|

市場調查報告書

商品編碼

1640710

證據管理:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Evidence Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

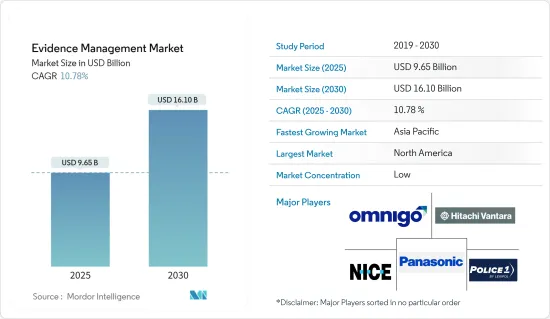

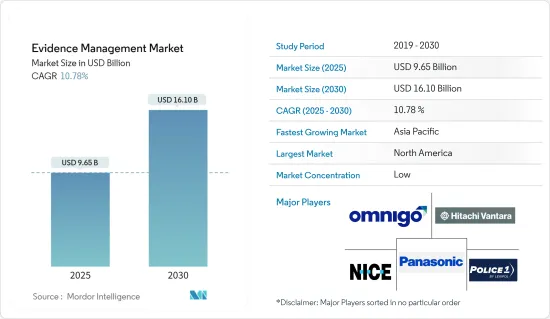

證據管理市場規模在 2025 年估計為 96.5 億美元,預計到 2030 年將達到 161 億美元,預測期內(2025-2030 年)的複合年成長率為 10.78%。

證據管理市場正在經歷快速成長,主要原因是對安全高效處理數位和實體證據的需求迅速成長,尤其是在執法和法律領域。這種需求是由數位犯罪的增加、鑒識科技的進步以及對簡化案件管理解決方案的需求增加所推動的。

主要亮點

- 隨身攝影機已經成為世界各地執法機構青睞的工具。攝影機不僅可以提高證據品質和警員安全性,還可以促進執法部門和公眾之間的更好互動。這些攝影機在更廣泛的執法策略、問題解決和社區參與中發揮著至關重要的作用。

- 雲端基礎方案,加上人工智慧和區塊鏈技術的整合,對於提高證據管理的安全性和透明度至關重要。重點保障證據處理過程的完整性、可近性和合規性。目前趨勢是,不再管理電子表格中的證據資料,而是轉向具有強大保管鍊和警報系統的集中式儲存庫。

- 隨著世界上汽車數量的不斷增加,車禍已經成為一個嚴峻的現實。為了應對事故和汽車失竊案的增多,世界各國政府都強制安裝行車記錄器。因此,全球範圍內車載攝影機的採用率正在大幅成長,提供了有利可圖的市場成長機會。數位證據管理系統因其安全的共用選項、人工智慧輔助功能和可自訂的部署而越來越受到信任,進一步推動了市場的成長。

- 2024 年 3 月,通用原子電磁系統公司 (GA-EMS) 推出了其最新創新—全光譜成像系統 (FSIS) 犯罪現場檢驗(FSIS-CSE)。該系統是 GA-EMS 著名的犯罪現場潛在證據檢測和影像擷取系統系列的一部分,具有輕巧、緊湊的設計。這款 13 吋平板電腦配備了 FSIS II 鏡頭,即使在車輛或小型辦公室等狹小空間內,也可以捕捉潛在證據的高解析度影像,包括化學、生物和微量元素。

- 雖然數位證據管理的好處顯而易見,但該系統對網路威脅的脆弱性仍然是一個重大問題。即使一次資料篡改也可能對執法部門構成重大挑戰。鑑於資料來自各種來源,包括文字訊息、電子郵件和線上交易,確保系統防篡改至關重要。此外,熟練專業人員的短缺和網路犯罪的複雜性也為數位證據管理市場帶來了重大挑戰。

- 自 COVID-19 以來,證據管理市場有望經歷顯著成長。這一成長是由工業領域對人工智慧、機器學習和物聯網的需求激增所推動的,特別是在加強關鍵基礎設施保護方面。值得注意的是,人工智慧和周邊設備的進步以及 5G 網路的廣泛採用,正在開啟以雲端基礎的人工智慧主導的解決方案取代傳統視訊監控的新時代。

證據管理市場趨勢

雲端部署領域預計將佔據市場的大部分佔有率

- 隨著雲端技術的日益普及,證據管理市場正經歷快速成長。雲端解決方案對於為執法和法律機構提供更高的可存取性、擴充性和安全性至關重要。這些平台能夠有效地儲存、管理和共用大量數位證據,促進協作,降低儲存成本並確保遵守資料保護法。

