|

市場調查報告書

商品編碼

1851653

語音辨識:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Voice Recognition - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

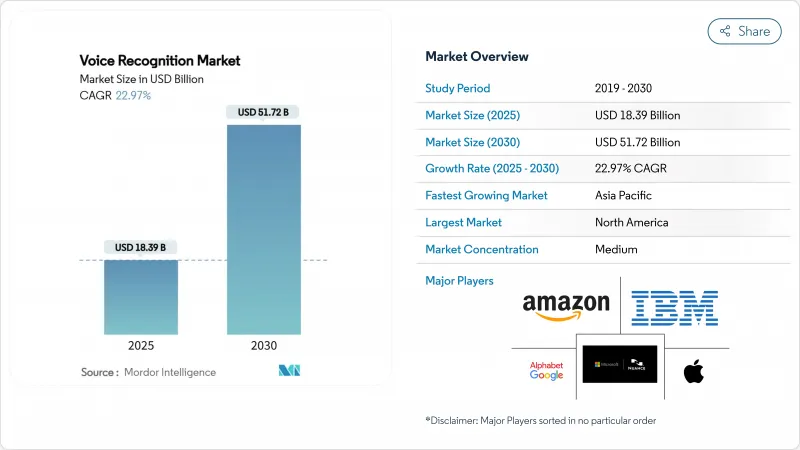

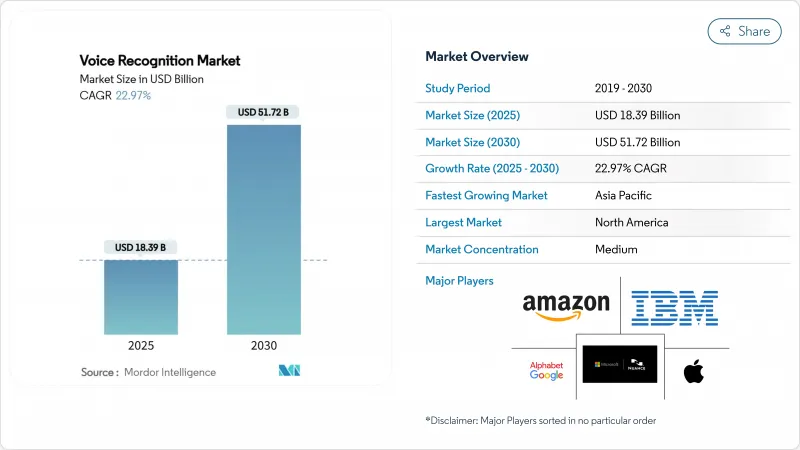

全球語音辨識市場預計到 2025 年將達到 183.9 億美元,到 2030 年將達到 517.2 億美元,複合年成長率為 22.97%。

市場擴張反映了三大同步驅動力:邊緣人工智慧 (AI) 晶片組的快速部署、監管機構對緊急通訊網路現代化施加的壓力,以及企業向語音生物識別技術遷移以進行客戶身份驗證。目前,以軟體為中心的架構佔據主導地位,軟體開發套件)和應用程式介面 (API) 平台將佔市場佔有率的 70.7%,而雲端部署預計到 2024 年將佔 62.1%。從區域來看,亞洲在多語言介面需求和強大的晶片製造生態系統的推動下,預計到 2024 年將佔據 32.5% 的市場佔有率。雖然語音辨識仍然是關鍵技術支柱,佔據 81.2% 的市場佔有率,但嵌入式設備端處理將實現 25% 的複合年成長率,成為成長最快的技術,這標誌著推理引擎將從純雲設計轉向混合或完全本地化設計。

全球語音辨識市場趨勢與洞察

亞洲邊緣設備語音AI晶片爆炸性成長

Chipintelli 的 14 款離線 AI 語音晶片和聯發科的 MR Breeze ASR 25 晶片的發布,標誌著對區域語言最佳化的專用晶片的投資不斷成長。在地化能夠降低延遲,解決雲端串流傳輸的隱私問題,並鞏固以往依賴北美超大規模資料中心的國內供應鏈。亞洲半導體公司正利用這一優勢,為設備 OEM 廠商提供可處理印尼、越南和印度等市場語碼轉換的承包語音協定棧,從而鞏固該地區在邊緣推理創新領域的領先地位。

