|

市場調查報告書

商品編碼

1641930

支出分析:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Spend Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

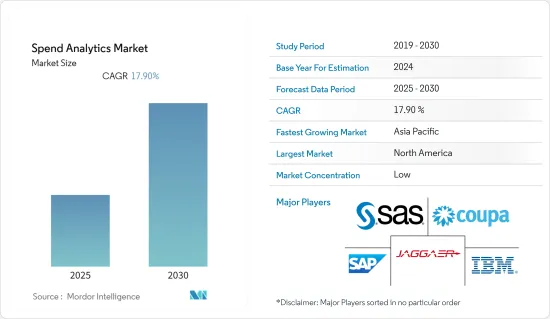

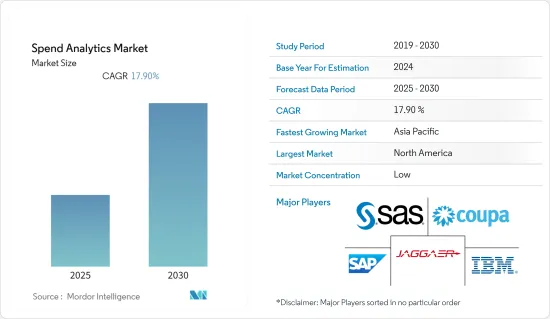

預計預測期內支出分析市場複合年成長率將達 17.9%。

主要亮點

- 支出分析是使用專業軟體或一次性支出立方體收集、清理、分類和分析支出資料的過程。支出分析評估支出資料以降低成本、提高效率並加強供應商關係。

- 隨著行動應用程式的普及和對雲端處理技術的需求不斷增加,預計未來幾年該市場將進一步擴大。巨量資料和雲端運算技術日益重要是影響企業商業智慧需求的兩個關鍵因素。數位化成倍地增加了產生的資料量並改變了資料的使用方式。數位轉型的關鍵促進因素是雲端。它提供了超越傳統資料處理的靈活性,並透過實現跨雲端或本地的即時同步來存取可能性。所調查的市場總體上正在擴大。

- 進階分析、快速洞察和雲端策略已經以個人化的客戶體驗、全通路網路和敏捷的供應鏈為先導改變了數位格局。 IBM 和牛津經濟研究院的一項研究概述了零售業的趨勢,並預測向雲端託管環境的轉變將推動零售業的發展。研究顯示,2018 年平均只有 22% 的應用程式在雲端,到 2020 年這一比例將上升至 40%,預計到 2022 年將達到 57%。約 61% 的受訪者表示,雲端運算將成為他們 2021 年最重要的投資,這意味著實現重大利益的轉變正在迅速發生。零售商對雲端運算的採用預計將推動雲端基礎的支出分析部署的需求。

- 然而,支出分析研究市場面臨多重挑戰,包括保持業務語義和解釋的一致性、對資料隱私和安全的擔憂以及投資收益(ROI)問題。此外,從舊有系統遷移的困難可能會限制市場成長。缺乏明確的流程、資料來源的激增以及從舊有系統遷移的困難也可能阻礙支出分析業務的未來成長。日益嚴格的資料安全和違規行為法規也可能嚴重阻礙支出分析市場研究。

- 例如,2022 年 3 月,為全球數百個地點和企業提供服務的 AI主導支出管理和採購軟體公司 Xeeva 宣布推出具有智慧機會和全新外觀的 Spend Analytics。此新版本使 Xeeva 客戶能夠透過改進的使用者介面分析並利用該應用程式產生的節省和採購機會。

- COVID-19 疫情使得企業能夠在現有產品中加入新功能,以滿足 COVID-19 疫情期間廣泛的客戶需求。例如,SpendHQ 正在幫助客戶分析和了解 COVID-19 危機對其供應鏈和採購需求的影響。該公司使用 SaaS 支出分析技術創建預互動式儀表板,幫助客戶在應對危機時做出關鍵業務決策。這種使用案例的一個例子是,一個醫療保健組織可以使用各縣的每日感染率資料來管理整個醫療保健設施網路中基本個人防護工具(PPE) 的庫存。

