|

市場調查報告書

商品編碼

1640313

粉末塗料:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Powder Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

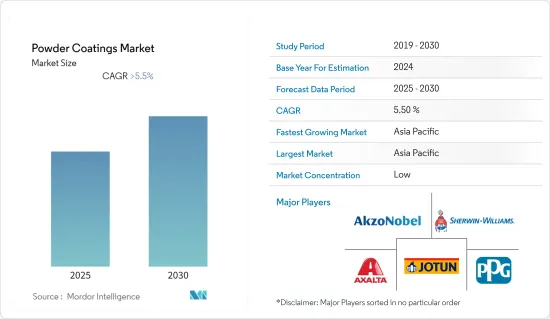

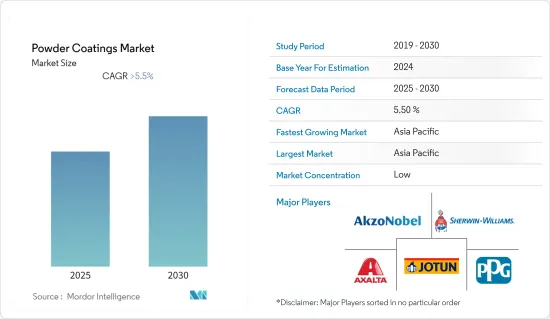

預計粉末塗料市場在預測期內的複合年成長率將超過 5.5%。

COVID-19的爆發導致世界各地的全國範圍內停工,擾亂了製造活動,供應鏈、生產停工和勞動力短缺對2020年的粉末塗料市場產生了負面影響。然而,情況在 2021 年開始改善,市場在預測期內恢復了成長軌跡。

主要亮點

- 從中期來看,對揮發性有機化合物排放的嚴格監管以及政府促進粉末塗料使用的有利舉措是推動市場的主要因素。

- 相反,獲得薄膜塗層的困難預計將阻礙市場成長。

- 亞太新興經濟體正在增加對基礎設施和建築業的投資,這可能為市場創造成長機會。

- 亞太地區主導全球市場,消費量最高的國家是中國、韓國和印度等。

粉末塗料市場趨勢

建築和裝飾領域的需求不斷成長

- 粉末塗料成長最快的市場之一是建築和裝飾市場,關鍵原因是粉末塗料的耐用性。

- 此外,聚酯樹脂技術的擴展,即穩定的低光澤配方,為建築市場提供了機會,並促進了粉末塗料的成長。

- 粉末塗料有多種顏色和飾面,這就是為什麼許多建設公司依靠粉末塗料為戶外場地和公共工程計劃提供持久的外部飾面。

- 2021年4月,Jababeka集團子公司PT Jababeka Morotai與OISCA國際學院基金會(OISCA International)合作開發了莫羅泰經濟特區(KEK)。根據這項合作,將在印尼北馬魯古省的 KEK 建造一座二戰紀念和支援設施。

- 在北美市場,綠建築的爆發和全球化越來越認知到粉末塗料是建築鋁材塗裝的有效選擇。

- 根據美國綠建築委員會 (USGBC) 的數據,2021 年美國前 10 個州將有 1,105 個計劃獲得 LEED 綠建築認證,獲得認證的土地面積達 2.47 億 GSF。該地區被認為是粉末塗料的主要商機。

- 根據美國人口普查,新建設約為 1.62 兆美元,較 2020 年的 1.49 兆美元大幅增加 8.46%。預計這種成長趨勢將在預測期內提振市場並創造利潤豐厚的機會。

- 根據FIEC統計,2021年建築業總投資大幅成長,成長5.2%,達到1.6兆歐元(約1.7兆美元)。義大利的投資增幅最大(16.4%),其次是愛沙尼亞(10.7%)、希臘(10.6%)和法國(10.5%)。歐盟(EU)投資的激增預計將引發建築和裝飾領域的成長機會,從而促進粉末塗料市場的發展。

- 因此,由於上述因素,建築和裝飾行業對粉末塗料的需求在預測期內可能會增加。

亞太地區主導市場

- 在亞太地區,由於汽車工業、建設活動和工業產品消費的增加,中國和印度在全球市場佔有率中佔據主導地位。這使得該地區粉末塗料市場的需求不斷增加。

- 中國的建築業正在經歷顯著成長。根據中國國家統計局數據,2021年中國建築業產值約29.31兆元人民幣(約4,215.7億美元)。

- 在印度2022-23年聯邦預算中,基礎設施資本支出將從5.54兆印度盧比(約669.8億美元)大幅增加至7.5兆印度盧比(約905.9億美元),成長35.4%,其中包括鐵路住宅總量。