北美地區對支援語音功能的911和緊急呼叫升級實施更嚴格的監管

美國聯邦語音辨識委員會 (FCC) 的新規要求美國通訊業者使用基於 IP 的對話啟動協定)路由 911 緊急通訊業者,在 165 公尺半徑範圍內以 90% 的置信度消除誤路由,並支援即時文字和視訊。語音辨識供應商需要在 6 至 12 個月內完成合規,這為處於緊急服務前沿的供應商帶來了可預見的收入成長。這項強制性規定可能會影響歐洲公共網路,擴大對語音分析的需求,以便利用轉錄音訊和元資料豐富事件資料。

口音和方言意識的不足限制了非洲地區的普及。

93種非洲方言的測試發現,醫療保健提供者遇到的錯誤率高達25%至34%,需要針對不同方言進行微調。 NaijaVoices提供的1800小時資料集將Whisper模型的字詞錯誤率降低了75.86%,但建構文化豐富的語料庫成本高且複雜,阻礙了商業性部署。 Intron Health的160萬美元種子輪融資顯示投資者已意識到這個問題,同時也凸顯了在地化模型訓練的資金需求。

細分市場分析

預計到2024年,雲端交付將佔全球收入的62.1%,隨著企業優先考慮快速部署、持續模型更新和廣泛的語言覆蓋,這一比例預計還將繼續成長。金融機構和醫療保健提供者擴大選擇混合架構,將原始錄音保存在本地,並將模型訓練資料匯總到雲端。這種方法既滿足了合規性要求,也兼顧了集中式學習帶來的表現優勢。因此,本地部署仍然非常適合滿足自主資料需求,這將推動該領域在2030年之前持續保持兩位數的成長。

對高可用性語音終端的需求正促使超大規模雲端服務供應商開放承包API,從而降低中型企業的整體擁有成本,並降低獨立開發者的進入門檻。因此,語音辨識的應用領域正在不斷拓展,從消費性設備擴展到流程自動化、物流和現場服務工作流程等領域。預計到2030年,雲端語音辨識的市場規模將接近320億美元,這反映了新增工作負載和現有部署的擴展。

到2024年,軟體平台將佔全球支出的70.7%,這一關鍵比例凸顯了產業正從專有硬體轉向模組化、對開發者友善的工具。 RESTful API和預先建構語言模型的普及,使得許多應用場景無需自訂晶片。隨著企業擴大轉向專業供應商尋求領域最佳化、語音識別和安全合規方面的支持,服務業務將以23.7%的複合年成長率成長。

在邊緣延遲、離線可用性和聲波束成形至關重要的應用中,硬體仍然非常重要,例如車載資訊娛樂系統和工業頭戴式顯示器,但大多數新參與企業正在透過使用平台即服務產品來繞過硬體,這表明橫向軟體提供商和垂直整合的硬體專家之間的差距正在擴大。

語音辨識市場配置(雲端、本地部署)、組件(軟體/SDK、硬體、服務)、科技(語音辨識、語音生物識別、邊緣語音AI)、裝置類型(智慧型手機、智慧音箱、汽車、穿戴式裝置、POS)、應用程式(身分驗證、語音搜尋、其他)、最終用戶垂直產業(汽車、銀行、金融服務和其他市場價值

區域分析

亞洲將佔2024年收入的32.5%,這反映了該地區的半導體製造能力和語言多樣性。日本資助東南亞語言模式的舉措就是一個例子。北美仍然是技術的早期採用者,但由於積極的本地化和設備成本的下降,其市場佔有率已被亞洲蠶食。歐洲則維持了穩定成長,主要得益於汽車和銀行、金融服務及保險(BFSI)產業的主題式應用。

中東地區以23.1%的複合年成長率領先,海灣地區的智慧城市計畫將對話式自助服務終端融入市民服務基礎建設。南美洲的電子商務語音搜尋和銀行身份驗證業務也實現了兩位數以上的成長。非洲由於口音多樣,難以採用一般模式,發展相對落後。然而,捐助方資助的語言計劃和電訊升級可望釋放2027年以後的潛在需求。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 亞洲邊緣設備中的語音AI晶片正在爆炸式成長。

- 北美監管機構推動語音911和緊急呼叫系統升級

- 汽車製造商轉向嵌入式語音操作系統以實現駕駛座個性化

- 銀行、金融服務和保險業採用語音生物辨識技術取代基於知識的身份驗證(歐洲)

