|

市場調查報告書

商品編碼

1640466

智慧應用過程(SPA):市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Smart Process Application (SPA) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

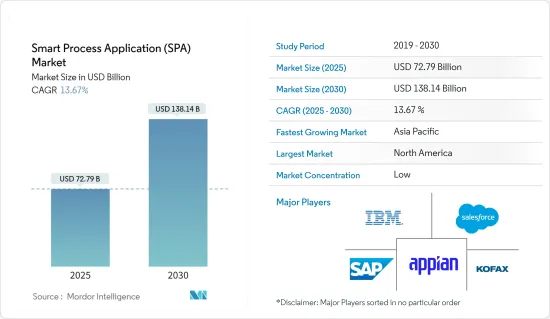

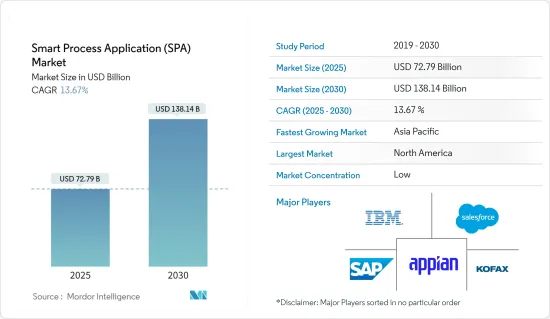

智慧應用過程(SPA) 市場規模預計在 2025 年為 727.9 億美元,預計到 2030 年將達到 1381.4 億美元,預測期內(2025-2030 年)的複合年成長率為 13.67%。

企業用戶的虛擬和探索性資料分析正在發展成為智慧應用過程(SPA) 市場最重要的趨勢之一。許多主要產業正在利用分析力量來制定策略性商業決策。

主要亮點

- 智慧應用過程(SPA) 的出現提供了一種新的技術範式並徹底改變了企業的運作方式。這些應用程式旨在支援動態、人力密集且頻繁變化的業務活動,它們有潛力推動技術進步並重塑全球產業的未來。

- 由於資料量不斷成長而導致的複雜性不斷增加,推動了智慧應用過程(SPA) 市場的需求。隨著公司尋求分析來自許多新的和不同來源的資料作為其戰術性和戰略決策的一部分,業務資料的複雜性正在增加。

- 管理複雜的資料模式、設定自動化 ETL 流程以及確保資料品質和管治等任務非常艱鉅。因此,為了管理這種複雜的資料,組織正在利用智慧應用過程(SPA) 來簡化大量現有資料的分析。

- 對更好的管理解決方案和自動化的日益成長的需求正在推動市場的發展。聰明的組織現在認知到採用智慧自動化的迫切性。因為我們知道智慧自動化可以提高IT資產利用率,幫助實現組織策略,實現新技術的採用,並改變客戶體驗。

- 需要提高對智慧應用過程(SPA) 優勢的認知,這限制了市場的發展。許多用戶仍需要適應使用傳統 BPM 套件或高度客製化的 ERP 實施等遺留解決方案,這對市場的有效成長構成了挑戰。此外,確保資料隱私和安全也是市場成長的關鍵挑戰。由於 SPA 處理大量敏感資料,因此採取強力的安全措施防止資料外洩極為重要。

智慧應用過程(SPA) 市場趨勢

醫療保健產業預計將推動市場成長

- 醫療保健系統是一個複雜的網路。醫療保健提供者和患者之間存在持續的資料流。此外,醫院經營團隊需要存取資料以用於會計目的。 HIPAA 法案規定了醫療保健提供者之間共用醫療資訊的規則,特別是電子健康記錄(EHR)、診斷結果等。行動技術正在使資料在這個複雜的生態系統中更有效地移動。透過行動電話和平板電腦作為端點,資料可以更快地在系統中傳輸。

- 據 Great Call 稱,目前 25% 的醫生使用智慧型手機、平板電腦或其他行動裝置為患者提供護理。人口老化、人手不足和成本上漲給醫療保健產業帶來壓力。醫院擴大利用技術和自動化來提高業務效率。此外,行動醫療應用的近期流行進一步推動了市場的成長。例如,根據 YouGov 的調查,2023 年,NHS 應用程式成為受訪者中領先的行動醫療應用程式,70% 的受訪者表示使用了該應用程式。

- 隨著我們從按服務收費轉向基於價值的付費,遠端醫療技術可以用來填補醫療照護方面的空白,而不會給服務提供者增加高成本。病人參與技術不再僅僅涉及入口網站。服務提供者現在正積極主動地與患者接觸,並以多種方式與他們接觸,尤其是透過行動裝置。

- 此外,《經濟和臨床健康資訊科技法案》(HITECH)的頒布已強制使用電子健康記錄(EMR),超過 90% 的醫療服務提供者已採用這些記錄。量正在增加。

北美佔據主要市場佔有率

- 北美地區的市場佔有率最高。由於整個非洲大陸的各公司早期採用了智慧應用過程(SPA),預計該地區將實現中等成長率。該地區組織的活躍運作進一步促進了市場的成長。 IT服務和設備的消費化正在推動企業中BYOD(自帶設備)的興起,並支持企業行動化趨勢。

