|

市場調查報告書

商品編碼

1642094

危險品物流:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Hazardous Goods Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

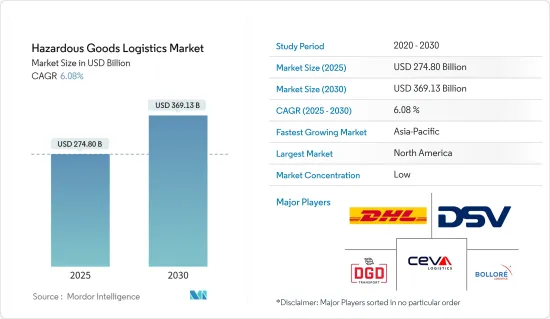

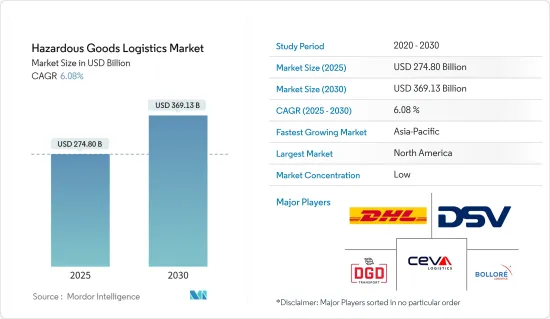

危險品物流市場規模預計在 2025 年為 2,748 億美元,預計到 2030 年將達到 3,691.3 億美元,預測期內(2025-2030 年)的複合年成長率為 6.08%。

在散裝運輸危險物品時,政府機構要求對每件產品進行準確的標記,以符合聯邦法規。 2003年,聯合國採用了一套全球系統來識別可能對身體、健康或環境造成風險的危險。危險物品分為易燃、腐蝕、氣態九個危險類別。 UN編號是一個四位數字,範圍從0004到3548,用於識別國際運輸中使用的某些危險貨物和危險材料。

危險品佔國際貨物的大部分,包括許多常用產品和物品。據稱,這些貨物大部分是汽油和其他石油產品。目前的石油繁榮可以歸因於過去幾年水力壓裂帶來的空前成長,以及政府為燃料生產所創造的有利環境。美國生產了世界上大部分的石油。

除了每年更新的眾多危險物品法規外,運輸危險物品的要求也預計將逐年增加。鋰電池運輸需求的不斷成長,以及該地區成熟的天然氣和石油業務,將推動危險物品市場創下歷史新高,從而增加對聯合國包裝、培訓、標籤和標誌的需求。

此外,還必須使用各種形式的運輸工具來運輸放射性藥物、病毒樣本、醫療危險化學品和手術器械等臨床廢棄物。例如,石油和天然氣產業可能會影響全球危險物質的預期擴張。石油和天然氣產業仍然是一個利潤豐厚的產業,預計未來十年將獲得總合2,370 億美元的投資,佔該產業全球投資總額的 25%。

危險品物流市場趨勢

易燃液體出貨量增加推動市場

醫療、核能、石油和天然氣以及石化產業是新興或已開發經濟體中廣泛使用危險物質的一些例子。運輸危險物品的運輸公司必須遵守標準程序,確保其車輛和船舶的安全。其他聯邦機構關於危險物質、職場安全和環境保護的規定也適用。

未來幾年,危險品物流市場可能會因日益嚴格的政府監管而受益匪淺。美國運輸部部 (DOT) 管線和危險物質安全管理局 (PHMSA) 負責制定和執行危險物質安全運輸的國家法規。當向美國、美國美國或在美國境內運送危險物品時,遵守危險物品法規(HMR 49,第 100-185 部分)至關重要。

聯合國《危險貨物運輸示範條例》為各類運輸方式製定標準化法規提供了參考。每兩年出版一次新版本。為了方便貿易,促進危險貨物的安全、高效運輸,危險貨物必須加貼專門為貨船運輸危險貨物而設計的標籤或標記。更重要的是,它有助於使交通更加安全。

亞太地區佔市場主導地位

促進亞太經合組織區域危險品運輸安全能力建設課程(包括研討會)於 2022 年 12 月 1 日至 2 日在普吉島線上舉行。培訓班學員共53人,包括來自亞太經合組織11個成員經濟體(中國、日本、韓國、馬來西亞、秘魯、菲律賓、新加坡、中國台北、泰國、美國和越南)和3個非成員經濟體(柬埔寨、斯里蘭卡和法國)的代表,以及相關國際和區域組織、港務局、大學、研究機構、專業協會和私營部門的代表。