- 智慧音箱家庭中語音商務的快速普及

- 亞太新興市場對多語言語音使用者體驗的需求日益成長

- 市場限制

- 口音和方言識別方面的差距阻礙了非洲的廣泛應用。

- 限制語音資料保存在雲端的隱私法規(GDPR、印度的DPDP)

- 標註特定領域語音語料庫的高成本

- 在吵雜的工業環境中,精度持續存在滯後。

- 價值/供應鏈分析

- 監理展望

- 技術展望

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

第5章 市場規模與成長預測

- 透過部署

- 雲

- 本地部署

- 按組件

- 軟體/SDK

- 硬體(ASIC、DSP、麥克風陣列)

- 服務(託管和專業服務)

- 透過技術

- 語音辨識

- 說話者/語音生物識別

- 嵌入式/邊緣語音人工智慧

- 依設備類型

- 智慧型手機和平板電腦

- 智慧音箱和顯示器

- 汽車資訊娛樂和遠端資訊處理

- 穿戴式裝置(TWS、智慧型手錶、AR/VR)

- 商用自助服務終端和POS機

- 透過使用

- 身份驗證和安全

- 語音搜尋和命令

- 文字稿和字幕

- 虛擬助理和聊天機器人

- 醫療文件

- 按最終用戶行業分類

- 車

- 銀行和金融服務

- 通訊領域

- 醫療保健提供者

- 政府和國防部

- 消費性電子產品

- 零售與電子商務

- 工業和製造業

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- ASEAN

- 澳洲

- 紐西蘭

- 亞太其他地區

- 中東和非洲

- 中東

- GCC

- 土耳其

- 以色列

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 埃及

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Apple Inc.

- Alphabet Inc.(Google LLC)

- Amazon.com Inc.

- Nuance Communications Inc.(Microsoft)

- IBM Corporation

- Baidu Inc.

- Samsung Electronics Co. Ltd.

- SoundHound AI Inc.

- iFLYTEK Co. Ltd.

- Sensory Inc.

- Cerence Inc.

- Verint Systems Inc.

- NICE Ltd.

- ElevenLabs

- Auraya Systems Pty Ltd.

- Intron Health

- PlayAI

- Mobvoi Information Technology Co. Ltd.

- Deepgram Inc.

- AssemblyAI Inc.

- Speechmatics Ltd.

第7章 市場機會與未來展望

The global voice recognition market size reached USD 18.39 billion in 2025 and is forecast to advance at a 22.97% CAGR to attain USD 51.72 billion by 2030.

Market expansion reflects three concurrent forces: the rapid roll-out of edge artificial intelligence (AI) chipsets, regulatory pressure for modernising emergency communications networks, and enterprise migration to voice biometrics for customer authentication. Software-centric architectures now dominate because 70.7% of market value sits in software development kits and application-programming-interface platforms, while cloud deployment accounts for 62.1% of implementations in 2024. Regionally, Asia led with 32.5% market share in 2024 on the back of multilingual interface demand and strong chip manufacturing ecosystems; speech recognition technology remained the principal technology pillar with 81.2% share, yet embedded on-device processing delivered the fastest 25% CAGR, showing a decisive shift from cloud-only designs to hybrid or fully local inference engines.

Global Voice Recognition Market Trends and Insights

Explosion of Voice-AI Chips in Edge Devices across Asia

The release of 14 offline AI speech chips by Chipintelli and MediaTek's MR Breeze ASR 25 model signal escalating investment in specialised silicon optimised for regional languages. Localisation delivers lower latency, resolves privacy concerns tied to cloud streaming, and entrenches domestic supply chains that historically depended on North American hyperscalers. Asian semiconductor firms leverage this advantage to offer device OEMs turnkey voice stacks that handle code-switching in markets such as Indonesia, Vietnam, and India, reinforcing the region's leadership in edge inference innovation.

Regulatory Push for Voice-Enabled 911 and Emergency Dispatch Upgrades in North America

New FCC rules obligate US carriers to route 911 calls via IP-based Session Initiation Protocol, cut misrouting below a 165-meter radius at 90% confidence, and support real-time text and video. Voice recognition vendors positioned around emergency services gain a predictable revenue ramp because compliance deadlines fall within a 6-12-month horizon for nationwide and regional operators. The mandate creates a template likely to influence European public safety networks, expanding total addressable demand for voice analytics that enrich incident data with transcribed speech and metadata.