- 此外,充足的基礎設施、大量全球金融機構的存在以及物聯網設備和網路用戶的日益普及將增加該地區對業務流程管理的採用。此外,擁有 100 多名員工的美國公司正在採用雲端基礎的應用程式。這將進一步加速採用敏捷、靈活且擴充性的雲端基礎的智慧應用過程(SPA) 軟體。

- 此外,自然語言處理和機器學習演算法等新興技術的快速發展正在推動該地區智慧應用過程(SPA) 市場的技術創新。此外,透過分析主要市場供應商的大量存在以及智慧應用過程(SPA) 領域主要企業的持續技術進步,可以促進該地區的市場成長。

- 敏捷處理模型的出現使得美國能夠支援跨不同類型組織在同一資料實例上的互動式分析、批次分析、全域通訊、資料庫和檔案式的模型。 2022 年 11 月,基層醫療提供者集團 Matter Health 與健康資料分析創新者 Ursa Health 合作開發了一個分析開發平台,以通知、改進和加速基於價值的護理服務。

智慧應用過程(SPA)產業概覽

智慧應用過程(SPA)市場高度分散,特徵是大量中小型企業與大型企業激烈競爭。這一動態領域的一些知名參與者包括 Kofax Ltd、Salesforce、IBM Corporation 等。最近的市場發展趨勢包括:

2023 年 1 月,HDFC 銀行與微軟建立策略夥伴關係關係,以徹底改變其數位化之旅。此次合作旨在透過全面的應用程式組合轉型、增強的企業安全性以及透過微軟雲端實現資料環境的現代化來釋放真正的商業價值。

2022 年 3 月,Datalogic SpA 宣布收購 Pekat Sro。該公司專門開發利用機器學習和深度學習的專有演算法來實現製造、運輸和物流等領域的流程自動化。此外,這些技術在零售應用領域具有巨大的應用潛力。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- 產業價值鏈分析

- COVID-19 市場影響評估

第5章 市場動態

- 市場促進因素

- 資料量不斷成長導致複雜性增加

- 對更好的管理解決方案和自動化的需求日益增加

- 市場限制

- 缺乏對智慧應用過程(SPA) 優勢的認知

第6章 市場細分

- 按類型

- 軟體

- 服務

- 按部署

- 本地

- 雲

- 按解決方案

- 客戶經驗管理

- 企業內容管理

- 企業行動性

- 商業智慧和分析

- 業務流程管理

- 其他解決方案

- 按最終用戶

- 娛樂和媒體

- 後勤

- 衛生保健

- BFSI

- 零售

- 通訊

- 能源和電力

- 公共產業

- 教育

- 製造業

- 其他最終用戶

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- Kofax Ltd

- Salesforce.com, Inc.

- IBM Corporation

- Appian Corporation

- SAP SE

- Opentext Corporation

- Kana Software, Inc.

- Pegasystems Inc.

- JDA Software

- Baan Corporation

第8章投資分析

第9章 市場機會與未來趨勢

The Smart Process Application Market size is estimated at USD 72.79 billion in 2025, and is expected to reach USD 138.14 billion by 2030, at a CAGR of 13.67% during the forecast period (2025-2030).

Virtualization and explorative data analysis for enterprise users have evolved into one of the most important trends in the smart process application market. A host of major industries are leveraging the power of analytics to make strategic business decisions.

Key Highlights

- The advent of smart process applications (SPA) has revolutionized how businesses operate, offering a new paradigm in technology. These applications, designed to support business activities that are highly variable, people-intensive, and subject to frequent change, have the potential to advance technology and reshape the future of industries worldwide.

- Rising complexity due to the increasing amount of data is driving the demand for the smart process application market. The complexity of business data is growing as companies look to analyze data from many new and disparate sources as part of their tactical and strategic decision-making.

- Tasks like managing complicated data schemas, setting up automated ETL processes, and securing data quality and governance are difficult tasks. Hence, in order to manage such complex data, organizations are making use of smart process applications to simplify the analysis of the existing piles of data.

- The rising need for better management solutions and automation is driving the market. Smart organizations are now aware of the urgency of deploying intelligent automation. They know it can improve the use of their IT assets, help meet organizational strategies, enable the adoption of new technologies, and transform the customer experience.

- A need for more awareness about the benefits of smart process applications is restraining the market. Many users still need to adapt to the use of a traditional solution, such as in traditional BPM suites or heavily customized ERP implementations, etc., which challenges the market to grow effectively. Moreover, ensuring data privacy and security is also a key challenge in the market's growth. As SPA handles a large amount of sensitive data, it is becoming crucial to have robust security measures in place to prevent data breaches.

Smart Process Application (SPA) Market Trends

Healthcare Segment is Anticipated to Drive the Market Growth

- The healthcare system is a complex network. There is an ongoing data flow across healthcare providers and patients. Along with this, the hospital management also needs access to the data for accounting purposes. The HIPAA Act lays down the rules for sharing medical information, especially electronic health records (EHR), diagnostic results, etc., amongst institutions. Mobile technology is making this complex ecosystem move data more efficiently. Data can move through the system faster with phones and tablets working as endpoints.