- 遠端即時存取證據可加快決策速度並簡化調查。此外,雲端平台還提供自動標記和人工智慧主導的分析等高級功能,以使證據管理更加可靠和有效。

- 對於雲端基礎的證據管理來說,安全至關重要。我們的資料中心和網路遵守嚴格的網路安全標準,以獲得全球認證。像 Microsoft Azure 這樣的大型供應商正在積極監控異常情況並僱用內部「駭客」來防範網路威脅。

- 整合是雲端基礎的證據保存工具的一個主要優勢。與隨身攝影機、CCTV系統和事件管理平台的無縫整合提高了業務效率和資料交換,使執法和法律部門的價值變得清晰。

- 行車記錄器對於保險索賠至關重要,它可以提供清晰的事件鏡頭並協助索賠過程。值得注意的是,許多行車記錄器供應商都提供雲端基礎的軟體。

- 雲端系統具有擴充性,允許執法機構快速擴展儲存容量。這一趨勢正在推動各行業雲端基礎的事件管理系統的需求。 Virtana 報告稱,2023 年,各種規模的企業中超過 50% 的資料將駐留在雲端中,混合雲端儲存將越來越受歡迎,並成為主要的儲存方法。

北美佔有最大市場佔有率

- 北美證據管理市場正在快速發展。這種轉變很大程度上歸因於美國專門針對執法隨身攝影機的聯邦資助計劃的激增。這些資金注入,加上後續舉措,不僅加速了而且顯著促進了隨身攝影機的出貨量,其中美國主導地位。目前,美國超過一半的警察部門正在積極試行隨身攝影機計畫。

- 隨著行動電話照片和影片、GPS資料、CCTV影像、簡訊和 ANPR 等多媒體來源在刑事調查中變得越來越重要,對強大的證據管理解決方案的需求也日益成長。美國執法機構擴大採用雲端技術,這是對他們每天處理的數位證據數量不斷增加的直接回應。

- 此外,數位證據的使用不僅提高了美國公民的安全,而且從根本上改變了刑事調查的格局。由於相機、智慧型手機、平板電腦和筆記型電腦無處不在,而且電子郵件、訊息、社交媒體貼文和照片等數位內容非常豐富,調查人員現在嚴重依賴數位證據。數位證據可用性的激增是市場成長軌跡的主要驅動力。

- 此外,許多公司和新興企業意識到了市場潛力,正在增加投資以擴大影響力並提高採用率。現有參與者正在對汽車儀錶板攝影機和增強型隨身攝影機等產品進行創新,力求實現產品組合多元化,佔領更大的市場佔有率。

- 例如,2024年3月,專注於公共的美國技術開發公司BRINC宣布了BRINC LiveOps。該軟體可以透過任何現代瀏覽器訪問,旨在提高公共無人機操作的效率、協調性和有效性。透過將 BRINC 硬體產品的功能整合到統一平台,LiveOps 將大幅改善公共安全團隊的證據管理、情境察覺和業務效率。

- 同樣,2024 年 4 月,以 BolaWrap 和尖端公共解決方案而聞名的 Wrap Technologies Inc. 宣布推出一套為其 Wrap Intrensic 隨身攝影機和數位證據管理 (DEMS) 平台量身定做的人工智慧產品。該套件承諾利用人工智慧、虛擬實境和資料驅動的解決方案來簡化世界各地警察部門和私人保全公司的業務。

證據管理產業概況

證據管理市場高度分散,主要參與者包括 NICE Ltd、QueTel Corporation、Police1(Lexipol)、Hitachi Vantara Corporation 和Panasonic Corporation 。市場參與者正在採用各種關鍵策略,例如夥伴關係、新產品發布和收購,以擴充其產品供應並獲得永續的競爭優勢。

- 2024 年 4 月, 公共事業 Associates, Inc.(公共事業 )和 STRAX Intelligence Group 建立策略夥伴關係關係,將公共事業的一體化數位證據管理系統與 STRAX 的即時犯罪中心平台和整合相連接。兩家公司將向市場推出一個統一的生態系統,透過即時情報實現更快的事件回應,並提高調查能力,以更有效地破案。

- 2024 年 1 月,全球公共技術供應商 Axon 推出了新一代隨身攝影機,主要為醫療機構和零售店的第一線工作人員開發。 Axon Body Workforce 可自訂、輕量級並與 Axon 的即時操作和證據管理技術整合。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 主要法規政策

- 價值鏈分析

- COVID-19 對證據管理市場的影響評估

第5章 市場動態

- 市場促進因素

- 全球犯罪率上升推動市場擴張

- 市場限制

- 儲存的資料可能被竄改,影響資料安全

第6章 市場細分

- 按部署

- 本地

- 雲

- 按組件

- 硬體

- 車載攝影機

- 車載行車記錄儀

- 城市相機

- 公共運輸影片

- 軟體

- 服務(諮詢、培訓、支援)

- 硬體

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- NICE Ltd

- QueTel Corporation(Omnigo)

- Police1(Lexipol)

- Hitachi Vantara Corporation

- Panasonic Corporation

- Motorola Solutions Inc.

