|

市場調查報告書

商品編碼

1641850

聚矽氧烷:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Polysiloxane - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

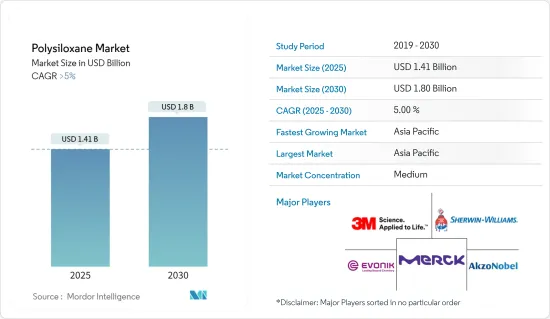

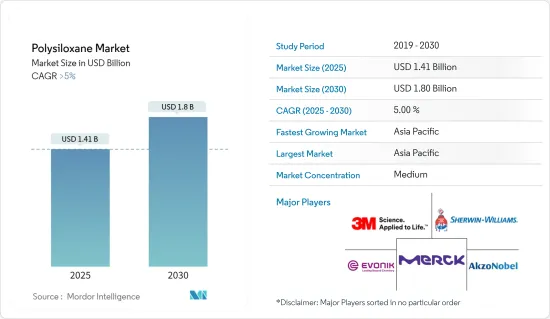

聚矽氧烷市場規模預計在 2025 年為 14.1 億美元,預計到 2030 年將達到 18 億美元,預測期內(2025-2030 年)的複合年成長率將超過 5%。

主要亮點

- 新冠肺炎疫情為市場帶來了負面影響,減緩了生產和流動,並迫使交通運輸和基礎設施等行業因防控措施和經濟混亂而推遲生產。現在,市場正從疫情中復甦。預計2022年市場將達到疫情前的水準並持續穩定成長。

- 推動研究市場成長的主要因素是防護塗料和工業塗料的應用日益廣泛及其在醫療保健產業的廣泛應用。技術缺陷和與其他材料和添加劑的不相容可能會阻礙市場成長。

- 持續研究和開發聚矽氧烷技術以實現新的應用開發可能會在未來幾年為市場創造機會。預計亞太地區將主導市場,並在預測期內以最高的複合年成長率成長。

聚矽氧烷市場趨勢

電子產業需求增加

- 聚矽氧烷因具有優異的溶解性、成膜性、對各種基材的適度附著力、優異的散熱性、無毒、低介電常數、優異的耐熱性和耐化學性而用於有機發光二極體(OLED)。

- 電氣和電子行業的使用量不斷增加以及廣泛的應用預計將推動全球市場的成長。

- 例如,根據日本電子情報技術產業協會(JEITA)的數據,全球電子和IT產業的產值預計將從2021年的3,4159億美元與前一年同期比較到2022年的3,4368億美元。預計到2023年終將達到35,266億美元,與前一年同期比較增3%。

- 此外,根據電子和資訊科技部的數據,2022會計年度印度全國消費電子產品(電視、配件和音訊)的產值預計將超過7,450億印度盧比(94.6億美元)。這就是我們支持市場成長的方式。

- 預計這種強勁的成長將在整個預測期內推動電子產業的聚矽氧烷消費量。

亞太地區佔市場主導地位

- 亞太地區在市場研究中佔最大佔有率,主要由中國、印度、日本和韓國等國家推動。這是因為該國擁有大型醫療設備、黏合劑和密封劑、合成橡膠、電子產品等生產基地。

- 2023年6月,漢高宣布將在中國增加一個新的黏合劑生產工廠。在中國山東省煙台化學工業園區建造漢高黏合劑技術新生產基地。新工廠「鯕鵬」的建設成本約為人民幣8.7億元(1.19億美元)。新工廠將增加漢高在中國的耐衝擊黏合劑產品的產能,並進一步最佳化供應鏈,以滿足國內外市場日益成長的需求,從而有利於市場成長。

- 此外,2023年5月,黏合劑製造商Jowat宣布將在中國建立自己的黏合劑中心,擴大在亞太地區的業務。亞洲新黏合劑中心佔地將超過 11,000平方公尺,計劃於 2023年終完工。

