|

市場調查報告書

商品編碼

1850345

招生管理軟體:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Admission Management Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

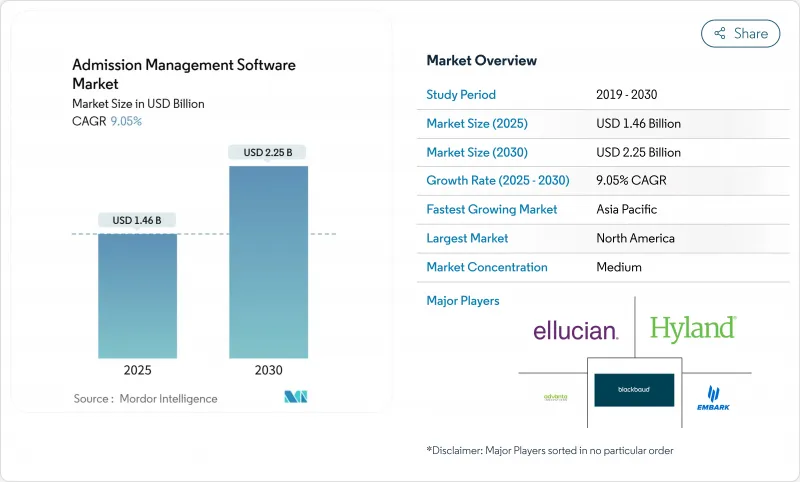

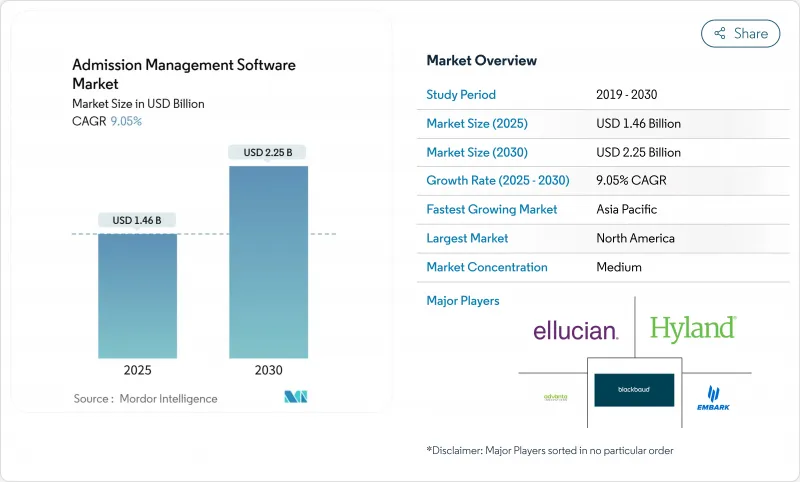

預計到 2025 年,招生管理軟體市場規模將達到 14.6 億美元,到 2030 年將達到 22.5 億美元,複合年成長率為 9.05%。

市場快速成長反映了從第三方 Cookie 轉向第一方資料的轉變、對即時轉換漏斗洞察的激烈競爭,以及雲端運算的成本效益——這使得大規模點選流擷取變得經濟實惠。零售和電商平台引領著這一採用趨勢,因為轉換率的提升能夠直接轉化為收益,而隱私法規也促使企業對其資料收集機制進行現代化改造。全端供應商將分析功能整合到廣泛的雲端產品組合中,而專注於提供更豐富行為洞察的專業供應商之間競爭激烈。招生管理軟體市場也受到事件流工程人才短缺的影響,這推動了對託管服務和低程式碼整合工具的需求。

全球招生管理軟體市場趨勢與洞察

第三方 Cookie 的結束將推動第一方分析的發展。

谷歌更改 cookie 棄用時間表並未帶來任何緩解,反而引發了危機感。早期投資於無 cookie 流程的公司現在更加重視加強用戶許可合規性和建立更豐富的第一方資料集,這促使競爭對手加快類似的升級步伐。供應商正在將隱私沙盒工作流程和客戶資料平台整合到招生管理軟體市場中,從而實現跨網路、行動裝置和自有媒體的統一用戶畫像。隨著監管審查力度的加大,早期採用者希望過渡過程能更加平穩。