- Oracle Corporation

- CaseGuard

- COBAN Technologies Inc.

- Porter Lee Corporation

- Finalcover LLC

- IBM Corporation

第8章投資分析

第9章:市場的未來

The Evidence Management Market size is estimated at USD 9.65 billion in 2025, and is expected to reach USD 16.10 billion by 2030, at a CAGR of 10.78% during the forecast period (2025-2030).

The evidence management market witnessed a surge in demand, primarily fueled by the imperative need for secure and efficient handling of both digital and physical evidence, especially in the realms of law enforcement and legal sectors. This demand is propelled by the escalating instances of digital crimes, advancements in forensic technologies, and a heightened requirement for streamlined case management solutions.

Key Highlights

- Body-worn cameras have emerged as a favored tool for law enforcement agencies worldwide. They not only bolster evidentiary outcomes and officer safety but also foster better interactions between law enforcement and the public. These cameras play a pivotal role in broader law enforcement strategies, problem-solving, and community engagement initiatives.

- Cloud-based solutions, coupled with the integration of AI and blockchain technologies, are pivotal in bolstering security and transparency in evidence management. The emphasis is on ensuring the integrity, accessibility, and compliance of the evidence-handling processes. The trend is shifting from managing evidence data on spreadsheets to centralized repositories with robust custody chains and alert systems.

- With the global increase in vehicle numbers, automobile accidents have become a stark reality. Governments worldwide, in response to rising accidents and car thefts, have mandated the installation of dashcams. Consequently, the global adoption of vehicle dash cameras has seen a significant upsurge, presenting lucrative market growth opportunities. The Digital Evidence Management System is gaining trust due to its secure sharing options, AI-assisted features, and customizable deployment, further fueling the market's growth.

- In March 2024, General Atomics Electromagnetic Systems (GA-EMS) unveiled its latest innovation, the Full Spectrum Imaging System (FSIS) Crime Scene Examiner (FSIS-CSE). This system, a part of GA-EMS's renowned line of crime scene latent evidence detection and image capture systems, features a lightweight, compact design. It houses the FSIS II camera on a 13-inch tablet, enabling it to capture high-resolution images of latent evidence, including chemical, biological, and trace elements, even in confined spaces like vehicles and small offices.

- While the benefits of digital evidence management are evident, the system's vulnerability to cyber threats remains a critical concern. A single instance of data tampering could pose significant challenges for law enforcement. Given that data originates from diverse sources like text messages, emails, and online transactions, ensuring the system's tamper-proof nature is paramount. Moreover, the shortage of skilled professionals and the intricate nature of cybercrimes present notable challenges for the digital evidence management market.

- Post-COVID-19, the evidence management market is poised for substantial growth. This growth is underpinned by the surging demand for AI, ML, and IoT in the industrial sector, particularly in bolstering critical infrastructure protection. Notably, advancements in AI, peripherals, and the widespread adoption of 5G networks are ushering in a new era, replacing traditional video surveillance with cloud-based, AI-driven solutions.

Evidence Management Market Trends

The Cloud Deployment Segment is Expected to Hold a Significant Share in the Market

- The evidence management market is witnessing a surge, propelled by the increasing adoption of cloud technology. Cloud solutions are pivotal in bolstering accessibility, scalability, and security for law enforcement and legal entities. These platforms enable efficient storage, management, and sharing of vast digital evidence, fostering collaboration, cutting storage costs, and ensuring compliance with data protection laws.

- Remote and real-time access to evidence expedites decision-making and streamlines investigations. Moreover, cloud platforms offer advanced features like automated tagging and AI-driven analytics, enhancing the reliability and effectiveness of evidence management.

- Security is paramount in cloud-based evidence management. Data centers and networks adhere to rigorous cybersecurity standards for global accreditations. Leading providers, such as Microsoft Azure, actively monitor for anomalies and employ internal "hackers" to preempt cyber threats.

- Integration is a key strength of cloud-based evidence tools. By seamlessly interfacing with body-worn cameras, CCTV systems, and case management platforms, they boost operational efficiency and data interchange, underlining their value to law enforcement and legal departments.

- Vehicle dash cams are crucial for insurance claims and capture events clearly, aiding in claims processing. Notably, many dashcam vendors now offer cloud-based software, reflecting a rising trend toward cloud deployments.

