|

市場調查報告書

商品編碼

1642113

無伺服器運算:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Serverless Computing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

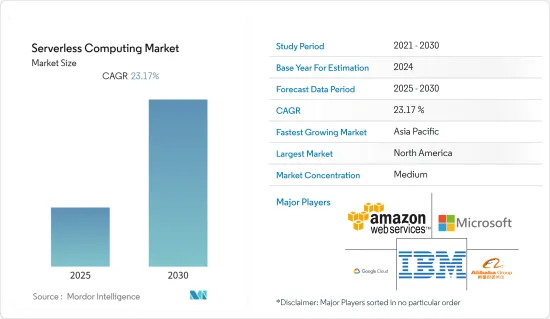

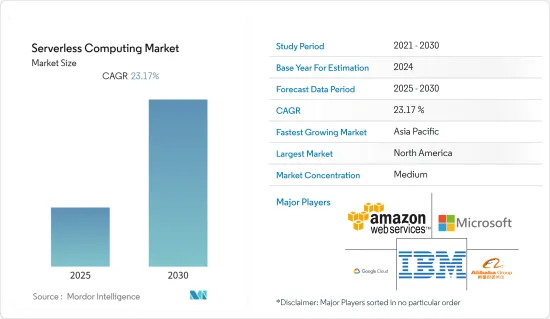

預測期內,無伺服器運算市場預計將以 23.17% 的複合年成長率成長。

主要亮點

- 透過採用無伺服器架構,企業可以有效地消除購買、安裝、配置和排除新硬體組件故障的昂貴且耗時的方法。

- 隨著商業環境中技術的快速變化,公司專注於縮短新產品和新功能的上市時間,以滿足消費者日益成長的期望。預計預測期內此類上升趨勢將推動市場發展。

- 在競爭激烈的市場中,新興企業有望迅速擴大規模並提供增強的產品和服務能力,從而提高商業價值。因此,採用無伺服器技術來最大限度地縮短前置作業時間並對業務產生積極影響有望推動市場成長。

- 日益成長的安全性問題限制了無伺服器運算技術的採用。猶他州智慧 IT 自動化軟體供應商 SaltStack 最近的一項調查發現,儘管三分之二的組織已經將超過 10% 的應用程式容器化,但 40% 的組織擔心他們的容器策略需要在安全性方面進行足夠的投資。此外,34% 的人表示他們公司的方法需要更詳細的考慮。

- COVID-19 正在影響新技術的採用。這是因為,由於 COVID-19,其他任務被優先處理,許多組織無法跟上新技術的步伐。不過,預計這種放緩可能是暫時的。

無伺服器運算市場趨勢

專業服務預計將實現強勁成長

- 數位時代正在急劇加速新產品、新服務和新經營模式的變革和發展。公司面臨越來越大的壓力,需要發布新功能和新產品來滿足不斷成長的客戶期望。無伺服器架構在靈活性方面為中小型企業提供了顯著的優勢並降低了整體基礎架構成本。

- 企業IT領域的重大創新使企業變得更加敏捷和有彈性,從而提高了成本效益。在這種情況下,無伺服器運算已經成為在不斷變化的商業環境中部署雲端服務和應用程式的重要元素。

- 此外,近年來,混合雲端多重雲端在專業服務運算中的使用有所增加。例如,如果一家公司希望釋放本地資源以儲存更敏感的資料和應用程式,混合雲端可以幫助他們做到這一點,而無需花費大量資金來滿足暫時的需求高峰。

- 此外,微服務和無伺服器運算的成長將從根本上改變 DevOps,模糊開發和營運之間的界線。企業希望透過其產品和服務提供增強的功能來提高業務價值並快速擴大規模。

- 此外,企業正在轉向雲端服務,從而刺激了現有競爭對手的競爭。然而,安全仍然是企業和雲端服務供應商關注的主要問題,他們不斷與網路安全供應商合作,以降低網路攻擊的風險。

預計北美將佔據最大市場佔有率

- 預計北美將在收益方面佔據最大的市場佔有率,這得益於技術的快速進步以及零售、BFSI、製造、醫療保健、IT 和電訊等各個垂直行業的各種知名參與者的存在,並在整個全部區域擁有龐大的用戶群。

- 為了在日益數位化和動態的市場中保持競爭力並快速提供新功能和新產品,企業正在積極採用新的雲端處理服務。

- 此外,新興企業正在尋求突破無伺服器運算模型的限制。該公司於去年 6 月宣布了開放原始碼開發者平台「Akka Serverless」。

- 隨著開發人員對管理其應用程式的責任越來越大,許多人正在採用可以代表他們自動管理IT基礎設施的平台,而無需 IT 營運團隊的參與。去年 6 月,提供雲端服務以實現 DevOps 流程自動化的公司 Render 宣布,它增加了根據開發人員需求自動即時擴展運算和記憶體資源的功能。預計這些因素將有助於推動市場成長。

無伺服器運算產業概覽

無伺服器運算市場競爭適中,有幾位大型參與者。就市場佔有率而言,目前少數幾家公司佔據主導地位。然而,隨著專業服務領域的雲端平台進步,新的參與者正進入市場,從而擴大其在新興經濟體的企業發展。

- 2022 年 11 月——為了更輕鬆地使用 AWS Lambda(亞馬遜雲端提供的無伺服器、事件驅動的運算服務)開發輕量級、可擴展的 Java 應用程式,AWS 發布了適用於 Java 的 AWS Lambda SnapStart。

- 2022年11月-在經歷歷史性低迷後試圖恢復發展的中國電子商務巨頭阿里巴巴宣布將在未來三個會計年度投資10億美元為其雲端運算客戶提供服務。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭對手之間的競爭

- 替代品的威脅

- COVID-19 產業影響評估

- 技術簡介

- API 閘道器

- Function as a Service(FaaS)

- Database as a Service(DbaaS)

- Backend as a Service(BaaS)

第5章 市場動態

- 市場促進因素

- 透過提高擴充性、加快上市時間和降低營運成本來實現成長

- 微服務架構在組織經營模式中的普及程度

- 全球對專業服務的需求不斷成長,推動市場

- 市場限制

- 受到攻擊時失去安全控制

第6章 市場細分

- 按服務

- 專業的

- 託管

- 按類型

- 混合雲端

- 多重雲端

- 按最終用戶產業

- 資訊科技/通訊

- BFSI

- 零售

- 政府

- 按行業

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- Amazon Web Services Inc.

- Microsoft Corp.

- Google LLC

- Alibaba Group Holding Limited

- SAP SE

- IBM Corp.

- Iron.io

- Oracle Corp.

- Webtask.io

- VMware Inc.

第8章投資分析

第9章:市場的未來

簡介目錄

Product Code: 66660

The Serverless Computing Market is expected to register a CAGR of 23.17% during the forecast period.

Key Highlights

- With the adoption of serverless architecture, organizations can effectively eliminate expensive and time-consuming approaches such as purchasing new hardware components, installing, configuring, and troubleshooting, thereby shifting the responsibility of managing servers, databases, and application logic, which reduces set-up and maintenance costs.

- With the rapid technological shift in the business environment, companies are releasing new products and features, thereby focusing on reduced time-to-market to meet the exponentially growing consumer expectations. The increasing prominence of such trends is expected to drive the market during the forecast period.

- In the competitive marketplace, startups are anticipated to scale rapidly and deliver enhanced product and service features, thereby improving their business values. Hence, to achieve minimum lead time and positively impact their business, they are anticipated to adopt serverless technology, propelling the market's growth.

- The rising security concerns have been limiting the adoption of serverless computing technology. According to a recent survey by SaltStack, a Utah-based provider of intelligent IT automation software, even though two-thirds of organizations have more than 10% of their applications containerized, 40% of the organizations still need to be concerned that their container strategy needs to invest in security adequately. Another 34% reported that their approach needs more detail.

- COVID-19 has impacted the adoption of new technologies. This is because many organizations cannot deal with new technology due to the other tasks that have taken precedence due to COVID-19. However, it is also anticipated to be likely a temporary slowdown.

Serverless Computing Market Trends

Professional Services are Expected to Grow at a Significant Rate

- The digital era has dramatically accelerated the change and evolution of new products, services, and business models. Enterprises face pressure to release new features and products that meet customers' growing expectations. Serverless architecture offers significant advantages to SMEs in terms of flexibility and reduces overall infrastructure costs.

- Significant innovations in the enterprise IT space have enabled business agility and improved resiliency, thereby driving cost-effectiveness. In such scenarios, serverless computing has emerged as a vital element for deploying cloud services and applications across the everchanging business environment.

- Further, hybrid and multi-cloud use in professional service computing has increased in recent years. For example, when a company wants to free up local resources for more sensitive data or applications, using a hybrid cloud enables it to do so without spending a ton of money on handling a temporary surge in demand.

- Moreover, the growth of microservices and serverless computing is fundamentally changing DevOps by blurring the line between development and operations. Organizations are envisioned to scale rapidly in delivering enhanced features through their products and services offering, thereby improving their business values.

- Further, businesses are moving toward cloud services, adding to the existing competition. However, security remains a significant concern among adopters and cloud service providers, who continuously work with cybersecurity vendors to reduce any risk of cyber-attacks.

North America is Expected to Hold the Largest Market Share

- North America is anticipated to capture the largest market share regarding revenue, owing to rapid advancement in technologies and the presence of various prominent players across the industries such as retail, BFSI, manufacturing, healthcare, and IT & Telecom, boasting of a large user base across the region.

- Due to high digitalization and high adoption of new cloud computing services by enterprises to remain competitive in the dynamic market and deliver new features and products quickly, they are constantly innovating and adopting new technologies, thereby fueling the market's demand across the region.

- Further, a startup called Lightbend Inc. is trying to get around the limitations of the serverless computing model that often prevent its adoption for more complex, data-hungry applications. In June last year, the company announced a new, open-source developer platform called Akka Serverless, which it said would set a new standard for cloud-native application development.

- As developers assume more responsibility for managing their applications, many are starting to embrace platforms that automate IT infrastructure management on their behalf without intervention from an IT operations team. In June last year, Render, a provider of cloud services that automates DevOps processes, announced it is adding the ability to automatically scale compute and memory resources up and down in real-time as developers require. Such factors would cater to the market growth adoptions.

Serverless Computing Industry Overview

The serverless computing market is moderately competitive and consists of several significant players. In terms of market share, some of the players are currently dominating the market. However, with the advancement in the cloud platform across professional services, new players are increasing their market presence, thereby expanding their business footprint across emerging economies.

- November 2022 - To make it simpler to develop nimble, scalable Java apps using AWS Lambda, the serverless, event-driven computing service in the Amazon cloud, AWS has released AWS Lambda SnapStart for Java.

- November 2022 - Alibaba, the Chinese e-commerce behemoth looking to restart development after a historical slump, announced that it would invest $1 billion over the next three fiscal years to serve its cloud computing customers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Force Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Assessment of COVID-19 impact on the industry

- 4.4 Technology Snapshot

- 4.4.1 API Gateway

- 4.4.2 Function as a Service (FaaS)

- 4.4.3 Database as a Service (DbaaS)

- 4.4.4 Backend as a Service (BaaS)

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth in Enhanced Scalability, Decreased in Time-To-Market Along with Reduced Operational Cost

- 5.1.2 Proliferation of the Microservices Architecture Across Organization's Business Model

- 5.1.3 Increase in demand of Professional services globally to drive the market

- 5.2 Market Restraints

- 5.2.1 Loss of Control on Security in Case of Attack

6 MARKET SEGMENTATION

- 6.1 By Service

- 6.1.1 Professional

- 6.1.2 Managed

- 6.2 By Type

- 6.2.1 Hybrid Cloud

- 6.2.2 Multi-Cloud

- 6.3 By End-user Industyr

- 6.3.1 IT & Telecommunication

- 6.3.2 BFSI

- 6.3.3 Retail

- 6.3.4 Government

- 6.3.5 Industrial

- 6.3.6 Other End-user Industries

- 6.4 Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amazon Web Services Inc.

- 7.1.2 Microsoft Corp.

- 7.1.3 Google LLC

- 7.1.4 Alibaba Group Holding Limited

- 7.1.5 SAP SE

- 7.1.6 IBM Corp.

- 7.1.7 Iron.io

- 7.1.8 Oracle Corp.

- 7.1.9 Webtask.io

- 7.1.10 VMware Inc.

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219