及人們對浴室和廚房維修計劃的興趣日益濃厚,裝飾瓷磚市場預計將出現強勁成長。都市化進程加速和商業基礎建設活性化也是刺激裝飾瓷磚需求的因素。從全球來看,已開發國家和新興國家對基礎建設的投資都在增加,這也是全球裝飾瓷磚市場的促進因素。

裝飾瓷磚市場的主要趨勢之一是 3D 列印瓷磚越來越受歡迎。通常使用黏土和沙子等材料來製作裝飾瓷磚。 3D 磁磚列印作為一種污染較少的方法正迅速流行起來。瓷磚製造商可以使用 3D 列印為其產品添加精緻的刻面和設計紋理。由於裝飾瓷磚具有抗污、抗刮擦等特性,且能夠模仿更昂貴的天然石材和硬木瓷磚的外觀,因此對裝飾瓷磚的需求不斷成長,預計這也是未來幾年推動這些瓷磚普及的一個因素。

裝飾瓷磚市場的趨勢

住宅市場可能主導裝飾瓷磚市場

住宅類裝飾瓷磚在去年的市場佔有率最高。隨著可支配收入的增加以及由此引發的私人和住宅建築的活性化,裝飾瓷磚在住宅市場越來越受歡迎。全球範圍內的建設活動正在蓬勃發展,預計住宅數量的增加將進一步推動裝飾瓷磚的成長。由瓷器、大理石和石材製成的裝飾瓷磚經過特別設計,以配合建築類型和主題。它們增強了牆壁和地板的美感,並為建築業增加了價值。

亞太地區裝飾瓷磚市場的成長

亞太地區的裝飾瓷磚市場經歷了顯著的成長,預計未來將繼續擴大。亞太地區包括中國、印度、日本、韓國和東南亞國家,正在經歷快速的都市化、有利的經濟狀況和不斷提高的可支配收入水準。這些因素導致該地區對裝飾瓷磚的需求不斷增加。由於顧客偏好的變化和對室內設計的興趣日益濃厚,裝飾瓷磚在住宅和商業建築中變得越來越普遍。消費者擴大尋求美觀和客製化的選擇,以增強生活空間和工作空間的視覺吸引力。由於亞太地區人口眾多且中等收入階層不斷壯大,裝飾瓷磚在該地區變得廣泛可用且價格實惠。電子商務平台的擴張也使消費者更容易在網路上研究和購買各種裝飾瓷磚,進一步推動了市場的成長。

裝飾瓷磚行業概況

裝飾瓷磚市場高度分散,多家公司相互競爭。幾家大公司正在致力於開發創新產品以擴大產品系列。全球主要製造商包括 RAK Ceramics、Group Lamosa、Mohawk Industries、Johnson Tiles、Kajaria Ceramics 等。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察與動態

- 市場概況

- 市場促進因素

- 對個人化和美觀的室內設計解決方案的需求日益增加

- 市場限制

- 裝飾瓷磚相關成本

- 裝飾瓷磚的耐用性和維護可能是一些消費者關心的問題。

- 市場機會

- 在商業領域,旅館、餐廳和其他商業空間可能成為目標。

- 產業價值鏈分析

- 波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- 洞察裝飾瓷磚行業的主要趨勢

- 洞察最新產業趨勢與創新

- COVID-19 市場影響

第5章 市場區隔

- 按類型

- 陶瓷牆磚

- 乙烯基牆磚

- 石牆磚

- 其他類型

- 按最終用戶

- 住宅

- 商業的

- 按應用

- 地板材料

- 牆壁材料

- 其他用途

- 按分銷管道

- 家裝中心

- 旗艦店

- 專賣店

- 網路商店

- 其他分銷管道

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 亞太地區

- 日本

- 中國

- 其他亞太地區

- 歐洲

- 英國

- 德國

- 其他歐洲國家

- 拉丁美洲

- 巴西

- 秘魯

- 其他拉丁美洲國家

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 其他中東和非洲地區

- 北美洲

第6章 競爭格局

- 市場集中度

- 公司簡介

- RAK Ceramics

- Group Lamosa

- Mohawk Industries Inc.

- Johnson tiles

- Kajaria Ceramics Limited

- The Siam Cement Public Company Limited

- Roca Sanitario SA

- Panariagroup Industrie Ceramiche SpA

- Gruppo Concorde SpA

- Pamesa Ceramica SL

- Guangdong Dongpeng Ceramic Co. Ltd

- Emser Tile LLC

- Seneca Tiles

- Porcelanosa Grupo

- British Ceramic Tile

- China Ceramics Co. Ltd*

第7章 市場趨勢

第 8 章:關於發布者

The Decorative Tiles Market size is estimated at USD 35.32 billion in 2025, and is expected to reach USD 44.37 billion by 2030, at a CAGR of 4.67% during the forecast period (2025-2030).

