|

市場調查報告書

商品編碼

1641979

聯網街道照明:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Connected Street Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

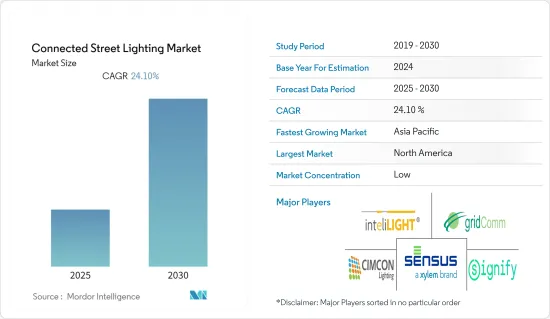

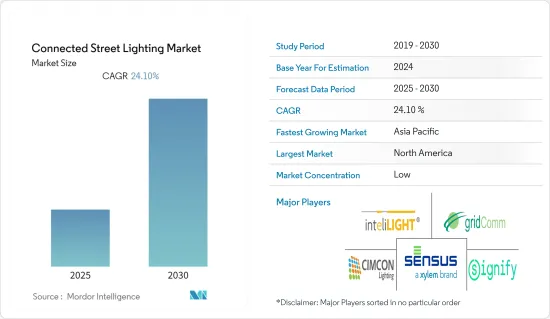

預測期內,連網街道照明市場預計複合年成長率為 24.1%。

主要亮點

- 聯網街道照明也使政府能夠使用街道照明進行 Wi-Fi 接入。市政工作人員可以使用這些網路基地台來減少行動電話資料使用量,從而節省市政資金。 Wi-Fi 接入點也為當地企業和居民提供網路接入,可能為該市創造新的租賃和廣告收入。此外,城市可以利用這些Wi-Fi接入點為貧困城市居民提供免費或低成本的網路接入,幫助縮小數位落差。智慧停車計費表和付費站也可以採用電線杆安裝或電線杆連接,因此無需為獨立計費表和付費站挖溝渠的成本。

- 此外,連接技術近年來已經取得了長足的進步。傳統上,希望集中連接智慧路燈的城市會使用預先連接到低頻寬通訊(例如符合某些 IEEE 標準的電力線載波 (PLC) 或本地 RF 網狀網路)的小段路燈。

- 目前,各種專有的 RF 網狀網路或星狀網路主導著智慧路燈安裝,但窄頻聯網 (NB-IoT) 和遠距(LoRa) 等低功耗廣域(LPWA) 技術的採用正在成長。

- 預計新興經濟體基礎設施薄弱將限制未來幾年對連網街道照明的需求。這是由於網路基礎設施不發達和網際網路普及率低導致的可用頻寬較低。

- 連網路燈市場也受到了 COVID-19 疫情的嚴重影響。同時,其他產業和企業被迫調整策略,以應對持續的疫情。 Telensa 和 Itron 等公司是受疫情打擊最嚴重的公司之一。

聯網街道照明市場的趨勢

智慧城市計畫的興起和 LED 價格的下降趨勢正在推動市場

- 採用智慧解決方案的主要驅動力之一是居住在都市區的人口數量的增加,包括城市人口的總體增加(總人口的 81%居住在城市)。現代城市擴張的一個主要原因是需要智慧城市進行高效率的資源管理。許多國家的政府正在進行合作與夥伴關係,以從傳統的基於孤島的服務提供模式轉向協作和整合的模式。聯網街道照明市場與智慧城市計畫的數量密切相關,因此隨著全球智慧城市數量的增加,連網街道照明的需求可能會變得更加強烈。

- 此外,智慧城市利用各種數位技術來增強設備性能和通訊,有助於節省成本並更好地利用資源。智慧路燈的數位網路和內建感測器使市政當局能夠監測交通和空氣品質。

- 此外,政府還對購買半導體機械(如用於製造 LED 的金屬有機化學氣相沉積 (MOCVD) 設備)提供激勵措施,從而降低了製造成本,鼓勵企業提高 LED 生產能力。

- 許多產業參與者正在與地方政府合作建造智慧城市。由於人們對節能高效照明技術的認知不斷提高,連網(智慧)街道照明領域正吸引參與者的注意。此外,智慧照明領域感測器和無線系統的發展有望推動市場發展。

- 此外,連網照明可以監控停車位情況並識別交通瓶頸。連接攝影機的智慧路燈有望減少事故和犯罪活動的發生,從而提高道路安全性。因此,隨著智慧城市的出現,預計預測期內市場將會擴大。

預計亞太地區將佔很大佔有率

- 亞太地區目前正經歷照明系統重大變革。由於與白熾燈和 LFL 等類似照明類型相比,LED 照明系統的能源效率更高,因此在該地區營運的多家公司擴大在其製造工廠中採用 LED 照明。

