|

市場調查報告書

商品編碼

1641923

資料準備:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Data Preparation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

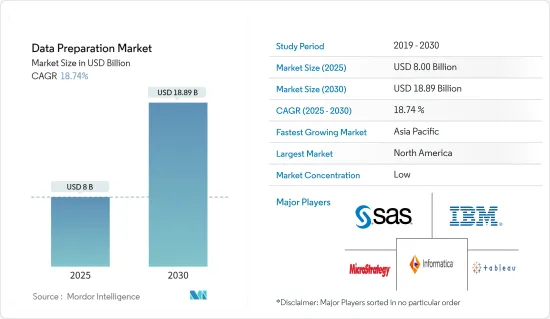

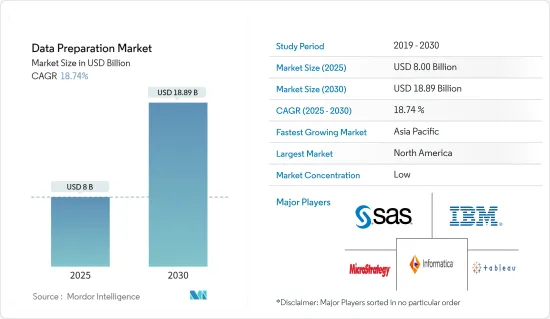

資料準備市場規模在 2025 年預計為 80 億美元,預計到 2030 年將達到 188.9 億美元,預測期內(2025-2030 年)的複合年成長率為 18.74%。

數位化顛覆正在推動企業需要比以往更快的調試時間,以產生有意義的見解,從而在市場中保持競爭力。因此,分析(尤其是資料分析)的需求正在滲透到各個組織中。隨著資料來源變得越來越複雜,資料分析專業人員和企業需要協助來獲得洞察力。這大大增加了組織對資料準備的需求。

主要亮點

- 企業和業務中自動化和雲端技術的快速採用導致了大量資料的產生和雲端資料流量。據Cisco稱,全球 IP資料流量預計將達到每月 333 Exabyte。特別是對於大型內容服務提供者(CSP)而言,資料流量正在從 P2P(P2P)檔案共用轉向影片內容傳送。

- 資料量的大幅增加導致了資料和資料分析的快速擴散。因此,企業需要比以往更快的洞察力才能保持競爭力,特別是在越來越多的產業面臨數位顛覆的情況下。因此,分析正在滲透到企業的各個角落,智慧來自越來越多樣化的資料來源。這就是資料準備市場蓬勃發展的現況。

- 此外,各種終端用戶業務也在不斷發展,變得更加資料為中心,以保持競爭優勢。當今的企業收集的資料比以往任何時候都多,以便做出明智的決策,了解業務趨勢並提高效率。為了幫助員工將資料轉化為行動,企業正迅速轉向資料準備工具,進而推動市場成長。

- 此外,市場領先的公司正在將人工智慧 (AI) 和機器學習 (ML) 等先進技術與資料準備相結合,以讀取、解釋和平整複雜的資料結構。這些因素進一步推動了對資料準備解決方案的需求。

資料準備市場趨勢

預計 IT 和電訊領域將佔據市場佔有率

- 全球各地的電信和IT公司產生大量資料,形成了資料金礦。缺乏對非結構化和結構化資料的可操作分析來更深入地了解客戶行為,以及對客戶偏好和使用模式的即時分析的日益成長的資料,這促使這些公司採用資料分析,從而間接影響市場成長。

- 此外,在高度發展和競爭的通訊業中,它們在處理包括客戶、網路和呼叫資料在內的龐大資料集方面發揮著至關重要的作用。此外,為了在如此競爭的環境中取得成功,電訊業參與者正在大量採用資料準備解決方案,以創造商業洞察力,幫助他們在競爭中獲得優勢。

- 資料解決方案可協助 IT 和電訊產業增強探索性分析能力、提高分析師的工作效率並改善組織中的資料利用率。通訊供應商習慣於處理大量客戶資料,但現代資料的複雜性帶來了新的挑戰。

- 此外,資料流量的迅猛成長也推動了IT和通訊業的資料準備需求。例如,根據Cisco的資料,到2022年全球行動資料流程量預計將達到每月Exabyte。

- 此外,愛立信預計,到 2022 年,全球智慧型手機每月平均使用的行動資料將達到 15.93 GB,高於 2021 年的 12.18 GB。此外,預計到 2028 年這一數字將達到 47.27 GB。

- 此外,IBM 公司等市場供應商已經幫助許多領先的通訊業資料分析供應商重塑其市場測量產品。這項工作將包括重新設計資料整合流程、開發新的自訂使用者介面和自動化工作流程。此外,將機器學習解決方案與資料準備工具相結合正在獲得市場佔有率。