Accent and Dialect Recognition Gaps Limiting Adoption in Africa

Tests across 93 African accents showed medical entity error rates that still required 25-34% refinement via accent-specific fine-tuning. NaijaVoices' 1,800-hour dataset cut word-error rates for Whisper models by 75.86%, but the cost and complexity of curating culturally rich corpora slow commercial roll-outs. Intron Health's USD 1.6 million seed round underlines investor recognition of the problem, yet it also highlights the capital demands of localised model training.

Other drivers and restraints analyzed in the detailed report include:

- Automotive OEM Shift to Embedded Voice OS for Cockpit Personalisation

- BFSI Adoption of Voice Biometrics to Replace Knowledge-Based Authentication in Europe

- Privacy Regulations (GDPR, India DPDP) Restricting Cloud Voice-Data Retention

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cloud delivery generated 62.1% of global revenue in 2024, and that share is projected to widen as enterprises prioritise rapid rollout, continuous model updates, and broad language coverage. Financial institutions and healthcare providers increasingly select hybrid architectures that keep raw recordings on premises but pool model-training insights in the cloud. The approach balances compliance with the performance gains of aggregated learning. On-premise deployments therefore remain relevant for sovereign-data mandates, explaining why the segment still posts double-digit growth through 2030.

Demand for high-availability voice endpoints has pushed hyperscalers to expose turnkey APIs. Consequently, total cost of ownership falls for mid-sized enterprises, and barriers to entry lower for independent developers. The result is a wider application funnel for voice recognition market adoption, extending beyond consumer devices into process automation, logistics, and field-service workflows. The voice recognition market size for cloud implementations is set to approach USD 32 billion by 2030, reflecting both new workloads and expansion of existing deployments.

Software platforms captured 70.7% of global spend in 2024, a decisive margin that underpins the industry's pivot from proprietary hardware to modular, developer-friendly tooling. The availability of RESTful APIs and pre-built language models removes the need for bespoke silicon in many use cases. Services, although representing a smaller base, rise at 23.7% CAGR as enterprises engage specialist vendors for domain tuning, accent adaptation, and security compliance.

Hardware maintains relevance where edge latency, offline availability, or acoustic beam-forming matter, such as in automotive infotainment or industrial head-mounted displays. Yet most new entrants bypass hardware by consuming platform-as-a-service offerings, illustrating an expanding gap between horizontally oriented software providers and vertically integrated hardware specialists.

Voice Recognition Market is Segmented by Deployment (Cloud, On-Premise), Component (Software/SDK, Hardware, Services), Technology (Speech Recognition, Voice Biometrics, Edge Voice AI), Device Type (Smartphones, Smart Speakers, Automotive, Wearables, POS), Application (Authentication, Voice Search, and More), End-User Vertical (Automotive, BFSI, and Morel), and by Geography. Market Forecasts in Value (USD).

Geography Analysis

Asia generated 32.5% of 2024 turnover, reflecting the region's semiconductor capacity and linguistic diversity. Domestic policy supports AI acceleration; Japan's initiative to fund Southeast Asian language models is one example. North America remains technology's early-adopter hub but ceded share to Asia because of aggressive localisation and lower device costs. Europe grew steadily, influenced by automotive and BFSI thematic adoption.

The Middle East exhibits the quickest 23.1% CAGR as Gulf smart-city programmes embed conversational kiosks in citizen-services infrastructure. South America records mid-teens growth from e-commerce voice search and banking authentication. Africa faces a lag because accent diversity complicates universal models; however, donor-funded language projects and telecom upgrades may unlock latent demand from 2027 onward.

- Apple Inc.

- Alphabet Inc. (Google LLC)

- Amazon.com Inc.

- Nuance Communications Inc. (Microsoft)

- IBM Corporation

- Baidu Inc.

- Samsung Electronics Co. Ltd.

- SoundHound AI Inc.

- iFLYTEK Co. Ltd.

- Sensory Inc.

- Cerence Inc.

- Verint Systems Inc.

- NICE Ltd.

- ElevenLabs

- Auraya Systems Pty Ltd.

- Intron Health

- PlayAI

- Mobvoi Information Technology Co. Ltd.

- Deepgram Inc.

- AssemblyAI Inc.