- 自疫情爆發以來,隨著企業注重效率、客戶習慣的改變要求企業適應其需求,以及各種規模的企業都著眼於未來,市場成長逐漸加快。

支出分析市場趨勢

零售領域預計將佔很大佔有率

- 由於零售業日益數位化、多通路業務的發展以及零售分析解決方案的演變,零售市場充滿活力。零售商必須管理大量的客戶資料,包括購買行為,因此每次互動和資料點都是使零售更有效率、更成功的機會。因此,零售商可以利用支出資料分析,透過個人化有效地鎖定目標客戶。

- 消費資料分析也使零售商能夠根據客戶行為做出更明智、更有效的決策。這些資料是即時提供的,有助於企業快速調整價格或更改產品供應。擴大寶貴客戶資料的存取權限使行業能夠透過所有管道提供一致的體驗。

- 市場的主要企業正致力於改善支出管理解決方案並進行策略性收購,以保持競爭力並獲得更高的知名度。

- 例如,2022 年 2 月,商業支出管理 (BSM) 解決方案供應商 Coupa Software 宣布推出下一代支出管理解決方案套件 Community.ai。 Coupa 正在透過將資料驅動的人工智慧的力量與人與人之間的關係相結合來改變 B2B 社群以及買家和賣家的互動方式。

- SAP SE 於 2012 年 10 月收購了 Ariba Inc.,擴大了其支出分析業務領域。同樣,該公司也願意建立合作夥伴關係和收購,以便更好地部署其平台。 2021 年 9 月,SAP SE 宣布與 Amazon Business 建立合作夥伴關係,讓員工直接在 SAP Ariba 解決方案中存取數百萬種 Amazon Business 產品,協助企業遵守採購政策。

- 美國零售聯合會估計,2022年美國零售額將達4.86兆美元以上。此外,零售額預計將成長6%至8%,到2022年電子商務零售額預計將達到1.17兆美元,成長率為11-13%。零售市場為各種規模的零售商提供了大量的成長機會,包括獨立直銷商和直銷商、大型「大型賣場」商店經營者以及中小型專利權。這些成長機會預計將從零售業產生大量資料,從而對支出管理解決方案產生巨大的需求。

北美有望成為成長最快的地區

- 根據OICA預測,2021年北美汽車產量將超過1,343萬輛。北美經濟嚴重依賴汽車生產。近年來,生產成本上升、供應鏈變化等因素導致該地區以及許多其他製造業的汽車產量下降。預計此次汽車生產將使汽車製造商能夠採用分析技術來追蹤採購支出和營運成本。

- 在北美,特別是美國有很多店。例如,CVS Health 在 2021 年在全國經營 9,939 家門市,而 Dollar General 在 46 個州經營 17,000 多家門市。此外,7-Eleven在全國各地擁有近9,000家門市。大量的商店預計將使零售商能夠採用並投資分析解決方案和服務。

- 根據Stormforge在2021年4月發布的報告,18%的北美受訪者表示其組織的雲端運算支出在每月10萬至25萬美元之間,44%的受訪者預計其雲端運算支出在未來12個月內將緩慢成長。此外,另有 32% 的受訪者預計其組織的雲端運算支出將在未來 12 個月內大幅增加。

- 2021年1月,為了幫助法律團隊利用資料支援的洞察力管理其法律業務,法律服務領域的全球性公司Epiq宣布推出其先進的支出分析產品。在經濟難以預測和預算支出解決方案不確定的時期,成本控制至關重要。因此,客戶需要更有針對性的資料來就其支出做出明智的業務決策。

- 在加拿大,由於新冠疫情導致的商店和購物中心關閉,2020 年商店商品領域的零售額受到嚴重打擊。隨後,該公司在 2021 年第二季表現出強勁成長,收復了先前的損失。這種反彈即將結束。 2021年第三季度,商店商品零售額較去年同期成長7.5%,較年初下降。但加拿大統計局表示,這仍處於歷史水準之內。總體而言,在 COVID-19 疫情期間,分析解決方案的使用增加。