預計北美將佔據最大市場佔有率

- 預計北美在預測期內的複合年成長率將達到 1.5%,這得益於對雲端基礎、資料分析和麵向資料的解決方案的高投資、新興技術的早期採用以及大量該地區重要的資料準備市場供應商之一。

- 此外,過去幾年資料的數量和複雜性使得資料準備對於全部區域各個技術先進的最終用戶行業來說資料,這些行業需要競爭才能保持領先地位。 。

- 許多地方計畫和研究人員正在使用資料科學來獲得更好的見解。資料準備解決方案有助於解決這些問題,並提供更便捷的存取方式和增強的廣泛資料的視覺性。例如,根據美國勞工統計局的資料,到 2026 年,對經驗豐富、消息靈通的資料科學家的需求預計將增加 27.9%。

- 此外,隨著雲端服務越來越普及,該地區的公司擴大尋求可以在雲端部署的資料準備解決方案。資料準備解決方案中擴大使用人工智慧和機器學習等先進技術,再加上企業對靈活部署資料準備工具解決方案的需求不斷成長,預計將在預測期內推動該地區資料準備市場的成長。

資料準備行業概覽

資料準備市場競爭激烈,市場上有幾個大型參與者。然而,隨著雲端領域的不斷創新和資料準備技術的改進,大多數公司正在擴大其市場影響力並探索新興經濟體的新市場。此外,供應商正在積極尋求合作、併購來擴大其市場佔有率。

2022 年 11 月,Qlik 將推出企業整合平台即服務 Qlik Cloud Data Integration,透過將所有企業應用程式和資料來源連接到雲端的即時資料整合結構來推進企業資料策略。這個新的資料整合平台將資料準備和編目功能集中在一起,使公司能夠即時準備分析所需的資料。

2022 年 6 月,分析自動化公司 Alteryx, Inc. 宣布收購 Trifacta。這家屢獲殊榮的雲端運算公司使用可擴展的資料管理和機器學習,使資料分析更快、更直覺。透過收購 Trifactor,該公司打算利用其領先的雲端平台來幫助客戶建立具有更強大的分析和準備能力的更強大的資料管道。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響評估

第5章 市場動態

- 市場促進因素

- 對自助資料準備工具的需求

- 資料分析需求不斷成長

- 市場挑戰

- 實施網路保險的難度和高成本

第6章 市場細分

- 按部署

- 本地

- 雲端基礎

- 按公司規模

- 中小型企業

- 大型企業

- 按行業

- BFSI

- 衛生保健

- 零售

- 製造業

- 資訊科技/通訊

- 其他行業

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- Informatica LLC

- IBM Corporation

- SAS Institute Inc.

- Microstrategy Inc.

- Tableau Software, LLC(Salesforce.com Inc.)

- SAP SE

- Alteryx Inc.

- Rapid Insight Inc.

- Unifi Software Inc.

- Qlik Technologies Inc. QlikTech International AB

- Paxata Inc.

- ClearStory Data Inc.

- Oracle Corporation

第8章投資分析

第9章:市場的未來

The Data Preparation Market size is estimated at USD 8.00 billion in 2025, and is expected to reach USD 18.89 billion by 2030, at a CAGR of 18.74% during the forecast period (2025-2030).

Due to digital disruption, companies are demanding faster debugging time to generate meaningful insights than ever to sustain in the market. As a result, the analytics requirement, particularly data analytics, is becoming pervasive among organizations. Data analytics professionals and companies need help driving insights owing to the rising complexities in procuring data. This significantly drives the demand for data preparation among organizations.

Key Highlights

- The rapid adoption of automation and cloud technologies across enterprises and businesses resulted in tremendous data generation and cloud data traffic. According to Cisco Systems, the global IP data traffic is anticipated to reach 333 exabytes per month. There is a significant shift in data traffic from P2P (peer-to-peer) file sharing to video content delivery, especially in large content service providers (CSPs).

- This significant increase in the volume of data has resulted in the swift proliferation of data and data analytics. Therefore, businesses are demanding faster time to insight than ever to remain competitive, particularly as more industries face digital disruption. As a result, analytics is becoming more pervasive across enterprises, and wisdom is derived from more significant numbers of diverse data sources. Thus, in turn, driving the data preparation market.

- Moreover, various end-user companies are constantly evolving and becoming more data-centric to stay ahead of the competition. Companies today gather unprecedented amounts of data that they want to use to make informed decisions, spot business trends, and increase efficiency. To help employees turn data into action, organizations are rapidly shifting towards data preparation tools, thus driving the market's growth.

- Further, leading market players are integrating advanced technologies, such as artificial intelligence (AI) and machine learning (ML), with data preparation to read, interpret, and flatten complex data structures. Such factors further boost the demand for data preparation solutions.

Data Preparation Market Trends

IT and Telecom Segment is Expected to Hold a Significant Market Share

- Telecom and IT companies worldwide are creating a data gold mine as they generate plenty of data. The lack of practical analysis of unstructured and structured data to get more profound insights into customer behavior and the growing need to analyze their preferences and service usage patterns in real-time motivates these companies to adopt data analytics, indirectly impacting the market's growth.