- Speechmatics Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Explosion of Voice-AI Chips in Edge Devices across Asia

- 4.2.2 Regulatory Push for Voice-Enabled 911 and Emergency Dispatch Upgrades in North America

- 4.2.3 Automotive OEM Shift to Embedded Voice OS for Cockpit Personalisation

- 4.2.4 BFSI Adoption of Voice Biometrics to Replace Knowledge-Based Authentication in Europe

- 4.2.5 Rapid Proliferation of Voice Commerce in Smart-Speaker Centric Households

- 4.2.6 Growth of Multilingual Voice UX Demand in Emerging APAC Markets

- 4.3 Market Restraints

- 4.3.1 Accent and Dialect Recognition Gaps Limiting Adoption in Africa

- 4.3.2 Privacy Regulations (GDPR, India DPDP) Restricting Cloud Voice Data Retention

- 4.3.3 High Cost of Annotated Domain-Specific Speech Corpora

- 4.3.4 Persistent Accuracy Lags in Noisy Industrial Environments

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Deployment

- 5.1.1 Cloud

- 5.1.2 On-premise

- 5.2 By Component

- 5.2.1 Software/SDK

- 5.2.2 Hardware (ASIC, DSP, Microphone Arrays)

- 5.2.3 Services (Managed and Professional)

- 5.3 By Technology

- 5.3.1 Speech Recognition

- 5.3.2 Speaker/Voice Biometrics

- 5.3.3 Embedded/Edge Voice AI

- 5.4 By Device Type

- 5.4.1 Smartphones and Tablets

- 5.4.2 Smart Speakers and Displays

- 5.4.3 Automotive Infotainment and Telematics

- 5.4.4 Wearables (TWS, Smart-watch, AR/VR)

- 5.4.5 Commercial Kiosks and POS

- 5.5 By Application

- 5.5.1 Authentication and Security

- 5.5.2 Voice Search and Command

- 5.5.3 Transcription and Captioning

- 5.5.4 Virtual Assistants and Chatbots

- 5.5.5 Medical Documentation

- 5.6 By End-user Vertical

- 5.6.1 Automotive

- 5.6.2 Banking and Financial Services

- 5.6.3 Telecommunications

- 5.6.4 Healthcare Providers

- 5.6.5 Government and Defence

- 5.6.6 Consumer Electronics

- 5.6.7 Retail and E-commerce

- 5.6.8 Industrial and Manufacturing

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 South America

- 5.7.2.1 Brazil

- 5.7.2.2 Argentina

- 5.7.2.3 Rest of South America

- 5.7.3 Europe

- 5.7.3.1 United Kingdom

- 5.7.3.2 Germany

- 5.7.3.3 France

- 5.7.3.4 Italy

- 5.7.3.5 Spain

- 5.7.3.6 Rest of Europe

- 5.7.4 Asia Pacific

- 5.7.4.1 China

- 5.7.4.2 Japan

- 5.7.4.3 India

- 5.7.4.4 South Korea

- 5.7.4.5 ASEAN

- 5.7.4.6 Australia

- 5.7.4.7 New Zealand

- 5.7.4.8 Rest of Asia Pacific

- 5.7.5 Middle East and Africa

- 5.7.5.1 Middle East

- 5.7.5.1.1 GCC

- 5.7.5.1.2 Turkey

- 5.7.5.1.3 Israel

- 5.7.5.1.4 Rest of Middle East

- 5.7.5.2 Africa

- 5.7.5.2.1 South Africa

- 5.7.5.2.2 Nigeria

- 5.7.5.2.3 Egypt

- 5.7.5.2.4 Rest of Africa

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)}

- 6.4.1 Apple Inc.

- 6.4.2 Alphabet Inc. (Google LLC)

- 6.4.3 Amazon.com Inc.

- 6.4.4 Nuance Communications Inc. (Microsoft)

- 6.4.5 IBM Corporation

- 6.4.6 Baidu Inc.

- 6.4.7 Samsung Electronics Co. Ltd.

- 6.4.8 SoundHound AI Inc.

- 6.4.9 iFLYTEK Co. Ltd.

- 6.4.10 Sensory Inc.

- 6.4.11 Cerence Inc.

- 6.4.12 Verint Systems Inc.

- 6.4.13 NICE Ltd.

- 6.4.14 ElevenLabs

- 6.4.15 Auraya Systems Pty Ltd.

- 6.4.16 Intron Health

- 6.4.17 PlayAI

- 6.4.18 Mobvoi Information Technology Co. Ltd.

- 6.4.19 Deepgram Inc.

- 6.4.20 AssemblyAI Inc.

- 6.4.21 Speechmatics Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment