|

市場調查報告書

商品編碼

1640515

金屬蓋子與封口裝置:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Metal Caps & Closures - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

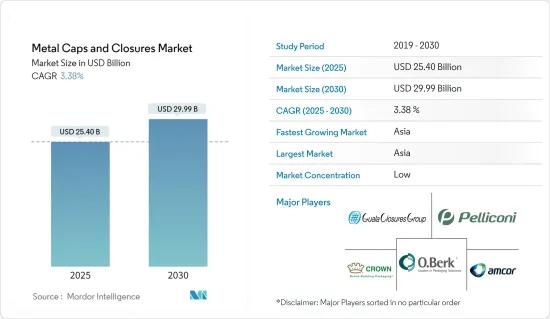

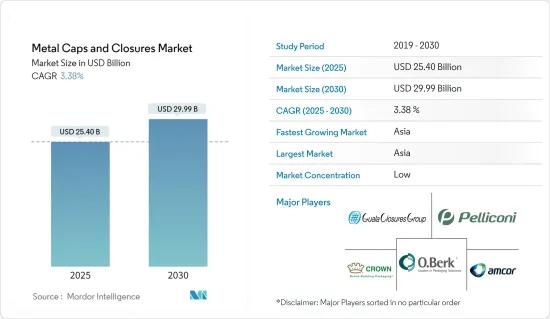

金屬蓋子與封口裝置市場規模預計在 2025 年為 254 億美元,預計到 2030 年將達到 299.9 億美元,預測期內(2025-2030 年)的複合年成長率為 3.38%。

由於對食品和飲料的需求不斷增加,預計預測期內金屬蓋子與封口裝置市場將迅速擴張。人們對酒精飲料、啤酒、麵包、家禽和魚類、已調理食品和乳製品的需求正在上升。此外,由於塑膠法規,軟性飲料包裝供應商更傾向於使用金屬皇冠蓋作為飲料包裝,從而推動了市場成長。

關鍵亮點

- 人們對使用環保產品的日益關注推動了金屬蓋子與封口裝置的採用。雖然塑膠瓶蓋對金屬瓶蓋構成了極大的威脅,但塑膠瓶蓋市場在環境問題方面面臨很大的威脅。這為金屬蓋子與封口裝置的應用創造了機會。近年來,一些公司已經開始用金屬瓶蓋取代塑膠蓋子與封口裝置。

- 此外,金屬瓶蓋和封口上可以印上標誌和其他設計,透過展示獨特的品牌來增強需求。此外,自適應冠蓋由獨特的金屬製成,與螺紋瓶頸結合時可實現最佳配合。 Crown Caps價格合理,功能強大,使用方便,安裝快捷,並且詐欺防篡改功能。

- 金屬蓋子與封口裝置在製藥業也很受歡迎,因為它們是無菌的並且通常由多層材料製成。工業中最常用的金屬蓋由鋼和鋁製成。

- 此外,鋁有多種款式,包括素色、壓花、彩色和自然色。因此,可以根據消費者的需求提供藥品包裝。

- 預計兒科、增值和老年人用瓶蓋市場將受到快速發展的製藥業和監管改革的推動,這些改革將鼓勵製造商生產更高品質的瓶蓋和瓶蓋。

- 然而,預計由塑膠、木材等製成的其他封閉系統的存在將在預測期內起到限制作用,並阻礙金屬蓋子與封口裝置市場的成長。

金屬蓋子與封口裝置市場的趨勢

製藥應用具有成長潛力

- 金屬蓋子與封口裝置主要用於製藥領域,因為它們是無菌的並且通常由層狀材料製成。該領域主要使用鋼和鋁金屬蓋。鋁還提供高級訂製選項,包括自然色、彩色、實心和浮雕。這樣,藥品包裝就可以依照消費者的需求來供應。

- 藥品銷售和生產的快速成長,以及監管變化導致對兒科、增值和老年病封蓋的更大偏好,將在預測期內推動市場發展。世界衛生組織(WHO)估計,全球銷售的藥品中有三分之一是非法的。仿冒藥品的風險越來越大,需要有效的防偽解決方案,並推動防偽封蓋的採用。