電子商務的目標是實現即時個人化和提高轉換率。

個性化已成為基本要求。零售商報告稱,由於點擊響應式產品建議,銷售額成長了約 20%,這顯著推動了對串流分析和低延遲決策引擎的需求。招生管理軟體市場正受益於點擊式工具,這些工具負責人無需深厚的程式設計技能即可推出動態優惠,而機器學習模型則可在每次互動後的幾毫秒內給出最佳行動方案。

全球隱私法規收緊了資料收集

隨著美國19個州實施更嚴格的同意要求,並計劃在2025年前提高GDPR罰款金額,分析流程面臨減少個人識別資料的壓力。雖然將自動化同意管理功能整合到招生管理軟體市場的供應商正在獲得市場認可,但隱私過濾器會移除行為細節,從而限制模型準確性並降低整體複合年成長率。

細分市場分析

到2024年,軟體部分將佔據招生管理軟體市場61.00%的佔有率,凸顯了那些將每一次點擊都與收益掛鉤的平台的主導地位。然而,隨著企業需要實際操作方面的幫助,將資料管治、隱私和機器學習模型與業務目標相契合,服務收入正以13.80%的複合年成長率成長。招生管理軟體市場依賴整合商來編配複雜的混合雲端拓撲結構並最佳化使用者體驗儀錶板。

第二個成長要素是管理方式的改變。大規模推廣往往會因為最終用戶無法理解新的指標而失敗。因此,諮詢合作夥伴正在將賦能研討會、實驗指南和持續最佳化審核服務打包提供。隨著隱私規則的演變,定期合規性評估正在推動服務計費,並縮小與純粹授權模式之間的差距。

2024年,雲端採用將佔招生管理軟體市場規模的67.40%,複合年成長率(CAGR)為14.40%。彈性運算能夠應對季節性宣傳活動期間的流量高峰,而託管安全控制可以滿足新的跨境資料法規要求。即時人工智慧功能(例如自動異常標記)通常首先部署在SaaS版本中,這進一步加速了雲端採用趨勢。

儘管在資料主權條款嚴格的行業中,本地部署仍然佔據主導地位,但大多數此類機構正在採用混合模式,將敏感標識符保留在防火牆內,同時將事件聚合資料串流傳輸到雲端分析引擎。在預測期內,現有授權續訂對SaaS的採用率不斷提高,將增強招生管理軟體市場基於訂閱的收益結構。

准入管理市場按組件(軟體、服務)、部署類型(雲端、本地部署)、應用程式(點擊路徑和網站最佳化、購物籃分析和個人化等)、垂直產業(零售和電子商務、媒體和娛樂等)、組織規模(大型企業和中小企業)以及地區進行細分。市場預測以美元計價。

區域分析

到2024年,北美將佔全球收入的41.50%,這主要得益於高數位商務滲透率、成熟的雲端基礎設施以及主要供應商的集中。該地區的企業正將分析定位為一項關鍵競爭力,並投資於人工智慧增強型和隱私設計框架。隨著市場普及率的提高,成長速度有所放緩,但由於買家在同一平台上擴展了使用場景並維持了基於帳戶的收益,其市場佔有率仍然很高。

歐洲則位居第二,主要受GDPR的影響,GDPR推動了兼具深度洞察和嚴格用戶許可管理的平台的需求。供應商正在本地化資料託管選項,並整合多語言使用者授權橫幅,以促進德國、法國和北歐地區的市場應用。招生管理軟體市場受益於歐盟範圍內的資料傳輸規則,這些規則有利於擁有歐盟資料中心和高級安全認證的供應商。隨著企業將分析深度嵌入行銷和資源管理工作流程,市場成長保持穩定。