- 此外,亞洲國家採用連網街道照明的一個主要驅動力是政府為防止二氧化碳排放而推出的法規。例如,韓國第二個國家能源計畫設定了2035年將商業活動排放量減少13%的目標。它還實施了各種法規,包括排放交易計劃(財政援助和稅額扣抵)。

- 世界各地的許多城市都正在實施 FTTH/Hub C 計劃,通常利用照明基礎設施來最大限度地降低部署成本。這也可能為智慧型應用程式的發展提供巨大的推動力。

- 此外,推動日本智慧照明成長機會的關鍵因素包括感測器和無線技術的快速發展,以及智慧城市和街道照明發展對智慧照明解決方案的不斷成長的需求。日本地方政府的發展計劃進一步為市場提供了必要的動力。

連網路燈產業概況

聯網街道照明市場競爭激烈,國內外有許多參與企業。大公司主要利用產品創新、併購來擴大影響力並維持競爭優勢。

- 2022 年 6 月 - Lucy Group Ltd 宣布收購 InteliLIGHT(Flashnet SA)。兩家公司計劃發展綜合創新照明業務,包括未來對智慧照明和智慧城市技術的投資,作為加強關鍵業務領域和實現整個全部區域永續成長策略的一部分。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場概況

第5章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭對手之間的競爭

- 替代品的威脅

- 產業價值鏈分析

- 技術簡介 -通訊技術

- 有線解決方案

- 無線解決方案

第6章 市場動態

- 市場促進因素

- 政府法規強制使用節能自動化解決方案

- 採用先進的無線連接技術(RF網狀網路、5G、LTE等)

- 智慧城市舉措增多,LED價格呈下降趨勢

- 市場限制

- 維修和新安裝的高資本投入導致預算緊張

- 網路安全和營運限制通常會限制 IT 和通訊基礎設施發達的城市的部署。

第7章 市場區隔

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第8章 競爭格局

- 公司簡介

- InteliLIGHT(Flashnet SA)

- Sensus, a Xylem Brand

- GridComm

- CIMCON Lighting

- Signify Holding

- Echelon Corporation

- Acuity Brands Inc.

- Telensa Limited

- Itron Inc.

- TVILIGHT Projects BV

- Guangdong Rongwen Energy Technology Group

- Delta Electronics Inc.

第9章投資分析

第10章:市場的未來

簡介目錄

Product Code: 64263

The Connected Street Lighting Market is expected to register a CAGR of 24.1% during the forecast period.

Key Highlights

- Connected street lighting also enables governments to use their street lights for Wi-Fi access. These access points can be used by city personnel to lower their cellular data usage, reducing the city's expenses. Wi-Fi access points can also provide internet access to local businesses and residents, providing the city with new leasing or advertising revenues. In addition, cities can use these Wi-Fi access points to help bridge the digital divide by delivering poorer city residents free or low-cost internet access. Smart parking meters or pay stations attached or connected to light poles can also eliminate the costs associated with trenching for standalone meters and pay stations.

- Additionally, there have been considerable advancements in connecting technologies in recent times. Traditionally, cities trying to centralize connectivity for smart street lighting used proprietary gateways connecting to smaller segments of streetlights that are priorly connected via low-bandwidth communications, such as a power line carrier (PLC) or local RF mesh network adhering to several IEEE standards.

- While various proprietary RF mesh or star networks currently account for the majority of smart street lighting installations, the adoption of low-power wide-area (LPWA) technologies such as narrowband IoT (NB-IoT) and long-range (LoRa) is growing fast, particularly in the European and Asian markets.

- Poor infrastructure in developing economies is expected to limit demand for connected street lights in the next few years. This can be ascribed to underdeveloped network infrastructure and low internet penetration, which leads to less bandwidth availability.

- The connected street lighting market has also been significantly affected by the outbreak of COVID-19 as other industries and companies have been forced to restructure their strategies to deal with the ongoing pandemic. Companies such as Telensa and Itron were among the worst hit due to this pandemic.

Connected Street Lighting Market Trends

Increasing Number of Smart City Initiative and Down Trend of LED Prices to Drive the Market

- One of the main forces behind the adoption of smart and intelligent solutions is an increase in the number of people residing in urban areas, including the overall growth of the urban population (81% of the total population lives in cities). Modern cities have expanded primarily due to the requirement for efficient resource management in smart cities. Governments from many nations are cooperating and partnering with one another to move away from the conventional silo-based service delivery model and toward a collaborative and integrated model. More smart cities globally will result in a more robust demand for linked street lights because the market for connected street lights is strongly correlated with the number of smart city initiatives.