2022會計年度曼谷港危險物品貨櫃總數為38,545 TEU。危險貨物貨櫃數量最多的是第 9 類(14,034 TEU),其次是第 3 類(9,489 TEU)。同時,危險品貨櫃數量最少的是6.1類(3083TEU)。同樣,林查班港的危險貨物貨櫃總數為174,938 TEU。危險貨物貨櫃數量最多的是第 9 類(59,734 TEU),其次是第 3 類(42,606 TEU)。

大規模的石化開發正在減少對汽油的需求。因此,石油和天然氣等危險物質通常使用卡車運輸服務在美國境內運輸。

預計未來五年內美國將超過沙烏地阿拉伯和俄羅斯,成為世界最大石油生產國。對於石油和天然氣行業來說,航運公司對於向世界各地的客戶運送貨物至關重要。這些市場趨勢可能導致危險品物流市場的擴大。適用的法律法規要求危險貨物必須包裝。在運輸危險物品時,在貨物裝運船隻上使用標籤和其他識別標記也很重要。這大大提高了運輸安全性。

危險品物流業概況

危險品物流市場較為分散,既有全球參與者,也有本地參與者。領先的公司包括 DHL、DSV、Ceva Logistics、Bollore Logistics 和 DGD Transport。協議、聯盟、合資和夥伴關係是這些參與者為保持競爭優勢和滿足不斷成長的客戶需求而實施的眾多策略之一。

我們也致力於研發,以加強我們的產品組合併擴大市場佔有率。本地企業的技術、產品範圍、提供的服務、庫存管理等方面的能力都有所提升。隨著危險品物流監管力道的不斷加強,不少能夠獨立提供全鏈條危險品物流服務的貨代公司應運而生。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態與洞察

- 當前市場狀況

- 產業價值鏈分析

- 政府法規和舉措

- 危險貨物類別概述

- 審查並說明貨物運輸法規和標準(《危險品運輸法》(HMTA)、國際航空運輸協會危險物品規則(IATA DGR)等)

- 關注供應鏈中的關鍵相關人員(貨運代理、地面代理、運輸公司、顧問、顧問等)

- 關鍵資訊 - 文件、特別許可證、安全檢查表

- 焦點 - 危險貨物運輸相關設備及配件(空運、海運及陸運)

- 運輸危險貨物的潛在風險

- 包裝洞察

- 技術簡介(數位化和流程最佳化和管理軟體、電子危險品申報(eDGD)等)

- COVID-19 對市場的影響

- 市場動態

- 市場促進因素

- 國際貿易擴張導致危險貨物運輸需求增加

- 環保意識的增強推動了人們對環保和永續物流的關注

- 市場限制/挑戰

- 確保遵守這些法規是物流公司面臨的持續挑戰

- 維護貨物和設施的安全是一項重大挑戰,需要監視、門禁控制和其他安全措施。

- 市場機會

- 有關危險貨物運輸的嚴格規定對專門確保合規的公司產生了很高的需求。

- 市場促進因素

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 購買者/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 按服務

- 運輸

- 倉儲和配送

- 附加價值服務

- 目的地

- 國內的

- 國際的

- 按地區

- 亞太地區

- 北美洲

- 歐洲

- 拉丁美洲

- 中東和非洲

第6章 競爭格局

- 公司簡介

- Deutsche Post DHL Group

- DSV

- Ceva Logistics

- Bollore Logistics

- DGD Transport

- Toll Group

- YRC Worldwide Inc.

- DB Schenker

- Hellmann Worldwide Logistics

- Agility Logistics

- Kuehne+Nagel

- XPO Logistics

- GEODIS

- Rhenus Logistics*

- 其他公司

第7章:市場的未來

第 8 章 附錄

- 主要國家按活動分類的 GDP 分佈

- 資本流動洞察 – 主要國家

- 全球危險貨物流動統計

- 外貿統計 - 出口和進口,按產品、目的地/原產國分類

The Hazardous Goods Logistics Market size is estimated at USD 274.80 billion in 2025, and is expected to reach USD 369.13 billion by 2030, at a CAGR of 6.08% during the forecast period (2025-2030).

