|

市場調查報告書

商品編碼

1642170

工業顯示器:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Industrial Monitor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

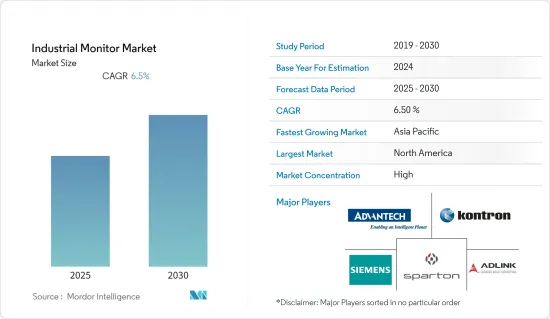

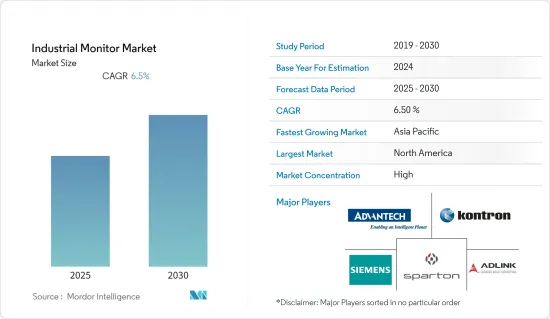

預計預測期內工業顯示器市場複合年成長率為 6.5%。

主要亮點

- 工業顯示器用於各種工業領域,包括製造業、採礦業、石油和天然氣、物流、安全和醫療保健。這些監視器透過高品質的流程簡化了勞動力並提高了工人的生產效率。結果是,勞動變得更加輕鬆並且工時生產力轉向高品質的業務。為了滿足生產目標和工業顯示器的改進,市場競爭日益激烈,這對全球工業顯示器市場產生了正面影響。

- 此外,預計工業顯示器市場成長的主要驅動力將是第四次工業革命。顯示技術、工業自動化技術的發展以及製造和製程行業人機介面 (HMI) 的快速採用都促進了市場的擴張。

- 工業監視器在單一平台上提供多種功能,無需安裝多個庫存。因此,工業企業正在採用自動化系統,從而需要安裝此類工業監視器。

- 工業顯示器產業投入大量資金研發,開發LED、LCD、OLED等顯示技術,實現高解析度與亮度。 IP 認證的邊框和出色的工業高級 LCD 和 LED 顯示器使操作員能夠在各種環境中使用工業顯示器。預計這將推動全球工業顯示器市場的擴張。

- 此外,具有 IP 等級和觸控螢幕的大型工業級 LCD 和 LED 顯示器的發展,正在增加其在採礦、金屬和石油工業等危險環境中的使用。工業監視器還具有允許其在危險環境中運行的溫度等級。

- 關於工業顯示器製造和銷售的法規因地區和國家而異。例如,歐盟《限制使用有害物質指令》(RoHS)規定,電子設備中鎘、鉛、汞、六價鉻以及多溴二苯基醚(PBDEs)和多溴聯苯(PBBs)等阻燃劑的使用在一定程度上受到限制。

- 然而,企業購買工業顯示器所需的高額前期成本可能會限制市場擴張。工業顯示器市場面臨的主要問題之一是製造商對不同設備和零件供應商的依賴。

工業監視器市場趨勢

LCD 佔據很大佔有率

- 液晶的光控能力被利用在平面顯示器:液晶顯示器。 LCD 顯示器使用背光或反射鏡而不是直接產生光來產生彩色或單色影像。液晶顯示器大致可分為電腦用液晶顯示器和電子手錶、視訊播放器等電子設備用液晶顯示器。

- 當工業技術用於工業用途時,預計其效率將非常高。人們需要能夠在各種情況和環境下發揮作用的 LCD 顯示技術。顯示器經常用於通訊、安全和工業任務執行。然而,許多顯示器無法在惡劣的工業環境中使用,這導致對LCD技術的需求增加。隨著液晶螢幕的流行,堅固的「工業」級顯示器也隨之流行。

- LCD 是汽車顯示應用的一種流行技術,可滿足所有溫度和耐用性要求。製造商根據車載顯示應用的用途和溫度範圍,使用 LCD 和 TFT 的組合進行顯示應用。 LCD 數位儀錶叢集和中控台是商用車的標準配備。這導致液晶顯示器領域的需求增加。

- 此外,由於採用了 LCD 技術,它們的品質標準比普通螢幕高得多。值得注意的是,工業級 LCD 的背光半衰期比標準顯示器更長,如果保養得當,其使用壽命可以比傳統 LCD 長 100,000 小時。