- 由於橡膠封蓋容易污染藥品,因此製藥業擴大採用鋁封蓋。污染源自合成橡膠容器的封閉部件。可能的污染物包括微生物、內毒素和化學物質。 2022會計年度,共有166個製造地發生912起藥品召回事件,為過去五年來的最高值。

- 資料顯示,CDER每年報告的這些召回中最大的缺陷仍然是現行良好生產規範(CGMP)偏差。大多數召回產品是由於倉庫的溫度控制和儲存問題。報告強調,這種情況可能會導致產品劣化,對保存期限、安全性和功效產生不利影響。

- 此外,由於使用方面普遍存在的規定,糖漿瓶領域對金屬蓋子與封口裝置的需求可能會面臨一些挑戰。草藥(HMP)近年來變得越來越重要,被廣泛用於預防和治療各種疾病。

亞太地區成長最快

- 由於亞太地區擁有兩個人口大國——中國和印度,預計該地區將實現最快成長。預計可支配收入的增加將促進這兩個國家的金屬蓋子與封口裝置市場的成長。

- 印度飲料業(包括酒精飲料)是最多元化的行業之一。該行業受大片與天氣有關的地理區域的影響很大。因此,包裝的容納飲料、運輸和保護飲料免受機械應力和材料損失的功能至關重要。根據印度東北銀行的一項調查,2020 年印度的酒精消費量為 48.6 億公升。預計到2024年將達到62.1億升。

- 中國的烈酒市場不斷擴大,對包裝解決方案的需求也很高。這些銷售對於中國的飲料包裝製造商來說代表著巨大的機會。外國投資者已經認知到這一領域的巨大潛力。此外,從中國進口的酒精飲料價值的增加也促進了飲料蓋子與封口裝置市場的發展。中國海關資料顯示,2022年10月公佈的最新資料顯示,7月至9月,中國向北韓出口了價值近300萬美元的葡萄酒和白酒。

- 隨著消費者永續性意識的增強以及各相關人員的興趣日益濃厚,東南亞飲料永續包裝的趨勢正在加速發展。一些製造商選擇用更永續的材料取代塑膠。

- 包裝食品和飲料的需求大幅增加,以及蓋子與封口裝置在長期保持包裝消費品新鮮方面發揮的重要作用,可能會促進這些地區的市場發展。

金屬蓋子與封口裝置產業概況

由於國際供應商的存在,全球金屬蓋子與封口裝置市場高度分散且競爭激烈。該市場的一些主要企業包括 Crown Holdings、O.Berk Company、Guala Closures SPA 和 Amcor PLC。在產品差異化、產品組合和定價方面,市場競爭激烈。對加值封蓋和防篡改功能的需求不斷成長,預計將推動金屬瓶蓋和封蓋在各個領域的使用,主要是在製藥和飲料領域。

2022 年 7 月,生產各種類型瓶子封蓋的製造商 Guala Closures 收購了位於維琴察的高階封蓋專家 Labrenta。此次收購對於刮拉瓶蓋公司來說具有重要意義,擴大了其在奢侈品領域的影響力,並幫助其成為該行業的全球領導者。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場動態

- 市場促進因素

- 飲料消費量不斷增加,對永續包裝材料的需求也不斷成長

- 與其他封蓋材料相比,性能更優越

- 市場限制

- 其他類型封蓋材料的採用率較高

第6章 市場細分

- 依材料類型

- 鋁

- 鋼

- 錫

- 按閉合類型

- 皇冠蓋

- 螺旋蓋

- 扭曲金屬蓋

- 其他瓶蓋(易開蓋、ROPP金屬蓋)

- 按最終用戶產業

- 食物

- 飲料

- 酒精飲料

- 非酒精性

- 藥品

- 個人護理

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- Crown Holdings Inc.

