|

市場調查報告書

商品編碼

1640584

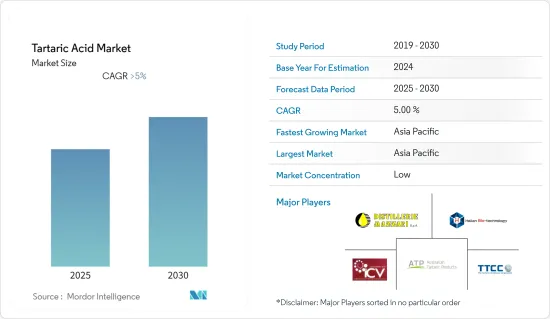

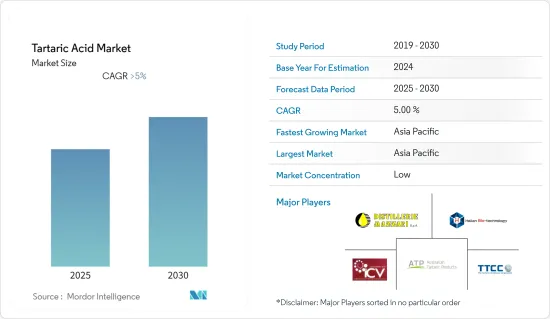

酒石酸 -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Tartaric Acid - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

預計預測期內酒石酸市場將以超過 5% 的複合年成長率成長。

疫情對各行各業造成了衝擊,影響了2020年酒石酸產業的成長。然而,疫情爆發後建設活動的激增刺激了整個產業的成長。

關鍵亮點

- 從長遠來看,製藥和食品行業對微膠囊化的採用越來越廣泛以及製藥行業的需求不斷成長是推動市場成長的關鍵因素。

- 政府擴大訂定法規限制食品工業中使用合成酒石酸,可能會阻礙市場的成長。

- 酒石酸在利基應用中的採用可能會在未來幾年為市場創造機會。

- 預計亞太地區將主導酒石酸市場,並可能在預測期內呈現最高的複合年成長率。

酒石酸市場趨勢

化妝品產業需求增加

- 化妝品和個人保健產品包括各種身體保養和頭髮護理產品。洗髮精、護髮素、沐浴乳、肥皂和其他護膚產品佔據了這一領域的主要佔有率。

- 酒石酸及其鹽用作化妝品和個人保健產品中的 pH 調節劑。它被認為是一種低風險、安全的護膚成分。它也被用作化妝品製造中的抗氧化劑。

- 個人護理領域在終端用戶產業中佔有第三大消費佔有率。從全球來看,這一領域正以中等速度成長。

- 男性消費者對個人健康和外表意識的不斷增強推動了男性美容產品市場的發展。由於這些因素,主要企業正專注於推出針對男性的新型創新產品,以增加其產品供應和客戶群。這可以讓你比競爭對手更具優勢。

- 據個人護理協會歐洲化妝品協會稱,化妝品和個人護理行業每年為歐洲經濟貢獻至少 290 億歐元(340 億美元)的附加價值。德國是歐洲最大的化妝品市場之一。 2021 年,德國身體保養和化妝品產業創造了約 7.9 億歐元(9.2 億美元)的收益。

- 亞太地區佔全球美容和個人護理市場的40%以上。產量已達到非常高的水平,使該國成為向美國、加拿大和奧地利等已開發國家出口化妝品和個人保健產品的中心樞紐。

- 中國是全球第二大化妝品市場,並正崛起成為全球最大的化妝品及護膚品市場。中國的化妝品和護膚市場涵蓋化妝、護膚、護髮和個人衛生等多個行業,在 2021-2022 年經歷了成長。此外,人口的持續成長也刺激了該國對化妝品的需求。因此,它促進了所研究市場的成長。

- 2022年,化妝品零售達3,936億元人民幣(610億美元)。中國二、三線城市化妝品需求進一步擴大,未來化妝品零售可望維持成長動能。

- 由於上述所有因素,預測期內酒石酸市場可能會成長。

亞太地區佔市場主導地位

- 亞太地區佔有酒石酸市場的最大佔有率。隨著新興市場對加工食品和食品飲料產品的需求增加,食品和飲料產品中酒石酸的消費量預計會增加。

- 由於中國和印度等最大消費國的存在,該地區對酒石酸的需求正在大幅增加。酒石酸在製藥業用途的快速增加也是推動市場成長的主要因素之一。

- 印度在全球製藥領域佔有重要地位。印度是世界上最大的學名藥生產國。印度製藥業滿足了全球50%以上各種疫苗的需求、美國40%的學名藥和英國25%的所有藥品的需求。