- 2021年9月,艾仕得宣佈在中國北部吉林省吉林市破土動工興建最先進的油漆廠。新工廠佔地 46,000平方公尺,將生產輕型汽車、商用車和汽車塑膠零件的移動塗料。

- 2021年5月,PPG宣布已完成對中國嘉定油漆塗料工廠的1,300萬美元投資。此次擴建將使該廠的產能每年增加8,000多噸。

- 此外,2021年中國電動車銷量將激增154%,從2020年的130萬輛增加到330萬輛。中國財政部宣布,自2021年1月1日至2022年12月31日,新增電動車免徵汽車購置稅並給予財政輔助。

- 因此,由於上述趨勢和終端用戶行業的成長,預計在預測期內該地區對粉末塗料的需求將顯著成長。

粉末塗料產業概況

粉末塗料市場是細分的,只有少數幾家國際參與企業佔據了相當大的佔有率,而每個國家都有幾家本土企業。這些主要企業包括 Akzo Nobel NV、Axalta Coating Systems LLC、The Sherwin-Williams Company、PPG Industries Inc. 和 Jotun。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 對VOC排放的嚴格監管以及政府為推廣粉末塗料的積極努力

- 其他司機

- 抑制因素

- 粉末塗料難以變薄

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔(以金額為準的市場規模)

- 樹脂型

- 丙烯酸纖維

- 環氧樹脂

- 聚酯纖維

- 聚氨酯

- 環氧聚酯

- 其他樹脂種類(聚氯乙烯、聚烯)

- 最終用戶產業

- 建築與裝飾

- 車

- 工業的

- 其他最終用戶產業(家具、家用電子電器產品)

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 南非

- 沙烏地阿拉伯

- 其他中東/非洲

- 亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場佔有率分析

- 主要企業策略

- 公司簡介

- Akzo Nobel NV

- Asian Paints PPG Pvt. Limited

- Axalta Coating Systems LLC

- BASF SE

- Berger Paints India Limited

- Cardinal

- IFS Coatings

- IGP Pulvertechnik AG

- Jotun

- Kansai Paint Co. Ltd

- National Paints Factories Co. Ltd

- Nippon Paint Holdings Co. Ltd

- Nivera Paints (India) Pvt. Ltd

- PPG Industries Inc.

- RPM International Inc.(TCI Powder Coatings)

- SAK Coat

- SHAWCOR

- The Sherwin-Williams Company

第7章 市場機會及未來趨勢

- 擴大亞太新興經濟體基礎建設投資

The Powder Coatings Market is expected to register a CAGR of greater than 5.5% during the forecast period.

Due to the COVID-19 outbreak, nationwide lockdowns around the globe disrupted manufacturing activities, and supply chains, production halts, and labor unavailability negatively impacted the powder coating market in 2020. However, the conditions started recovering in 2021, restoring the market's growth trajectory during the forecast period.

Key Highlights

- Over the medium term, the significant factors driving the market studied are strict regulation against VOC emissions and favorable government initiatives promoting powder coatings usage.

- Conversely, the difficulties in obtaining thin film coatings are expected to hinder the market's growth.

- Nevertheless, growing investments in the infrastructure and construction industry in the emerging economies of the Asia-Pacific region is likely to create growth opportunities for the market studied.

- Asia-Pacific dominated the market globally, with the most significant consumption from countries such as China, South Korea, and India.

Powder Coatings Market Trends

Growing Demand from Architectural and Decorative Segment

- One of the fastest-growing markets for powder coatings is the architectural and building market, primarily due to powder coating durability.

- Moreover, polyester resin technology expansion, namely stable, low-gloss formulas, provided architectural market opportunities that promoted powder coating growth.

- Due to the variety of colours and finishes available in powder coatings, many construction companies are turning to powder coatings to provide long-term exterior finishes for outdoor venues and public work projects.

- In April 2021, PT Jababeka Morotai, a subsidiary of Jababeka Group, collaborated with the OISCA International College Foundation (OISCA International) to develop the Morotai Special Economic Zone (KEK). Under this collaboration, a World War II monument and supporting facilities will get constructed in KEK, North Maluku Province, Indonesia.

- In the North American market, green construction practices explosion and globalization have further increased the awareness regarding powder coatings as a viable option to coat architectural aluminum.

- In 2021, according to the U.S. Green Building Council (USGBC), 1,105 projects had been certified with LEED certification for green buildings in the top 10 states of the US with 247 million GSF land. It will likely provide a massive opportunity for powder coatings in the region.

- As per US Census, the new construction value was around USD 1.62 trillion, with a notable growth of 8.46% from USD 1.49 trillion in 2020. The upward growth trend is expected to boost the market and create lucrative opportunities in the forecast period.

- According to FIEC, the construction industry witnessed a notable growth in total investment, with 5.2% in 2021, and amounted to EUR 1.6 trillion (~USD 1.70 trillion). The most significant rise in investment was observed in Italy (16.4%), followed by Estonia (10.7%), Greece (10.6%), and France (10.5%). A rapid increase in investment in European Union is anticipated to trigger growth opportunities for the Architectural and Decorative segment, which in turn would help the development of the Powder Coating market.

- Therefore, with the abovementioned factors, the demand for powder coatings in the architectural and decorative industries will likely increase over the forecast period.

Asia-Pacific to Dominate the Market

- In the Asia-Pacific region, China and India dominated the global market share due to the rising consumption from the automotive industry, construction activities, and industrial goods. It is augmenting the demand for the powder coatings market in the region.

- China is in experiencing massive growth in its construction sector. According to the National Bureau of Statistics of China, in 2021, the construction output in China was valued at approximately CNY 29.31 trillion (~USD 421.57 billion).

- In the Indian Union Budget 2022-23, capital expenditure on infrastructure increased sharply by 35.4%, from INR 5.54 lakh crore (~USD 66.98 billion) to INR 7.50 lakh crore (~USD 90.59 billion) in 2022-23, which includes a total of 2,000 km of the rail network and 60,000 houses under PM Aawas Yojna, among others.

- In September 2021, Axalta announced that it broke ground to construct a state-of-the-art coatings facility in Jilin City, Jilin Province, North China. The 46,000 sq m new plant will produce mobility coatings for light vehicles, commercial vehicles, and automotive plastic components.

- In May 2021, PPG announced a USD 13 million investment completion in its Jiading, China, paint and coatings facility, including eight new powder coating production lines and an expanded Powder Coatings Technology Center. The expansion will increase the plant's capacity by more than 8,000 metric tons annually.

- Furthermore, in 2021, electric vehicle sales in China skyrocketed by 154%, with total electric vehicle sales of 3.3 million units, up from 1.3 million in 2020. It is the Ministry of Finance of China's statement to provide financial subsidies for new electric vehicles, as they will be exempted from vehicle purchase tax between January 1, 2021, to December 31, 2022.

- Hence, with such trends mentioned above and the end-user mentioned above industries' growth, the demand for powder coatings is estimated to grow substantially in the region during the forecast period.

Powder Coatings Industry Overview

The powder coatings market is fragmented, with only a few international players holding a considerable share and several local players in individual countries. These major players include Akzo Nobel NV, Axalta Coating Systems LLC, The Sherwin-Williams Company, PPG Industries Inc., and Jotun.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Strict Regulations against VOC Emissions and Favorable Government Initiatives Promoting the Use of Powder Coatings

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 Difficulty in Obtaining Thin Film of Powder Coating

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Resin Type

- 5.1.1 Acrylic

- 5.1.2 Epoxy

- 5.1.3 Polyester

- 5.1.4 Polyurethane

- 5.1.5 Epoxy-Polyester

- 5.1.6 Other Resin Types (Polyvinyl Chloride, Polyolefins)

- 5.2 End-user Industry

- 5.2.1 Architecture and Decorative

- 5.2.2 Automotive

- 5.2.3 Industrial

- 5.2.4 Other End-user Industries (Furniture, Appliances)

- 5.3 Geography

- 5.3.1 Asia Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Akzo Nobel NV

- 6.4.2 Asian Paints PPG Pvt. Limited

- 6.4.3 Axalta Coating Systems LLC

- 6.4.4 BASF SE

- 6.4.5 Berger Paints India Limited

- 6.4.6 Cardinal

- 6.4.7 IFS Coatings

- 6.4.8 IGP Pulvertechnik AG

- 6.4.9 Jotun

- 6.4.10 Kansai Paint Co. Ltd

- 6.4.11 National Paints Factories Co. Ltd

- 6.4.12 Nippon Paint Holdings Co. Ltd

- 6.4.13 Nivera Paints (India) Pvt. Ltd

- 6.4.14 PPG Industries Inc.

- 6.4.15 RPM International Inc. (TCI Powder Coatings)

- 6.4.16 SAK Coat

- 6.4.17 SHAWCOR

- 6.4.18 The Sherwin-Williams Company

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Investments in the Infrastructure in the Emerging Economies of the Asia Pacific Region