- O.Berk Company

- Guala Closures SPA

- Pelliconi & C. SpA

- Nippon Closures Co. Ltd

- Silgan White Cap LLC

- Sks Bottle & Packaging Inc.

- Amcor PLC

- Qorpak(Berlin Packaging)

- Alameda Packaging LLC

- Closure Systems International Inc(CSI)

第8章投資分析

第9章:市場的未來

The Metal Caps & Closures Market size is estimated at USD 25.40 billion in 2025, and is expected to reach USD 29.99 billion by 2030, at a CAGR of 3.38% during the forecast period (2025-2030).

The market for metal caps and closures is predicted to expand rapidly during the forecast period due to the increased demand for food and beverages. There is a rising demand for alcoholic drinks, beer, bread, poultry and fish, ready-to-eat meals, dairy goods, etc. Moreover, due to plastic regulations, soft drink packaging vendors prefer metal crown caps for beverage packaging, driving the market growth.

Key Highlights

- The growing concerns regarding the usage of environment-friendly products have boosted the adoption of metal caps and closures. Though plastic-based caps pose a high threat to metal caps, the plastic caps market is witnessing high threats regarding environmental problems. This has been creating the opportunity for metal caps and closures. Several companies in recent years have been replacing their plastic-based caps and closures with metal.

- Further, metal caps and closures can be branded with logos or other designs, increasing demand for them by promoting the distinctive brand. Moreover, the adaptable crown caps are composed of a unique metal that gives the optimum fit when combined with a threaded bottleneck. Crown caps are reasonably priced, very functional, simple to use, allow for high-speed application, and provide genuine tamper protection.

- Metal caps and closures are also often utilized in the pharmaceutical industry since they are sterile and typically made of multilayer materials. The most common metal caps used in the industry are comprised of steel and aluminum.

- Additionally, aluminum is made in various variations, including plain or embossed, colored, or natural. As a result, pharmaceutical packaging may be provided in accordance with consumer demand.

- The market for child-resistant, value-added, and senior-friendly closures is expected to be driven by the rapidly expanding pharmaceutical industry as well as regulatory reforms, which have encouraged manufacturers to produce superior-quality caps and closures.

- However, the presence of other closure systems made of plastics, wood, etc., is expected to act as a restraint and challenge the growth of the metal closures market over the forecast period.

Metal Caps and Closures Market Trends

Pharmaceutical Application Offers Potential Growth

- Metal caps and closures are predominantly used in the pharmaceutical sector as they are sterile and are generally composed of layered material. Metals caps made of steel and aluminum are mostly used in the sector. Besides, aluminum can be highly customizable: natural or colored, plain or embossed. Thus, pharmaceutical packaging can be supplied according to the consumers' needs.

- The rapidly growing pharmaceutical sales and production and the regulatory changes further favor child-resistant, value-added, and senior-friendly closures, which are anticipated to drive the market in the foreseen period. The World Health Organization (WHO) estimated that one-third of all medicines sold worldwide are illegitimate. The increasing risks from falsified drugs are creating the need for efficient anti-counterfeiting solutions, boosting the adoption of anti-counterfeiting closures.

- The adaptation of aluminum closures in the pharmaceutical industry is on the rise, as its rubber counterparts tend to contaminate the drugs. The contamination is attributable to elastomeric container closure components. Possible contaminants include microorganisms, endotoxins, and chemicals. In the fiscal year 2022, 912 drug recalls were generated by 166 manufacturing sites, marking the highest number of recalls in the past five years.

- The data indicates that the largest defect group for these recalls remains current good manufacturing practice (CGMP) deviations, as reported in previous years by CDER. The majority of the products were recalled due to issues with temperature control and storage in warehouses. The report highlights the fact that these conditions can cause degradation of the product, leading to a negative impact on its shelf-life, safety, or effectiveness.

- Further, the demand for metal caps and closures may witness a few challenges in the syrup bottle sector owing to the regulations prevailing in their usage. Herbal medicinal products (HMP) have recently gained importance and are extensively used to prevent and treat various ailments.