- 此外,現今使用最常見、用途最廣泛的電子平板技術是工業液晶顯示器。工業液晶顯示器通常與工業電腦一起使用,但它們也可用於顯示當今幾乎任何視訊來源的視訊影像。早期在工業顯示器中使用多年的陰極射線管(CRT)技術幾乎完全被 LCD 技術所取代。

- 這些 LCD 技術已在高階面板中得到應用,預計未來將繼續改進並變得更加實惠。這些技術包括更大的螢幕、更高的解析度、與影格速率同步的更高刷新率以實現流暢的播放、高動態範圍照明和色域與每像素背光相結合,以便在明亮的陽光下準確觀看並且不會出現燒屏。由於目前尚無可行液晶面板替代品,因此市場正在擴大。

- 我們的堅固工業液晶螢幕的品質與零售店和家庭常用的液晶螢幕不同。工業級顯示器在品質方面已經超越了普通液晶顯示器,而且由於薄膜電晶體技術,真正的工業液晶顯示器現在更加耐用並提供卓越的圖像品質。這些堅固的顯示器專為承受工業工作環境而製造,可承受極端溫度、灰塵和碎片。

北美是工業顯示器市場的主要動力

- 北美地區包括美國、加拿大等已開發國家、新興經濟體。近年來,它已成為汽車製造中心。購買力的上升刺激了該地區對汽車的需求。該地區汽車產業的擴張也得益於北美新興經濟體對半自動汽車的需求穩定成長。預計北美汽車智慧顯示器市場將受到顯示器成本下降和豪華汽車興起的推動。

- 按地區分類,北美目前佔據全球工業顯示器市場的主導地位。預計該區域市場將在預測期內保持領先地位,而該地區的工業部門預計對 HMI、遠端監控解決方案、互動式顯示模組和其他基於物聯網的技術的需求將快速成長。

- 由於企業對數位電子看板應用顯示重要資訊的需求不斷增加,工業顯示器市場正在成長。由於多項技術進步和自動化工業流程的引入,工業監控市場正在不斷擴大。

- 通用電氣、斯巴達、艾倫布拉德利和希望工業系統是該領域的一些領先公司。此外,該地區擁有幾家大型汽車製造商,並且是世界上最大的汽車市場之一。汽車業是該地區製造業最大的收益來源。該地區提供了巨大的市場擴張機會,主要由於汽車行業採用工業顯示器。

- 據估計,美國擁有北美最大的工業顯示器市場,主要受遠端監控、HMI 和互動式顯示應用的需求所推動。該地區對工業顯示器的需求主要由製造業和發電業推動。此外,由於工業自動化的廣泛採用、對IIoT應用和多功能HMI設備的支出增加,該地區工業顯示器的產能可能會加速成長。

工業顯示器產業概況

工業監視器市場競爭激烈,由幾家大公司組成。從市場佔有率來看,其中少數幾家公司佔據著市場主導地位。由於顯示技術發展迅速,且顯示器產業出現了多家專注於研發創新解決方案的公司,導致過去幾年市場競爭異常激烈。這些公司正在利用策略合作措施來增加市場佔有率和盈利。

- 2022 年 5 月-羅克韋爾自動化推出全新工業監視器系列,幫助機器製造商區分他們的機器並滿足廣泛的應用需求。新款 Allen-Bradley ASEM 6300M 工業顯示器屬於原先稱為 VersaView 6300 的產品系列的一部分,提供多種設計選擇。這些選項使機器製造商能夠根據成本、性能和外觀等因素自由地自訂他們的顯示器。

- 2022 年 3 月-Oizom 推出 AQBot,一款智慧且價格實惠的工業空氣品質監測器。這款全面的工業級空氣品質監測設備有 14 種型號,可檢測各種空氣污染物和顆粒物,為各種工業需求提供即時、可操作的見解。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭對手之間的競爭

- 替代品的威脅

- 技術簡介

- COVID-19 市場影響評估

第5章 市場動態

- 市場促進因素

- 對 HMI 設備的需求不斷增加

- 物聯網的普及率不斷提高

- 市場挑戰

- 企業購置工業顯示器的初始投資較高

第6章 市場細分

- 按下顯示技術

- LCD

- LED

- OLED

- 按行業

- 車

- 物流與運輸

- 石油和天然氣

- 醫療保健

- 金屬與礦業

- 其他行業

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 其他亞太地區

- 其他拉丁美洲和中東地區

- 北美洲

第7章 競爭格局

- 公司簡介

- Advantech Co., Ltd.

