|

市場調查報告書

商品編碼

1640564

英國太陽能光電 -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)UK Solar Power - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

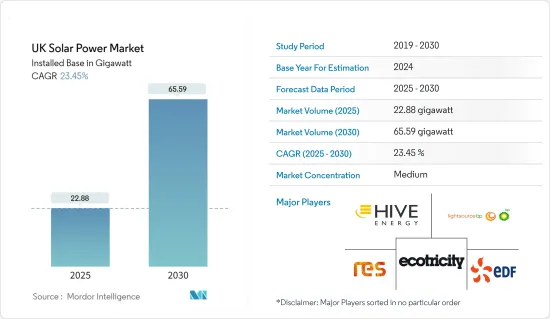

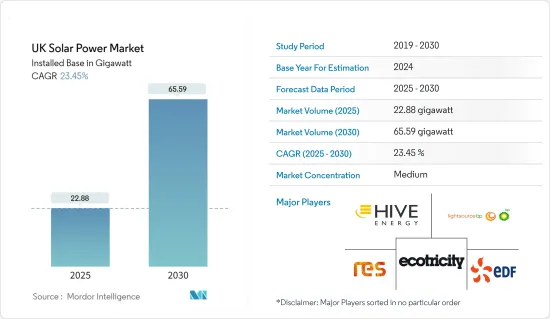

基於安裝基數,英國太陽能光電市場規模預計將從 2025 年的 22.88 吉瓦成長到 2030 年的 65.59 吉瓦,預測期內(2025-2030 年)的複合年成長率為 23.45%。

關鍵亮點

- 從中期來看,政府支持政策以及減少對石化燃料依賴和碳足跡的再生能源來源需求等因素預計將在預測期內推動英國太陽能光電市場的發展。

- 然而,土地供應有限和再生能源來源的日益普及等因素預計將在預測期內阻礙英國太陽能市場的成長。

- 該國制定了雄心勃勃的太陽能發電目標,即在 2030 年實現 40GW 的裝置容量。預計這些因素將在預測期內為在市場上營運的公司創造商機。

英國太陽能市場趨勢

住宅領域預計將顯著成長

- 過去十年,在政府激勵措施的支持下,英國太陽能光電發電的採用大幅增加。

- 截至2023年,英國太陽能光電裝置容量為15,993MW,佔總發電量的4.8%。這與前一年同期比較成長了 9.1%。報告稱,太陽能的成長將由大量50kW以下的裝機量推動,2023年將新增172,000個家庭裝機量,這是自2015年以來年度最高數量。

- 在英國,普通家庭每天消耗 3kWh 至 6kWh 的能源,因此系統的規模也有所不同。最常見的系統容量之一是4kW系統,適合滿足3-4人家庭的能源需求。然而,5kW 太陽能發電系統通常適用於有 4-5 人的家庭,而 6kW 太陽能板系統則建議用於有 5 人或更多居住者的家庭。因此,大多數住宅太陽能發電系統的容量為10kW或更低。

- 推動住宅市場成長的關鍵因素是國內市場能源價格的上漲。由於最近的能源危機,據估計自 2000 年以來能源價格幾乎上漲了兩倍。能源價格的大幅上漲使得許多住宅轉向使用太陽能來降低家庭能源成本。

- 由於技術進步和智慧家庭技術的日益普及,預計預測期內住宅領域對太陽能的需求將會增加。

小型太陽能發電安裝成本下降推動市場需求

- 小型太陽能光電系統及其安裝成本的下降是過去幾年推動英國分散式太陽能市場發展的關鍵因素之一。 2013年至2023年間,0至4千瓦太陽能光電系統的平均安裝、連接電力供應和增值稅成本下降。

- 這一趨勢推動了英國住宅、商業和工業領域的太陽能安裝總量增加。 2022-2023會計年度,全國系統規模為4kW或以下的太陽能發電設施(主要是住宅)總數將達到115,648個系統,創下歷年最高紀錄。

- 4kW以下的太陽能發電系統主要部署在住宅領域作為屋頂系統。 50kW 至 5MW 的系統正在大型住宅、商業和工業(C&I) 領域作為屋頂和地面安裝系統部署。

- 在英國,政府的支持政策、補貼和獎勵支持了小規模和分散式太陽能市場的成長,但預計在預測期內,太陽能發電和相關系統成本的下降將推動市場的發展。

- 在研究期間,英國小型太陽能光電系統的平均安裝成本出現波動。 0-4kW 範圍內的太陽能安裝成本從 2022 年 4 月開始上漲,增幅超過 4-10kW 範圍內的增幅。 0-4kW 頻段的價格在 2023 年 1 月達到峰值,為每千瓦安裝價 2,622 英鎊。由於技術的發展,預計預測期內安裝太陽能光電發電的成本將會下降。

- 鑑於上述情況,小型太陽能發電安裝成本的下降預計將推動市場發展。

英國太陽能產業概況

英國太陽能光電市場中等程度細分。市場的主要企業包括法國電力公司(Electricite de France SA)、Ecotricity Group Ltd、再生能源系統有限公司(Renewable Energy Systems Ltd)、Lightsource BP、再生能源投資有限公司(Renewable Energy Investments Limited) 和Hive Energy。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第 2 章執行摘要

第3章調查方法

第4章 市場概況

- 介紹

- 至2029年太陽能發電裝置容量及預測(單位:GW)

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 政府政策與再生能源來源需求

- 太陽能技術成本下降

- 限制因素

- 土地有限和對替代再生能源來源的需求

- 驅動程式

- 供應鏈分析

- PESTLE分析

第 5 章市場區隔(按最終用戶)

- 住宅

- 商業和工業

- 公共產業

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- First Solar Inc.