- According to Great Call, at present, 25% of physicians use smartphones, tablets, and other mobile devices to deliver care to patients. With an aging population, shortage in staff, and rising costs, there has been pressure on the healthcare industry. Hospitals are increasingly turning to technology and automation to improve operational efficiency. Moreover, the recent proliferation of mHealth applications is further driving the growth of the market. For instance, according to the YouGov, in 2023, among respondents, the NHS app emerged as the leading mHealth application, with 70% reporting its usage.

- As we move towards value-based payments from fee-for-service, telehealth technologies can be deployed to close gaps in care without adding high costs for providers. And patient engagement technologies are no longer just about the portal. Providers are now active with patients and engaging with them in a variety of methods, most notably via mobile devices.

- Moreover, with the enactment of the Health Information Technology for Economic and Clinical Health (HITECH) Act, electronic medical records (EMRs) have become mandatory, and the adoption has risen to more than 90% of healthcare providers, which increases the usage of mobile app software.

North America Account for Significant Market Share

- North America region has the highest market share. It is expected to show a moderate growth rate due to the early adoption of smart process applications by various businesses in the continent. The dynamic functioning of organizations in the region has further helped the growth of the market. Consumerization of IT services & devices has cemented the ground for BYOD (bring your device) among enterprises, supporting the enterprise mobility trend.

- Also, with the high availability of adequate infrastructure, the presence of numerous global financial institutions, and the increased adoption of IoT devices and internet users, the adoption of business process management will increase in this region. Additionally, companies in the United States, where employees are more than 100 in number, are adopting cloud-based applications. Thus further bolstering the adoption of cloud-based smart process application software for agility, flexibility, and scalability.

- Additionally, the rapid development of new and advanced technologies, such as natural language processing and machine learning algorithms, is driving innovation in the region's Smart process application market. Moreover, the substantial presence of major market vendors coupled with the ongoing technological advancements by the major companies in the smart process application landscape is analyzed to aid the market growth in the region.

- The advent of agile processing models enables the same instance of data to support interactive analytics, batch analytics, global messaging, database, and file-based models in different types of organizations in the United States. In Nov 2022, Matter Health, a primary care provider group, partnered with an analytics development platform from Ursa Health, the healthcare data analytics innovator, to inform, refine, and expedite its value-based care delivery.

Smart Process Application (SPA) Industry Overview

The smart process application (SPA) market exhibits a high degree of fragmentation, characterized by the presence of numerous small and medium-sized enterprises engaged in intense competition alongside large corporations. Notable players in this dynamic landscape include Kofax Ltd, Salesforce, IBM Corporation, and more. Recent significant developments within the market include:

In January 2023, HDFC Bank entered into a strategic partnership with Microsoft to revolutionize its digital journey. This collaboration aims to unlock substantial business value by undergoing a comprehensive transformation of the application portfolio, enhancing enterprise security, and modernizing the data landscape through Microsoft Cloud.

In March 2022, Datalogic S.p.A announced its acquisition of Pekat S.r.o. This company specializes in the development of proprietary algorithms utilizing machine learning and deep learning to automate processes across sectors such as Manufacturing, Transportation, and Logistics. Additionally, there is considerable potential for applying these technologies in the realm of retail applications.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Complexity Due to Increasing Amount of Data

- 5.1.2 Rising Need for Better Management Solutions and Automation

- 5.2 Market Restraints

- 5.2.1 Lack of Awareness About the Benefits of Smart Process Application

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Software

- 6.1.2 Services

- 6.2 By Deployment

- 6.2.1 On-Premise

- 6.2.2 Cloud

- 6.3 By Solution

- 6.3.1 Customer Experience Management

- 6.3.2 Enterprise Content Management

- 6.3.3 Enterprise Mobility

- 6.3.4 Business Intelligence and Analytics

- 6.3.5 Business Process Management

- 6.3.6 Other Solutions

- 6.4 By End-User

- 6.4.1 Entertainment and Media

- 6.4.2 Logistics

- 6.4.3 Healthcare

- 6.4.4 BFSI

- 6.4.5 Retail

- 6.4.6 Telecommunications

- 6.4.7 Energy and Power

- 6.4.8 Commercial Utilities

- 6.4.9 Education

- 6.4.10 Manufacturing

- 6.4.11 Other End-Users

- 6.5 By Geography

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Asia

- 6.5.4 Australia and New Zealand

- 6.5.5 Latin America

- 6.5.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Kofax Ltd

- 7.1.2 Salesforce.com, Inc.

- 7.1.3 IBM Corporation

- 7.1.4 Appian Corporation

- 7.1.5 SAP SE

- 7.1.6 Opentext Corporation

- 7.1.7 Kana Software, Inc.

- 7.1.8 Pegasystems Inc.

- 7.1.9 JDA Software

- 7.1.10 Baan Corporation