- Kontron S&T AG

- ADLINK Technology Inc.

- Sparton Inc.

- Siemens AG

- Rockwell Automation Inc.(Allen-Bradley)

- Hope Industrial System Inc.

- Pepperl+Fuchs Inc.

- AAEON Technology Inc.

- Axiomtek Co. Ltd

- National Instruments Corporation

第8章投資分析

第9章 市場機會與未來趨勢

The Industrial Monitor Market is expected to register a CAGR of 6.5% during the forecast period.

Key Highlights

- Industrial monitors are used in many different industrial sectors, including manufacturing, mining, oil & gas, logistics, security, and healthcare. These monitors streamline labor and improve worker productivity over high-quality processes. As a result, it makes labor easier and shifts man-hour productivity toward quality operations. The worldwide industrial monitor market is positively impacted by increased market competitiveness to match production targets and improved industrial monitors.

- The main driver of the industrial monitor market growth is also projected to be the fourth industrial revolution. The development of display technologies, automated technologies in the industry, and the quick adoption of human-machine interfaces (HMIs) in the manufacturing and process sectors all contribute to the market's expansion.

- As industrial monitor provides multi functionalities on an individual platform, the installation of multiple inventories is diminished. Thus, industrial firms are adopting automated systems, and industrial monitor creates one such need for installation.

- The industrial monitor industry has invested much in research and development, which has developed display technologies, including LED, LCD, and OLED, that provide higher resolution and greater brightness. The IP-certifiedified bezel and outstanding industrial high-grade LCD and LED display allow operators to use industrial monitors in various settings. This is expected to propel the industrial monitor market's expansion on a global scale.

- Moreover, the development of sizeable industrial-grade LCD and LED displays with IP ratings and touch panels has increased their use in hazardous settings, including the mining, metals, and oil industries. Industrial monitors are also given temperature ratings that enable them to operate in dangerous environments.

- Regulations governing the production and sale of industrial displays differ by region or nation. For instance, the use of cadmium, lead, mercury, hexavalent chromium, and flame retardants, such as polybrominated diphenyl ethers (PBDE) or polybrominated biphenyls (PBB), in electronic equipment has been somewhat restricted by the European Union Law on the Restriction of Hazardous Substances (RoHS).

- However, the high initial expenditure required by enterprises to purchase industrial monitors may limit the market's expansion. One of the main issues facing the industrial display market is manufacturers' reliance on different suppliers for equipment and components.

Industrial Monitor Market Trends

LCD to Hold Significant Share

- The ability of liquid crystals to regulate light is used in liquid crystal displays, which are flat panel displays. Liquid crystal displays employ a backlight or reflector rather than producing light directly to produce images in color or monochrome. LCDs fall into two main categories: those used in computers and those used in electronic gadgets like digital clocks and video players.

- Industrial technology must be highly effective when used for industrial applications. The need for LCD equipment technology that can function in various settings and circumstances grows. Displays are frequently required for communication, safety, and the performance of industrial tasks. However, many monitors cannot be used in harsh industrial environments, which increases the demand for LCD technology. Rugged, "industrial" grade monitors followed the widespread adoption of LCD screens.

- LCD is a frequently utilized technology in car display applications and satisfies all temperature and durability requirements. Manufacturers use a combination of LCD and TFT in display applications, depending on the purpose of the vehicle display application and the temperature range. LCD digital instrument clusters and center stacks are standard features in commercial vehicles. Thus, increasing the demand for the LCD segment.

- Moreover, Due to LCD technology, these meet quality criteria that are much higher than what a regular screen would ever need to withstand. It's interesting to note that industrial-grade LCDs have a longer backlight half-life than standard displays and that, with proper care, they can last up to 100,000 hours longer than traditional LCDs.

- Additionally, the most popular and versatile electronic flat-screen technology currently in use is an industrial LCD monitor, which is typically used in conjunction with an industrial computer but can also be utilized to display video images from virtually any video source that is currently available. The earlier cathode ray tube (CRT) technology, used for industrial monitors for many years, has almost entirely been superseded by LCD technology.

- These LCD technologies are already present in high-end panels, and it is anticipated that they will get better and more affordable. They include higher resolution with larger screens, higher refresh rates with frame rate synchronization for fluid playback, high dynamic range lighting, and color gamut combined with per-pixel backlighting for precise viewing in bright sunlight and zero burn-in. The market is expanding because a realistic substitute for LCD panels has yet to exist.