- Electricite de France SA

- Ecotricity Group Ltd

- Renewable Energy Systems Ltd

- Lightsource bp Renewable Energy Investments Limited

- Hive Energy

- Ameresco Inc.

- 市場排名/佔有率(%)分析

第7章 市場機會與未來趨勢

- 雄心勃勃的太陽能發電目標:到 2030 年達到 40 吉瓦

The UK Solar Power Market size in terms of installed base is expected to grow from 22.88 gigawatt in 2025 to 65.59 gigawatt by 2030, at a CAGR of 23.45% during the forecast period (2025-2030).

Key Highlights

- In the medium period, factors such as supportive government policies and demand for renewable energy sources to decrease dependency on fossil fuels and carbon footprints are driving the UK solar power market during the forecast period.

- On the other hand, factors such as limited land and increasing adoption of alternative renewable energy sources are expected to hinder the growth of the UK solar power market during the forecast period.

- Nevertheless, the country has ambitious solar power targets to reach 40GW installed capacity by 2030. Such factors are expected to create opportunities for companies operating in the market during the forecast period.

UK Solar Power Market Trends

The Residential Segment is Expected to Witness Significant Growth

- The United Kingdom has witnessed significant solar PV installations over the past decade, supported by the government's incentives, which can be credited to the increasing demand for clean electricity.

- As of 2023, the United Kingdom registered 15,993 MW of solar capacity, which accounted for 4.8% of total electricity generation. This is an increase of 9.1% compared to the previous year. As per the report, the growth in solar PV has been dominated by numerous installations of less than 50 kW, including 172,000 new domestic installations in 2023, the most in a calendar year since 2015.

- In the United Kingdom, an average home consumes between 3 kWh and 6 kWh of energy daily, and accordingly, system sizes may vary. One of the most common system capacities installed is a 4 kW system, which is suited to satisfy the energy needs of a household of 3-4 people. However, a 5 kW solar system is typical for a home with 4-5 people, while a 6 kW solar panel system is suggested for a home with over five residents. Thus, most residential PV systems have a capacity below 10 kW.

- The primary factor driving the growth of the residential segment is the increasing energy prices in the domestic market. It is estimated that due to the recent energy crisis, energy prices have nearly tripled since 2000. Due to this significant rise in energy prices, many homeowners are turning toward solar to reduce home energy costs.

- With technological advancements and the increasing adoption of smart home technologies, the demand for solar power is expected to increase in the residential sector during the forecast period.

Declining Small Scale Solar PV Installation Costs is Driving the Demand in the Market

- The declining cost of small-scale solar PV systems and their installation has been one of the major factors driving the distributed solar power generation market in the United Kingdom for the past few years. The average cost of solar PV generating equipment, installing and connecting to electricity supply, and VAT of the systems between 0 kW and 4 kW declined between 2013 and 2023.

- This trend has led to a growth in the total number of solar PV installations in the residential, commercial, and industrial sectors in the United Kingdom. In FY 2022-3023, the country's total number of solar PV installations with a system size of less than 4 kW (primarily residential) stood at 1,15,648 systems, representing the highest number this year.

- Solar PV systems under 4 kW are majorly deployed as rooftop systems in the residential sector. Systems between 50 kW and 5 MW are deployed as rooftop and ground-mounted systems in large housing communities and commercial and industrial (C&I) sectors.

- Although supportive government policies, subsidies, and incentives supported the growth of small-scale and distributed solar PV markets in the United Kingdom until 2023, the declining cost of solar PV and associated systems are expected to drive the market during the forecast period.

- The average installation costs of small-scale solar photovoltaic systems in the United Kingdom fluctuated during the study period. Solar installation costs in the 0-4 kW range began to rise in April 2022, exceeding increases in the 4-10 kW range. The 0-4 kW band prices peaked at 2,622 British pounds per kilowatt installed in January 2023. With technological developments, solar PV installation cost is expected to decrease during the forecast period.

- Thus, owing to the above points, declining small-scale solar PV installation costs are expected to drive the market.

UK Solar Power Industry Overview

The UK solar power market is moderately fragmented. Some of the major players in the market are Electricite de France SA, Ecotricity Group Ltd, Renewable Energy Systems Ltd, Lightsource BP, Renewable Energy Investments Limited, and Hive Energy.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Solar Power Installed Capacity and Forecast in GW, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Government Policies and Demand for Renewable Energy Sources

- 4.5.1.2 The Declining Costs of Solar Technologies

- 4.5.2 Restraints

- 4.5.2.1 Limited Land and Demand for Alternative Renewable Energy Sources

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

5 MARKET SEGMENTATION - BY END USER

- 5.1 Residential

- 5.2 Commercial and Industrial

- 5.3 Utilities

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 First Solar Inc.

- 6.3.2 Electricite de France SA

- 6.3.3 Ecotricity Group Ltd

- 6.3.4 Renewable Energy Systems Ltd

- 6.3.5 Lightsource bp Renewable Energy Investments Limited

- 6.3.6 Hive Energy

- 6.3.7 Ameresco Inc.

- 6.4 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Ambitious Solar Power Targets to Reach 40 GW by 2030