亞太地區是成長最快的區域,預計複合年成長率將達到16.00%。印度、印尼和菲律賓等國的行動優先消費行為,使得多設備身分融合成為必要,推動了當地企業對事件流分析的早期採用。以生成式人工智慧為中心的功能集引起了渴望利用低程式碼提取洞察的數位原民原生新興企業的共鳴。區域政府推動跨境資料流動和雲端技術應用的舉措,尤其是在電子支付和超級應用生態系統中,將進一步擴大招生管理軟體市場。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 第三方 Cookie 的逐步淘汰將促進第一方分析。

- 電子商務的目標是實現即時個人化和提高轉換率。

- 經濟高效的雲端服務能夠攝取大量的點擊資料。

- 數位行銷投資報酬率壓力驅動旅程分析

- Edge瀏覽器分析(Wasm)透過設計保護隱私

- 零售媒體網路透過聚合點擊面板收益

- 市場限制

- 全球隱私法規將增加資料收集

- 串流技術堆疊之間整合的複雜性

- 瀏覽器反追蹤(ITP、ETP)會損害資料保真度

- 事件流動工程人才短缺

- 價值/供應鏈分析

- 監管格局

- 技術展望

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭的激烈程度

第5章 市場規模與成長預測

- 按組件

- 軟體

- 服務

- 透過部署模式

- 雲

- 本地部署

- 透過使用

- 點擊路徑和網站最佳化

- 客戶分析

- 購物籃分析與個人化

- 交通分析

- 網站/應用程式效能最佳化

- 按行業

- 零售與電子商務

- 媒體與娛樂

- BFSI

- 通訊/IT

- 旅遊與飯店

- 衛生保健

- 其他

- 按公司規模

- 主要企業

- 小型企業

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 其他亞太地區

- 中東

- 以色列

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 埃及

- 其他非洲國家

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Adobe Inc.

- Google LLC(Google Analytics/GA4)

- Microsoft Corp.(Azure Data Explorer)

- IBM Corp.(Tealeaf/Watson CX)

- Oracle Corp.(Oracle CX Suite)

- SAP SE(Customer Data Platform)

- Amplitude Inc.

- Mixpanel Inc.

- Heap Inc.

- Piano Analytics(AT Internet)

- Contentsquare SA

- FullStory Inc.

- Quantum Metric Inc.

- Snowplow Analytics Ltd

- Hotjar Ltd

- Crazy Egg Inc.

- Matomo(Innocraft Ltd)

- Piwik PRO SA

- Twilio Inc.(Segment CDP)

- Yandex Metrica(YANDEX LLC)

第7章 市場機會與未來展望

The admission management software market size stands at USD 1.46 billion in 2025 and is projected to reach USD 2.25 billion by 2030, registering a 9.05% CAGR.

The market's fast rise mirrors the shift from third-party cookies to first-party data, the race for real-time funnel insights, and cloud cost efficiencies that make large-scale click-stream ingestion affordable. Retail and e-commerce platforms are leading adopters because incremental conversion gains translate directly into revenue, while privacy regulations are prompting enterprises to modernize data-collection mechanisms. Intense competition is emerging between full-stack vendors that bundle analytics with broader cloud portfolios and specialist vendors focused on richer behavioural insights. The admission management software market is also shaped by talent shortages in event-stream engineering, pushing demand for managed services and low-code integration tools.

Global Admission Management Software Market Trends and Insights

Phasing-out of third-party cookies fuels first-party analytics

Google's shifting cookie-deprecation schedule created a sense of urgency rather than relief. Enterprises that invested early in cookieless pipelines now highlight stronger consent compliance and richer first-party datasets, prompting competitors to accelerate similar upgrades. Vendors are embedding Privacy Sandbox workflows and customer data platforms into the admission management software market, enabling unified profiles across web, mobile and owned media. Early adopters anticipate smoother transitions as regulatory scrutiny intensifies.