When shipping large quantities of hazardous materials, government agencies require accurate labeling of each product to comply with federal regulations. In 2003, the UN adopted a global system for identifying hazardous materials that may pose physical, health, and environmental risks. Dangerous materials are classified into nine hazard categories: flammable, corrosive, and gaseous. The UN number is a required four-digit number ranging from 0004 to 3548 that identifies specific dangerous goods and hazardous materials for international transportation.

Risky materials comprise the bulk of international cargo, containing many commonly used products and items. Much of this cargo reportedly consists of gasoline and other petroleum products. The current oil boom may result from unprecedented growth over the past few years due to hydraulic fracturing and a government fostering a more conducive environment for fuel production. The United States produces the bulk of the world's oil.

The requirement to ship dangerous goods is anticipated to increase yearly, in addition to the numerous hazardous goods rules being updated annually. The need for UN packaging, training, labels, and placards will rise due to the growing requirement to move lithium batteries and the region's well-established gas and oil businesses, driving the dangerous goods market to record highs.

Additionally, all forms of transportation must be used to convey radioactive medication, virus samples, healthcare hazardous chemicals, and clinical waste such as surgical equipment. For example, the oil and gas industry may impact this expected expansion of dangerous goods around the globe. The oil and gas industry, which is still lucrative, is anticipated to receive investments totaling USD 237 billion over the next 10 years, or 25% of the estimated worldwide investment in this industry.

Hazardous Goods Logistics Market Trends

Increase in Shipment of Flammable Liquids Driving the Market

The medical, nuclear power, oil and gas, and petrochemical industries are examples of the widespread use of hazardous materials in developing or developed economies. Transport companies transporting dangerous goods must follow standard procedures for the safety of their vehicles and vessels. Other federal agencies' regulations on dangerous products, workplace safety, and environmental protection also apply.

Over the next few years, the hazardous product logistics market will benefit significantly from increasingly strict government regulations. The US Department of Transportation's (DOT) Pipeline and Hazardous Materials Safety Administration (PHMSA) is responsible for developing and implementing national regulations for the safe transport of dangerous goods. When transporting dangerous goods to, from, or within the United States, it is critical to comply with the Hazardous Materials Regulations (HMR 49, Part 100-185).

The UN Model Regulations for the carriage of dangerous goods serve as a reference for the development of standardized regulations for all modes of transport. There is a new edition every two years. In order to facilitate trade and facilitate the safe and efficient transportation of dangerous products, labels or marks specifically designed for the carriage of dangerous commodities on cargo vessels must be applied to the dangerous goods. More importantly, they help make transportation safer.

Asia-Pacific Dominates the Market

The Capacity Building Course on Promoting Safety for Dangerous Goods Transportation in the APEC Region, including the workshop, was held online in Phuket from December 1 to 2, 2022. The course was attended by a total of 53 participants from 11 APEC member economies, namely China, Japan, the Republic of Korea, Malaysia; Peru, the Philippines, Singapore, Chinese Taipei, Thailand, the United States; and Vietnam and three Non-APEC economies, namely Cambodia, Sri Lanka, and France, as well as representatives of relevant international organization, regional agencies, port authorities, universities, research institutes, professional associations, and private sectors.

In the fiscal year 2022, the total number of dangerous goods containers in Bangkok Port was 38,545 TEUs. The highest number of hazardous goods containers was in Class 9 (14,034 TEUs), followed by Class 3 (9,489 TEUs). At the same time, the lowest number of dangerous goods containers was in Class 6.1 (3,083 TEUs). Similarly, the total number of hazardous goods containers in Laem Chabang Port was 174,938 TEUs. The highest number of dangerous goods containers was in Class 9 (59,734 TEUs), followed by Class 3 (42,606 TEUs).

Large-scale petrochemical development has decreased the gasoline demand. As a result, more dangerous goods, such as oil and gas, are being transported across the country using trucking services.

The United States is projected to become the largest oil producer in the world within the next five years, overtaking both Saudi Arabia and Russia. Shipping companies are essential for the oil and gas industry to get their goods to customers worldwide. These market trends should lead to the expansion of the hazardous goods logistics market. Applicable laws and regulations should package dangerous materials. It is also important to use labels or other identifying indicators on cargo carriers when transporting hazardous materials. This would significantly enhance transit security.