- 此外,中國是世界上最大的電子產品製造基地。智慧型手機、 有機發光二極體電視、平板設備、電線電纜等電子產品在電子產業中成長最快。該國不僅滿足國內電子產品需求,還將電子產品出口到其他國家。由於中國中產階級的可支配收入不斷增加,以及從中國進口電子產品的國家對電子產品的需求不斷增加,預計預測期內電子產品產量將進一步成長。

- 中國製造商正在建立海外生產基地,以打入國際電子市場。例如,TCL正在透過在越南、馬來西亞、墨西哥和印度設立海外工廠生產電視、模組和太陽能電池來擴大其在國際市場的影響力。此外,我們也與當地企業夥伴關係,共同開發生產設施、供應鏈和研發基礎設施。

- 由於上述因素,預計預測期內聚矽氧烷的需求將會增加。

聚矽氧烷產業概況

聚矽氧烷市場部分整合。研究的市場中的主要企業(不分先後順序)包括 3M、阿克蘇諾貝爾公司、贏創工業集團、默克公司、宣威公司、瓦克化學公司等。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 擴大防護塗料和工業塗料的應用

- 醫療產業廣泛應用

- 擴大光電子領域的應用

- 限制因素

- 技術缺陷以及與其他材料和添加劑的不相容性

- 其他阻礙因素

- 價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第 5 章 市場區隔(以金額為準的市場規模)

- 按應用

- 醫療

- 油漆和塗料

- 無機聚矽氧烷

- 環氧-聚矽氧烷雜化材料

- 丙烯酸-聚矽氧烷混合物

- 黏合劑和密封劑

- 合成橡膠

- 有機電子材料

- 織物

- 其他用途(個人護理、化妝品等)

- 按最終用戶產業

- 衛生保健

- 石油和天然氣

- 力量

- 基礎設施

- 運輸

- 電子產品

- 飲食

- 紡織品

- 其他最終用戶產業(膜、消泡劑等)

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作與協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- 3M

- Akzo Nobel NV

- Asian Paints

- Biro Technology Inc.

- Dampney Company

- Evonik Industries AG

- Gelest Inc.

- Huntsman Corporation LLC

- Merck KGaA

- Restek Corporation

- The Sherwin-Williams Company

- Wacker Chemie AG

第7章 市場機會與未來趨勢

- 持續研發聚矽氧烷技術,拓展新應用領域

- 其他機會

簡介目錄

Product Code: 59591

The Polysiloxane Market size is estimated at USD 1.41 billion in 2025, and is expected to reach USD 1.80 billion by 2030, at a CAGR of greater than 5% during the forecast period (2025-2030).

Key Highlights

- The market was negatively impacted by the COVID-19 pandemic as there was a slowdown in production and mobility wherein industries, such as transportation, infrastructure, etc., were forced to delay their production due to containment measures and economic disruptions. Currently, the market has recovered from the pandemic. The market reached pre-pandemic levels in 2022 and is expected to grow steadily in the future.

- The major factors driving the growth of the market studied are the growing usage of protective and industrial coatings and vast applications in the healthcare industry. Technological drawbacks and incompatibility with a few other materials or additives are likely to hinder the growth of the market.

- Continuous R&D of polysiloxane technologies for the development of newer applications is likely to create opportunities for the market in the coming years. Asia-Pacific region is expected to dominate the market and is also likely to witness the highest CAGR during the forecast period.

Polysiloxane Market Trends

Increasing Demand from Electronics Sector

- Polysiloxanes, owing to their good solubility, film-forming ability, fair adhesion to various substrates, excellent heat radiation, non-toxic characteristics, low dielectric constants, and superior thermal & chemical resistivity, are widely used to manufacture electronic items such as organic light-emitting diodes (OLEDs), solar cells, electrical memories, and liquid crystalline materials, among other products.

- The increasing usage and wide areas of application in the electrical and electronics industry are expected to drive market growth across the globe.

- For instance, according to the Japan Electronics and Information Technology Industries Association (JEITA), the production by the global electronics and IT industry was estimated at USD 3,436.8 billion in 2022, registering a growth rate of 1% year on year, compared to USD 3,415.9 billion in 2021. Moreover, the industry was expected to reach USD 3,526.6 billion, with a growth rate of 3% year on year, at the end of 2023.

- Moreover, according to the Ministry of Electronics and Information Technology, the production value of consumer electronics (TV, accessories, and audio) across India was above INR 745 billion (USD 9.46 billion) in fiscal year 2022. Thus supporting the growth of the market.

- Such positive growth is expected to increase the consumption of polysiloxane in the electronics sector through the forecast period.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific accounted for the largest share of the market studied, mainly driven by countries such as China, India, Japan, and South Korea. Owing to its large production base of medical devices, adhesives and sealants, elastomers, electronics, etc.

- In June 2023, Henkel announced the addition of a New adhesive Manufacturing Facility in China. The new manufacturing facility of Henkel Adhesive Technologies in the Yantai chemical industry park in Shandong province, China. The new plant, 'Kunpeng,' will cost approximately CNY 870 million (USD 119 million). The new plant will increase Henkel's production capacity of high-impact adhesive products in China and further optimize the supply chain to meet the increasing demand from domestic and foreign markets, which in turn is expected to benefit the market growth.

- Moreover, in May 2023, Jowat, the adhesive manufacturer, announced to expand its presence in Asia-Pacific with the establishment of its own adhesive center in China. The new adhesive center in Asia will have a surface area of more than 11,000 sq meters and is planned to be finished by the end of 2023.

- Furthermore, China has the world's largest electronics production base. Electronic products, such as smartphones, OLED TVs, tablets, wires, and cables, recorded the highest growth in the electronics segment. The country not only serves the domestic demand for electronics but also exports electronic output to other countries. Owing to the increase in the disposable incomes of the middle-class population in China and the rising demand for electronic products in the countries that import electronic products from China, the production of electronics is estimated to grow further during the forecast period.

- The Chinese manufacturers are setting up overseas production bases in order to expand in the electronics international markets. For instance, TCL has broadened its presence in international markets by establishing factories abroad, producing televisions, modules, and photovoltaic cells in Vietnam, Malaysia, Mexico, and India. In addition, it has formed partnerships with local companies in Brazil to collaboratively develop production facilities, supply chains, and an R&D infrastructure.

- The factors above are expected to boost the demand for polysiloxane in the region during the forecast period.

Polysiloxane Industry Overview

The polysiloxane market is partially consolidated in nature. The major players in the studied market (not in any particular order) include 3M, Akzo Nobel N.V., Evonik Industries AG, Merck KGaA, The Sherwin-Williams Company, and Wacker Chemie AG, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Usage in Protective and Industrial Coatings

- 4.1.2 Vast Applications in the Healthcare Industry

- 4.1.3 Augmenting Usage in Optoelectronic Applications

- 4.2 Restraints

- 4.2.1 Technological Drawbacks and Incompatibility with Few Other Materials or Additives

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Application

- 5.1.1 Medical

- 5.1.2 Paints and Coatings

- 5.1.2.1 Inorganic Polysiloxane

- 5.1.2.2 Epoxy-Polysiloxane Hybrids

- 5.1.2.3 Acrylic-Polysiloxane Hybrids

- 5.1.3 Adhesives and Sealants

- 5.1.4 Elastomers

- 5.1.5 Organo Electronic Materials

- 5.1.6 Fabrics

- 5.1.7 Other Applications (Personal Care, Cosmetics, Etc.)

- 5.2 End-user Industry

- 5.2.1 Healthcare

- 5.2.2 Oil and Gas

- 5.2.3 Power

- 5.2.4 Infrastructure

- 5.2.5 Transportation

- 5.2.6 Electronics

- 5.2.7 Food and Beverage

- 5.2.8 Textile

- 5.2.9 Other End-user Industries (Membranes, Antifoaming Agents, Etc.)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Akzo Nobel N.V.

- 6.4.3 Asian Paints

- 6.4.4 Biro Technology Inc.

- 6.4.5 Dampney Company

- 6.4.6 Evonik Industries AG

- 6.4.7 Gelest Inc.

- 6.4.8 Huntsman Corporation LLC

- 6.4.9 Merck KGaA

- 6.4.10 Restek Corporation

- 6.4.11 The Sherwin-Williams Company

- 6.4.12 Wacker Chemie AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Continuous R&D of Polysiloxane Technologies for Development of Newer Applications

- 7.2 Other Opportunities

02-2729-4219

+886-2-2729-4219