E-commerce push for real-time personalization & conversion lift

Personalisation has become table stakes. Retailers report sales uplifts of about 20% when product recommendations react instantly to clicks, driving heavy demand for streaming analytics and low-latency decision engines. The admission management software market benefits because point-and-click tooling lets marketers launch dynamic offers without deep coding skills, while machine learning models surface next-best actions within milliseconds of each interaction.

Global privacy regulations tighten data collection

Nineteen US states added stricter consent mandates in 2025, while GDPR fines rose, forcing analytics pipelines to reduce personally identifiable data. Vendors that bundle automated consent management within the admission management software market gain favour, yet privacy filters remove some behavioural detail, limiting model accuracy and restraining overall CAGR.

Other drivers and restraints analyzed in the detailed report include:

- Cloud cost efficiency enables massive click-data ingestion

- Digital-marketing ROI pressure drives journey analytics

- Integration complexity across streaming stacks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The software segment held 61.00% of admission management software market share in 2024, underscoring the primacy of platforms that map every click to revenue outcomes. Yet services revenue is rising at a 13.80% CAGR because enterprises need hands-on help aligning data governance, privacy and machine-learning models with business goals. The admission management software market relies on integrators to orchestrate complex hybrid cloud topologies and fine-tune user-journey dashboards.

A second growth driver is changing management. Large rollouts often fail when end-users cannot interpret new metrics. Advisory partners therefore bundle enablement workshops, experimentation playbooks, and continuous optimisation audits. As privacy rules evolve, recurring compliance assessments expand services billings, narrowing the gap with pure-play licences.

Cloud deployments captured 67.40% of admission management software market size in 2024 and are scaling at a 14.40% CAGR. Elastic compute absorbs traffic surges during seasonal campaigns, while managed security controls help satisfy emerging cross-border data regulations. Real-time AI features-such as automated anomaly flags-tend to launch first on SaaS editions, further accelerating cloud preference.

On-premises persists in sectors with strict data-sovereignty clauses, but most of these organisations are introducing hybrid patterns that keep sensitive identifiers inside the firewall yet stream event aggregates to cloud analytics engines. Over the forecast window, existing licence renewals increasingly convert to SaaS, reinforcing the admission management software market's subscription-based revenue mix.

Admission Management Market is Segmented by Component (Software, Services), Deployment Mode (Cloud, On-Premises), Application (Click Path and Website Optimization, Basket Analysis and Personalization and More), Industry Vertical (Retail and E-Commerce, Media and Entertainment and More), Organization Size (Large Enterprises and SMEs), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America delivered 41.50% of global revenue in 2024 due to high digital-commerce penetration, mature cloud infrastructure, and concentration of leading vendors. Enterprises in the region treat analytics as a make-or-break competency, funnelling budgets into AI augmentation and privacy-by-design frameworks. While growth is slowing as adoption saturates, wallet share remains high because buyers expand use cases within the same platforms, sustaining account-based revenue.

Europe ranks second, driven by GDPR-induced demand for platforms that blend insight depth with strict consent controls. Vendors localise data-hosting options and integrate multilingual consent banners, boosting uptake in Germany, France and the Nordics. The admission management software market benefits from pan-EU data-transfer rules that favour providers offering in-region datacentres and advanced security certifications. Growth is steady as organisations embed analytics deeper into marketing resource-management workflows.

Asia-Pacific is the flash-growth engine, forecast to log a 16.00% CAGR. Mobile-first consumer behaviour in India, Indonesia and the Philippines requires multi-device identity stitching, pushing local firms to adopt event-stream analytics early. Generative-AI-centric feature sets resonate with digitally native start-ups eager for low-code insight extraction. Regional governments' push for cross-border data flows and cloud adoption further enlarges the admission management software market, especially in e-payments and super-app ecosystems.