The decorative tiles market is expected to grow strongly, owing to increasing building construction spending and rising interest in bathroom and kitchen renovation projects worldwide. The rise in urbanization and increased commercial infrastructure development are other factors fuelling the demand for decorative tiles. Globally, there is an increase in investments in infrastructure development in developed and developing countries, which is another factor driving the global decorative tiles market.

One of the main trends in the decorative tile market is the rising popularity of 3D-printed tiles. Since clay, sand, and other materials are typically used to make decorative tiles. A method that produces less pollution is 3D tile printing, which is rapidly gaining traction. Tile manufacturers may add exquisite facets and design textures to their products using 3D printing. The rising demand for decorative tiles, owing to their stain and scratch resistance and ability to mimic the appearance of more expensive natural stone and hardwood tiles, is another factor that is anticipated to boost the adoption of these tiles in the next few years.

Decorative Tiles Market Trends

The Residential Segment is Likely to Dominate the Decorative Tiles Market

The market share of decorative tiles held by the residential category was the highest the year before. Decorative tiles are growing in popularity in the residential market, partly because of increased private and residential construction activity brought on by customers' increasing disposable income. Construction activity is growing rapidly at a worldwide level, and there is an increase in the growth of housing units, which is likely to propel the growth of decorative tiles further in the anticipated period. Decorative tiles made from porcelain, marble, and stones are designed specifically for construction type and theme. They enhance the aesthetic appeal of walls and floors and increase the value of the construction sector.

Rise in Decorative Tiles Market in Asia-Pacific

The decorative tiles market in the Asia-Pacific region is experiencing substantial growth and is expected to continue expanding in the coming years. Rapid urbanization, advantageous economic conditions, and rising disposable income levels have been observed throughout the Asia-Pacific region, including nations like China, India, Japan, South Korea, and Southeast Asian states. These factors have contributed to the rise in demand for decorative tiles in the region. Decorative tiles are becoming more common in residential and commercial settings due to shifting customer preferences and an increased focus on interior design. Consumers are increasingly looking for aesthetically appealing and customized options to enhance the visual appeal of their living and working spaces. Decorative tiles are now more widely available and affordable in the Asia-Pacific region due to the region's vast population base and growing middle class. The expansion of e-commerce platforms has also assisted in the growth of the market by making it simpler for customers to explore and buy a wide selection of decorative tiles online.

Decorative Tiles Industry Overview

The decorative tiles market is highly fragmented, with several companies competing against one another. Several key players engage in the development of innovative products to expand their product portfolios. Leading worldwide producers include RAK Ceramics, Group Lamosa, Mohawk Industries, Johnson Tiles, and Kajaria Ceramics.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Demand for Personalized and Aesthetically Pleasing Interior Design Solutions

- 4.3 Market Restraints

- 4.3.1 Cost Associated with Decorative Tiles

- 4.3.2 Durability and Maintenance of Decorative Tiles can be a Concern for Some Consumers

- 4.4 Market Opportunities

- 4.4.1 In the Commercial Sector, Businesses can Target Hotels, Restaurants, and Other Commercial Spaces

- 4.5 Industry Value Chain Analysis

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Insights into the Key Trends in the Decorative Tiles Industry

- 4.8 Insights into the Recent Developments and Technological Innovations in the Industry

- 4.9 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Ceramic Wall Tiles

- 5.1.2 Vinyl Wall Tiles

- 5.1.3 Stone Wall Tiles

- 5.1.4 Other Types

- 5.2 By End User

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.3 By Application

- 5.3.1 Flooring

- 5.3.2 Wall Coverings

- 5.3.3 Other Applications

- 5.4 Distribution Channel

- 5.4.1 Home Centers

- 5.4.2 Flagship Stores

- 5.4.3 Specialty Stores

- 5.4.4 Online Stores

- 5.4.5 Other Distribution Channels

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 Asia-Pacific

- 5.5.2.1 Japan

- 5.5.2.2 China

- 5.5.2.3 Rest of Asia-Pacific

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 Rest of Europe

- 5.5.4 Latin America

- 5.5.4.1 Brazil

- 5.5.4.2 Peru

- 5.5.4.3 Rest of Latin America

- 5.5.5 Middle East & Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Rest of Middle East & Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Company Profiles

- 6.2.1 RAK Ceramics

- 6.2.2 Group Lamosa

- 6.2.3 Mohawk Industries Inc.

- 6.2.4 Johnson tiles

- 6.2.5 Kajaria Ceramics Limited

- 6.2.6 The Siam Cement Public Company Limited

- 6.2.7 Roca Sanitario SA

- 6.2.8 Panariagroup Industrie Ceramiche SpA

- 6.2.9 Gruppo Concorde SpA

- 6.2.10 Pamesa Ceramica SL

- 6.2.11 Guangdong Dongpeng Ceramic Co. Ltd

- 6.2.12 Emser Tile LLC

- 6.2.13 Seneca Tiles

- 6.2.14 Porcelanosa Grupo

- 6.2.15 British Ceramic Tile

- 6.2.16 China Ceramics Co. Ltd*