- 此外,日本的製藥業是繼美國和中國之後世界上最大的製藥業之一。 2021年,日本處方藥總產值約為9.2兆日圓(870億美元),低於前一年的約9.3兆日圓(880億美元)。

- 亞太地區佔全球化妝品市場的近40%,是化妝品和個人護理行業最大的市場,並且隨著新興國家對個人護理意識的提高而成長。印度青少年和中年人的化妝品消費量呈上升趨勢,主要原因是人們更重視自我護理。

- 化妝品和個人護理行業是印度成長最快的消費品市場之一,為美國公司進入該市場提供了巨大的潛力。該國的個人護理和化妝品行業正在經歷強勁成長,零售商店和精品店的貨架空間不斷擴大。

- 在印度,2022年化妝品、肥皂、洗護用品和精油的出口達到約29億美元。與上年度相比,這是一個顯著的成長。

- 預計所有這些因素將在預測期內推動該地區酒石酸市場的發展。

酒石酸產業概況

酒石酸市場比較分散。主要的市場參與企業包括(不分先後順序)Distillerie Mazzari SpA、AUSTRALIAN TARTARIC PRODUCTS、安徽海蘭生物技術有限公司、The Tartaric Chemicals Corporation、Industria Chimica Valenzana ICV SpA 等。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 亞太地區和拉丁美洲對葡萄酒的需求不斷成長

- 微膠囊技術在製藥和食品產業的應用日益廣泛

- 製藥業的需求不斷成長

- 限制因素

- 政府法規不斷加強,限制食品工業合成酒石酸的使用

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場區隔(市場規模(基於數量))

- 類型

- 天然酒石酸

- 合成酒石酸

- 應用

- 防腐劑和添加劑

- 瀉藥

- 中間體

- 其他

- 最終用戶產業

- 飲食

- 藥品

- 化妝品

- 建造

- 其他

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作與協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- ATP Group

- Anhui Hailan Bio-technology Co., ltd

- AUSTRALIAN TARTARIC PRODUCTS

- Changmao Biochemical Engineering Company Limited

- Dastech International Inc.

- Derivados Vinicos SA

- Distillerie Mazzari SpA

- Giovanni Randi SpA

- Industria Chimica Valenzana ICV SpA

- Ningbo Jinzhan BIoTechnology Co.,Ltd.

- Omkar Speciality Chemicals Ltd

- Tarac Technologies

- Tartaros Gonzalo Castello

- The Tartaric Chemicals Corporation

- Vinicas

第7章 市場機會與未來趨勢

- 酒石酸在利基應用的採用

- 其他機會

The Tartaric Acid Market is expected to register a CAGR of greater than 5% during the forecast period.

COVID-19 impacted various industries, affecting the tartaric acid industry growth in 2020. However, the surging construction activities post-pandemic propelled the overall industry growth.

Key Highlights

- Over the long term, the significant factors driving the studied market growth are increased microencapsulation adoption across pharmaceuticals and food industries and rising demand from the pharmaceutical industry.

- Increasing government regulations for restricting synthetic tartaric acid use in the food industry will likely hinder the market growth.

- Adopting tartaric acid in niche applications will likely create opportunities for the market in the coming years.

- The Asia-Pacific region is expected to dominate the tartaric acid market and will likely witness the highest CAGR during the forecast period.

Tartaric Acid Market Trends

Increasing Demand from the Cosmetics Industry

- Cosmetics and personal care products include a variety of body care, as well as hair care products. Shampoos, hair conditioners, body washes, soaps, and other skincare products, occupy a significant share of the segment.

- Tartaric acid and its salts are used as pH adjusters in cosmetics and personal care products. It is considered a low-risk and safe-to-use ingredient for skincare. It is also used as an antioxidant in the production of cosmetics.

- The personal care segment accounts for the third-largest consumption share in end-user industries. Globally, this segment is growing at a moderate rate.

- An increasing consciousness catalyzed the male grooming products market growth among male consumers of personal wellness and appearance. Owing to this factor, key players are focusing on launching new and innovative products for men to increase their product offerings and customer base. It may give them an edge over their competitors.

- According to Cosmetic Europe, the personal care association, the cosmetics and personal care industry brings at least EUR 29 billion (USD 34 billion) in added value to the European economy annually. Germany is one of the biggest cosmetics markets in Europe. In 2021, the German body care and cosmetics industry generated almost EUR 790 million (USD 920 million) in revenue.

- The Asia-Pacific region accounts for over 40% of the global beauty and personal care marketplace. The production reached very high levels, thus becoming a central hub for exporting cosmetics and personal care products to developed nations, such as the United States, Canada, and Austria.