- The quality of rugged, industrial LCD screens differs from those often utilized in retail or household settings. Industrial-grade displays beat regular LCDs in terms of quality, and due to thin-film transistor technology, real industrial LCD monitors are now more durable and provide superior picture quality. These tough displays are resilient to industrial work settings and can survive harsh temperatures, dust, and debris.

North America Significantly Drives the Industrial Monitor Market

- The North American area includes developed countries like the United States and Canada and growing economies. The area has been a center for the manufacture of automobiles in recent years. The increase in purchasing power has sparked the region's demand for cars. The expansion of the automotive industry in the area is also attributed to the steady rise in demand for semi-autonomous vehicles in North America's developing economies. The automotive smart display market in North America is anticipated to be driven by declining display costs and an increase in luxury automobiles.

- Geographically speaking, North America currently dominates the world market for industrial monitors. Over the projected period, the regional market is anticipated to hold onto its top position while also experiencing a sharp increase in demand for HMIs, remote monitoring solutions, interactive display modules, and other IoT-based technologies in the area's industrial sector.

- The market for industrial monitors is experiencing growth due to the increasing demand in the area for digital signage applications in businesses for presenting essential information. The industrial monitor market is expanding due to the introduction of several technological advancements and automated industrial processes.

- General Electric, Sparton Inc., Allen-Bradley, Hope Industrial System Inc., etc., are a few of the top companies active in the sector. Additionally, the area is home to several major auto manufacturers and has one of the largest automobile marketplaces in the world. One of the largest revenue producers in the region's manufacturing sector has been the automotive industry. The area presents a significant opportunity for market expansion as the automotive industry is primarily responsible for adopting industrial monitors.

- According to estimates, the U.S. has the most significant industrial display market in the entire of North America, which drives considerable demand for remote monitoring, HMI, and interactive display applications. The manufacturing and power-generating sectors are primarily responsible for driving the need for industrial displays in the area. Furthermore, industrial display capabilities in this area may be accelerated by the increased prevalence of industrial automation, rising spending on IIoT applications, and multifeatured HMI devices.

Industrial Monitor Industry Overview

The Industrial Monitor Market is highly competitive and consists of several major players. In terms of market share, several of these players majorly control the market. The market has become highly competitive in the past few years owing to the rapid pace of development of display technologies and the presence of several companies that are focused on research and development efforts aimed at the development of innovative solutions in the monitor industry. These firms are leveraging strategic collaborative initiatives to increase their market share and profitability.

- May 2022 - Rockwell Automation, Inc. announced the release of a new line of industrial monitors that can help machine builders differentiate their machines and meet a wide range of application needs. The new Allen-Bradley ASEM 6300M industrial monitors, part of the product family formerly known as VersaView 6300, offer several design options. These options give machine builders significant freedom to customize the monitors based on factors like cost, performance, and look and feel.

- March 2022 - Oizom launched AQBot, a smart, affordable Industrial air quality monitor. The comprehensive, industrial-grade air quality monitoring device comes in 14 variants and helps detect a wide range of air pollutants and particulate matter, providing real-time actionable insights for diverse industrial needs.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of SubstituteProdcuts

- 4.4 Technology Snapshot

- 4.5 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 The Increasing Demand for HMI Devices

- 5.1.2 The Augmented Adoption of IoT

- 5.2 Market Challenegs

- 5.2.1 High Primary Investment in Getting Industrial Monitors by the Businesses

6 MARKET SEGMENTATION

- 6.1 By Display Technology

- 6.1.1 LCD

- 6.1.2 LED

- 6.1.3 OLED

- 6.2 By Industry Vertical

- 6.2.1 Automotive

- 6.2.2 Logistics and Transportation

- 6.2.3 Oil and Gas

- 6.2.4 Medical and Healthcare

- 6.2.5 Metal and Mining

- 6.2.6 Other Industry Verticals

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 Rest of Asia-Pacific

- 6.3.4 Rest of the World (Latin America & Middle East )

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Advantech Co., Ltd.

- 7.1.2 Kontron S&T AG

- 7.1.3 ADLINK Technology Inc.

- 7.1.4 Sparton Inc.

- 7.1.5 Siemens AG

- 7.1.6 Rockwell Automation Inc. (Allen-Bradley)

- 7.1.7 Hope Industrial System Inc.

- 7.1.8 Pepperl+Fuchs Inc.

- 7.1.9 AAEON Technology Inc.

- 7.1.10 Axiomtek Co. Ltd

- 7.1.11 National Instruments Corporation