|

市場調查報告書

商品編碼

1640450

橡膠測試機:市場佔有率分析、產業趨勢與成長預測(2025-2030 年)Rubber Testing Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

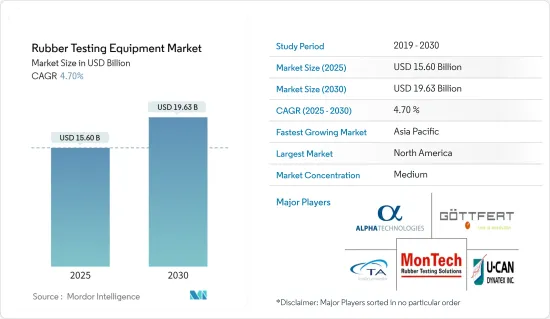

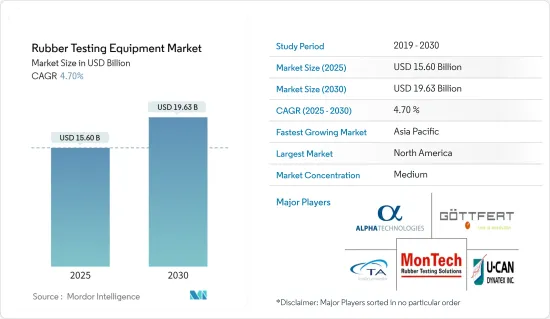

橡膠測試機市場規模預計在 2025 年為 156 億美元,預計到 2030 年將達到 196.3 億美元,預測期內(2025-2030 年)的複合年成長率為 4.7%。

全球經濟不斷增強、工業化和快速都市化進程對橡膠的需求產生了積極影響。橡膠測試機械的成長主要受到汽車、航太、醫療保健和建築等行業對高品質橡膠產品的需求不斷成長的推動。

此外,嚴格的品質標準和法規要求進行嚴格的測試和分析,以確保產品的耐用性、安全性和性能。自動化、數位化等技術進步也顯著提高了測試的效率和準確性,進一步推動了市場的成長。

橡膠測試包括使用流變儀、硫化儀和黏度計來最佳化生產和最終使用特性。橡膠流變儀可測量最小黏度、最大黏度、焦燒時間和轉換時間等重要特性。硫化儀在使用者定義的恆定應變和頻率下測量等溫和非等溫測試條件下橡膠化合物的硫化曲線。

工業化和都市化帶來的建設活動加強,加上汽車產量的穩定成長,預計將主要促進橡膠測試機械市場的成長。

隨著消費者對耐用商品的需求不斷成長,預計軟管和皮帶等產品的需求將穩定成長。建築業經歷了強勁成長,這可能會導致對橡膠屋頂材料的需求大幅增加。製造業也持續實現有效成長,預計將有助於擴大需求。

市場前景樂觀,區域分析顯示成長將主要集中在全球最大的橡膠生產國亞太地區。市場正在經歷多項技術突破,從自動化技術到軟體管理工具和智慧測試技術的出現。這些技術進步以及對在設計和生產過程中需要測試的耐用消費品的需求不斷成長,預計將成為市場成長的主要驅動力。

橡膠試驗機市場趨勢

輪胎需求成長推動市場

輪胎橡膠試驗機廣泛用於測量橡膠和其他材料的拉伸強度和伸長率。該機器專為輪胎動態和靜態測試而設計。識別輪胎的性能和屬性並確定其設計對車輛動態的影響。

輪胎測試包括多種特性的詳細分析,包括耐久性和壽命、負載、力矩、室內胎面磨損、加速老化、政府監管測試和故障分析。

配備非公路輪胎(如 iOR、重型卡車輪胎、輕型卡車輪胎和乘用車輪胎)的車輛數量不斷增加,正在推動全球橡膠測試機市場的發展。耐久性測試和徹底跳動測試等輪胎測試技術的進步進一步推動了市場成長。

從銷售和生產角度來看,美國是與中國並列的全球最重要的汽車市場之一。根據OICA統計,2023年美國汽車產業產量約1,060萬輛。預計這些因素將極大地促進市場發展。

北美佔有最大市場佔有率

北美地區工業橡膠製品需求略顯低迷,但隨著汽車產量明顯改善及製造業復甦,需求逐漸回升。

美國是世界上最大的汽車製造國之一,平均每年生產超過1400萬輛汽車。自從本田在美國開設第一家製造廠以來,大多數日本、韓國和歐洲汽車製造商都在美國建立了一家或多家製造廠。