- Cloud systems offer scalability, allowing law enforcement agencies to expand their storage capacities swiftly. This trend fuels the demand for cloud-based event management systems across various industries. Hybrid cloud storage, increasingly popular, is now the dominant storage method, with over 50% of data residing in the cloud for companies of all sizes, as reported by Virtana in 2023.

North America Holds the Largest Market Share

- The North American evidence management market has witnessed rapid evolution. This transformation is largely attributed to the surge in federal funding programs in the United States, specifically aimed at law enforcement body-worn cameras. These funding injections, coupled with subsequent initiatives, have not only accelerated but also significantly boosted the shipments of body-worn cameras, with the US leading the charge. Today, over half of US police departments are actively piloting body-worn camera programs.

- As multimedia sources, such as photos and videos from mobile phones, GPS data, CCTV footage, SMS, and ANPR, become pivotal in criminal investigations, the demand for robust evidence management solutions is on the rise. Cloud technology adoption is on the rise among US law enforcement agencies, a direct response to the escalating volume of digital evidence they handle daily.

- Furthermore, the utilization of digital evidence has not only enhanced citizen safety in the US but has also fundamentally reshaped the landscape of criminal investigations. Investigators now heavily rely on digital evidence, given the ubiquitous presence of cameras, smartphones, tablets, and laptops and the sheer volume of digital content like emails, messages, social media posts, and photos. This surge in digital evidence availability is a key driver behind the market's growth trajectory.

- Moreover, recognizing the market's potential, numerous businesses and startups are ramping up investments to bolster their presence and drive adoption rates. Established players are innovating, with offerings like dash cameras for cars and enhanced body-worn cameras, aiming to diversify their portfolios and capture a larger market share.

- For instance, in March 2024, BRINC, a US-based technology developer focused on public safety, unveiled BRINC LiveOps. This software, accessible via any modern browser, is designed to enhance efficiency, coordination, and effectiveness in public safety drone operations. By consolidating the features of BRINC's hardware products into a unified platform, LiveOps significantly boosts evidence management, situational awareness, and operational efficiency for entire public safety teams.

- Similarly, in April 2024, Wrap Technologies Inc., renowned for its BolaWrap and cutting-edge public safety solutions, introduced an artificial intelligence product suite tailored for its Wrap Intrensic Body-Worn Camera and Digital Evidence Management (DEMS) platform. This suite promises to streamline operations for police departments and private security firms worldwide, leveraging AI, virtual reality, and data-driven solutions.

Evidence Management Industry Overview

The evidence management market is highly fragmented, with major players like NICE Ltd, QueTel Corporation, Police1 (Lexipol), Hitachi Vantara Corporation, and Panasonic Corporation. Players in the market are adopting various significant strategies, such as partnerships, new product launches, and acquisitions, to augment their product offerings and gain a sustainable competitive advantage.

- April 2024: Utility Associates Inc. (Utility) and STRAX Intelligence Group signed a strategic partnership linking Utility's all-in-one digital evidence management system with STRAX's real-time crime center platform and integrations. Together, they're bringing to market a unified ecosystem, allowing faster incident response utilizing real-time intelligence and greater investigative capabilities to solve crimes more effectively.

- January 2024: Axon, the worldwide public safety technology provider, introduced a new generation of body cameras primarily built for frontline workers in healthcare facilities and retail stores. Axon Body Workforce is customizable, lightweight, and integrated with Axon's real-time operations and evidence management technology.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Major Policies and Regulations

- 4.4 Value Chain Analysis

- 4.5 Assessment of Impact of COVID-19 on the Evidence Management Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Crime Rate Globally is Leading to Market Expansion

- 5.2 Market Restraints

- 5.2.1 Data Stored can be Tampered, Affecting the Security of Data

6 MARKET SEGMENTATION

- 6.1 By Deployment

- 6.1.1 On-premise

- 6.1.2 Cloud

- 6.2 By Component

- 6.2.1 Hardware

- 6.2.1.1 Body-worn Camera

- 6.2.1.2 Vehicle Dash Camera

- 6.2.1.3 Citywide Camera

- 6.2.1.4 Public Transit Video

- 6.2.2 Software

- 6.2.3 Services (Consulting, Training, and Support)

- 6.2.1 Hardware

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 NICE Ltd

- 7.1.2 QueTel Corporation (Omnigo)

- 7.1.3 Police1 (Lexipol)

- 7.1.4 Hitachi Vantara Corporation

- 7.1.5 Panasonic Corporation

- 7.1.6 Motorola Solutions Inc.

- 7.1.7 Oracle Corporation

- 7.1.8 CaseGuard

- 7.1.9 COBAN Technologies Inc.

- 7.1.10 Porter Lee Corporation

- 7.1.11 Finalcover LLC

- 7.1.12 IBM Corporation