支出分析產業概覽

支出分析市場本質上是分散的,因為沒有一個供應商能夠主導市場,新興參與者在激烈的競爭中蓬勃發展。這些參與者的目標是透過投資研發或收購參與者,進行創新產品開發,以獲得優於其他參與者的優勢。主要參與者有IBM Corporation、SAS Institute Inc.、JAGGAER Incorporation等。近期市場發展趨勢如下:

- 2022 年 4 月 - SAS 和微軟可能會在深度科技整合方面進行合作,以使醫療保健和生命科學公司更容易獲得先進的健康分析。透過加速採用快速醫療保健互通性資源 (FHIR) 標準並在 Azure 上整合 Azure 健康資料服務和 SAS Health,提高醫療保健互通性。

- 2022 年 1 月-SAP SE 和 Icertis 宣布擴大夥伴關係以改善合約管理。夥伴關係也可能包括 SAP 對 Icertis 的投資。此次合作預計將帶來聯合產品藍圖和更深層的技術整合,以幫助在整個企業中實現價值,包括增強合規性、加快談判速度以及人工智慧驅動的業務洞察和自動化。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 市場促進因素與限制因素簡介

- 市場促進因素

- 在行業採購流程中擴大採用

- 雲端服務的普及和物聯網應用的普及

- 市場限制

- 資料外洩案例不斷增加

- 價值鏈/供應鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 按類型

- 軟體

- 服務

- 專業服務

- 託管服務

- 透過分析

- 說明

- 規定性

- 預測

- 按部署

- 本地

- 雲

- 按最終用戶產業

- 製造業

- 供應鍊和物流

- 零售

- BFSI

- 資訊科技/通訊

- 教育

- 衛生保健

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第6章 競爭格局

- 公司簡介

- IBM Corporation

- SAS Institute Inc.

- JAGGAER Incorporation

- SAP SE

- Coupa Software

- Proactis Inc.

- Oracle Corporation

- Empronc Solutions Pvt. Ltd

- Zycus Inc.

- Genpact

- Sievo Oy

第7章投資分析

第8章 市場機會與未來趨勢

The Spend Analytics Market is expected to register a CAGR of 17.9% during the forecast period.

Key Highlights

- Spend analytics is the process of gathering, cleaning, classifying, and analyzing spend data using either specialist software or one-time spend cubes. Spend analysis evaluates spending data to reduce expenses, improve efficiency, or strengthen supplier relationships.

- The market studied is expected to have more opportunities to expand in the next years due to the increasing popularity of mobile applications and the increased demand for cloud computing technologies. Big data's expanding importance and cloud computing technologies are two key factors that impact a company's requirement for business intelligence. Data generation increased tremendously due to digitization, which also altered the use of data. A key accelerator for digital transformation is clouded. It offers flexibility by eclipsing conventional data processing and accessing possibilities by delivering real-time synchronization across the cloud or on-premise. The market studied appears to be expanding overall.

- Advanced analytics, quick insights, and cloud strategies transformed the digital landscape around personalized customer experiences, omnichannel networks, and agile supply chains. IBM and Oxford Economics study indicated trends in retail, with a shift to cloud hosting environments expected to gain traction for the retail sector. The study showed that, on average, only 22% of applications were in the cloud in 2018, going up to 40% in 2020, and estimated to reach 57% by 2022. About 61% of respondents stated investing in the cloud became the most crucial thing in 2021, signifying a quick transition to seeing huge benefits. Such a rise in the adoption of the cloud by retailers is expected to increase the demand for the deployment of cloud-based spend analytics.