Asia-Pacific to Witness the Fastest Growth

- Asia-Pacific is expected to witness the fastest growth because of the presence of two highly populated countries, i.e., China and India. In these two countries, the increase in disposable income will supplement the growth of the metal caps and closures market.

- The Indian beverage sector, consisting of alcohol, is one of the most diverse sectors. The industry is highly influenced by the country's vast geography associated with the weather. With it comes the imperative of packaging function to contain beverages, enabling transportation, and protecting beverages against mechanical stress and material loss. According to a study performed by Banco do Nordeste, alcohol consumption in India was 4.86 billion liters in 2020. The consumption is expected to reach 6.21 billion liters in 2024.

- China's spirits market is expanding continuously, leading to a high demand for packaging solutions. Such turnover represents an enormous opportunity for domestic producers in Chinese beverage packaging. Foreign investors have recognized the huge potential of such a market segment. Moreover, the growing import value of alcoholic drinks from China has boosted the market for caps and closures for beverages. Recent data published in October 2022 showed that China exported nearly USD 3 million of wine and liquor to North Korea from July to September, according to Chinese customs data.

- The trend for sustainable beverage packaging is accelerating in Southeast Asia, buoyed by greater consumer awareness of sustainability and increased focus by various stakeholders, with governments incentivizing a shift towards a circular economy and manufacturers focusing on recycling, packaging reduction, and the adoption of more sustainable packaging alternatives. Some manufacturers are opting to replace plastics with more sustainable materials.

- The vast rise in the demand for packaged foods and beverages and the critical role played by caps and closures in keeping packaged consumables fresh for extended periods are likely to boost the market in these regions.

Metal Caps and Closures Industry Overview

The global metal caps and closures market is highly fragmented and competitive due to the presence of international vendors. Some of the key players in this market are Crown Holdings, O.Berk Company, Guala Closures S.P.A., and Amcor P.L.C., amongst others. Intense competition prevails in the market in terms of product differentiation, portfolio, and pricing. The rising demand for value-added closures and tamper resistance properties will augment the usage of metal caps and closures in various segments, primarily pharmaceuticals and beverages.

In July 2022, Guala Closures, a company that produced closures for various types of bottles, acquired Labrenta, a high-end closure specialist based in Vicenza. This acquisition was crucial for Guala Closures as it helped the company expand its reach in the luxury segment, thus making it a world leader in the industry.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Consumption of Beverages with a Rising Need for Sustainable Packaging Materials

- 5.1.2 Superior Properties Compared to Other Closure Materials

- 5.2 Market Restraints

- 5.2.1 High Adoption Rate of Other Types of Closure Materials

6 MARKET SEGMENTATION

- 6.1 By Material Type

- 6.1.1 Aluminium

- 6.1.2 Steel

- 6.1.3 Tin

- 6.2 By Closures Type

- 6.2.1 Crown Caps

- 6.2.2 Screw Caps

- 6.2.3 Twist Metal Caps

- 6.2.4 Other Closures Types (Easy Open Ends, ROPP Metal Caps)

- 6.3 By End-User Industry

- 6.3.1 Food

- 6.3.2 Beverages

- 6.3.2.1 Alcoholic

- 6.3.2.2 Non-Alcoholic

- 6.3.3 Pharmaceuticals

- 6.3.4 Personal Care

- 6.3.5 Other End-User Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

7 Competitive Landscape

- 7.1 Company Profiles

- 7.1.1 Crown Holdings Inc.

- 7.1.2 O.Berk Company

- 7.1.3 Guala Closures S.P.A.

- 7.1.4 Pelliconi & C. SpA

- 7.1.5 Nippon Closures Co. Ltd

- 7.1.6 Silgan White Cap LLC

- 7.1.7 Sks Bottle & Packaging Inc.

- 7.1.8 Amcor PLC

- 7.1.9 Qorpak (Berlin Packaging)

- 7.1.10 Alameda Packaging LLC

- 7.1.11 Closure Systems International Inc (CSI)