在新的聯邦立法和電動車需求不斷成長的推動下,美國汽車業正在投入數十億美元建設新工廠。例如,現代汽車正在美國加緊興建第一家電動車工廠,目標於2025年投入生產。

加拿大的汽車產業競爭力強,對加拿大的GDP貢獻巨大。加拿大雖然逐漸失去製造地,但每年仍生產超過120萬輛汽車,領先橡膠測試機市場。

加拿大是北美第二大汽車生產國,擁有五座大型組裝廠、540多家OEM零件製造商、400多家經銷商以及許多其他與汽車相關的產業。該行業是該國製造業的最大貢獻者,從而推動了對橡膠測試機的需求。

橡膠試驗機產業概況

橡膠測試機市場由幾家主要公司組成。從市場佔有率來看,目前少數幾家大公司佔據著市場主導地位。這些領先公司憑藉著突出的市場佔有率,致力於擴大海外基本客群。這些公司正在利用策略合作措施來增加市場佔有率和盈利。

2024 年 4 月—Alpha Technologies 宣布推出其下一代拉伸解決方案—AlphaFlex10 拉伸試驗機。 AlphaFlex10 拉伸試驗機與我們流變儀器產品組合的可靠軟體和服務支援無縫整合,是 Alpha Technologies 為您的橡膠和合成橡膠材料測試需求提供的綜合解決方案不可或缺的一部分。

2023 年 11 月-美卓推出磨機襯板橡膠。這種橡膠是革命性的 SkegaTM Life 橡膠,其耐磨壽命比目前的優質橡膠高出 25%。這種新型橡膠是在美卓實驗室開發的,並在現場研究中檢驗。 Skegalife 是美卓 Planet Positive 產品的一部分,透過提高耐磨性和減少維護,實現了更高的永續性和安全性,最佳化了產量並增加了運轉率。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- 新冠肺炎疫情及其他宏觀經濟因素對市場的影響

第5章 市場動態

- 市場促進因素

- 耐用消費品需求不斷增加

- 橡膠測試的技術進步。

- 市場限制

- 擁有成本高

第6章 市場細分

- 按考試類型

- 密度測試

- 黏度測試

- 硬度測試

- 彎曲試驗

- 其他測試

- 按最終用戶應用

- 胎

- 通用橡膠製品

- 工業橡膠製品

- 通用聚合物

- 化合物

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- Alpha Technologies

- TA Instruments Inc.

- U-Can Dynatex Inc.

- Montech Rubber Testing Instruments

- Goettfert Inc.

- Prescott Instruments Ltd

- Ektron Tek Co. Ltd

- Gotech Testing Machines

- Norka Instruments, Sanghai Ltd.

- Gibitre Instruments Srl

第8章投資分析

第9章 市場機會與未來趨勢

The Rubber Testing Equipment Market size is estimated at USD 15.60 billion in 2025, and is expected to reach USD 19.63 billion by 2030, at a CAGR of 4.7% during the forecast period (2025-2030).

The demand for rubber is positively influenced by the constant efforts to strengthen global economies, industrialization, and rapid urbanization. The growth of rubber testing equipment is primarily driven by the increasing demand for high-quality rubber products across industries like automotive, aerospace, healthcare, and construction.

Additionally, stringent quality standards and regulations contribute to the need for precise testing and analysis to ensure product durability, safety, and performance. Technological advancements, such as automation and digitalization, also significantly enhance testing efficiency and accuracy, further fueling market growth.

Rubber testing includes using rheometers, curemeters, and viscometers to optimize production and end-use properties. Rubber rheometers measure important characteristics such as minimum and maximum viscosity, scorch time, and conversion time. Curemeters measure curing profiles of rubber compounds under isothermal and non-isothermal test conditions at constant user-defined strain and frequency.

The intensifying construction activities, on account of industrialization and urbanization, combined with the steady rise in the production of automobiles, are expected to primarily contribute to the growth of the rubber testing equipment market.

Owing to the snowballing consumer demand for long-lasting goods, products like hoses and belts are expected to witness a steady rise in demand. There can be a substantial requirement for rubber roofing, as the construction sector saw robust growth. The manufacturing industry is also expected to contribute to the growing demand as it continues to record growth effectively.

The market outlook is positive, and the region-wise analysis reveals that growth is mainly concentrated in Asia-Pacific, the largest global rubber producer. There have been several technological developments in the market, ranging from automated techniques to the advent of software management tools and intelligent testing techniques. In addition to the growing demand for durable goods, which require testing during design and production, these technological advancements are expected to majorly drive the market's growth.

Rubber Testing Equipment Market Trends

The Rising Demand for Tires to Drive the Market

Rubber testing equipment for tires is widely used to determine rubber and other materials' tensile strength and elongation. The equipment is specially designed for dynamic and static testing of tires. It identifies the tire's performance and attributes and defines its design's effect on the vehicle's dynamics.

Tire testing encompasses a detailed analysis of several properties, such as durability and endurance, force, moment, indoor tread wear, accelerated aging, government regulatory testing, and failure analysis.

The increasing number of vehicles with off-the-road tires, i.e., OTR, heavy truck tires, and light truck and passenger car tires, has driven the rubber testing equipment market globally. The evolution of tire testing techniques, such as endurance and radical run-out testing, has further boosted the market's growth.

Along with China, the United States is among the most significant automobile markets worldwide in terms of sales and production. As per OICA, in 2023, the auto industry in the United States produced approximately 10.6 million motor vehicles. Such factors are expected to boost the market significantly.

North America Holds Largest Market Share

Although there is a slight slump, North America's demand for industrial rubber products is gradually recovering, owing to a drastic turnaround in motor vehicle production and the recovering manufacturing sector.

The United States is one of the largest automotive manufacturers in the world, manufacturing an average of over 14 million vehicles annually. Since Honda opened its first manufacturing plant in the United States, almost every Japanese, Korean, and European automaker has established one or more manufacturing plants in the United States.

Due to new federal legislation and increased demand for electric vehicles, the US automotive industry is pouring billions of dollars into building new factories. For instance, Hyundai is rapidly building its first US electric vehicle plant, with production on track for 2025.

Canada's automotive industry is competitive and significantly contributes to the Canadian GDP. Although Canada is gradually losing its manufacturing base, it still produces more than 1.2 million cars annually, driving the rubber testing equipment market.

With over five heavy-duty assembly plants, over 540 OEM parts manufacturers, 400 dealerships, and many other automotive-related industries, Canada is the 2nd largest vehicle producer in North America. This sector is the most significant contributor to the country's manufacturing industry, thus driving the demand for rubber testing equipment.

Rubber Testing Equipment Industry Overview

The rubber testing equipment market consists of a few major players. In terms of market share, few of the major players currently dominate the market. These major players, with a prominent market share, focus on expanding their customer base across foreign countries. These companies leverage strategic collaborative initiatives to increase their market share and profitability.

April 2024 - Alpha Technologies announced the launch of its next-generation tensile solution, the AlphaFlex10 Tensile Tester. The AlphaFlex10 tensile tester seamlessly integrates with the trusted software and service support of rheology equipment products that are an integral part of Alpha's comprehensive solutions for rubber and elastomer material testing needs.

November 2023 - Metso launched a mill lining rubber that introduced its mill lining portfolio, an innovative SkegaTM Life rubber with up to 25% longer wear life than the current premium rubber. The new rubber type is developed in Metso's laboratory and validated by field studies. Skega Life is a part of Metso's Planet Positive offering, enabling increased sustainability and safety, optimized throughput, and uptime due to improved wear resistance and lower maintenance.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand for Durable Goods

- 5.1.2 Technological Advancements in Rubber Testing

- 5.2 Market Restraints

- 5.2.1 High Cost of Ownership

6 MARKET SEGMENTATION

- 6.1 By Type of Testing

- 6.1.1 Density Testing

- 6.1.2 Viscocity Testing

- 6.1.3 Hardness Testing

- 6.1.4 Flex Testing

- 6.1.5 Other Types of Testing

- 6.2 By End-user Application

- 6.2.1 Tire

- 6.2.2 General Rubber Goods

- 6.2.3 Industrial Rubber Products

- 6.2.4 General Polymer

- 6.2.5 Compound

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Alpha Technologies

- 7.1.2 TA Instruments Inc.

- 7.1.3 U-Can Dynatex Inc.

- 7.1.4 Montech Rubber Testing Instruments

- 7.1.5 Goettfert Inc.

- 7.1.6 Prescott Instruments Ltd

- 7.1.7 Ektron Tek Co. Ltd

- 7.1.8 Gotech Testing Machines

- 7.1.9 Norka Instruments, Sanghai Ltd.

- 7.1.10 Gibitre Instruments Srl