- However, the market studied for spend analytics faces several difficulties, including maintaining uniformity in business semantics and interpretations, fears about data privacy and security, and issues with a positive return on investment (ROI). Additionally, the market growth may be constrained by the difficulty of migrating from legacy systems. The future expansion of the spend analytics business may also be hampered by the lack of a defined process, the abundance of data sources, and the difficulty in transitioning from legacy systems. The market studied for expenditure analytics may also be severely hampered by the increasingly strict regulatory regulations on data security and breaches.

- For instance, in March 2022, Xeeva, the AI-driven Spend Management and Procurement software firm serving hundreds of locations and enterprises globally, were thrilled to announce the release of Spend Analytics with Intelligent Opportunities and a new appearance. This new release allows Xeeva clients to analyze and act on application-generated savings and sourcing opportunities with an updated user interface.

- The COVID-19 outbreak enabled companies to incorporate new features in their existing products to cater to a wide range of customers' needs during the COVID-19 pandemic. For example, SpendHQ is assisting clients in analyzing and comprehending the impact of the COVID-19 crisis on their supply chain and procurement requirements. The company created pre-built interactive dashboards using its SaaS spend analysis technology to enable clients to make crucial operational decisions as they navigate the crisis. Examples of such use cases include healthcare organizations managing their inventory of essential personal protective equipment (PPE) throughout their network of providers by using data on daily infection rates by county.

- Since the pandemic, the market's growth has been rising gradually as companies focus on becoming more efficient, changing customer habits need companies to adjust to their needs, and companies of all sizes look to the future.

Spend Analytics Market Trends

Retail Segment is Expected to Hold Significant Share

- With the increase in digitalization across the retail industry, the development of multi-channel operations, and the evolution of retail analytics solutions, the retail market has become dynamic. Since retail businesses have to manage an enormous amount of customer data, such as customer buying behavior, every interaction and data point offers an opportunity to make the retail industry more efficient and successful. Retailers can thus leverage the spend data analytics for effectively targeting customers through personalization.

- Spend data analytics also allow retailers to make smart, efficient decisions based on customer behavior. This data can be viewed in real-time, allowing businesses to adjust prices quickly or alter merchandise offerings. Expanded access to valuable customer data helps companies in the industry to create a consistent experience across all channels.

- The key players in the market are focusing on improving their spend management solutions and involving in strategic acquisitions to remain competitive and increase their visibility.

- For instance, in February 2022, Coupa Software, the provider of Business Spend Management (BSM) solutions, announced the launch of Community.ai, a suite of next-generation spend management solutions. Coupa transforms B2B communities and how buyers and sellers engage by combining the power of data-driven artificial intelligence with person-to-person relationships.

- SAP SE expanded its spend analytics footprint by acquiring Ariba Inc. in October 2012. Similarly, the company is open to partnerships and acquisitions for better platform reach. In September 2021, SAP SE announced partnering with Amazon Business to enable employees to tap into millions of items on Amazon Business directly from within SAP Ariba solutions and assist with compliance with corporate purchasing policies.

- The National Retail Federation estimated that sales from over retail establishments in the United States would reach more than USD 4.86 trillion in 2022. In addition, retail industry sales are expected to increase between 6% and 8%, with e-commerce retail sales expected to reach USD 1.17 trillion by 2022 with a growth rate of 11-13%. Numerous growth opportunities exist in the retail market for retail providers of all sizes, including individual direct sellers or direct marketers, large 'big-box' store operators, and small to medium-sized franchise unit owners. Such growth opportunities are poised to create significant data generation from the retail sector and a considerable requirement for spend management solutions.

North America is Expected to be the Fastest Growing Region

- According to OICA, in 2021, over 13.43 million automobiles were made in North America. The North American economy is heavily dependent on the production of vehicles. Due to increasing production costs, altered supply networks, and other factors, car production decreased in the region and many other manufacturing sectors in recent years. Such automobile production is expected to enable automotive manufacturers to deploy and spend analytics to track procurement spending and operational cost.