- Additionally, smart cities use various digital technologies to enhance device performance and communication; this helps to save expenses and use resources more effectively. A digital network and embedded sensors in smart street lighting enable the monitoring of municipal traffic and air quality.

- Moreover, government incentives for purchasing semiconductor machinery, such as metal-organic chemical vapor deposition (MOCVD) equipment used to make LEDs, are lowering manufacturing costs, pushing firms to boost their LED production capacity.

- Several industry players are working together with local governments to build smart cities. The connected (smart) street light sector garners participants' attention due to the growing awareness of energy-saving and efficient lighting techniques. Furthermore, it is anticipated that the market will rise due to the development of sensors and wireless systems in smart lighting.

- Additionally, the networked lights can monitor parking availability and identify traffic bottlenecks. It is anticipated that camera-connected smart street lighting will increase road safety by reducing the likelihood of accidents and criminal activity. As a result, the market expansion is expected during the forecast period as smart cities emerge.

Asia-Pacific is Expected to Hold Major Share

- Asia-Pacific is currently experiencing a significant shift in lighting systems. Several companies operating in the region are increasingly adopting LED lighting, as compared to their counterparts, like incandescent and LFL, for use in their manufacturing plants, due to the improved energy efficiency of LED lighting systems.

- Further, the primary driver towards the adoption of connected street lighting is the government regulations towards preventing CO2 emissions incurred by Asian countries. For instance, South Korea's second National Energy Master Plan established the goal of 13% below the business-as-usual emission level by 2035. It also implemented various regulations, including the plan for an emissions-trading system (financial support and tax credits).

- In many cities around the globe, FTTH/ Hub C plans are ongoing, often using lighting infrastructure to minimize the cost of roll-out. This could also represent a significant boost to the development of smart applications.

- Moreover, In Japan, significant factors providing growth opportunities for smart lighting include the speedy development of sensor and wireless technology and increasing demand for smart lighting solutions for developing smart cities and street lighting. The development projects undertaken by the country's local authorities are further providing the necessary impetus for the market.

Connected Street Lighting Industry Overview

The connected street lighting market is competitive because numerous participants operate nationally and internationally. The big firms mostly use product innovation, mergers, and acquisitions to expand their footprint and stay ahead of the competition.

- June 2022 - Lucy Group Ltd has announced the acquisition of InteliLIGHT (Flashnet SA), and both companies will work closely to develop the combined innovative lighting businesses, such as investing in smart lighting and smart city technologies into the future as part of the strategy for enhancing their key business areas and delivering sustainable growth across the regions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

5 MARKET INSIGHTS

- 5.1 Market Overview

- 5.2 Industry Attractiveness - Porter's Five Forces Analysis

- 5.2.1 Bargaining Power of Suppliers

- 5.2.2 Bargaining Power of Consumers

- 5.2.3 Threat of New Entrants

- 5.2.4 Intensity of Competitive Rivalry

- 5.2.5 Threat of Substitute

- 5.3 Industry Value Chain Analysis

- 5.4 Technology Snapshot - Communication Technologies

- 5.4.1 Wired Solutions

- 5.4.2 Wireless Solutions

6 MARKET DYNAMICS

- 6.1 Market Drivers

- 6.1.1 Government Regulations Mandating the Use of Energy Efficient Automation Solutions

- 6.1.2 Adoption of Advanced Wireless Connectivity Technologies (RF Mesh Networks, 5G, LTE etc.)

- 6.1.3 Increasing Number of Smart City Initiative and Down Trend of LED Prices

- 6.2 Market Restraints

- 6.2.1 Higher Capital Investment for Retrofitting or New Installations Leading to Budget Constraints

- 6.2.2 Cyber security and Operational Constraints Often Limiting the Installations to Cities with Fitting IT and Communication Infrastructure

7 MARKET SEGMENTATION

- 7.1 Geography

- 7.1.1 North America

- 7.1.2 Europe

- 7.1.3 Asia-Pacific

- 7.1.4 Rest of the World

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 InteliLIGHT (Flashnet SA)

- 8.1.2 Sensus, a Xylem Brand

- 8.1.3 GridComm

- 8.1.4 CIMCON Lighting

- 8.1.5 Signify Holding

- 8.1.6 Echelon Corporation

- 8.1.7 Acuity Brands Inc.

- 8.1.8 Telensa Limited

- 8.1.9 Itron Inc.

- 8.1.10 TVILIGHT Projects BV

- 8.1.11 Guangdong Rongwen Energy Technology Group

- 8.1.12 Delta Electronics Inc.

9 INVESTMENT ANALYSIS

10 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219