Hazardous Goods Logistics Industry Overview

The hazardous goods logistics market is fragmented, with a mixture of global and local players. Some of the strong players include DHL, DSV, Ceva Logistics, Bollore Logistics, and DGD Transport. Contracts, collaborations, joint ventures, and partnerships are among many other strategies these players have implemented to stay ahead of the competition and meet the expanding needs of their clients.

Also, they engage in research and development operations to strengthen their portfolios and gain market share. The capabilities of local players in terms of technology, items handled, service offered, and inventory management are all improving. With the tightening of hazardous goods logistics regulations, many freight forwarding businesses that can independently provide dangerous competent goods logistics full-chain services have emerged.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Current Market Scenario

- 4.2 Industry Value Chain Analysis

- 4.3 Government Regulations and Initiatives

- 4.4 Brief on Dangerous Goods Classes

- 4.5 Review and Commentary on Goods Transport Regulations and Standards (Hazardous Materials Transportation Act (HMTA), International Air Transport Association Dangerous Goods Regulations (IATA DGR), etc.)

- 4.6 Focus on Key Stakeholders in Supply Chain (Freight Forwarders, Ground Handling Agents, Carriers, Advisors and Consultants, etc.)

- 4.7 Key Information - Documentation, Special Permissions, and Safety Checklists

- 4.8 Spotlight - Equipment and Accessories Associated with Transport of Dangerous Goods (Air, Sea, and Road)

- 4.9 Potential Risk Involved in Shipment of Hazardous Materials

- 4.10 Insights on Packaging

- 4.11 Technology Snapshot (Digitalization and Process Optimization and Management Software, e-Dangerous Goods Declaration (eDGD), etc.)

- 4.12 Impact of COVID-19 on the Market

- 4.13 Market Dynamics

- 4.13.1 Market Drivers

- 4.13.1.1 The growth of international trade has led to an increased demand for the transportation of hazardous materials

- 4.13.1.2 Growing environmental awareness has led to an increased focus on eco-friendly and sustainable logistics practices.

- 4.13.2 Market Restraints/Challenges

- 4.13.2.1 Ensuring compliance with these regulations is a constant challenge for logistics companies.

- 4.13.2.2 Maintaining the security of shipments and facilities is a significant challenge, requiring surveillance, access controls, and other security measures.

- 4.13.3 Market Opportunities

- 4.13.3.1 With strict regulations governing the transportation of hazardous materials, there is a growing demand for companies that specialize in ensuring compliance.

- 4.13.1 Market Drivers

- 4.14 Industry Attractiveness - Porter's Five Forces Analysis

- 4.14.1 Bargaining Power of Suppliers

- 4.14.2 Bargaining Power of Buyers/Consumers

- 4.14.3 Threat of New Entrants

- 4.14.4 Threat of Substitute Products

- 4.14.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Service

- 5.1.1 Transportation

- 5.1.2 Warehousing and Distribution

- 5.1.3 Value-added Services

- 5.2 By Destination

- 5.2.1 Domestic

- 5.2.2 International

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.2 North America

- 5.3.3 Europe

- 5.3.4 Latin America

- 5.3.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Overview (Market Concentration and Major Players)

- 6.2 Company Profiles

- 6.2.1 Deutsche Post DHL Group

- 6.2.2 DSV

- 6.2.3 Ceva Logistics

- 6.2.4 Bollore Logistics

- 6.2.5 DGD Transport

- 6.2.6 Toll Group

- 6.2.7 YRC Worldwide Inc.

- 6.2.8 DB Schenker

- 6.2.9 Hellmann Worldwide Logistics

- 6.2.10 Agility Logistics

- 6.2.11 Kuehne + Nagel

- 6.2.12 XPO Logistics

- 6.2.13 GEODIS

- 6.2.14 Rhenus Logistics*

- 6.3 Other Companies

7 FUTURE OF THE MARKET

8 APPENDIX

- 8.1 GDP Distribution, by Activity - Key Countries

- 8.2 Insights on Capital Flows - Key Countries

- 8.3 Global Dangerous Goods Flow Statistics

- 8.4 External Trade Statistics - Exports and Imports, by Product and by Country of Destination/Origin