- There are many businesses in the North American region, particularly in the United States, where numerous stores exist. For instance, although CVS Health had 9,939 locations across the country in 2021, Dollar General has more than 17,000 locations across 46 states. Additionally, there are nearly 9,000 7-Eleven locations nationwide. The vast number of stores is expected to enable retailers to adopt and spend on analytics solutions or services.

- According to a report published by Stormforge in April 2021, 18% of respondents from North America stated that their organization had a monthly cloud expenditure between USD 100,000 and USD 250,000, and 44% of respondents expected cloud spending to increase moderately over the next 12 months. Another 32% expected their organization's cloud spending to increase significantly over the next 12 months.

- In January 2021, to enable legal teams to manage their legal business with data-backed insights, Epiq, a global participant in the legal services sector, announced the debut of their advanced spend analytics product. During this period of economic unpredictability, spending solutions are offered when budgets are unclear, and cost management is essential. As a result, clients require more focused data to make wise operational decisions regarding spending.

- In Canada, retail sales in the store merchandise sector took a big hit in 2020 due to COVID-19-related store and shopping mall closures. A significant growth spike followed this in Q2 2021, which reversed the previous losses. This rebound is in the process of abating. Store merchandise retail sales were up to 7.5% year-over-year in Q3 2021, a lower gain than earlier in the year. However, it was still well within historical levels, as per Statistics Canada. Overall, the usage of analytics solutions increased during the COVID-19 pandemic.

Spend Analytics Industry Overview

The spend analytics market is fragmented in nature, as no single vendor dominates the market, as well as new emerging players, are thriving in intense rivalry. These players aim to gain an edge over the other players through innovative product development by investing in research and development and player acquisitions. Key players are IBM Corporation, SAS Institute Inc., JAGGAER Incorporation, etc. Recent developments in the market are -

- April 2022 - SAS and Microsoft could collaborate to create deep technological integrations to make advanced health analytics more accessible to healthcare and life science enterprises. The collaboration could improve healthcare interoperability by facilitating the adoption of Fast Healthcare Interoperability Resources (FHIR) standards and integrating Azure Health Data Services with SAS Health on Azure.

- January 2022 - SAP SE and Icertis announced expanding their partnership for improved contract management, helping companies increase efficiency, minimize risk, and realize the whole purpose of their agreements. The partnership could include a financial investment from SAP in Icertis. It is expected to lead to a joint product roadmap and deeper technological integration to help deliver enterprise-wide value, including greater compliance, faster negotiations, and AI-powered business insights and automation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Rising Adoption in Procurement Process in Industries

- 4.3.2 Rising Adoption of Cloud Services and Increasing Penetration of IoT Applications

- 4.4 Market Restraints

- 4.4.1 Growing Data Breaches Cases

- 4.5 Value Chain / Supply Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Software

- 5.1.2 Service

- 5.1.2.1 Professional Service

- 5.1.2.2 Managed Service

- 5.2 By Analysis

- 5.2.1 Descriptive

- 5.2.2 Prescriptive

- 5.2.3 Predictive

- 5.3 By Deployment

- 5.3.1 On-Premise

- 5.3.2 Cloud

- 5.4 By End-user Industry

- 5.4.1 Manufacturing

- 5.4.2 Supply Chain & Logistic

- 5.4.3 Retail

- 5.4.4 BFSI

- 5.4.5 IT & Telecommunication

- 5.4.6 Education

- 5.4.7 Healthcare

- 5.4.8 Other End-user Industries

- 5.5 By Geography

- 5.5.1 North America

- 5.5.2 Europe

- 5.5.3 Asia-Pacific

- 5.5.4 Latin America

- 5.5.5 Middle East & Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 IBM Corporation

- 6.1.2 SAS Institute Inc.

- 6.1.3 JAGGAER Incorporation

- 6.1.4 SAP SE

- 6.1.5 Coupa Software

- 6.1.6 Proactis Inc.

- 6.1.7 Oracle Corporation

- 6.1.8 Empronc Solutions Pvt. Ltd

- 6.1.9 Zycus Inc.

- 6.1.10 Genpact

- 6.1.11 Sievo Oy