- China is the world's second-largest cosmetics market and emerging as the largest market in cosmetics and skin care products globally. The Chinese cosmetics and skin care market, which includes various industries such as makeup, skincare, hair care, and personal hygiene, experienced growth in 2021-2022. Furthermore, the continuous population growth is another factor fueling the demand for cosmetics products in the country. It, in turn, is augmenting the growth of the market studied.

- In 2022, the retail sales value of cosmetic products reached CNY 393.6 billion (USD 61 billion). As the demand for cosmetic products expands further in second-and third-tier cities of China, cosmetics retail is expected to maintain its growth momentum in the coming years.

- The tartaric acid market will likely grow during the forecast period due to all the factors above.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific region accounted for the largest share of the tartaric acid market. Tartaric acid consumption in foods and beverages in developing markets is expected to grow, along with the increasing demand for processed food and beverages.

- The demand for tartaric acid in the region is growing significantly due to the presence of the largest consuming countries, such as China and India. The surging application of tartaric acid in the pharmaceutical industry is also one of the key factors driving the market growth.

- India holds a significant position in the global pharmaceuticals sector. India is the largest producer of generic drugs in the world. The Indian pharmaceutical industry caters to more than 50% of the global demand for various vaccines, 40% of generic medicine in the United States, and 25% of all medicines in the United Kingdom.

- Furthermore, the pharmaceutical industry in Japan is one of the largest in the world, surpassed only by the United States and China. The total production value of medical drugs in Japan amounted to approximately JPY 9.2 trillion (USD 87 billion) in 2021, a decrease from around JPY 9.3 trillion (USD 88 billion) in the previous year.

- The Asia-Pacific region includes a share of nearly 40% in the global cosmetics and growing with the increase in the awareness of personal care in the emerging economies, making it the largest market in the cosmetics and personal care industries. Cosmetics consumption is increasing among Indian teens and middle-aged people, primarily driven by an increasing focus on self-care.

- The cosmetics and personal care industry is one of India's fastest-growing consumer product markets, with a strong market entry potential for US companies. The country's personal care and cosmetics sector grew strongly, increasing shelf space in retail stores and boutiques.

- In India, the export value of cosmetics, soap, toiletries, and essential oils amounted to nearly USD 2.9 billion in 2022. It was a significant increase compared to the previous fiscal year.

- All these factors are expected to increase the market for tartaric acid in the region during the forecast period.

Tartaric Acid Industry Overview

The tartaric acid market is fragmented in nature. Some of the major players in the market include Distillerie Mazzari S.p.A, AUSTRALIAN TARTARIC PRODUCTS, Anhui Hailan Biotechnology Co. Ltd, The Tartaric Chemicals Corporation, and Industria Chimica Valenzana I.C.V. SpA, among others (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand for Wine in the Asia-Pacific and Latin American Regions

- 4.1.2 Increased Adoption of Microencapsulation across Pharmaceuticals and Food Industries

- 4.1.3 Rising Demand from the Pharmaceutical Industry

- 4.2 Restraints

- 4.2.1 Increasing Government Regulations for Restricted Use of Synthetic Tartaric Acid in the Food Industry

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Type

- 5.1.1 Natural Tartaric Acid

- 5.1.2 Synthetic Tartaric Acid

- 5.2 Application

- 5.2.1 Preservative and Additive

- 5.2.2 Laxative

- 5.2.3 Intermediate

- 5.2.4 Other Applications

- 5.3 End-user Industry

- 5.3.1 Food and Beverage

- 5.3.2 Pharmaceutical

- 5.3.3 Cosmetics

- 5.3.4 Construction

- 5.3.5 Other End-user Industries

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ATP Group

- 6.4.2 Anhui Hailan Bio-technology Co., ltd

- 6.4.3 AUSTRALIAN TARTARIC PRODUCTS

- 6.4.4 Changmao Biochemical Engineering Company Limited

- 6.4.5 Dastech International Inc.

- 6.4.6 Derivados Vinicos S.A.

- 6.4.7 Distillerie Mazzari S.p.A

- 6.4.8 Giovanni Randi SpA

- 6.4.9 Industria Chimica Valenzana I.C.V. SpA

- 6.4.10 Ningbo Jinzhan Biotechnology Co.,Ltd.

- 6.4.11 Omkar Speciality Chemicals Ltd

- 6.4.12 Tarac Technologies

- 6.4.13 Tartaros Gonzalo Castello

- 6.4.14 The Tartaric Chemicals Corporation

- 6.4.15 Vinicas

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Adoption of Tartaric Acid in Niche Application

- 7.2 Other Opportunities