|

市場調查報告書

商品編碼

1642134

應用容器:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Application Container - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

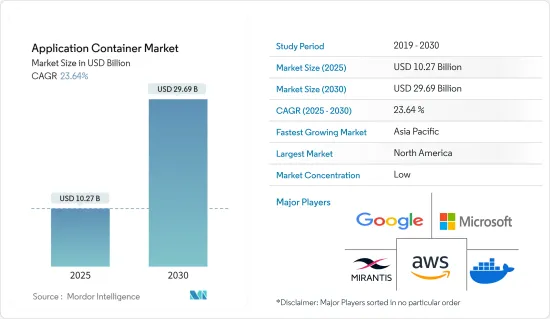

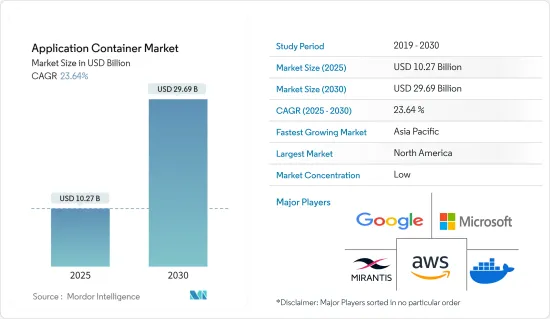

應用容器市場規模預計在 2025 年為 102.7 億美元,預計到 2030 年將達到 296.9 億美元,預測期內(2025-2030 年)的複合年成長率為 23.64%。

主要亮點

- Kubernetes 和 Docker 等容器平台的出現改變了軟體應用程式的配置、開發和管理方式。隨著企業加速採用雲端原生架構並實現IT基礎設施基礎架構的現代化,對應用程式容器的需求預計將會成長。

- 推動應用容器市場成長的關鍵因素包括AI(人工智慧)等先進技術的廣泛採用、軟體服務的重大進步(尤其是在新興市場)以及全球公司推出容器編配和安全服務。

- 容器是微服務架構的一個組成部分,已成為任何規模的雲端原生應用程式背後的驅動力。然而,它的流行使其更容易受到勒索軟體和駭客等威脅。配置錯誤的網路策略可能會允許來自容器的詐欺的流量,從而突破安全邊界並損害資料完整性。

- 容器被設計為短暫的,這使得安全監控和事件回應變得複雜。傳統安全工具在容器快速推出和關閉的環境中往往舉步維艱。特別是當容器關閉時證據可能會消失。

- 疫情之下,電子商務、線上服務、遠端協作等嚴重依賴容器化的產業都出現了顯著的成長。相較之下,旅遊、餐旅服務業和零售等行業受到停工和消費者需求減少的影響,這可能抑制了貨櫃的採用。儘管如此,疫情推動了對雲端處理和資料轉換應用的需求激增,刺激了容器的採用。

應用容器市場趨勢

雲端處理的日益普及將推動市場成長

- 傳統資料中心外包(DCO)的衰落,加上雲端服務和工業化產品重要性的日益提高,預示著向混合基礎設施服務的顯著轉變。雖然 DCO 正在下降,但主機託管(尤其是公共事業基礎設施服務)的支出卻大幅增加。預計這一勢頭將進一步加速向雲端基礎設施即服務(IaaS)和託管的轉變。

- 根據 Flexera Software 2023 報告,47% 的中小型企業 (SMB) 正在積極使用 AWS CloudFormation 範本。 AWS CloudFormation 透過模板機制簡化了應用程式或服務(稱為「堆疊」)的配置。到 2023年終,29% 的企業將揭露年度公共雲端支出超過 1,200 萬美元。如此大的支出凸顯了一個整體趨勢。在全面數位轉型措施的推動下,企業正穩步遷移到雲端。這種轉變自然地推動了對應用程式容器的需求增加。

- 具有自動縮放功能的 Kubernetes 允許應用程式根據流量需求即時調整資源。這不僅可以實現高效率的資源利用,還能確保最佳的使用者體驗。透過支援容器編配,Kubernetes 在雲端處理提供了許多好處,包括提高靈活性和增強可擴展性。

- 必須認知到,雲端容器旨在虛擬特定的應用程式。例如,MySQL 容器的主要功能是提供 MySQL 應用程式的虛擬實例。亞馬遜、Google、微軟和 IBM 等主要雲端運算公司都提供容器即即服務。重要的是,這些容器不僅限於專業服務。

