|

市場調查報告書

商品編碼

1642146

園藝照明:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Horticulture Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

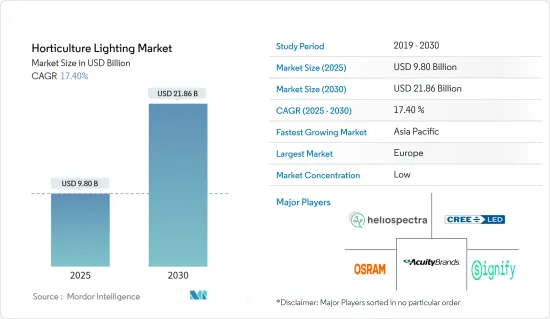

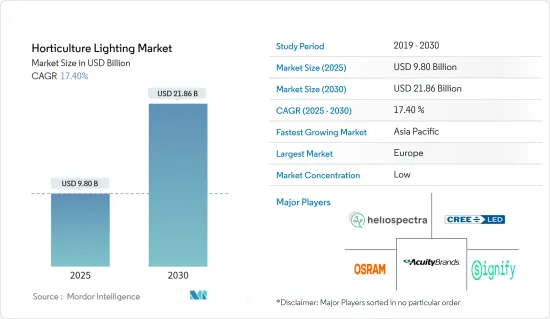

2025 年園藝照明市場規模預估為 98 億美元,預計到 2030 年將達到 218.6 億美元,預測期內(2025-2030 年)的複合年成長率為 17.4%。

有效的光譜分佈對於植物生長至關重要。預計對此認知的不斷提高將推動園藝照明的需求。隨著可擴展食品生產的未來成為越來越重要的關注點,園藝照明產業正在蓬勃發展。種植者正在尋求高品質的太陽能替代品作為現代室內農業環境的關鍵組成部分。為了滿足這些需求,LED製造商正在競相開發能夠有效改善植物栽培的園藝照明解決方案。

關鍵亮點

- 為了維持可控的農業環境,天氣變化是園藝照明需求增加的最大促進因素之一。園藝照明可幫助您透過新的照明解決方案節省能源並提高作物產量。園藝照明的這些屬性以及農民日益增強的認知可能會在預測期內為研究市場注入動力。食品供應商和農場企業的增加預計將推動包括 LED 在內的園藝照明的採用。

- 隨著垂直農業和室內農業應用趨勢的興起,LED照明應用在園藝領域的重要性日益增加。具有可控照度和頻譜的LED 廣泛用於種植番茄、香草、綠色蔬菜和黃瓜等多種作物。韓國農業種植公司 Farm8 正在利用 LED 技術促進植物生長。這種獨特的技術可使植物在約 35 天內生長成熟,而室外生長則需 50 天。

- 世界人口不斷成長,導致對食物的需求不斷增加。然而,園藝照明方面的多項進步使得透過室內農業有效提高作物產量成為可能。當自然光源不全或不存在時,園藝照明是室內農業的一級資訊來源。 Signify(飛利浦照明)等領先公司已經建立了 GrowWise,這是一個城市農業設施,專注於種植各種作物,例如綠葉蔬菜和草莓。為了提高室內農業設施的作物產量,該公司計劃使用 LED 園藝照明。

- 一些公司正在推出新的園藝照明產品。例如,2023 年 1 月,Polymatech 宣布推出其下一代園藝 LED 生長燈。新的園藝 LED 產品包括單色 LED 和 RavayeTM全光譜封裝和模組。這些新產品專注於提供增強的垂直農業、溫室和園藝照明。這些新產品以更廣泛的頻譜設定了標準,可以促進植物更健康、更快地生長,改善農業環境並降低照明系統的成本。

- 由於近年來供應過剩,冠狀病毒大流行對該行業的影響相對較小。包裝公司是停工期間唯一受到勞動力短缺輕微影響的公司。因此,LED產業生態系統和供應鏈結構可能不會有太大變化。

- 過去,UVC LED 供應商透過提高效率和具競爭力的定價來獲得品牌認可。然而,受到新冠肺炎疫情的影響,具備殺菌功能的UVC LED正成為家用電子電器產品的標準組件,並進入市場主流。 COVID-19疫情將為LED產業帶來更多的應用機會,例如殺菌UVC LED、控制社交距離的紅外線感測器以及支援食品供應的園藝照明。

園藝照明市場趨勢

LED 預計將佔據主要市場佔有率

- LED 技術在園藝領域越來越受歡迎,這主要是因為 NASA 繼續在 LED 照明下進行植物種植實驗。它們能耗低、使用方便,並且能夠自訂頻譜輸出以發射植物可用的特定波長,這使得它們在園藝照明方面具有巨大的潛力。

- 它也比其他人工光源更具成本效益。 LED 不會像傳統燈泡那樣燒壞,但隨著時間的推移,它們的光通量會衰減。燈泡的平均使用壽命為一年,而 LED 的使用壽命則可超過 50,000 小時(取決於應用類型)。延長的使用壽命確保了高可靠性。

- LED 發光效率高,且產生的熱量比其他照明燈具少得多。在大多數室內農業中,熱量被視為廢棄物,並透過空調或風扇去除。然而,LED 本身並不會產生熱量,這減少了去除多餘熱量所需的能耗。

- 預計,隨著人們對垂直農場益處的認知不斷提高,以及人口成長導致的糧食需求不斷增加,該地區將採用垂直農場。荷蘭研究人員正在計算都市區實施垂直農業的可行性。例如,Ams Osram 將於2022 年4 月在馬來西亞(居林高科技園區)開設新的8 吋LED 前端生產能力,總投資額為8 億歐元,以支持先進的LED 技術和微型LED 製造。計劃進行額外投資。此外,Ams Osram 計劃在 2030 年實現碳中和。

- 例如,2022 年 4 月,三星宣布推出針對最有效的室內農業的「以植物為中心的頻譜LED,LM301H EVO」。三星利用其頻譜工程技術,開發了一種可靠的園藝光源,其頻譜峰值為 437nm,使行業領先的 PPE 能夠改善植物生長並提高作物品質。與現有的園藝照明解決方案相比,三星創新的以植物為中心的頻譜LED 大大提高了光合作用,從而實現了更好、更全面的植物生長。

- 具有感應功能的紅外線 LED 可應用於公共區域的人流監控,幫助個人在解鎖時保持社交距離。 COVID-19 疫情激發了紅外線感測的一個新應用:社交距離控制。紅外線感應技術可以實現匿名和精確的追蹤。它分析人流量並監控購物中心、公共場所、銀行、機場和其他人群密集場所的交通情況,以幫助維持個人之間的安全社交距離。

歐洲正在經歷快速成長

- 歐洲佔據園藝照明市場的大部分佔有率,並與其他歐洲國家一起持續成長。歐盟鼓勵採用 LED 技術的舉措預計將為園藝領域 LED 照明供應商創造更多機會。

- 目前,LED 已在許多市場大規模生產,製造商之間的競爭正在推動更大的創新、更廣泛的產品選擇和更低的價格。園藝 LED 照明是一個快速成長的市場。在歐洲,園藝 LED 照明的創新將顛覆當地從農場到餐桌的農業的未來。美味佳餚的製作方法在您進入廚房之前就開始了。農民現在正在使用 LED 照明創新來調整他們的氣候配方,並向消費者提供更新鮮、更有營養的水果和蔬菜。

- 該地區的 LED 照明供應商也正在開發全系列園藝產品並擴大與各種合作夥伴的合作。例如,2022 年 3 月,GE Current 在其廣泛的 Arize 園藝 LED 解決方案中增加了一個新類別,推出了 Arize Integral座艙罩照明 (ICL) 燈具。 Integral 可提供高達 346μmol/s 的一流光輸出和 3.5μmol/J 的功效,可策略性地放置在植物座艙罩深處,以最大程度地提高番茄、黃瓜和辣椒等高劑量作物的產量。於放置燈光。

- LED 園藝照明的優點在於有助於提高植物產量,因為人口成長、農業用地有限以及天氣波動等因素都有助於提高植物產量。其他因素包括對更高品質產品的需求、歐洲政府補貼以及大麻用於醫療和娛樂用途的合法化。

園藝照明產業概況

園藝照明市場競爭激烈,國內外都有多家公司參與。市場高度細分,主要企業採用產品創新、夥伴關係、聯盟和併購等策略。市場的主要企業包括 Heliospectra AB、OSRAM GmbH、Everlight Electronics、Gavita International BV、Epistar Corp、LEDiL Oy、Koninklijke Philips NV、Samsung Electronics、Hubbell Inc.、Cree LED 和 Signify Holding。

2022年7月,GE Current更名並收購了Hubbell Lighting,擴大了產品範圍和銷售能力。此次收購是 Current 更名的推手。 Hubbell 和 Current 產品(包括 Alizee 園藝照明)將以 Current 品牌銷售。 Current 的大部分園藝照明燈具在北卡羅來納州亨德森維爾生產,但收購 Hubbell 將幫助其度過供應鏈挑戰。根據Current通報,全球對照明解決方案的需求正在迅速成長。該公司正在積極採用多種新產品以滿足需求。 2022年3月,Signify和Perfect Plants擴大了大麻合作。兩種新型氣候細胞採用可調光的飛利浦 GreenPower LED 頂裝緊湊型生長燈和飛利浦 GrowWise 控制系統,提供在每個生長階段有效、高效的照明系統。 Perfect Plants 正在競爭獲得荷蘭合法的大麻種植許可證,並最近投資了一個研究和生產設施。 Signify 提供靈活的 GreenPower LED 系統和專業知識。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力模型

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 對園藝照明市場的影響

第5章 市場動態

- 市場促進因素

- 人口成長和耕地有限

- 政府支持採用園藝 LED 的舉措

- 市場問題

- LED植物生長燈技術高成本

第6章 市場細分

- 依照明技術

- LED

- HID(MH(金屬鹵化物)和HPS(高壓鈉)燈)

- 其他照明技術

- 按應用類型(定性)

- 蔬菜和水果

- 花卉栽培

- 都市農業

- 溫室

- 室內/垂直農業

- 垂直農業

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 其他

第7章 競爭格局

- 公司簡介

- Heliospectra AB

- Cree LED

- OSRAM GmbH

- Acuity Brands Inc.

- Signify Holding

- LEDiL Oy

- Koninklijke Philips NV

- Samsung Electronics Co. Ltd

- Hubbell Inc.

- Everlight Electronics Co. Ltd

- Gavita International BV

- Epistar Corp.

- Lumileds Holding BV

- Current Lighting Solutions, Inc.

第8章投資分析

第9章:市場的未來

The Horticulture Lighting Market size is estimated at USD 9.80 billion in 2025, and is expected to reach USD 21.86 billion by 2030, at a CAGR of 17.4% during the forecast period (2025-2030).

Effective spectral distribution of light is essential for the growth of plants. Increasing awareness about the same is expected to propel the demand for horticulture lights. The horticulture lighting industry is experiencing rapid growth as the future of scalable food production becomes an increasingly critical concern. Growers seek high-quality sunlight substitutions as crucial components in modern indoor agricultural environments. To address these needs, LED manufacturers fiercely compete to develop horticulture lighting solutions that can effectively improve plant cultivation.

Key Highlights

- Weather change is one of the most significant causes augmenting the demand for horticulture lights to maintain a controlled agricultural environment. Horticulture lights help save energy with new lighting solutions and crop yield. Such qualities of horticulture lights and their rising awareness among farmers will likely gain momentum for the market studied over the forecast period. An increase in food suppliers and farm start-ups is expected to increase the adoption of horticulture lights such as LED.

- The significance of LED lighting applications in the horticultural sector is growing with the rising trend of vertical and indoor farming applications. With controllable illuminance and spectrum, LED is widely used in cultivation for several crops, such as tomatoes, herbs, greens, and cucumbers. A South Korean agriculture cultivator, Farm8, utilizes the technology of LEDs for the plant's growth. With this unique technology, a plant can be grown in around 35 days compared to the time taken (i.e., 50 days) by a plant to grow outdoors.

- The growing population worldwide is generating additional demand for food, which is challenging and can be met through conventional farming. However, several advancements in horticulture lighting enable indoor agriculture to increase crop yield efficiently. Horticulture light is the primary source of indoor agriculture in the partial or absence of natural light sources. Major companies such as Signify (Philips Lighting) established GrowWise, a city farm facility focusing on cultivating various crops, such as leafy vegetables, strawberries, and many more. To increase crop production in its indoor farming facilities, the company has planned to utilize LED horticulture lights.

- Several companies are introducing new products for horticulture lighting. For instance, in January 2023, Polymatech unveiled the next-gen horticulture LED grow light. Launching new horticulture LED products includes monochromatic LEDs and RavayeTM full-spectrum packages and modules. These new products are focused on providing enhanced vertical farming and greenhouse and lighting for horticulture applications. They set a standard with their broader light spectrum for healthier and faster plant growth, improved farming environments, and reduced lighting system costs.

- The coronavirus epidemic has had a relatively slighter impact on the industry due to oversupply in the past few years. Only the packaging companies suffered slightly from a lack of workforce during the lockdowns. Therefore, it is likely to see little changes in the LED industry's ecosystem and supply chain structure.

- UVC LED suppliers used to rely on increased efficiency and competitive prices to receive branding contrast. However, affected by the coronavirus epidemic, UVC LED with disinfecting function is becoming a standard component for home appliances, making its way to the mainstream market. Nevertheless, the COVID-19 pandemic does drive more application opportunities for the LED industry, including germicidal UVC LEDs, social distance-controlling infrared sensors, and horticulture lighting to back food supply.

Horticulture Lighting Market Trends

LEDs are Expected to Hold a Significant Market Share

- LED technology is gaining popularity in the horticultural sector, mainly due to NASA, which continues to conduct plant-growth experiments under LED lighting. It shows immense potential as a horticultural lighting fixture because of low energy consumption, better operation, and the capability to customize the spectral output to emit the specific wavelengths usable by plants.

- These lights are also more cost-efficient than other artificial light sources. LEDs do not burn out like traditional light bulbs but experience minimum lumen depreciation over time. Light bulbs are liable to fail on average after one year, but they can operate LEDs for more than 50,000 hours (depending on the type of application). The increased lifetime ensures high reliability.

- LEDs can emit light efficiently, producing much less heat than other lighting fixtures. In most indoor farming, heat is considered waste and is removed by an air conditioner or fan. Still, LEDs can reduce the energy consumption associated with removing excess heat by not producing it in the first place.

- Increasing awareness of benefits and rising demand for food owing to the rising population is expected to drive the adoption of vertical farms in the region. Researchers in the Netherlands are calculating the viability of vertical farming in urban areas. For instance, in April 2022, ams-OSRAM was also planning additional investment in a significant new 8in LED front-end capacity in Malaysia (at the Kulim Hi-Tech Park) to support advanced LED technologies and microLED manufacturing totaling EUR 800 million. Furthermore, ams Osram is also planning to be carbon neutral by 2030.

- For instance, in April 2022, Samsung introduced 'Plant-Centric Spectrum LEDs, LM301H EVO' for the Most Effective Indoor Farming. Using its spectrum engineering technology, Samsung has developed a trustworthy horticultural light source with a 437 nm spectral peak that delivers industry-leading PPE to improve plant growth and enhance crop quality. Samsung's innovative plant-centric spectrum LED dramatically boosts photosynthesis over existing horticulture lighting solutions, resulting in better, more holistic plant growth.

- IR LEDs with sensing functions can be applied for people flow monitoring in public areas, helping individuals to keep social distance when lockdowns are lifted. The COVID-19 pandemic has inspired a new application for IR sensing: social distance control. IR sensing technology enables anonymous and accurate tracking. It analyzes the flow of people, supporting malls, public buildings, banks, airports, and other venues visited by large amounts of people to monitor people flow and maintain safe social distance between individuals.

Europe to Witness Significant Growth

- Europe accounted for a significant share of the horticulture lighting market and continues to grow with other European countries, promoting plant factories and providing subsidies to spur local demands. The European Union's initiatives to encourage the adoption of LED technology are expected to create more opportunities for the providers of LED lights for the horticulture sector.

- LEDs are now massively produced in many markets, and competition among manufacturers is driving further innovation, wider product choices, and lower prices. LED lighting for horticulture is a fast-growing market. In Europe, innovation in horticulture LED lighting is turning the local farm-to-fork future of agriculture on its head. The recipe for delicious food begins well before the kitchen. Farmers now dial up climate recipes using innovations in LED lighting to deliver fresher, more nutritious fruits and vegetables to consumers.

- LED lighting providers in the region are also developing a full range of horticultural products and are broadening collaboration with different partners. For instance, in march 2022, GE Current added a new category to its broad Arize range of horticultural LED solutions with the launch of the Arize Integral intra-canopy lighting (ICL) fixture. Offering best-in-class lighting output of up to 346 µmol/s and efficiency of 3.5 µmol/J, the Integral is designed to help growers maximize yields of high-wire crops such as tomatoes, cucumber, and peppers through the more strategic deployment of light deep within the plant canopy.

- The benefits of LED horticultural lighting are enablers for the growth in increasing plant production, driven by population growth, limited availability of agricultural land, and growing unreliability of weather conditions. Other factors are the demand for higher-quality products, European government subsidies, and the legalization of cannabis for medicinal and recreational use.

Horticulture Lighting Industry Overview

The Horticulture Lighting Market is highly competitive, owing to the presence of multiple domestic and international companies. The market appears to be highly fragmented, with significant players adopting strategies like product innovation, partnerships, collaborations, and mergers and acquisitions. Some of the major players in the market are Heliospectra AB, OSRAM GmbH, Everlight Electronics Co. Ltd, Gavita International BV, Epistar Corp., LEDiL Oy, Koninklijke Philips NV, Samsung Electronics Co. Ltd, Hubbell Inc., Cree LED, Signify Holding, and many more.

In July 2022, GE Current Re-Brands its name and acquired Hubbell Lighting to increase the range of products and distribution capacity. The acquisition drove the Current name change. The Hubbell and Current products, including Arize horticultural lighting, will be sold under the Current brand name. The company Current is manufacturing most of the horticultural lighting fixtures in Hendersonville, N.C. The acquisition of Hubbell will help them to navigate the supply chain challenges. According to the Current, there has been an enormous increase in demand for lighting solutions globally. The company is actively running several new product introductions to keep pace with demand. In March 2022, Signify and Perfect Plants companies expand their collaboration on cannabis. Two new climate cells are equipped with dimmable Philips GreenPower LED toplighting compact grow lights and the Philips GrowWise Control System, providing a light system that can work effectively and efficiently in every growth phase. Perfect Plants is competing for a Dutch license for the legal cultivation of cannabis and recently invested in facilities for research and production. Signify supplies flexible GreenPower LED systems and specialist knowledge.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter Five Forces

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Horticulture Lighting Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Population and Availability of Limited Agricultural Land

- 5.1.2 Government Initiatives to Support Adoption of LEDs in Horticulture

- 5.2 Market Challenges

- 5.2.1 High Cost of LED Grow Light Technologies

6 MARKET SEGMENTATION

- 6.1 By Lighting Technology

- 6.1.1 LED

- 6.1.2 HID (MH (Metal Halide) and HPS (High Pressure Sodium) Light)

- 6.1.3 Other Lighting Technologies

- 6.2 By Application Type (Qualitative)

- 6.2.1 Vegetables and Fruits

- 6.2.2 Floriculture

- 6.2.3 City Farming

- 6.2.4 Greenhouses

- 6.2.5 Indoor & Vertical Farming

- 6.2.6 Vertical Farming

- 6.2.7 Others

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Heliospectra AB

- 7.1.2 Cree LED

- 7.1.3 OSRAM GmbH

- 7.1.4 Acuity Brands Inc.

- 7.1.5 Signify Holding

- 7.1.6 LEDiL Oy

- 7.1.7 Koninklijke Philips NV

- 7.1.8 Samsung Electronics Co. Ltd

- 7.1.9 Hubbell Inc.

- 7.1.10 Everlight Electronics Co. Ltd

- 7.1.11 Gavita International BV

- 7.1.12 Epistar Corp.

- 7.1.13 Lumileds Holding BV

- 7.1.14 Current Lighting Solutions, Inc.