- Further, in the highly evolving and competitive industry, the telecommunication industry plays a significant role in handling massive data sets of customers, network, and call data. Further, to thrive in such a competitive environment, the telecom industry players are significantly adopting data preparation solutions to create helpful business insights to stay ahead of the competitors.

- Data solutions help the IT and telecom industry to empower exploratory analytics, increase analyst productivity, and improve organizational data usage. While telecommunications providers are used to dealing with large volumes of customer data, the considerable complexity of modern-day data is a new challenge.

- In addition, the exponential growth in data traffic also drives the demand for data preparation in the IT and telecom industry. For instance, according to the data from Cisco Systems, by 2022, mobile data traffic worldwide is expected to reach 77.5 exabytes per month.

- Moreover, as per Ericsson, In 2022, smartphones across the globe used an average of 15.93 gigabytes of mobile data per month, up from 12.18 gigabytes in 2021. Additionally, the figure is expected to reach 47.27 gigabytes by 2028.

- Moreover, market vendors like IBM Corporation have helped many leading telecom industry data analytics providers re-engineer their market measurement products. The effort included restructuring data integration processes, developing new custom user interfaces, and making workflow automation. Further, integrating the ML solution with data preparation tools is gaining the market.

North America is Expected to Hold the Largest Market Share

- North America is expected to have a significant share in the market studied during the forecast period, mainly due to high investments in cloud-based, data analytics, and data-oriented solutions, early adoption of new and emerging technologies, and a large number of significant data preparation market vendors in the region.

- Moreover, the volume and complexity of data in the past few years have only made data preparation essential for various technologically advanced end-user industries across the region, which are constantly evolving and becoming more data-centric to keep themselves ahead of the fierce competition.

- Many regional programs and researchers use data science for better insights. Data preparation solutions can penetrate this opportunity and help them easily access extensive data and enhance visualization. For instance, according to the US Bureau of Labor Statistics data, demand for experienced and informed data scientists will likely increase by 27.9% by 2026.

- In addition, with the growing popularity of cloud services, enterprises in the region are increasingly looking for data preparation solutions that can be deployed in the cloud. The increasing use of advanced technologies such as AI and ML in data preparation solutions, coupled with the ever-increasing demand from enterprises for data preparation tool solutions that are flexible in terms of deployment, will shape the future of the growth of the data preparation market in the region over the forecast period.

Data Preparation Industry Overview

The data preparation market is highly competitive and consists of several significant players across the market space. However, with the growing innovation across the cloud segment and the advancement across the data preparation technique, most companies are increasing their market presence, thereby tapping into new markets of emerging economies. Moreover, the market vendors are indulging in partnership, merger, and acquisition activities to enhance their market presence.

In November 2022, Qlik launched its Enterprise Integration Platform as a Service Qlik Cloud Data Integration to fuel enterprise data strategies through a real-time data integration fabric that connects all enterprise applications and data sources to the cloud. The new data integration platform joins data preparation and cataloging capabilities in one place, enabling enterprises to ready their data in real-time for analysis.

In June 2022, Alteryx, Inc., the Analytics Automation company, announced the acquisition of Trifacta. This award-winning cloud company leverages scalable data management and machine learning to make data analytics faster and more intuitive. By acquiring Trifacta, the company intends to use its advanced cloud platform to help customers build a more robust data pipeline with more significant profiling and preparation capabilities.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of COVID-19 Impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Demand for Self-service Data Preparation Tools

- 5.1.2 Increasing Demand for Data Analytics

- 5.2 Market Challenges

- 5.2.1 Difficulties in Implementing Cyber Insurance and High Costs

6 MARKET SEGMENTATION

- 6.1 By Deployment

- 6.1.1 On-premise

- 6.1.2 Cloud-based

- 6.2 By Enterprise Size

- 6.2.1 Small and Medium Enterprises (SMEs)

- 6.2.2 Large Enterprises

- 6.3 By End-user Vertical

- 6.3.1 BFSI

- 6.3.2 Healthcare

- 6.3.3 Retail

- 6.3.4 Manufacturing

- 6.3.5 IT and Telecommunication

- 6.3.6 Other End-user Verticals

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Informatica LLC

- 7.1.2 IBM Corporation

- 7.1.3 SAS Institute Inc.

- 7.1.4 Microstrategy Inc.

- 7.1.5 Tableau Software, LLC (Salesforce.com Inc.)

- 7.1.6 SAP SE

- 7.1.7 Alteryx Inc.

- 7.1.8 Rapid Insight Inc.

- 7.1.9 Unifi Software Inc.

- 7.1.10 Qlik Technologies Inc. QlikTech International AB

- 7.1.11 Paxata Inc.

- 7.1.12 ClearStory Data Inc.

- 7.1.13 Oracle Corporation