- 越來越多的企業將容器視為雲端處理中虛擬機器(VM)的可行替代方案。鑑於容器能夠在筆記型電腦、內部系統和雲端中無縫運行,它們正在成為雲端供應商和混合雲端配置的有吸引力的基礎設施選擇。

亞太地區成長強勁

- 在快速發展的技術環境中,中國已成為行動應用程式開發的領先中心。作為全球最大的智慧型手機市場,中國對各個領域的複雜行動應用程式的需求正在激增。未來將會利用新技術、建立創新解決方案並優先考慮以用戶為中心的體驗。值得注意的是,中國的容器應用公司在引領國家數位化變革中扮演關鍵角色。

- 據進步政策研究所(PPI)稱,預計到 2024年終,印度將超過美國,成為全球開發人員數量最多的國家。低程式碼/無程式碼應用程式開發的興起減少了對大量編碼專業知識的依賴,預計將進一步推動該市場的擴張。因此,這種成長可能會擴大該國對應用容器的需求。

- 此外,開發人員透過簡化流程並專注於更小、更獨立的服務,大大縮短了產品上市時間。此策略不僅加速了測試階段,而且加速了錯誤修復。人們對微服務架構的需求日益成長,尤其是對於關鍵模組和業務功能。針對此,印度企業正迅速採用微服務開發以獲得更高的靈活性。

- 此外,印度資料中心產業在數位時代正在經歷顯著的成長。印度地理位置優越,正在崛起成為全球資料中心樞紐,尤其是雲端處理,呈現出良好的成長軌跡。印度雲端服務供應商正在幫助推動對應用程式容器的需求。隨著越來越多的企業(無論大小)將其應用程式遷移到雲端基礎的平台,這一趨勢正在推動該國對應用程式容器的需求。

- 由於從內部部署系統向雲端解決方案的轉變以及對以雲端為中心的服務的需求不斷增加,日本的雲端市場正在經歷強勁成長。工作動態的變化,特別是遠距辦公的興起、對技術的依賴性增加以及遠端通訊和網路系統維護的普及,進一步加速了這種轉變。此外,日本在企業範圍內迅速採用雲端優先策略,增強了其雲端運算領域的穩定性和擴張性。

應用容器行業概況

在應用程式容器市場中,全球和地區參與者紛紛爭奪市場佔有率。儘管進入門檻很高,但一些新參與企業已經成功開闢出利基市場。該領域的主要參與者包括 Mirantis, Inc.、Docker, Inc.、Amazon Web Services, Inc.、Google, LLC 和 Microsoft Corporation。

該市場具有中等至高度的產品差異化和高市場滲透率的特點,競爭激烈。解決方案通常是捆綁在一起的,並且服務被整合到產品中。

為了控制成本,許多用戶更喜歡按年訂閱。一些供應商根據合約定價模式提供基於公共容器的軟體。在這種模式下,使用者預先購買固定數量的許可證,並在固定的時間內獲得軟體的使用權。此類交易增加了對容器化解決方案的需求,從而可以實現即時更新。供應商正在大力投資夥伴關係和創新,以刺激競爭格局。綜上所述,該市場競爭對手之間的競爭非常激烈。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 評估宏觀經濟因素和新冠疫情對市場的影響

第5章 市場動態

- 市場促進因素

- 雲端基礎運算的採用日益廣泛

- 市場限制

- 與技術相關的安全風險

- 打入市場策略

- 為新興企業提案的打入市場策略

- 深入了解進入市場的方法,包括夥伴關係、通路和行銷活動

- 科技與創新趨勢

- 與市場相關的新技術和創新概述

- 市場風險與機遇

- 為新興企業發現尚未開發的機會和市場空白

- 消費者/企業採用狀況與痛點

- 深入了解消費者和企業在當前技術和解決方案方面面臨的挑戰

- 獨特的價值提案或解決的迫切問題

第6章 容器的關鍵使用案例

- 管理和編配

- 監控

- DevOps

- 安全功能

- 聯網

- 貯存

第7章 市場區隔

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 亞洲

- 中國

- 印度

- 日本

- 澳洲和紐西蘭

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 北美洲

第8章 競爭格局

- 公司簡介

- Mirantis, Inc.

- Docker, Inc.

- Amazon Web Services, Inc.

- Google, LLC

- Microsoft Corporation

- Oracle Corporation

- Red Hat, Inc.

- Portainer.io. Ltd.

- Heroku Services(Salesforce.com)

第9章 產品比較分析

第10章 市場機會與未來趨勢

The Application Container Market size is estimated at USD 10.27 billion in 2025, and is expected to reach USD 29.69 billion by 2030, at a CAGR of 23.64% during the forecast period (2025-2030).

Key Highlights

- The emergence of container platforms like Kubernetes and Docker has transformed the deployment, development, and management of software applications. As organizations increasingly adopt cloud-native architectures and modernize their IT infrastructures, the demand for application containers is poised to rise.

- Key factors propelling the growth of the application container market include the widespread adoption of advanced technologies, such as AI (Artificial Intelligence), increased investments in software services-particularly in developing countries-and the global rollout of container orchestration and security services by enterprises.

- Containers, integral to microservices architectures, have been the driving force behind cloud-native applications of all scales. However, their widespread adoption renders them vulnerable to threats like ransomware and hacking. Misconfigured network policies can permit unauthorized traffic from containers, breaching security perimeters and risking data integrity.

- Containers, designed for transient use, complicate security monitoring and incident response. Conventional security tools often struggle in environments where containers are swiftly spun up and down. This rapid lifecycle makes it challenging to detect and analyze security incidents, especially since evidence can dissipate once a container is shut down.

- In the wake of the pandemic, industries such as e-commerce, online services, and remote collaboration - heavily reliant on containerization-experienced notable growth. In contrast, sectors like tourism, hospitality, and retail grappled with shutdowns and dwindling consumer demand, which may have tempered their adoption of containers. Still, the surging demand for cloud computing and data transformation applications, mirroring the pandemic's trends, spurred an increase in container adoption.

Application Container Market Trends

Increased Adoption of Cloud-based Computing to Drive the Market Growth

- The growing prominence of cloud services and industrialized offerings, alongside a decline in traditional data center outsourcing (DCO), indicates a marked shift towards hybrid infrastructure services. While DCO experiences a downturn, spending on colocation and hosting, particularly in conjunction with utility infrastructure services, is witnessing a significant rise. This momentum is anticipated to further accelerate the transition towards cloud Infrastructure as a Service (IaaS) and hosting.

- According to the 2023 Flexera Software report, 47% of small and medium-sized businesses (SMBs) actively utilized AWS CloudFormation templates. AWS CloudFormation simplifies the provisioning of applications or services, referred to as "stacks," through its templating mechanism. By the end of 2023, 29% of enterprises disclosed annual public cloud spending, surpassing USD 12 million. Such substantial expenditure highlights a prevailing trend: organizations are unwaveringly transitioning to the cloud, propelled by comprehensive digital transformation initiatives. These transitions naturally amplify the demand for application containers.

- Kubernetes, with its auto-scaling feature, allows applications to adjust resources in real time based on traffic demands. This not only streamlines resource use but also guarantees an optimal user experience. By enabling container orchestration, Kubernetes offers numerous benefits in cloud computing, ranging from enhanced agility to superior scalability.

- It's essential to recognize that cloud containers are designed to virtualize specific applications. For example, a MySQL container's primary role is to provide a virtual instance of the MySQL application. Major cloud players like Amazon, Google, Microsoft, and IBM offer containers-as-a-service. Importantly, these containers aren't confined to specialized services; they can function on both public and private cloud platforms.

- More organizations are considering containers as practical substitutes for virtual machines (VMs) in cloud computing. Given their ability to function seamlessly on laptops, on-premises systems, and in the cloud, containers emerge as a compelling infrastructure option for cloud providers and hybrid cloud configurations.

Asia Pacific to Register Major Growth

- In the rapidly evolving tech landscape, China has emerged as a leading hub for mobile app development. As the world's largest smartphone market, China witnesses a significant surge in demand for sophisticated mobile applications across diverse sectors. Moving forward, the emphasis will be on harnessing emerging technologies, crafting innovative solutions, and prioritizing user-centric experiences. Notably, Chinese container application firms play a crucial role in steering the nation's digital evolution.

- As per the Progressive Policy Institute (PPI), India is on track to eclipse the US, positioning itself as the home to the world's largest developer population by the end of 2024. The ascent of low-code/no-code app development, which reduces the reliance on extensive coding expertise, is anticipated to propel this market's expansion further. Consequently, this growth is likely to amplify the demand for application containers in the country.

- Furthermore, developers are streamlining their processes, leading to a notable reduction in time-to-market by focusing on smaller, independent services. This strategy not only accelerates the testing phase but also expedites bug-fixing. The appetite for microservices architecture is growing, especially for critical modules and business functions. In response, Indian businesses are swiftly adopting microservices development to boost their agility.

- Moreover, India's data center sector is witnessing a significant upswing in the digital era. With its strategic positioning, the nation is set to emerge as a global data center hub, particularly for cloud computing, and boasts a promising growth trajectory. Cloud service providers in India are instrumental in propelling the demand for application containers. As more organizations, regardless of size, pivot to cloud-based platforms for their applications, this trend amplifies the nation's appetite for application containers.

- Japan's domestic cloud market is witnessing vigorous growth, spurred by a transition from on-premise systems to cloud solutions and an escalating demand for cloud-centric services. This shift is further catalyzed by changing work dynamics, especially the rise of remote work, increased reliance on technology, and a surge in remote communications and network system upkeep. Additionally, Japan's rapid embrace of a cloud-first strategy across its enterprises has fortified the stability and expansion of its cloud computing sector.

Application Container Industry Overview

The application container market features a mix of global and regional players competing for prominence. Despite high entry barriers, several newcomers have successfully carved out a niche. Key players in this arena include Mirantis, Inc., Docker, Inc., Amazon Web Services, Inc., Google, LLC, and Microsoft Corporation.

Characterized by moderate to high product differentiation and increasing market penetration, this market is fiercely competitive. Typically, solutions are bundled, integrating the service into the product offering.

To manage expenses, many users prefer annual contracts. Some vendors provide public container-based software with a contract pricing model. This model allows users to make a one-time upfront payment for a set number of licenses, granting access to the software for a chosen duration. Such arrangements have spurred demand for containerized solutions, enabling real-time updates. Providers are heavily investing in partnerships and innovations, fueling the competitive landscape. In summary, the competitive rivalry in this market is pronounced.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of Macroeconomic Factors on the Market and Impact of COVID-19

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Adoption of Cloud-based Computing

- 5.2 Market Restraints

- 5.2.1 Security Risks Associated With the Technology

- 5.3 Market Entry Strategies

- 5.3.1 Recommendations for Market Entry Strategies Tailored for a Startup

- 5.3.2 Insights into Go-to-Market Approaches, including Partnerships, Channels, and Marketing Efforts

- 5.4 Technology and Innovation Trends

- 5.4.1 Overview of Emerging Technologies or Innovations Relevant to the Market

- 5.5 Market Risks and Opportunities

- 5.5.1 Identification of Untapped Opportunities or Market Gaps for a Startup

- 5.6 Consumer/Enterprise Adoption and Pain Points

- 5.6.1 Insights into Challenges Faced by Consumers or Businesses with Current Technologies/Solutions

- 5.6.2 Unique Value Proposition or Solve a Pressing Problem

6 MAJOR CONTAINER USE-CASE AREAS

- 6.1 Management and Orchestration

- 6.2 Monitoring

- 6.3 DevOps

- 6.4 Security

- 6.5 Networking

- 6.6 Storage

7 MARKET SEGMENTATION

- 7.1 By Geography

- 7.1.1 North America

- 7.1.1.1 United States

- 7.1.1.2 Canada

- 7.1.2 Europe

- 7.1.2.1 United Kingdom

- 7.1.2.2 Germany

- 7.1.2.3 France

- 7.1.2.4 Spain

- 7.1.3 Asia

- 7.1.3.1 China

- 7.1.3.2 India

- 7.1.3.3 Japan

- 7.1.4 Australia and New Zealand

- 7.1.5 Latin America

- 7.1.5.1 Brazil

- 7.1.5.2 Argentina

- 7.1.5.3 Mexico

- 7.1.6 Middle East and Africa

- 7.1.6.1 United Arab Emirates

- 7.1.6.2 Saudi Arabia

- 7.1.6.3 South Africa

- 7.1.1 North America

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Mirantis, Inc.

- 8.1.2 Docker, Inc.

- 8.1.3 Amazon Web Services, Inc.

- 8.1.4 Google, LLC

- 8.1.5 Microsoft Corporation

- 8.1.6 Oracle Corporation

- 8.1.7 Red Hat, Inc.

- 8.1.8 Portainer.io. Ltd.

- 8.1.9 Heroku Services (Salesforce.com)