- Adobe Inc.

- Google LLC (Google Analytics / GA4)

- Microsoft Corp. (Azure Data Explorer)

- IBM Corp. (Tealeaf / Watson CX)

- Oracle Corp. (Oracle CX Suite)

- SAP SE (Customer Data Platform)

- Amplitude Inc.

- Mixpanel Inc.

- Heap Inc.

- Piano Analytics (AT Internet)

- Contentsquare SA

- FullStory Inc.

- Quantum Metric Inc.

- Snowplow Analytics Ltd

- Hotjar Ltd

- Crazy Egg Inc.

- Matomo (Innocraft Ltd)

- Piwik PRO SA

- Twilio Inc. (Segment CDP)

- Yandex Metrica (YANDEX LLC)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Phasing-out of third-party cookies fuels first-party analytics

- 4.2.2 E-commerce push for real-time personalization and conversion lift

- 4.2.3 Cloud cost efficiency enables massive click-data ingestion

- 4.2.4 Digital-marketing ROI pressure drives journey analytics

- 4.2.5 Edge browser analytics (Wasm) preserves privacy-by-design

- 4.2.6 Retail-media networks monetise aggregated click panels

- 4.3 Market Restraints

- 4.3.1 Global privacy regulations tighten data collection

- 4.3.2 Integration complexity across streaming stacks

- 4.3.3 Browser anti-tracking (ITP, ETP) erodes data fidelity

- 4.3.4 Scarcity of event-stream engineering talent

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Software

- 5.1.2 Services

- 5.2 By Deployment Mode

- 5.2.1 Cloud

- 5.2.2 On-premise

- 5.3 By Application

- 5.3.1 Click Path and Website Optimization

- 5.3.2 Customer Analysis

- 5.3.3 Basket Analysis and Personalization

- 5.3.4 Traffic Analysis

- 5.3.5 Website / App Performance Optimization

- 5.4 By Industry Vertical

- 5.4.1 Retail and E-commerce

- 5.4.2 Media and Entertainment

- 5.4.3 BFSI

- 5.4.4 Telecommunications and IT

- 5.4.5 Travel and Hospitality

- 5.4.6 Healthcare

- 5.4.7 Others

- 5.5 By Organisation Size

- 5.5.1 Large Enterprises

- 5.5.2 Small and Medium Enterprises

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 United Kingdom

- 5.6.3.2 Germany

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Rest of Asia-Pacific

- 5.6.5 Middle East

- 5.6.5.1 Israel

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 United Arab Emirates

- 5.6.5.4 Turkey

- 5.6.5.5 Rest of Middle East

- 5.6.6 Africa

- 5.6.6.1 South Africa

- 5.6.6.2 Egypt

- 5.6.6.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Adobe Inc.

- 6.4.2 Google LLC (Google Analytics / GA4)

- 6.4.3 Microsoft Corp. (Azure Data Explorer)

- 6.4.4 IBM Corp. (Tealeaf / Watson CX)

- 6.4.5 Oracle Corp. (Oracle CX Suite)

- 6.4.6 SAP SE (Customer Data Platform)

- 6.4.7 Amplitude Inc.

- 6.4.8 Mixpanel Inc.

- 6.4.9 Heap Inc.

- 6.4.10 Piano Analytics (AT Internet)

- 6.4.11 Contentsquare SA

- 6.4.12 FullStory Inc.

- 6.4.13 Quantum Metric Inc.

- 6.4.14 Snowplow Analytics Ltd

- 6.4.15 Hotjar Ltd

- 6.4.16 Crazy Egg Inc.

- 6.4.17 Matomo (Innocraft Ltd)

- 6.4.18 Piwik PRO SA

- 6.4.19 Twilio Inc. (Segment CDP)

- 6.4.20 Yandex Metrica (YANDEX LLC)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment